The Critical TMS Omnichannel Integration Evaluation Framework: How to Prevent the Precision Operations Crisis That's Breaking 70% of Supplier Relationships and Build Unified Fulfillment Strategies in 2026

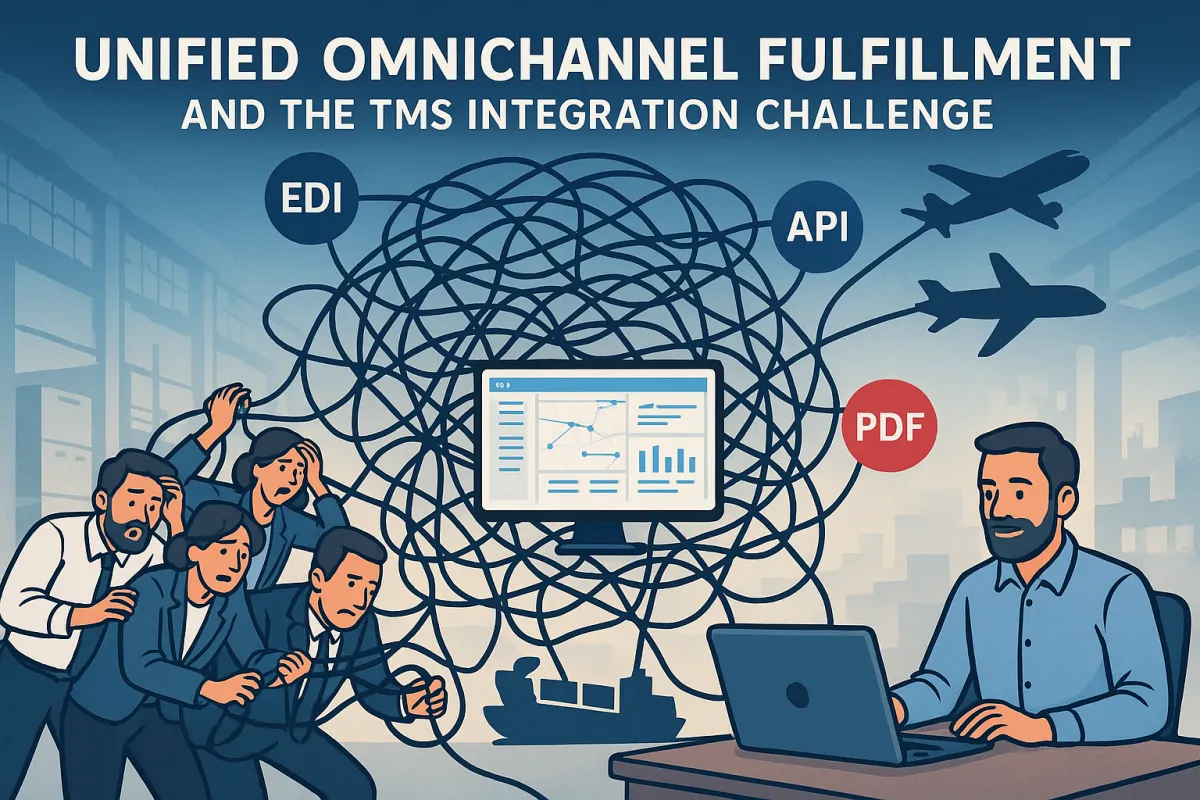

Here's the brutal reality facing supply chain leaders in 2026: Precision omnichannel operations will separate leading suppliers from those struggling to maintain partnerships. Many suppliers still process PDF orders manually while managing EDI connections and API integrations with the same retailer across different channels. This fragmented approach doesn't just hurt efficiency. A single missed update can cascade into stockouts, order cancellations and damaged relationships.

Your TMS selection just became the difference between survival and obsolescence. Traditional vendor evaluations that focus on individual features miss the unified omnichannel capabilities that retailers now demand as baseline requirements. Budget overruns hit 75% of European TMS implementations, often because procurement teams evaluate systems based on subscription costs while ignoring the integration complexity that transforms promising platforms into costly failures.

The Precision Omnichannel Crisis Breaking Traditional TMS Selection

The problem with current TMS procurement starts with the fundamental misunderstanding of what "omnichannel" means in 2026. Most evaluation frameworks still treat it as a feature checklist rather than an operational imperative. Consumers expect every channel to deliver at the same speed and accuracy, forcing suppliers to maintain precision across all channels simultaneously. 55% of shoppers prefer to return online purchases in store and 40% often make extra purchases when picking up or returning.

You're not just competing on efficiency anymore. Leading suppliers now treat "an order is an order" as their operating principle, investing in systems that provide single-pane visibility across all channels rather than managing each channel separately. Meanwhile, suppliers stuck with channel-specific operations find themselves juggling separate workflows for EDI, PDF processing, and API integrations with the same retail partner.

The vendor landscape compounds this challenge. WiseTech's acquisition of e2open for $3.30 per share in cash equating to an enterprise value of $2.1 billion marks the largest TMS industry acquisition to date, while Descartes Systems Group has acquired Columbus, Ohio-based 3Gtms for $115 million USD in cash, reshaping vendor options for European buyers. Traditional TMS providers like Manhattan Active, SAP TM, and Oracle TM now compete alongside specialized omnichannel platforms including Cargoson and integrated solutions from SPS Commerce and Cleo.

Why "Single Channel" TMS Approaches Fail in 2026's Retail Environment

The operational reality has shifted permanently. Delivering on that promise requires suppliers to keep information precise and synchronized across an expanding web of systems and order types. Your legacy approach of managing each retail channel through separate systems creates exactly the fragmentation that breaks supplier relationships.

Consider what happens when Target sends you an EDI purchase order for store replenishment while simultaneously processing API orders for same-day delivery and PDF purchase orders for seasonal merchandise. Without unified fulfillment architecture, each channel operates with different inventory data, pricing updates, and order status information.

The Hidden Cost of Channel Fragmentation

With more than 80% of retail sales still occurring through brick-and-mortar stores, retailers are realizing that omnichannel success depends less on adding new capabilities and more on operational discipline and system unification. Yet most suppliers approach TMS selection as if they're still managing separate channel silos.

The financial impact exceeds obvious inefficiencies. Implementation costs range from €30,000 to €900,000, and for shippers with freight spend exceeding $250M annually, implementation can cost 2-3 times the subscription fee. Add the hidden costs of managing multiple integration points, manual data reconciliation, and the operational overhead of channel-specific teams, and you're looking at total costs that traditional procurement assessments completely miss.

The Complete TMS Omnichannel Integration Assessment Matrix

Building an effective evaluation framework requires moving beyond feature comparisons to capability validation. Your assessment must test how well each platform handles the unified fulfillment scenarios that retailers demand daily. Here's the structured approach that prevents costly mistakes:

API-EDI Hybrid Support Assessment: Test how the platform handles simultaneous EDI 856 shipment confirmations, API order status updates, and PDF acknowledgment workflows with the same retail partner. Platforms like Cleo's integration suite and Cargoson's unified approach should demonstrate seamless data flow across all three communication methods.

Real-Time Inventory Synchronization: Validate that inventory updates from warehouse management systems immediately reflect across all channels. A truly unified management system encompassing orders, inventory, transportation, the yard and the warehouse ensures that all internal and external partners have access to the same workflow, exceptions and analytics, at the same time, in real or near-real time.

Cross-Channel Status Updates: Confirm the platform can manage order status synchronization when a single shipment contains items for multiple channels. This tests whether the TMS treats unified fulfillment as core functionality rather than an add-on capability.

Critical Integration Capabilities Checklist

Your evaluation must validate these non-negotiable capabilities:

- Single-pane visibility: All order types visible in unified dashboard regardless of source channel or communication protocol

- Automated order ingestion: System processes EDI, API, and PDF orders through unified workflow without manual intervention

- Real-time inventory sync: Automated order ingestion and real-time inventory visibility become baseline requirements

- Exception management: Unified handling of shipping delays, inventory shortages, and delivery exceptions across all channels

When evaluating vendors, include traditional enterprise platforms (SAP TM, Oracle TM, Manhattan Active) alongside specialized omnichannel solutions like Cargoson, integrated platforms from SPS Commerce, and hybrid approaches from MercuryGate and Descartes.

Building Future-Proof Unified Fulfillment Architecture

The architectural decision you make today determines operational capability for the next five years. Suppliers are moving from channel-specific operations teams to unified fulfillment approaches. Your TMS must support this transition rather than perpetuate channel silos.

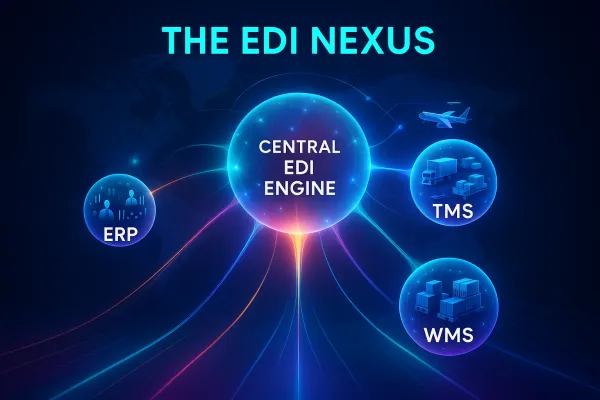

Centralized Data Flows vs. Point-to-Point Connections: Design integration architecture that treats order management as a unified process. Modern supply chains are powered by a vast digital ecosystem of WMS, TMS, OMS, LMS, WES, WCS, APIs and microservices. Your TMS should orchestrate these connections rather than requiring separate integration points for each channel.

Error Handling and Exception Management: Build comprehensive exception handling that works across all order types. When inventory shortages occur, the system should simultaneously update EDI partners via 856 transactions, notify API consumers through webhook callbacks, and generate exception reports for PDF-based orders.

Integration Architecture Best Practices

Implement microservices architecture where possible. Integration within a microservices architecture, which reduces the size and interdependency of platform modules, is an added benefit companies might look for, because it offers agility for client IT teams to build their own customized solutions. This approach provides flexibility for managing changing retailer requirements without complete system overhauls.

Plan for scalability from day one. According to a 2025–2026 logistics trends report, AI and automation are expanding across warehousing, fleet management, and fulfillment workflows. Simultaneously, market outlooks forecast solid growth for TMS solutions: one research note estimates that the TMS market will grow by several billion USD between 2025 and 2030. Your architecture must handle increasing transaction volumes and new channel types.

Avoiding the 75% Implementation Failure Rate

The numbers paint a bleak picture: seventy-six percent of logistics transformations never fully succeed, failing to meet critical budget, timeline or key performance indicator (KPI) metrics, with more than 80% of respondents attempting four transformations in fewer than five years. Most failures stem from underestimating integration complexity and treating TMS selection as a software purchase rather than operational transformation.

Vendor Capability Validation Framework: Test omnichannel scenarios during the evaluation process. Create realistic test cases that mirror your actual retailer relationships. If you manage both EDI and API integrations with Walmart, your evaluation should simulate processing simultaneous orders through both channels.

Reference Customer Validation: Require vendors to provide references with similar omnichannel complexity. A supplier managing only EDI transactions can't validate capabilities you need for unified API-EDI-PDF operations.

Implementation Timeline and Resource Requirements

The timeline provides an 18-month implementation window, but procurement and integration typically require 12-15 months for complex European operations. Plan implementation phases that establish core unified functionality first, then add specialized features incrementally. Phased implementation strategies protect against vendor disruption by establishing core functionality first, then adding compliance modules and specialized features in subsequent phases. This approach allows platform changes or vendor consolidation to be addressed without complete system replacement.

The 2026 Competitive Advantage: From Fragmented to Unified Operations

The suppliers achieving competitive advantage through precision omnichannel operations share common characteristics: unified data architecture, automated order processing across all channels, and real-time visibility that treats orders identically regardless of source. Companies using platforms like Cargoson's unified TMS approach, SPS Commerce's omnichannel solutions, or comprehensive implementations with Cleo's integration platform demonstrate these capabilities in production environments.

Given the technological advances and rising pressures in cost, labor, compliance, and customer demand, 2026 stands out as the most likely year when full TMS automation becomes mainstream. Companies that begin migrating now, blending AI, automation, and clean data workflows, will gain speed, resilience, and competitive advantage.

The evaluation framework you build today determines whether your supplier relationships strengthen through precision operations or fragment under the weight of disconnected systems. Choose platforms that treat omnichannel integration as core functionality, not an afterthought. Your competitive position in 2026 depends on getting this decision right.