The 2026 European E-Invoicing Mandate Crisis: How Supply Chain Companies Must Rebuild EDI and TMS Integration Architecture to Survive Cross-Border Compliance Requirements

Poland's mandatory B2B e-invoicing via KSeF starts February 1, 2026 for large firms (annual revenues exceeding PLN 200 million), with smaller firms following April 1, 2026. Belgium implements mandatory PEPPOL-based B2B e-invoicing from January 1, 2026. France begins its phased rollout September 1, 2026 for large and mid-sized firms, then SMEs from September 2027. But here's what supply chain managers need to understand: this isn't just about changing invoice formats.

PDFs alone will no longer be accepted for in-scope transactions in many European countries. The legally relevant document is the structured e-invoice, usually in an EN 16931-based XML or similar format. That PDF you're emailing? It becomes just a human-readable copy. The real business happens in structured data that your systems must process automatically.

The Critical Country-by-Country Implementation Timeline

When you operate across borders, you face a patchwork of different requirements. A format that is compliant in one country may not be sufficient in another. Poland requires all B2B invoices to be submitted to KSeF and approved before becoming legally valid, with structured XML as mandatory. Belgium mandates the use of Peppol-BIS as the standard format for all transactions transmitted via the required Peppol network. Germany allows any format that is compliant with the EN 16931 standard, giving more flexibility but creating another variation to manage.

Each country's approach affects how transportation management systems must handle invoice data. TMS platforms like Cargoson, MercuryGate, and Descartes are now building specific compliance modules for each market. The challenge isn't just technical - it's operational.

How E-Invoicing Mandates Break Traditional EDI Supply Chain Architectures

Most supply chain EDI architectures were designed around batch processing and end-of-period reporting. Real-time reporting demands high system reliability and automated error handling. Clearance systems like Poland's KSeF require real-time, fault-tolerant integrations. Your monthly VAT reconciliation process just became a real-time transaction validation requirement.

Electronic data interchange traditionally handled business documents like purchase orders, advance ship notices, and invoices through standardized formats. But e-invoicing mandates change the fundamental relationship between invoicing and tax compliance. B2B invoicing in Europe is becoming structured, digital, and monitored in near real time.

Transportation companies face specific challenges because their invoicing often involves multiple parties: shippers, consignees, customs authorities, and logistics providers. The EDI 210 document is used by carriers to electronically submit freight invoices to shippers, providing detailed breakdowns of charges and working in conjunction with other EDI documents like the EDI 204 for shipment instructions and EDI 214 for tracking. Now these established workflows must accommodate real-time tax clearance.

Integration Challenges with TMS Systems

Consider how this affects TMS operations. When a shipment completes delivery, your TMS triggers invoice generation. Under traditional systems, that invoice gets processed through your accounting system and eventually reaches the customer via EDI or email. Under e-invoicing mandates, that same invoice must be validated by government systems before it becomes legally valid - potentially blocking the entire freight settlement process if there are errors.

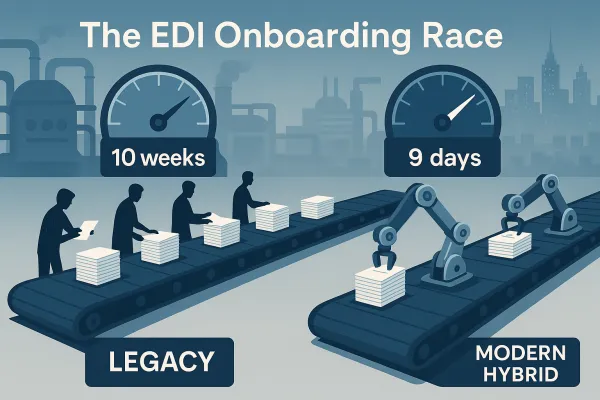

Implementing an EDI solution enables transport and logistics businesses to increase resource efficiency, but EDI is crucial to building and maintaining long-term business relationships with customers and suppliers, ensuring efficient automation of daily communications on a large scale. The challenge is retrofitting existing EDI architectures to handle real-time compliance validation.

The Hidden Supply Chain Compliance Crisis: Why Non-EU Companies Can't Ignore This

Supply chains are interconnected. A key customer or supplier in an early-mandate market can force change in your processes even if your own local rules are slower to move. This is exactly what's happening in transportation and logistics.

A US-based logistics company discovered this when their largest European customer implemented internal policies requiring e-invoice capability from all suppliers - six months ahead of the Belgian mandate. Suddenly, 40% of their European revenue was at risk because their TMS couldn't generate compliant PEPPOL invoices.

Large shippers like Walmart, Amazon, and major retail chains mandate EDI integration for their carrier networks. Without EDI capability, you're automatically excluded from lucrative dedicated contracts. The same pattern applies to e-invoicing compliance. Major European shippers are already building e-invoicing requirements into their carrier selection criteria.

TMS Vendor Response and Capabilities

Leading TMS providers are adapting differently. Some are building direct integrations to government clearance systems. Others are partnering with e-invoicing specialists. Cargoson offers integration for carriers that have their own e-environments, allowing you to link them to your Cargoson software account to send transport orders directly to your transport partner's system. But e-invoicing compliance requires deeper integration than simple order management.

The most sophisticated TMS platforms are rebuilding their invoice processing engines to support multiple compliance models simultaneously. This isn't just about format conversion - it's about handling different validation rules, error correction workflows, and timing requirements across markets.

Technical Implementation Framework: Bridging EDI and E-Invoicing Systems

Your implementation approach depends on your current EDI architecture. You have options: upgrade or configure your ERP to support the required formats, use middleware to transform invoices into compliant structures, or work with a specialist e-invoicing provider that connects to your existing systems.

Many businesses choose cloud-based EDI solutions instead of building in-house systems. These platforms offer strong advantages: lower infrastructure costs, automatic updates, and better scalability. Cloud solutions remove the need to maintain complex hardware setups and provide strong data security through ISO 27001 compliance.

For transportation companies, the technical challenge involves three integration layers:

TMS-to-ERP Integration: Your transportation management system must pass invoice data to your ERP in a format that supports e-invoicing validation. Integration between Transport Management System and business software enables automation, time savings, cost savings, and reduced errors. This includes the cost of integrating the TMS with existing software systems, such as enterprise resource planning (ERP) software.

ERP-to-Compliance Integration: Your ERP system must connect to government clearance platforms like Poland's KSeF or Belgium's PEPPOL network. This requires handling different authentication methods, error responses, and timing requirements.

Exception Handling: When invoices fail validation, you need automated workflows to correct errors without disrupting operations. If the Motor Carrier Freight Details and Invoice document is not in alignment with the shipper's expectations, the invoice may be rejected and payment could be delayed. Managing ongoing EDI tasks can be complex and time-consuming.

Format Requirements and Standards

While the EU provides the overarching framework with the European Norm (EN16931), individual countries add their own country-specific formats and rules on top of it. A format that is compliant in one country may not be sufficient in another.

Key technical standards include:

- UBL (Universal Business Language): Belgium uses the Peppol network with UBL 2.1 format for all B2B e-invoicing.

- PEPPOL Framework: The Peppol (Pan-European Public Procurement OnLine) network provides a decentralized, interoperable framework for e-invoice exchange.

- National XML Schemas: Poland's KSeF requires XML format submission to their clearance system.

Strategic Preparation Framework for Supply Chain Operations

Organizations that approach mandatory e-invoicing strategically typically report lower processing costs, fewer disputes, better visibility of liabilities and improved cash-flow predictability. Compliance is the trigger; the upside lies in how you redesign the whole invoicing process.

Start with a compliance audit of your current trading partners. Which ones operate in early-mandate countries? What percentage of your revenue could be affected? Then map your current invoice processing workflow - from shipment completion to payment receipt.

As a carrier able to facilitate EDI, you can compete not just on price, but on reliability and ease, thereby securing more high-paying loads. Less sophisticated and less well-integrated carriers will be left behind. Enabling EDI for trucking thus becomes essential for those looking to grow and secure bigger and more lucrative contracts. The same principle applies to e-invoicing compliance.

TMS Selection and Upgrade Considerations

If you're evaluating TMS platforms, e-invoicing capability should be a primary selection criterion. Modern cloud-based shipping software connects directly with hundreds of carriers through pre-built API and EDI integrations. Instead of setting up separate technical connections with each transport provider, you get access to your whole carrier network through one platform. Look for similar consolidation in e-invoicing compliance.

Key evaluation criteria include:

- Support for multiple e-invoicing standards within a single platform

- Real-time error handling and correction workflows

- Integration capabilities with your existing ERP and accounting systems

- Scalability across different European markets

Solutions like Cargoson are positioning themselves as comprehensive platforms that handle both traditional EDI and emerging e-invoicing requirements. Cargoson's cloud-based transportation management system is specifically tailored to the unique requirements and constraints of SMBs, managing all types of transport operations including import, export, domestic, parcel, less than truckload (LTL), and full truckload (FTL) shipments.

The Competitive Advantage in Compliance Readiness

Early adopters are already seeing benefits beyond compliance. Real-time invoice validation means faster dispute resolution. Structured data enables better analytics and forecasting. Automated compliance reduces administrative overhead.

With Belgium, Poland, and France implementing requirements in 2026, followed by Germany in 2027-2028, the time to act is now. Understanding the regulatory landscape is the first critical step. The next is selecting the right technical approach and implementation partner to ensure compliance while maximizing business benefits.

The companies that thrive in this transition will be those that view e-invoicing not as a compliance burden, but as a competitive differentiator. They'll win contracts from shippers who value automated processes and real-time visibility. They'll reduce processing costs and improve cash flow through faster, more accurate invoicing.

But the window for preparation is narrowing. Countries are already phasing in national mandates, and from July 1, 2030, intra-EU B2B transactions must use structured e-invoices. Your competitors who start now will have refined, efficient processes while others scramble to achieve basic compliance.

The question isn't whether European e-invoicing mandates will affect your supply chain operations - it's whether you'll be ready to turn compliance requirements into operational advantages.