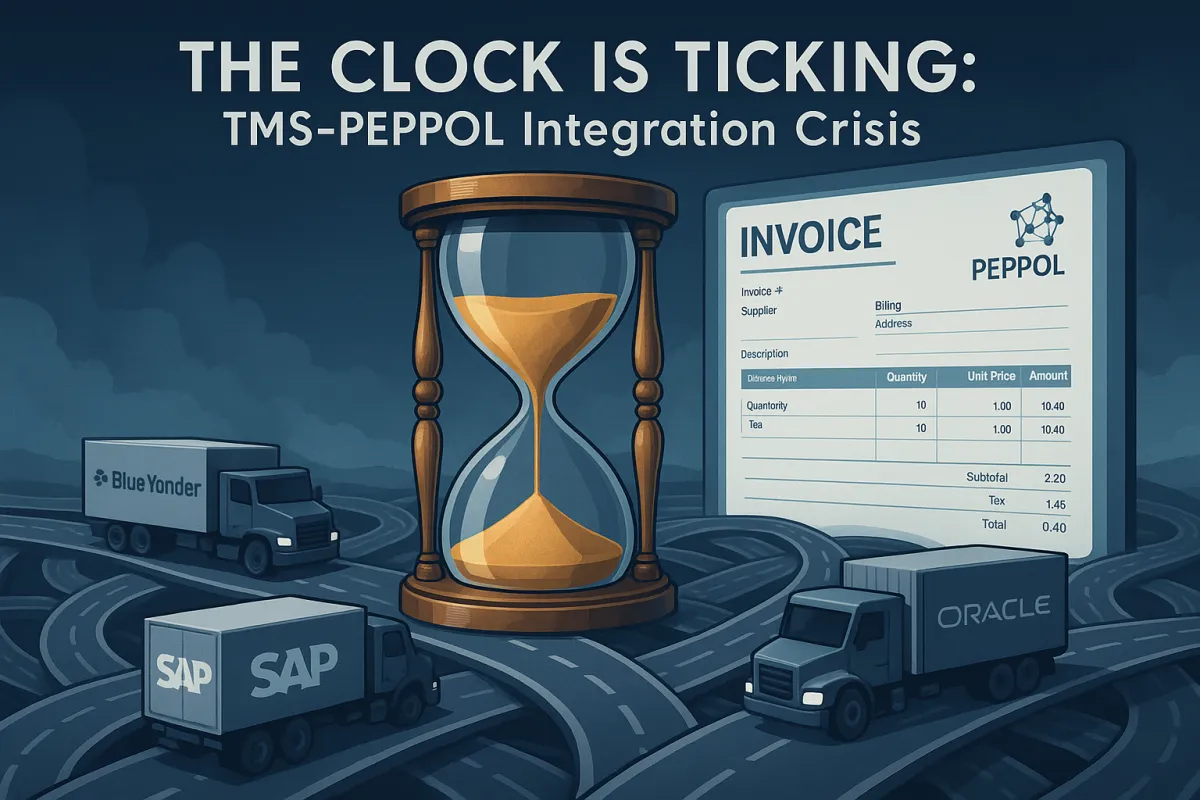

The 2026 TMS-PEPPOL Integration Crisis: How to Evaluate Transportation Management System Readiness for Mandatory E-Invoicing and Prevent Supply Chain Compliance Failures

Belgium is making e-invoicing mandatory for all B2B transactions from January 2026, using PEPPOL as the standard network. Non-compliance will result in graduated penalties, starting at €1,500 for a first offense, €3,000 for a second, and €5,000 for a third within three months. For transportation management system (TMS) operators, this represents more than just another regulatory compliance requirement. Many legacy TMS or accounting tools weren't built with modern e-invoicing in mind, and retrofitting compliance can be expensive, slow, and complex.

Your freight invoices, carrier payments, and 3PL settlements all run through your TMS. When PEPPOL becomes mandatory, every one of these financial transactions needs to flow through the new system. Miss this deadline, and you're looking at immediate business disruption and substantial fines.

The PEPPOL Mandate Reality Check: Why 2026 Changes Everything for TMS Operations

From January 1, 2026, all VAT-registered businesses must issue and receive e-invoices for domestic B2B transactions. Paper invoices and unstructured formats (e.g., PDF) will not be allowed. This affects every player in your transportation ecosystem differently:

**Freight carriers** need to send PEPPOL-compliant invoices to shippers and receive structured purchase orders. **3PLs** must handle both directions - billing customers and paying subcontractors through the network. **Shippers** face the most complex scenario, managing hundreds of carrier relationships where each party must be PEPPOL-ready.

The new mandates will use the PEPPOL 4-corner network, ensuring continuity with the existing B2G standards. Unlike traditional EDI point-to-point connections, PEPPOL operates as a network where each participant connects once — and can exchange invoices with any other party in the network.

Here's what catches most TMS teams off guard: Alternative channels (such as EDI) may be used only if they fully comply with the same European semantic and syntax standards. Every in-scope business must, in any event, be PEPPOL-capable. Your existing EDI infrastructure doesn't automatically qualify.

There will be a 3-month grace period from fines and loss of deductibility for taxpayers that make best efforts to comply with the 1 January 2026 e-invoicing mandate. The Belgian tax authorities will require evidence of serious attempts to send/receive e-invoices and issues were only caused by technical or system difficulties. This isn't a delay - it's breathing room for companies already implementing.

The Technical Challenge: PEPPOL vs Traditional EDI Integration

Traditional EDI creates direct connections between trading partners. PEPPOL works differently through the four-corner model: The supplier (corner 1) sends the electronic invoice, the supplier's Access Point (corner 2) validates and transmits the document to the PEPPOL network using the PEPPOL BIS Billing 3.0 standard, the buyer's Access Point (corner 3) receives and checks the document, and the buyer (corner 4) processes the invoice in its ERP or finance system.

All invoices must be in structured formats conforming to EN16931, primarily UBL 2.1 and CII 16B. Your TMS needs to generate or consume these specific XML formats, not just exchange data. Most TMS platforms weren't designed with this level of document structure validation.

A protocol named eDelivery AS4 (based on AS4) is used to deliver procurement documents between Access Points (APs). This is different from the SFTP, AS2, or VAN connections your EDI team knows. Your integration architecture may need fundamental changes.

TMS Vendor Readiness Assessment: Who's Prepared and Who's Not

The major TMS platforms show varying levels of PEPPOL readiness. The five largest TMS providers, alphabetically, are Blue Yonder, Descartes Systems, Oracle, SAP, and TMW Systems (Trimble Transportation). Here's how they stack up:

**SAP TM** has the clearest path forward through their existing ERP integration capabilities. PeppolNavigator Enterprise seamlessly integrates with SAP, Oracle, Microsoft Dynamics, IFS Connect, and other ERP systems for mandatory PEPPOL e-invoicing compliance in Belgium from January 2026. Your existing SAP, Oracle, Dynamics, or other ERP systems need seamless PEPPOL integration. PeppolNavigator provides native SAP connectors for S/4HANA, Business One, and ByDesign. Integration uses standard SAP APIs and IDocs, ensuring seamless data flow without disrupting existing processes. We support both cloud and on-premise SAP environments.

**Oracle TM** faces similar challenges to SAP but lacks the same level of integration maturity. Oracle TMS has no proprietary carrier network; relies on standard EDI connections rather than direct carrier integrations. Adding new carriers requires significant implementation effort, typically through Oracle partners. PEPPOL integration will likely follow this same pattern - expensive and slow.

**Blue Yonder TMS** shows mixed signals. Blue Yonder has no proprietary carrier network. For real-time visibility, partners with third-party visibility providers like Transporeon, FourKites, and Project44. Adding new carriers usually handled through partner integrations. This partner-dependent model could actually work for PEPPOL if they choose the right integration providers.

**Cloud-native solutions** like Cargoson and Qargo have built-in advantages. At Qargo, we knew this change was coming and built for it early. Our e-invoicing module is designed specifically to remove friction, not add it. PEPPOL-ready architecture Your invoices flow through the network without extra software or plugins. Qargo has been built from the ground up to make e-invoicing effortless. PEPPOL isn't an add-on or a patch – it's part of our platform architecture. PEPPOL-ready out of the box: Qargo connects directly to the PEPPOL network, so your invoices are automatically sent in the correct format.

Oracle TMS pricing typically starts at $250,000-$1,000,000+ annually, with implementation costs often exceeding $1,000,000. SAP TMS pricing typically starts at €250,000-€1,000,000+ annually, with significant implementation costs often reaching seven figures. Factor in PEPPOL integration costs, and you're looking at serious budget implications.

The Hybrid Integration Challenge

Most TMS environments will need to support both traditional EDI and PEPPOL simultaneously. Your German carriers might use traditional EDI, Belgian partners require PEPPOL, and UK suppliers use different formats entirely. PeppolNavigator Enterprise supports heterogeneous ERP environments. You can connect SAP in one subsidiary, Oracle in another, and Dynamics in a third, all managed through a centralized platform with unified reporting and governance.

Partner onboarding becomes exponentially more complex when you're managing multiple protocols. Each new carrier requires evaluation of their technical capabilities - can they handle PEPPOL, traditional EDI, or both? Businesses must ensure that both their suppliers and customers are ready to exchange PEPPOL-compliant invoices, which may be difficult for smaller firms or those using outdated systems.

Data mapping presents another challenge. Companies that already have another means of communication in an EDI context, can maintain it if both parties agree or if the invoices issued comply with European standards on semantics and syntax EN 16.931-1 and CEN/TS 16.931-2. Your data transformation layer needs to handle multiple formats while maintaining semantic accuracy across all channels.

Implementation Roadmap: Getting Your TMS PEPPOL-Ready

Start with a technical capability assessment. Can your current TMS generate UBL 2.1 or CII 16B formatted documents? Does it support AS4 protocol connections? "Take time to review where the support lies in your current software and whether it's PEPPOL-ready. If your software isn't ready, look for the right digital tools that fit within your processes to step into the e-invoicing story".

**Phase 1: Access Point Selection** - Choose a certified PEPPOL Access Point that integrates with your TMS platform. E-invoicing and PEPPOL integrates with the following applications: SAP S/4HANA Cloud, Infor M3, SAP Integration Suite, Oracle Linux, SAP Integrated Business Planning for Supply Chain, Oracle Blockchain. Not all Access Points support all TMS platforms equally well.

**Phase 2: Integration Architecture** - PEPPOL integration with your ERP system allows your finance teams to manage invoices directly within their familiar environment, SAP, Oracle, or any other platform. No manual uploads or external portals are needed. Design your integration to minimize disruption to existing workflows.

**Phase 3: Trading Partner Onboarding** - Once your company and your customer are registered in the network, the invoice is delivered instantly. But getting every carrier and 3PL registered takes months of coordination. Start this process immediately.

**Phase 4: Testing and Validation** - Real-time monitoring and error resolution: Automated notifications and correction workflows for rejected invoices. Supporting all formats and protocols: Includes UBL, CII, AS2, AS4, and HTTPs formats. Your testing phase needs to cover document validation, network connectivity, and error handling scenarios.

Common Integration Pitfalls and How to Avoid Them

**Legacy system compatibility** often becomes the biggest obstacle. As a vendor-independent platform, PeppolNavigator Enterprise integrates directly with your existing finance and ERP systems, from modern cloud platforms to legacy mainframe solutions. No vendor lock-in, no forced migrations, no expensive replacements. But this integration isn't always straightforward with older TMS platforms.

**Multi-entity compliance** creates complexity you might not expect. From January 1, 2026, all VAT-registered companies in Belgium must exchange B2B invoices electronically via the PEPPOL network. All subsidiaries and business units must be connected to PEPPOL. Each VAT-registered entity within your corporate structure requires individual PEPPOL registration and compliance. Centralized management across entities is essential for operational efficiency.

Vendor lock-in scenarios are more common than you'd think. Some Access Point providers require proprietary software installations or specific technical architectures. Others charge excessive fees for data portability if you want to switch providers later.

The Logistics-Specific PEPPOL Challenges

Transportation invoices are inherently more complex than standard commercial invoices. Freight bills include multiple line items for base rates, fuel surcharges, accessorial charges, and detention fees. Each component may have different VAT treatment under Belgian law.

VAT rounding rules: Starting January 1, 2026, and applicable only to e-invoices, rounding will only be allowed on the total amount per VAT rate. Line-by-line rounding will no longer be permitted. This affects how your TMS calculates and presents freight charges in the PEPPOL format.

Multiple carrier integration requirements compound the challenge. A single shipment might involve the originating carrier, a linehaul provider, and a final-mile delivery company. Each generates separate invoices that must flow through PEPPOL, but coordination between them is your responsibility.

Cross-border transport creates additional complexity. Different PEPPOL requirements across EU jurisdictions, multi-currency support, and varying tax compliance requirements for international operations. A shipment from Belgium to Germany involves Belgian PEPPOL rules for the pickup, but German requirements for delivery-related charges.

Cost-Benefit Analysis Framework

Calculate penalty avoidance first. Non-compliance penalties start at €1,500 for a first offense, €3,000 for a second, and €5,000 for a third within three months. With hundreds of carrier relationships, violation risk is high. Annual penalty exposure could easily exceed €100,000 for a mid-sized logistics operation.

Efficiency gains take longer to materialize but offer substantial ROI. Automated, digital invoicing removes the need for manual handling, printing, and mailing. It also leads to faster payment cycles and fewer invoice disputes, thanks to standardized data formats that reduce errors and omissions.

Hidden costs include ongoing Access Point fees, integration maintenance, and staff training. Budget 15-25% annual overhead on top of initial implementation costs for the first three years.

Future-Proofing Your TMS Strategy Beyond 2026

Belgium will require e-invoicing for all domestic B2B transactions from 2026, and the rest of the EU will follow by 2028 under a common framework. Your PEPPOL implementation needs to scale across multiple countries and regulatory frameworks.

API-first integration approaches offer more flexibility than traditional EDI implementations. Modern TMS solutions like Cargoson, Descartes, and others are building PEPPOL support through RESTful APIs rather than batch file processing. This enables real-time invoice validation and immediate error resolution.

Vendor consolidation trends are accelerating. The decree highlights PEPPOL as a critical component of Belgium's future near real-time e-Reporting system, planned for implementation in 2028, aligned with the ViDA initiative. Companies using multiple TMS vendors will face integration complexity as PEPPOL requirements expand.

PEPPOL's adoption is expected to increase in the coming years. The EU's widespread e-invoicing initiatives and emerging B2B requirements make it clear that digital document exchange via PEPPOL is becoming the standard. Businesses already connected to the network are positioned to meet these changes quickly and without additional investment.

Vendor Selection Criteria for 2026 and Beyond

When evaluating TMS vendors for PEPPOL readiness, ask specific technical questions: Does the platform natively generate EN16931-compliant documents? Can it handle AS4 protocol connections without middleware? How does error handling work for rejected invoices? Manual workarounds are not viable for enterprise-scale invoice volumes.

Support model evaluation becomes crucial when regulatory compliance is mandatory. For our Belgian customers, PEPPOL compliance isn't a project. It's just something that happens in the background while they get on with the work. Look for vendors where compliance is built-in rather than bolt-on.

Integration flexibility determines your long-term success. Whether you use Exact, AFAS, Adsolut, Easy (Adfinity) or another system, invoices sync seamlessly without double entry. Automatic delivery confirmation: You'll know instantly when your invoice has been sent. The best solutions integrate with your existing financial systems without requiring parallel processes.

The 2026 PEPPOL deadline isn't just another compliance requirement. For transportation companies, it represents a fundamental shift in how financial transactions flow through supply chain systems. Companies that treat this as a strategic transformation opportunity rather than a regulatory burden will emerge with more efficient operations and competitive advantages. So while others are scrambling to adapt, Qargo customers are already ready - and the same principle applies regardless of which TMS platform you choose, provided you start planning now.