The $30,000 EDI Scaling Trap: How SMEs Can Break Free from Per-Transaction Pricing and Scale Operations Without Breaking Budgets in 2026

Companies are paying $3 per transaction for EDI when better alternatives exist. A recent forum discussion revealed one company paying $25,000 annually for their subscription plus tiered partner fees ranging from $2,000 to $5,000 per trading partner. With 25,000 transactions annually, their actual cost reached $1.20 per transaction after factoring in all fees.

This pricing model represents the biggest obstacle preventing SMEs from scaling beyond their first few trading partners. 56% of respondents point to "initial cost" as the primary obstacle to implementing EDI, while traditional EDI providers charge $0.30 to $3.00+ per transaction, with costs increasing as businesses grow.

The Hidden Reality of EDI Scaling Costs for SMEs

Most SMEs discover the true cost of EDI only after committing to their first implementation. EDI pricing varies widely based on transaction volume, integration needs, and the number of trading partners. The problem compounds as success breeds additional expense.

Transaction-based pricing can spike quickly as transaction volumes grow, with seasonal fluctuations and test transactions driving up bills. A manufacturer processing 2,000 transactions monthly might pay $600 at $0.30 per transaction, but scaling to 10,000 transactions could cost $3,000 monthly, not the expected $1,500.

The mathematics become punitive at scale. Consider a growing distributor with modest volumes: A company processing 25,000 transactions annually might pay a $25,000 subscription fee plus $0.20 per transaction, totaling $30,000 - that's $1.20 per transaction, far higher than the advertised $0.20 rate.

The Five Cost Traps That Block SME EDI Expansion

Setup Fees Per Trading Partner

Many traditional providers charge $2,000-$5,000 annually per trading partner on top of transaction fees, regardless of transaction volume, making it expensive to onboard new retailers or suppliers. Adding five new retail partners could mean $10,000-$25,000 in additional annual costs.

Transaction Charges That Compound With Success

The per-transaction model punishes growth in multiple ways. Functional acknowledgments double costs since both sending and receiving are charged separately - every document you send requires a 997 confirmation, which you pay for twice.

Seasonal businesses face crushing peak period costs, with retailers processing holiday season volume or agricultural suppliers during harvest season seeing EDI costs spike dramatically.

Legacy System Integration Costs

Each third-party integration adds $8,000–$25,000, depending on API maturity and data volume, with legacy systems without APIs potentially doubling integration costs.

Training and Maintenance Overhead

The skills shortage hits SMEs particularly hard, with EDI experts becoming harder to find, making this unviable for many small- and medium-sized businesses. 22% of respondents cite "lack of resources" as a significant obstacle.

Compliance Penalties and Chargebacks

Hidden costs are where many businesses feel the most pain, with mapping and partner testing fees being a common surprise. Many providers charge separately every time a new trading partner is added or existing partner changes document requirements.

The Mathematics of EDI Scaling Failure

Breaking down the real numbers reveals why traditional EDI pricing kills SME growth. The oldest pricing model charges $0.05 to $0.50 per kilo-character, where every space, delimiter, and piece of data counts toward your bill, creating unpredictable monthly costs that fluctuate with document complexity, not just volume.

Volume tier pricing requires constant monitoring to avoid overages - move from 999 to 1,001 transactions in a month and you might jump to the next pricing tier and pay significantly more for all transactions.

Hidden costs inflate budgets by 300% when you factor in VAN mailbox charges tied to legacy EDI models, which can quietly add hundreds or thousands of dollars per month, especially for high-volume businesses.

Modern Solutions: Cloud-Based and Hybrid Approaches

Many businesses choose cloud-based EDI because it's flexible, cost-effective, and easy to scale, eliminating the need for expensive on-premise IT systems. Cloud-based solutions offer the most cost-effective approach, with predictable monthly or annual fees while the service provider handles all infrastructure, maintenance, and updates.

Modern platforms like Orderful, Cleo, TrueCommerce, and Cargoson offer subscription-based pricing that eliminates transaction penalties. These solutions provide flat, per-partner pricing with predictable costs and unlimited transactions, keeping costs predictable and eliminating surprise transaction fees.

Leading providers include established players like SPS Commerce, TrueCommerce, Cleo, and OpenText, alongside emerging solutions like Cargoson that specifically target transport and logistics businesses with integrated TMS capabilities.

The Complete SME EDI Cost Optimization Framework

Smart SMEs evaluate total cost of ownership beyond sticker price. Consider the total cost of ownership over time, including implementation costs, training expenses, ongoing maintenance and support fees, and any potential costs associated with upgrading or scaling the solution as your business grows.

Different EDI providers offer various pricing models - evaluate each to determine which aligns best with your business needs and budget constraints, considering factors such as cost predictability, scalability, and additional fees.

Key Evaluation Criteria

Consider how many trading partners are already EDI-compliant, whether the provider offers coverage for your geographic locations, what level of support they offer, and how they calculate data volume - including any cost-per-transaction fees or underlying fees.

TMS Integration Considerations

Transportation management system choice significantly affects EDI costs. Built-in EDI capabilities within TMS platforms like Cargoson can eliminate separate EDI provider fees while maintaining seamless freight operations integration.

The complexity increases when integrating standalone EDI solutions with existing TMS platforms, potentially requiring $8K–$25K per integration, plus 10–15% per year for API maintenance and break/fix.

2026 Implementation Roadmap for Cost-Conscious SMEs

Smart implementation follows a phased approach that minimizes upfront costs while building capability.

Quick Wins: Web-Based EDI Platforms (5-Day Setup)

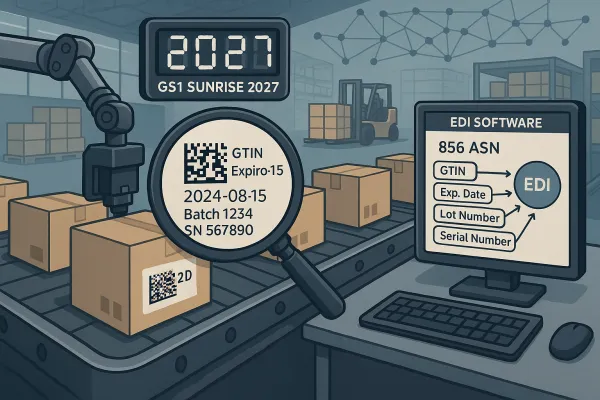

Web-based platforms require no software installation, provide built-in retailer compliance, and enable connection to new partners in days using self-service setup tools, making them the easiest way for small businesses to meet retailer compliance requirements.

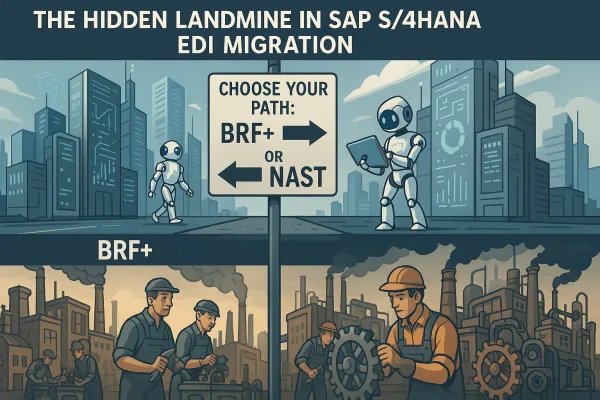

Medium-Term: ERP/TMS Integration (1-3 Weeks)

Most migrations complete in 2-4 weeks, not the months required for traditional EDI implementations. Fast ERP connectivity platforms connect quickly with systems like NetSuite and Microsoft Dynamics for seamless data flow.

Long-Term: Enterprise-Grade Automation

API-based infrastructure ensures compatibility as business systems and requirements evolve, helping growing SMBs automate critical data flows and scale confidently without legacy system complexity.

Real-World Success Stories and Lessons Learned

The transformation from traditional to modern EDI pricing delivers significant savings. Modern EDI platforms can save businesses up to 70% on EDI expenses through transparent, flat-rate pricing that eliminates unpredictable VAN fees and per-transaction charges.

Smart companies avoid the common mistake of choosing the cheapest upfront option. The least expensive option upfront often becomes the most expensive solution long term, while solutions with slightly higher subscriptions but fewer hidden fees and faster implementation often deliver significantly lower long-term costs.

The average paper requisition to order costs $37.45 in North America, while EDI requisitions cost $23.83 - clear savings exist, but the barrier was getting there. Modern cloud-based platforms have eliminated this barrier for SMEs willing to look beyond traditional VAN providers.

The key to success lies in transparent pricing models that align with business growth rather than penalize it. Predictable costs without hidden fees enable confident budgeting without worrying about transaction surcharges, giving businesses flexibility to grow without paying enterprise prices.