The API-First TMS Revolution: How Leading Transportation Management System Vendors Are Positioning Real-Time Connectivity Over EDI and What Supply Chain Teams Need to Know for 2026 Vendor Evaluations

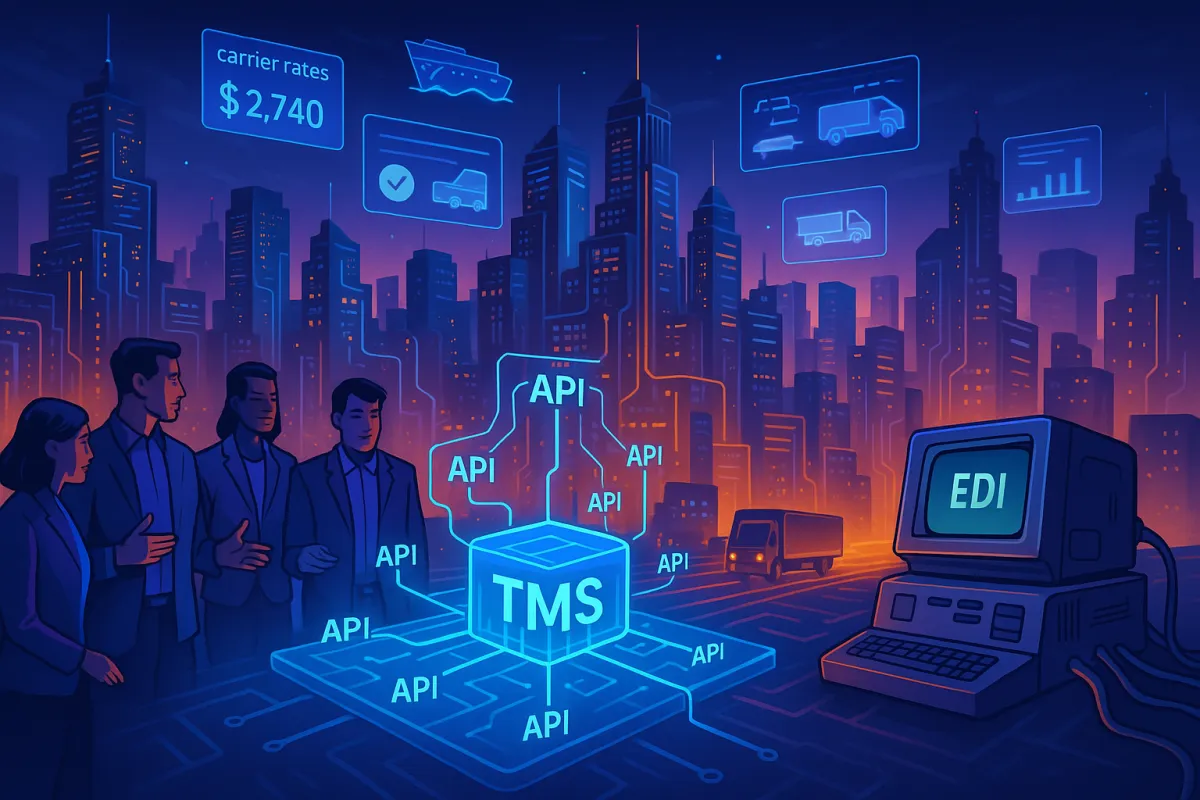

Major carriers across North America and Europe now deliver rate quotes within milliseconds through API connections, while traditional EDI requests still take hours or days to process. This shift from Electronic Data Interchange (EDI) integrations to Application Programming Interface (API) integrations is providing improved access to real-time carrier rates, shipment statuses, carrier onboarding, and more, with modern transportation software increasingly integrating via APIs that provide real-time rate access, smoother onboarding, and high-fidelity shipment status updates across ecosystem partners.

Supply chain professionals evaluating TMS platforms in 2026 face a fundamental question: which vendors offer genuine API-first connectivity versus those simply adding API layers to legacy EDI frameworks? The answer determines whether your organization can capitalize on the 27% productivity increases and 23% operational cost decreases that companies report when adopting API-connected TMS solutions.

The Strategic Shift to API-First TMS Architecture

Tasks that once required custom development, like connecting a TMS to an ERP system, are easier because of more mature application programming interfaces (APIs) and standardized data flows, with "the API-fication of TMS has evolved far beyond where it was just a few years ago" according to Capgemini's supply chain experts.

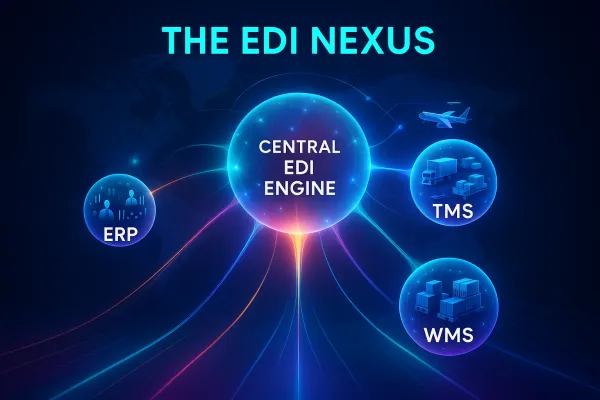

Leading carriers increasingly position APIs as their preferred integration pathway for good reason. APIs enable tighter integration between TMS, warehouse systems, fleet telematics, and customers, bridging data silos and delivering a unified view of operations, critical for scalable transportation management technology. When FedEx updates a delivery status, that information flows instantly into your TMS, ERP, and customer notification system simultaneously.

In March 2025, Descartes Systems Group acquired the TMS provider 3GTMS for USD 115 million, expanding Descartes' capabilities in domestic North American transportation management, adding robust planning, rating, consolidation, and routing tools for truckload, less-than-truckload, and parcel modes while extending Descartes' reach with API-enabled carrier connectivity. This acquisition signals how established vendors recognize API connectivity as a competitive necessity, not a nice-to-have feature.

Real-World Performance: API vs EDI in Transportation Operations

The performance gap between API and EDI integration becomes stark when handling time-sensitive logistics operations. With cloud-based solutions, API allows transportation management systems (TMS) to transmit data in less than a second, with the application programming interface capable of performing specific processing tasks much faster than electronic data interchange.

Consider carrier onboarding timelines. Traditional EDI connections require weeks or months of back-and-forth testing, VAL verification, and compliance certification. API integrations can be functional within days. Most machinery manufacturers are live in 1-2 weeks when implementing modern TMS platforms, importing carrier rate cards in any format, setting up API connections, and providing go-live training, compared to 6-18 month implementations typical of enterprise TMS platforms.

The operational benefits extend beyond speed. Enhanced adaptors between platforms like Descartes MacroPoint and Oracle Transportation Management provide global, multimodal connectivity where customers can seamlessly connect with an unparalleled network of ready-to-track global carriers, with shipment data automatically communicated via API enabling real-time tracking and exception management directly within OTM.

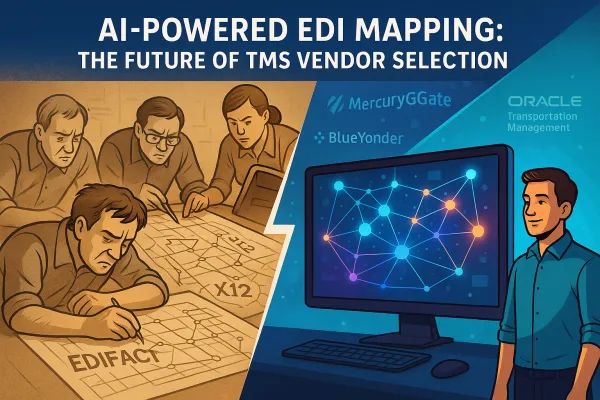

Vendor Positioning Analysis: Who's Leading the API-First Movement

The TMS vendor landscape divides into three categories: API-native platforms, hybrid integrators, and legacy providers retrofitting API capabilities.

API-native platforms like Cargoson, Shipwell, and FreightPOP built their architecture around API connectivity from day one. Cargoson offers direct API/EDI integrations with carriers across all transport modes (FTL, LTL, parcel, air, and sea freight), allowing you to compare rates, book shipments, and track imports and deliveries from a single platform, building true API/EDI connections with carriers, not just accounts in software or standardized EDI messages that carriers must implement themselves.

Established enterprise vendors take different approaches. SAP's transportation management system (TMS) empowers global organizations to plan, execute, and monitor goods movement efficiently by integrating seamlessly with other SAP modules, supporting high-volume data processing, document and order management, transport analysis, and freight settlement. However, many TMS vendors, including SAP and Oracle, have API connectivity but do not necessarily offer EDI/API connections with all carriers in all modes, with this connectivity potentially required outside of the TMS for an additional cost.

Startups and SMEs like VTradEx, Shipwell, and Tesisquare have distinguished themselves by offering cloud-native, modular TMS with real-time shipment visibility, API-first integrations, AI-driven routing/optimization, freight marketplace/connectivity, and collaborative supply-chain orchestration that accelerates digitalization for shippers and carriers.

The distinction matters because true API/EDI connections provide automatic rate updates, real-time tracking, and seamless booking workflows. Vendors offering only "EDI messages that carriers must implement themselves" shift integration complexity and costs back to carriers, limiting your actual connectivity options.

The Hidden Costs of API-First vs EDI-First TMS Strategies

API-first TMS platforms promise cost savings, but implementation approaches vary dramatically in their financial impact. Full EDI transformations range from USD 50k for a single-lane pilot to USD 500k for a global rollout, while more accessible projects running an API alongside EDI or starting with dock-scheduling data begin in the low five figures and often pay back inside a year through faster gate turns and fewer chargebacks.

Generally, shipper TMS recurring pricing models use transaction-based structures using the number of shipments planned and executed through the system, with the transaction-based model offering scalability as the cost is directly tied to the usage and workload of the shipper. However, unpredictable per-transaction pricing can create budget surprises as shipping volumes fluctuate.

Platforms like Cargoson address cost predictability differently. Companies like Cargoson offer transparent pricing starting at €199 per month, making professional freight management accessible to smaller shippers, compared to enterprise solutions that typically cost $100,000-$500,000 annually plus significant implementation costs.

Traditional EDI connections rely heavily on manual labor because it's a peer-to-peer system with no automation involved in processing data, while APIs are often more budget-friendly than EDI, not needing constant upkeep or special translation services.

Critical Evaluation Framework for API-Ready TMS Platforms

When evaluating API-first TMS capabilities, focus on integration depth rather than vendor marketing claims. Essential requirements include automated delivery creation, maximum interoperability with ERP, WMS, or CRM systems, and genuine carrier API connections.

Look for TMS platforms that offer robust APIs and pre-configured connectors specifically designed for SAP and Oracle ERP systems, reducing integration time and complexity, with support for real-time data sharing ensuring shipment updates, freight costs, and inventory levels are instantly reflected in your ERP.

Technical architecture matters more than feature lists. Platforms like Cargoson integrate with carriers by setting up direct API connections that automatically sync rates, transit times, and tracking information, with lots of these API connections already pre-built and ready for use, and any customer can request a new carrier integration for free within a few weeks.

Examine vendor carrier onboarding processes closely. While carriers can easily join some platforms through their portals, requesting completely new carrier API/EDI integrations is more complex and costly, with vendors like Alpega typically not building custom carrier integrations themselves but acquiring companies with existing connections or providing standard EDI interfaces that carriers must implement.

Hybrid Integration: The Practical Reality for 2026

Despite API enthusiasm, most organizations operate hybrid networks where APIs handle priority functions while EDI provides fallback connectivity. Going "API-only" promises real-time updates and cost savings, but the reality is rarely binary, with time-sensitive events like dock appointments, GPS pings and on-hand stock benefiting from API speed, while invoices and customs forms sit comfortably in EDI's structured format.

Freight brokers utilizing both API and EDI integrations make the best use of both worlds, with API being the interface and EDI providing an engine, with one of the best API-EDI TMS integrations being an API that serves as a data feed for EDI software.

Platforms like Cleo Integration Cloud combine traditional EDI with modern API capabilities, designed to support complex logistics operations by connecting 3PLs with trading partners across multiple business systems, with strong support for hybrid integration that combines EDI documents with APIs.

The hybrid approach addresses partner reality. Full EDI retirement only becomes viable when three hurdles clear: partner readiness where every carrier and customer can send/receive APIs, system limits where your WMS, TMS, or ERP can send and receive API messages without messy workarounds, and compliance comfort where finance and quality teams are confident using digital logs in place of traditional EDI control reports.

Implementation Roadmap: Transitioning from EDI-Centric to API-First TMS

Companies report measurable benefits when implementing API-connected TMS solutions, but success depends on strategic implementation sequencing. The loading dock is the best first project because it solves the daily pain of door congestion while giving your team a safe playground for APIs, moving from first-come-first-served to appointment scheduling with a SaaS dock-scheduling tool letting carriers book slots online and instantly cutting yard chaos.

Start with high-impact, low-risk processes. Customers typically report 10-30% freight cost reduction and positive ROI within 2 months, with savings coming from comparing rates across all carriers for each shipment instead of defaulting to familiar choices and managing more carriers effectively.

Technical implementation follows a predictable pattern. Cloud-based shipping software often integrates with ERP systems, warehouse management software, and e-commerce platforms, with popular cloud TMS integrations including Microsoft Dynamics 365 Business Central, SAP, NetSuite, Odoo, Magento, and WooCommerce, while platforms like Cargoson offer pre-built integrations with major business software platforms.

Migration timing varies by vendor and complexity. Cloud TMS implementation takes weeks not months, allowing you to compare all carrier rates in one platform, starting at €199/month versus €100k+ annually for traditional enterprise implementations.

The transportation industry's API-first movement represents a fundamental shift in how supply chain professionals approach carrier connectivity and system integration. Organizations evaluating TMS platforms in 2026 must distinguish between vendors offering genuine API-native architectures versus those retrofitting legacy EDI systems with API facades. Success requires understanding each vendor's true integration capabilities, cost structures, and migration support.

The evidence shows hybrid approaches will dominate the near term, with APIs handling time-sensitive operations while EDI maintains compatibility with traditional partners. Smart implementation starts with high-impact use cases like dock scheduling or rate comparison, then expands based on proven ROI and partner readiness.