The Complete EDI Vendor Evaluation Framework: How to Eliminate the 73% Implementation Failure Rate and Select the Right Integration Partner for Your TMS in 2026

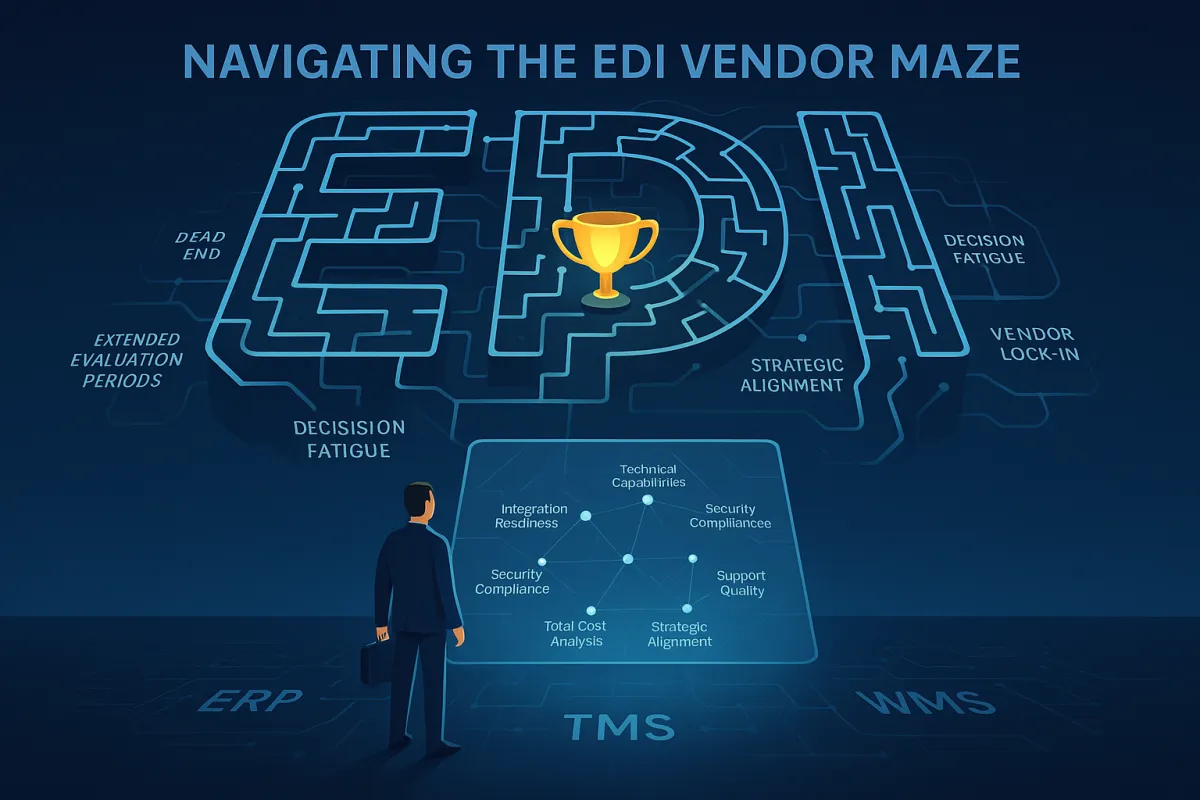

The 73% implementation failure rate isn't limited to ERP systems—EDI vendor selection follows the same pattern of costly mistakes, with companies spending months evaluating solutions only to discover their chosen vendor can't handle real-world complexities. Features vary widely, and vendor claims often do not accurately reflect real-world performance, leaving teams drowning in extended evaluation periods and decision fatigue.

Your transportation management system integration makes this problem worse. When an enterprise grows and is looking to implement a new ERP or TMS, the switch will impact EDI with its trading partners. The average company that performs EDI has anywhere from 100-200 partners, and 400-500 maps—all of which will be impacted by the switch. One wrong vendor choice creates cascading failures across your entire partner network.

The Root Causes of EDI Vendor Selection Failures

Most EDI vendor selection processes fail before they begin. Companies approach evaluation like they're buying office software instead of mission-critical infrastructure that touches every trading partner relationship.

Integrating EDI with TMS can be technically challenging, especially for organizations with outdated systems or limited IT resources. The complexity multiplies when you realize EDI is a complex process. If performing EDI inside an ERP, it usually requires other solutions around the ERP to help complete the EDI processing. This is because ERP, TMS, and WMS tend to have very lightweight EDI processing. For example, a company may have a different communication software to support various protocols— scripts to complete EDI processing, scripts for database table lookups, or integration between different databases.

Incomplete RFP processes miss the technical realities. Your suppliers wait four to six weeks just to get onboarded with traditional EDI vendors, and in practice, the theoretical 1-2 week timeline often stretches to 1-2 months or longer. Meanwhile, Suppliers often use different EDI vendors for every new trading partner connection without realizing they can consolidate all EDI services with a single provider. This fragmentation causes suppliers to lose approximately $27K in yearly revenue per trading partner and pay 35% more in EDI costs.

Vendor lock-in becomes the silent killer. Configurations and integrations are proprietary, offering quick implementation but less control and flexibility. SPS retains ownership of maps and process logic. When you need to change or upgrade, you're trapped.

The 7-Pillar EDI Vendor Evaluation Framework

Stop evaluating EDI vendors like you're comparing email platforms. You need a systematic approach that exposes vendor weaknesses before they become your operational nightmare.

This framework covers seven critical pillars that determine success or failure: technical capabilities, integration readiness, scalability, security compliance, support quality, total cost analysis, and strategic alignment. Each pillar includes specific evaluation criteria with weighted scoring to standardize your decision-making process.

Pillar 1: Technical Architecture Assessment

Your EDI vendor must prove they can handle your technical environment, not just claim they can. System Integration: EDI tools should easily connect with ERP, accounting, WMS, or TMS systems like SAP, Oracle, Microsoft Dynamics, or NetSuite to automate workflows.

Demand proof of ERP/TMS connectivity through live demonstrations using your actual data formats. Standards Selection: Choose the right EDI standards (like X12 or EDIFACT) based on your industry and partner requirements. Test their transport protocol support—AS2, SFTP, VAN connectivity—with your current partner requirements.

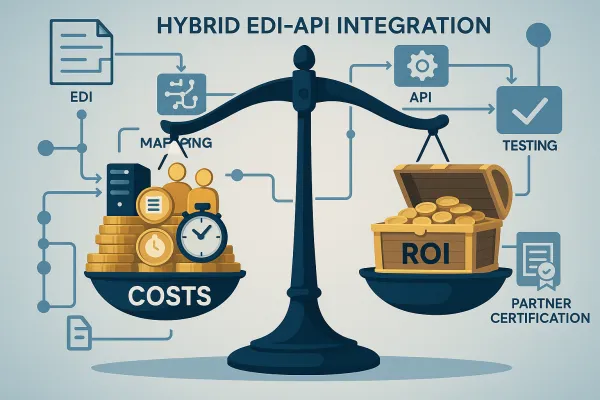

API capabilities separate modern vendors from legacy providers. While EDI establishes a connection between two EDI systems, API is a web-based protocol that enables different programs to communicate. With cloud-based solutions, API allows transportation management systems (TMS) to transmit data in less than a second. Your evaluation must verify both traditional EDI and modern API support.

Pillar 2: TMS Integration Compatibility Evaluation

TMS integration failures destroy trading partner relationships overnight. But when it's time to upgrade or replace your transportation management system (TMS), those EDI connections often break, sometimes without warning. EDI and TMS systems are tightly intertwined. Everything from tendering a load to confirming delivery relies on structured, automated data flows between shippers, carriers, and brokers. When a TMS system is swapped out or reconfigured without an EDI continuity plan, the result is often delays, chargebacks, or failed deliveries.

Test document flow handling for transportation standards—EDI 940 (Warehouse Shipping Order), 204 (Motor Carrier Load Tender), and 214 (Transportation Carrier Shipment Status Message). TMS EDI with LSPs can support a wide range of transaction sets, such as load tendering, shipment status updates, proof of delivery, and freight invoice reconciliation. This may include load tendering, shipment status updates, proof of delivery, and freight invoice reconciliation.

Field mapping capabilities determine success speed. Data Mapping Complexity Traditional EDI requires mapping your internal data fields to standardized formats. This process can take weeks and requires technical expertise most carriers lack. Modern TMS Solution: Cloud-based platforms like Dashdoc provide pre-built mappings for common EDI transactions, reducing setup time from weeks to days.

Migration risk assessment prevents partner disruption. Legacy Systems: Use middleware solutions to bridge the gap between older systems and modern EDI requirements. Evaluate each vendor's continuity planning and rollback capabilities before committing.

Building Your EDI RFP Evaluation Matrix

Your RFP becomes your weapon against vendor promises that evaporate post-contract. Build a standardized evaluation matrix that forces vendors to provide concrete proof, not marketing fluff.

Structure your matrix around weighted scoring for technical capability (40%), methodology and support (30%), company background (20%), and cost analysis (10%). This weighting reflects the reality that technical failures kill projects more often than cost overruns.

Include specific evaluation criteria for each vendor comparison. Partner Management: Simplify the onboarding and configuration of trading partners with support for custom rules and document formats for each. Test their onboarding automation—Each broker or shipper may have unique EDI requirements, connection protocols, and testing procedures. Modern TMS Solution: Automated partner onboarding tools guide you through connection setup with step-by-step wizards and pre-configured templates.

Critical RFP Questions That Expose Vendor Weaknesses

Ask these specific questions to separate real capabilities from vendor promises:

- How many transportation-specific EDI implementations have you completed in the last 12 months?

- What is your average partner onboarding time for TMS integrations, measured from initial contact to production data flow?

- Provide references from three customers with similar TMS platforms and trading partner volumes

- Demonstrate your error handling for failed EDI transactions during peak shipping periods

- What happens to our EDI maps and business logic if we terminate your service?

Vendors with deep knowledge of industry processes can ease implementation, helping you avoid common pitfalls and ensuring smoother transitions. Industry-specific expertise can significantly reduce integration times and improve business outcomes by ensuring the right customization of EDI solutions. Generic answers indicate generic solutions that create implementation problems.

Billing model transparency reveals hidden costs. Traditionally, EDI providers have used transaction-based pricing models, charging a fee for each document exchanged. But as the average volume of transactions increased, some EDI vendors have switched to partner-based pricing models that allow customers to send and receive an unlimited number of transactions for a flat fee. Per-Transaction Model: Each document exchange with trading partners is charged individually, causing costs to fluctuate as EDI transaction volume fluctuates. Per-Trading-Partner Model: A fixed fee is associated with each trading partner