The Complete Guide to EDI-Powered Carbon Tracking: Automating Scope 3 Emissions Collection for CSRD Compliance in 2025

Companies with major carbon reporting obligations are facing 2025 deadlines sooner than many expected. The first companies subject to the Corporate Sustainability Reporting Directive (CSRD) have to apply the new rules for the first time in the 2024 financial year, for reports published in 2025. In Europe, 11,700 of the largest, exchange-listed companies, banks, and insurers will have to report their greenhouse gas emissions for the first time in 2025 because of the European Union's Corporate Sustainability Reporting Directive (CSRD). The complexity goes beyond simple compliance - The same cannot be said for Scope 3 emissions, which are trickier ― primarily because they involve emissions created outside the reporting company.

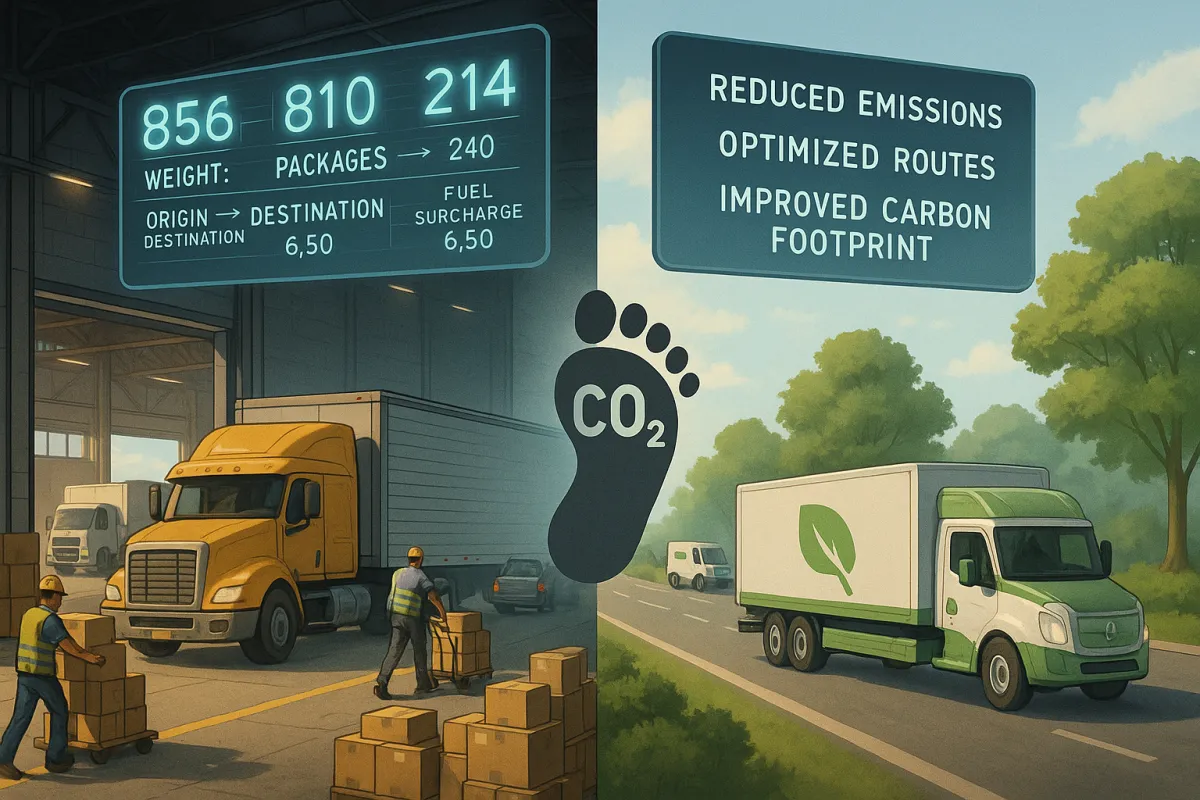

Your EDI systems already contain much of the transportation and logistics data needed for carbon tracking, but most companies aren't extracting this information systematically. Entities should work towards obtaining primary data from value chain partners to enhance the accuracy of Scope 3 emissions reporting. The good news? EDI transactions like shipment status updates and freight invoices carry the weight, distance, and fuel consumption data that form the foundation of accurate emissions calculations.

Scope 3 Emissions Collection Through EDI: What Data You Need and Where to Find It

Transportation represents a significant portion of most companies' Scope 3 footprint, and your EDI infrastructure captures this data daily. Transportation is often seen as being the biggest driver of supply chain emissions — however, it is raw material inputs from land use and heavy industries which make up the largest share of supply chain emissions worldwide. Still, for many manufacturers and retailers, transportation accounts for 15-30% of total Scope 3 emissions.

The most valuable EDI documents for carbon tracking contain shipment-specific information. EDI 214 shipment status messages include actual routing data, delivery confirmations, and timing details that help calculate real transport emissions versus estimates. EDI 210 freight invoices often contain fuel surcharge information, which correlates directly to fuel consumption and emissions. When carriers break out these charges separately, you get insight into actual fuel costs per shipment.

Trucking carriers would transmit their operating data to Microsoft via EDI that is then converted into emissions calculations in their supply chain optimization tool, resulting in a 60% reduction in carbon emissions from North American trucking over our projected baseline in their forward supply chain.

Essential EDI Transaction Sets for Carbon Data Collection

EDI 856 (Advance Ship Notice) transactions provide shipment weight, package counts, and origin-destination pairs - critical inputs for distance-based emissions calculations. The weight data helps determine vehicle utilization rates, while package counts indicate consolidation efficiency. Many ASNs also include carrier SCAC codes, allowing you to apply carrier-specific emission factors.

EDI 810 invoices deserve special attention because they often separate fuel surcharges from base transportation rates. These surcharges fluctuate with fuel prices and consumption, giving you a proxy for actual fuel usage per shipment. Some carriers also include equipment type codes in their invoices, helping you differentiate between truck classes with different emission profiles.

Less obvious but valuable are EDI 204 load tender messages, which contain planned routing information. Comparing planned versus actual routes (from EDI 214s) reveals route optimization opportunities and helps validate emissions calculations.

Setting Up Automated Carbon Data Extraction from EDI Transactions

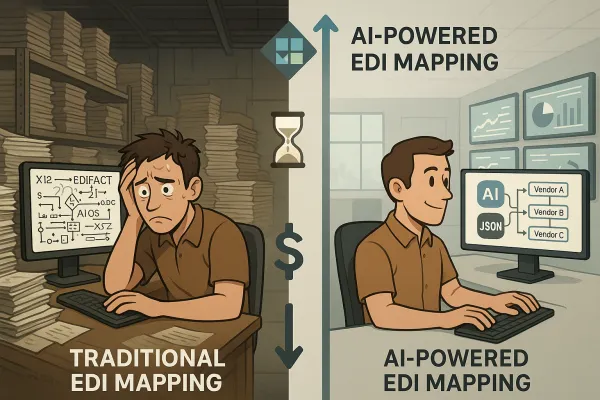

The challenge isn't accessing the data - it's systematically extracting and normalizing it for carbon calculations. Most EDI systems weren't designed with carbon tracking in mind, so the relevant fields are scattered across different message segments and often encoded in ways that require translation.

Start with your EDI mapping software to identify and extract key carbon-relevant fields. Weight typically appears in the HL*S segment of an 856, but the unit of measure code determines whether you're dealing with pounds, kilograms, or metric tons. Distance calculations require geocoding origin and destination ZIP codes or city/state combinations from the N1 and N4 segments.

Fuel surcharge extraction from EDI 810 invoices requires careful parsing of the TXI (Tax Information) segments, where carriers often embed fuel adjustments. The challenge here is that different carriers use different codes for fuel-related charges - some use "FSC," others use "FUEL," and larger carriers often have proprietary codes.

Data Mapping Strategies for Carbon Calculation

Weight, distance, and mode data from EDI transactions need transformation into standardized formats for carbon calculations. Collecting higher quality data for priority activities allows companies to focus resources on the most significant GHG emissions in the value chain, more effectively set reduction targets, and track and demonstrate GHG reductions over time.

Create mapping tables that translate carrier equipment codes to vehicle types with known emission factors. A "TT" equipment code might map to "53-foot dry van," which has a specific grams-per-ton-kilometer emission factor. Without this translation layer, you'll struggle to apply accurate emission factors to your shipments.

Route optimization impact measurements require comparing planned routes (EDI 204) with actual delivery data (EDI 214). Deviations often indicate driver efficiency issues, traffic problems, or customer-requested routing changes that increase emissions. Document these patterns to identify systemic inefficiencies.

Building Your EDI Carbon Tracking Architecture

The most effective EDI carbon tracking systems integrate with existing transportation management systems rather than replacing them. Companies like Cargoson offer cloud-based TMS platforms that can ingest EDI data streams and automatically calculate carbon emissions using established methodologies. Similar capabilities are available through platforms like Cleo, MercuryGate, and Descartes, though carbon tracking features vary widely.

Trax's Carbon Emissions Manager, for example, enables companies to track their actual carbon emissions across all modes of transportation, providing valuable insights and data-driven decision support for transportation spend management and freight audit processes. The key is finding a solution that can process your existing EDI formats without requiring extensive data restructuring.

Your architecture needs three core components: EDI data extraction, emissions calculation engines, and reporting tools. The extraction layer pulls relevant fields from incoming EDI messages and normalizes them into a standard format. The calculation engine applies emission factors based on distance, weight, mode, and equipment type. The reporting layer aggregates emissions data for CSRD compliance and internal sustainability metrics.

Consider data quality controls at each stage. EDI messages sometimes contain errors - negative weights, impossible distances, or missing carrier information. Build validation rules that flag suspicious data for manual review while allowing clean transactions to flow through automatically.

CSRD Compliance: EDI Data Quality and Audit Trail Requirements

The submitted data will then be subject to "limited third-party assurance," meaning that an auditor will need to evaluate the data. This creates new requirements for EDI-sourced carbon data that many companies haven't considered. Your EDI carbon tracking system needs to maintain complete audit trails from the original transaction through the final emissions calculation.

CSRD's emphasis on data verification means you can't rely solely on estimated emission factors. Use recognised standards: Leverage established frameworks such as the GHG Protocol Corporate Standard, ISO 14064-1, and the GHG Protocol Scope 3 Standard for accurately measuring and reporting GHG emissions. When possible, supplement EDI-derived calculations with primary data from carriers about actual fuel consumption and route efficiency.

The undertaking shall disclose its total GHG emissions disaggregated by Scopes 1 and 2 and significant Scope 3 per this table. Your EDI system needs to categorize transportation emissions correctly - inbound shipments from suppliers typically fall under Scope 3 Category 4 (Upstream Transportation), while outbound shipments to customers are Category 9 (Downstream Transportation).

Creating Audit-Ready EDI Carbon Reports

Documentation standards for EDI-sourced emissions data require tracking the calculation methodology for each shipment. Store the original EDI message alongside the extracted data fields, emission factors used, and calculation results. This creates a complete chain of custody that auditors can follow.

Error handling becomes critical for audit purposes. When EDI data is incomplete or questionable, document the assumptions made and alternative data sources used. If you estimate distance using ZIP code centroids because the EDI message lacks precise addresses, note this limitation in your audit trail.

Data quality controls should include statistical validation - flag shipments with emissions per ton-kilometer that fall outside normal ranges for similar routes and modes. These outliers often indicate data entry errors or unusual circumstances that require explanation in your CSRD report.

Common EDI Carbon Tracking Implementation Challenges (And Solutions)

The biggest obstacle most companies face is inconsistent data formats across carriers. One carrier might report weight in pounds while another uses kilograms. Origin and destination information varies from full addresses to ZIP codes to city/state combinations. However, many companies struggle with data gaps, inconsistencies, or lack of standardization, hindering their ability to make informed decisions.

Equipment type standardization poses another challenge. Carrier A's "TT" code represents a different truck configuration than Carrier B's "TT" code, leading to incorrect emission factor applications. Create comprehensive translation tables that map each carrier's equipment codes to standardized vehicle types with known emission characteristics.

Missing or incomplete EDI data requires fallback calculations. When shipment weight is missing, you might estimate based on product density and package counts. When exact addresses aren't available, calculate distance using ZIP code centroids. Document these estimation methods for audit purposes and update calculations when better data becomes available.

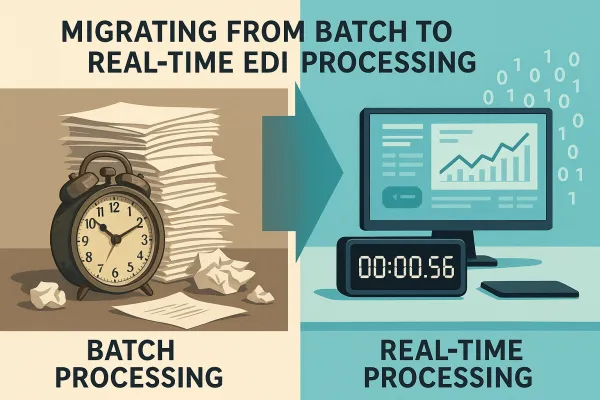

Real-time versus batch processing presents operational trade-offs. Processing EDI messages as they arrive provides immediate emissions feedback but requires more system resources. Batch processing daily or weekly EDI files is more efficient but delays emissions visibility. Most companies find success with hybrid approaches - real-time processing for high-value shipments and batch processing for routine transactions.

ROI and Future-Proofing Your EDI Carbon Tracking Investment

The cost of CSRD non-compliance provides strong financial motivation for EDI carbon tracking investments. With governments and regulatory bodies introducing stricter emissions standards and sustainability reporting requirements, proactively managing supply chain carbon emissions can help companies mitigate legal and financial risks associated with non-compliance. Manual carbon data collection for thousands of monthly shipments becomes prohibitively expensive at scale.

Operational benefits extend beyond compliance. Companies using EDI carbon tracking often identify transportation inefficiencies that weren't visible before. Route optimization, carrier selection, and shipment consolidation opportunities emerge from detailed emissions analysis. This reduction in errors not only saves time and resources but also helps reduce fuel consumption associated with unnecessary transportation, lowers additional transportation emissions and minimizes packaging waste.

Future regulatory developments will likely increase EDI carbon tracking requirements. The SEC's proposed climate disclosure rules in the US would affect companies with EU subsidiaries already subject to CSRD. California's SB 253 requires Scope 3 reporting for large companies by 2026. Building robust EDI carbon tracking capabilities now positions you for multiple regulatory requirements.

Technology evolution points toward AI-enhanced carbon optimization. Machine learning algorithms can analyze EDI transaction patterns to recommend carrier selections, routing changes, and consolidation strategies that reduce emissions while maintaining service levels. Early adopters of integrated EDI carbon tracking systems will have the data foundation needed to leverage these advanced capabilities.

The 2025 CSRD reporting deadline is approaching quickly, but your EDI systems already contain much of the data needed for Scope 3 emissions tracking. The key is implementing systematic data extraction, calculation, and audit processes before manual reporting becomes unmanageable. Companies that act now will find themselves ahead of both regulatory requirements and competitive pressures in an increasingly carbon-conscious marketplace.