The Complete Hybrid EDI-API Integration Business Case Framework: How to Calculate True ROI and Build Bulletproof Cost-Benefit Analysis for 2026 Supply Chain Modernization Projects

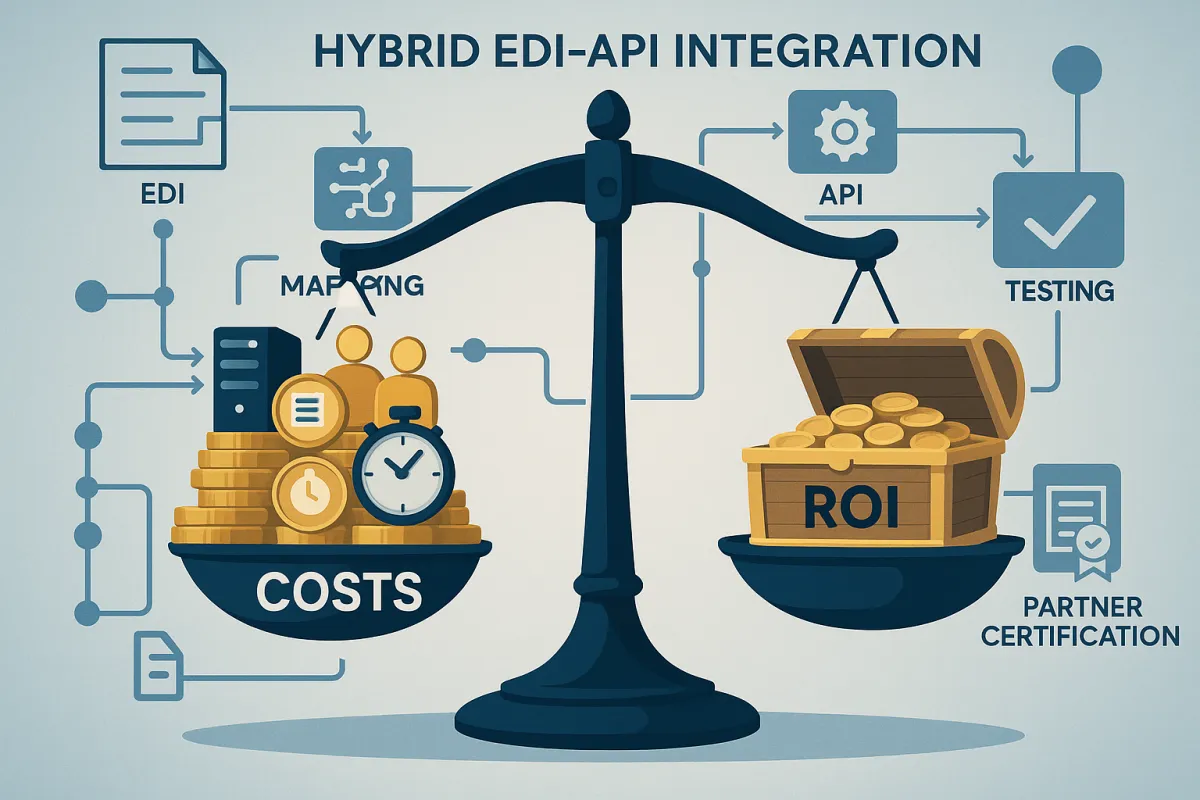

Most hybrid EDI-API integration projects fail to deliver on their promised ROI because finance teams underestimate the hidden complexities. You've probably seen the pattern: executives approve $200K budgets based on vendor presentations, only to discover the real costs hit $500K when maintenance, training, and partner onboarding drag on for months beyond schedule.

The Global Supply Chain Management Software Market is projected to expand from USD 27.17 Billion in 2025 to USD 53.57 Billion by 2031, reflecting a compound annual growth rate of 11.98%. But while 85% of supply chain transactions are still managed through EDI, companies are increasingly recognizing that a hybrid approach provides the benefit of using the best B2B technology for the circumstance rather than forcing an either-or choice.

Here's your comprehensive framework for calculating true hybrid EDI-API integration ROI and building bulletproof cost-benefit analysis that actually holds up to scrutiny.

The Hidden Financial Reality Behind EDI-API Integration Decisions

APIs can be configured by your IT department or any tech-savvy analyst in weeks. EDI generally requires expensive, specialized consultants for setup and any changes. This fundamental cost difference shapes every aspect of your integration strategy, yet most ROI models completely ignore it.

Look for sub-USD 500/month packages that bundle pre-mapped templates for orders (850), inventory (846), and shipments (856) when evaluating cloud-native solutions. Compare this against traditional EDI implementations that often start at $50K just for setup with vendors like IBM Sterling B2B Integrator or Oracle TM.

Modern platforms now offer pre-built connectors that integrate EDI directly with major ERP systems, including SAP, Oracle, NetSuite, and Microsoft Dynamics. Solutions like Cargoson address hybrid integration challenges alongside competitors like Cleo Integration Cloud and SPS Commerce by dramatically simplifying partner onboarding and reducing legacy system complexity.

Why Traditional ROI Models Fail for Hybrid Integration Projects

Standard IT ROI calculations miss the operational complexity that kills project timelines. They focus on licensing costs and ignore the weeks spent on data mapping, testing cycles, and partner certification processes that stretch implementations from 3 months to 12 months.

The difficulty of integrating advanced digital tools with entrenched legacy systems acts as a major decelerator. As organizations attempt to modernize their logistics networks, they frequently encounter severe technical friction when synchronizing new applications with fragmented, decades-old infrastructure. This interoperability deficit results in data silos that obscure the real-time visibility necessary for modern operations.

VAN-based approaches carry predictable monthly fees but limit your scaling flexibility. Cloud-native hybrid platforms eliminate VAN costs but require stronger internal technical capabilities. Factor this trade-off into your 3-year cost projections.

The 7-Factor Hybrid Integration Cost Analysis Model

Calculate hybrid EDI API integration cost benefit analysis using these seven cost dimensions that most finance teams miss:

Implementation Costs: Beyond software licensing, include professional services for data mapping, testing environments, and certification processes. Budget 40-60% of total project cost for services when working with enterprise solutions like MercuryGate or Descartes, versus 15-25% for cloud-native platforms.

Infrastructure and Middleware: Traditional EDI requires dedicated servers, backup systems, and network security hardening. Hybrid cloud platforms reduce infrastructure needs but increase API management and monitoring requirements.

Maintenance and Support: EDI maps require updates every time trading partners change formats or add fields. APIs need version management and backward compatibility testing. Budget 18-25% of implementation cost annually for maintenance.

Training and Skill Development: EDI specialists command $90-120K salaries in most markets. API integration skills are more common but still require training on your specific platform and partner requirements.

Partner Onboarding Acceleration: For partners that have not signed up for EDI due to costs or complexity, APIs provide an alternative way to transact. This reduces trading partner onboarding time by up to 50% with prebuilt templates, but requires API documentation and testing processes.

Scaling and Volume Costs: EDI typically charges per-kilocharacter or per-document. APIs use call-based pricing that scales differently with transaction volume. Model both scenarios across your 3-year growth projections.

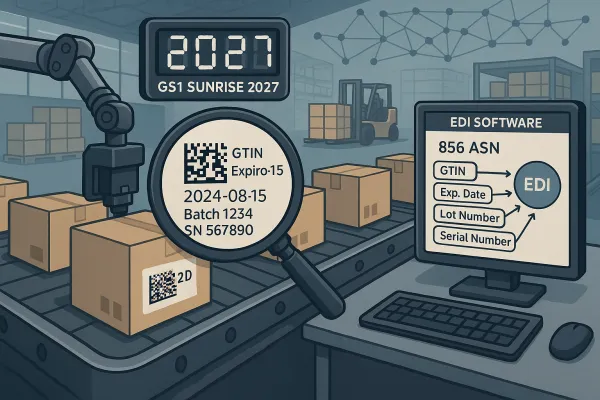

Risk Mitigation and Compliance: Hybrid solutions must maintain audit trails for both EDI and API transactions. Include costs for compliance monitoring tools and documentation processes that satisfy trading partner requirements.

Hard Cost Calculations: Implementation and Infrastructure

Enterprise EDI solutions start with licensing fees of $25-75K annually, plus $40-150K in professional services. Add infrastructure costs of $8-15K for servers, security, and backup systems.

Cloud-based hybrid platforms typically run $500-2,000 monthly for SMB packages, scaling to $5-15K monthly for enterprise volumes. Professional services drop to $15-40K because pre-built connectors eliminate custom mapping work.

Compare TMS integration costs: traditional solutions like Transporeon require 6-12 months for full implementation, while platforms like Cargoson can onboard carriers in weeks thanks to standardized API connections and pre-mapped EDI formats.

Soft Cost Analysis: Operational Efficiency and Risk Mitigation

Manual order processing costs $15-25 per transaction when you factor in data entry, error correction, and exception handling. Organizations save approximately $30,000 annually per EDI integration through automated processing, but hybrid solutions can double those savings by reducing partner onboarding friction.

Error reduction provides measurable benefits: Up to 90% fewer manual entry mistakes translate directly to reduced chargebacks, faster payment cycles, and improved customer satisfaction scores.

Real-time visibility through API integration enables proactive exception management. Instead of discovering shipping delays 24 hours later through EDI batch processing, APIs can push the same information in real time, with messages traveling in seconds instead of hours, giving teams time to adjust labor, inventory, or routing before costs mount.

The Business Value Quantification Matrix for Supply Chain Leaders

Build your TMS integration business case using measurable value drivers that executives understand:

Revenue Protection: Calculate the cost of lost sales due to inventory visibility gaps or delayed shipment notifications. Companies gain competitive advantage when freight carriers require real-time shipment status and load-tender responses to be competitive. Seconds can make a difference, particularly in shipping marketplaces where the fastest click wins the business.

Customer Satisfaction Metrics: Track Net Promoter Score improvements tied to faster order processing and proactive exception notifications. B2B customers increasingly expect real-time updates that only hybrid integration can deliver efficiently.

Working Capital Optimization: Faster invoice processing accelerates cash flow. Real-time inventory updates reduce safety stock requirements. Calculate the financial impact of improved working capital turnover.

Competitive Positioning: Small and medium-sized businesses are increasingly turning to EDI technology as a competitive necessity rather than a luxury. Once considered exclusive to large corporations, modern EDI solutions are now accessible to businesses of all sizes. Quantify the business won or lost based on integration capabilities.

Compare multi-carrier shipping solutions like ShippyPro and Shippo against integrated platforms that combine EDI compliance with API flexibility. Companies that adopt integrated approaches typically see 25-40% faster partner onboarding and 60% fewer integration-related support tickets.

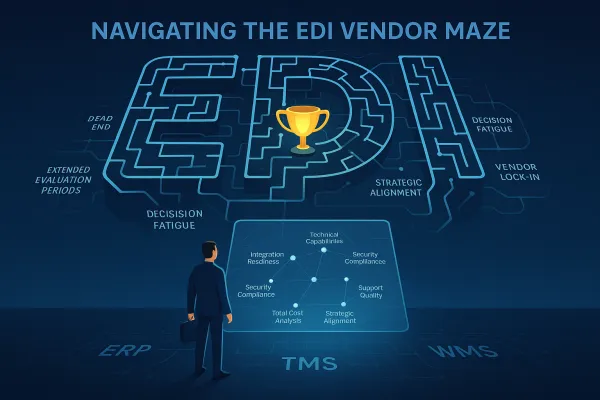

Risk Assessment Framework: Technical, Operational, and Strategic Factors

Every hybrid implementation faces three categories of risk that directly impact ROI calculations:

Technical Risks: Partner buy-in still tops the list. Schema drift (when field meanings change over time) runs second, and security hardening rounds out the top three. A shared sandbox environment and strict version control tags shrink these risks before launch.

Operational Risks: Integration failure rates increase when you support both EDI and API formats simultaneously. Plan for additional testing cycles and rollback procedures. Budget 15-20% more project time for dual-format validation.

Strategic Risks: Vendor lock-in becomes more complex with hybrid solutions. Evaluate how easily you can migrate data and trading partner connections if you need to switch platforms. Some vendors make it easy to export configurations, others don't.

With the flow of time and increased digitalization, EDI has proven less capable in comparison to APIs, which operated faster and more smoothly. However, many carriers and companies are still hesitant to change their EDI for a variety of reasons, such as insufficient budget and encountering troubles with development and implementation. This reality shapes your risk mitigation strategy.

Include contingency planning for the 15-25% of trading partners who may never adopt API integration. Healthcare and finance may continue to rely on EDI for audit compliance for years. Meanwhile global supply chains will probably make use of both until the last holdouts modernize their systems.

Implementation Timeline and Milestone-Based ROI Tracking

Phase your EDI modernization cost analysis using measurable milestones that validate ROI assumptions before full deployment:

Phase 1 - Hybrid Platform Setup (Months 1-2): Deploy cloud infrastructure, configure basic EDI templates, and establish API endpoints. Success metrics: platform uptime > 99.5%, basic order processing functional within 30 days.

Phase 2 - Partner Migration (Months 3-6): Migrate 3-5 strategic trading partners to validate both EDI and API pathways. Success metrics: 90% transaction accuracy, partner onboarding time < 2 weeks, zero critical errors.

Phase 3 - Scale and Optimize (Months 7-12): Onboard remaining partners and optimize performance. Success metrics: full partner portfolio migrated, processing time reduced by 40%, support tickets down 50%.

By integrating an API layer on top of existing EDI systems, companies can modernize without disrupting critical trading partner connections. This API layer enables faster onboarding of new trading partners, provides real-time monitoring and alerts, and reduces testing time through prebuilt maps and standardized data flows.

Pilot Project Success Metrics and Scaling Decisions

Set clear go/no-go criteria for full implementation based on pilot performance:

Financial Metrics: Pilot should demonstrate 25% reduction in processing costs and 40% faster partner onboarding within 90 days. If you don't hit these targets, reassess your platform choice or implementation approach.

Technical Metrics: API response times under 200ms, EDI processing accuracy above 99%, and zero security incidents during pilot phase. Technical failures during pilot typically predict larger problems at scale.

Partner Satisfaction: Survey pilot partners on integration experience. Look for Net Promoter Scores above 7 and willingness to recommend your integration approach to other partners.

Executive Presentation Template: Building the Business Case

Structure your hybrid B2B integration strategy presentation to address C-level concerns directly:

Executive Summary Slide: Lead with total 3-year savings projection, risk mitigation value, and competitive advantage timeline. Executives want the bottom line first.

Market Context: The global EDI software market projected to soar to $4.52 billion by 2030, marking a Compound Annual Growth Rate (CAGR) of 12.5% demonstrates continued investment in integration infrastructure. Position hybrid approach as strategic necessity, not optional upgrade.

Financial Justification: Present 5-year TCO comparison between current state, pure API approach, and hybrid solution. Include scenarios for different growth rates and partner mix assumptions.

Risk Mitigation: Address supply chain disruption concerns by highlighting how hybrid maintains existing EDI connections while enabling faster partner onboarding through APIs.

Compare your recommended solution against cloud-native alternatives like ShipStation, Sendcloud, and integrated platforms. Explain how your chosen approach (such as Cargoson) differentiates through specific technical capabilities or cost advantages.

Common Executive Objections and Response Strategies

"Why not wait for full API adoption?" 50% of all transactions will still be supported by EDI. Companies need to support both or risk missing important opportunities to drive revenue, growth and competitive differentiation. Waiting means losing competitive advantage to companies already gaining integration efficiencies.

"Can't we just upgrade our existing EDI?" Pure EDI upgrades don't solve partner onboarding speed or real-time visibility requirements. EDI is ideally suited for batch processing of mission-critical transactions like financial documents, APIs work well when you need to connect directly to transactional systems or enable real-time data exchange. You need both to maximize partner ecosystem value.

"Budget concerns and phased investment approaches": Emphasize that hybrid platforms allow incremental investment. Start with critical trading partners and expand based on proven ROI. Most platforms offer usage-based pricing that scales with success.

The companies that will thrive in the next five years are those building integration strategies today that combine EDI's reliability with API speed and flexibility. Your hybrid integration business case should reflect this reality: not choosing between old and new, but optimizing both for maximum competitive advantage.