The Complete Legacy EDI Modernization Decision Framework: How to Build a Data-Driven Business Case That Eliminates the $30M Annual Maintenance Trap and Unlocks 335% ROI in 2026

Legacy EDI systems are consuming budgets at an alarming rate, yet most organizations haven't measured the true cost of maintaining their decades-old infrastructure. The U.S. government alone spends roughly 80% of IT budgets maintaining legacy systems, while a mid-market company might spend $5,000 per year on licenses and subscription fees to their EDI provider, another $20,000 in IT hours for troubleshooting and maintenance, and lose $15,000 in delayed revenue from onboarding partners weeks later than competitors. When you add those up — ($5,000 + $20,000 + $15,000) ÷ 1 year — the annualized EDI TCO comes to $40,000, much more than the sticker price of the software alone.

The numbers get worse when you consider what modernization could deliver instead. "Organizations that implement modernized B2B integration stand to gain a 335% ROI or more than $4 in benefits per $1 invested."-IDC Research Yet 62% of respondents said their organization continues to rely on legacy software, trapped in what experts call the $30M maintenance cycle.

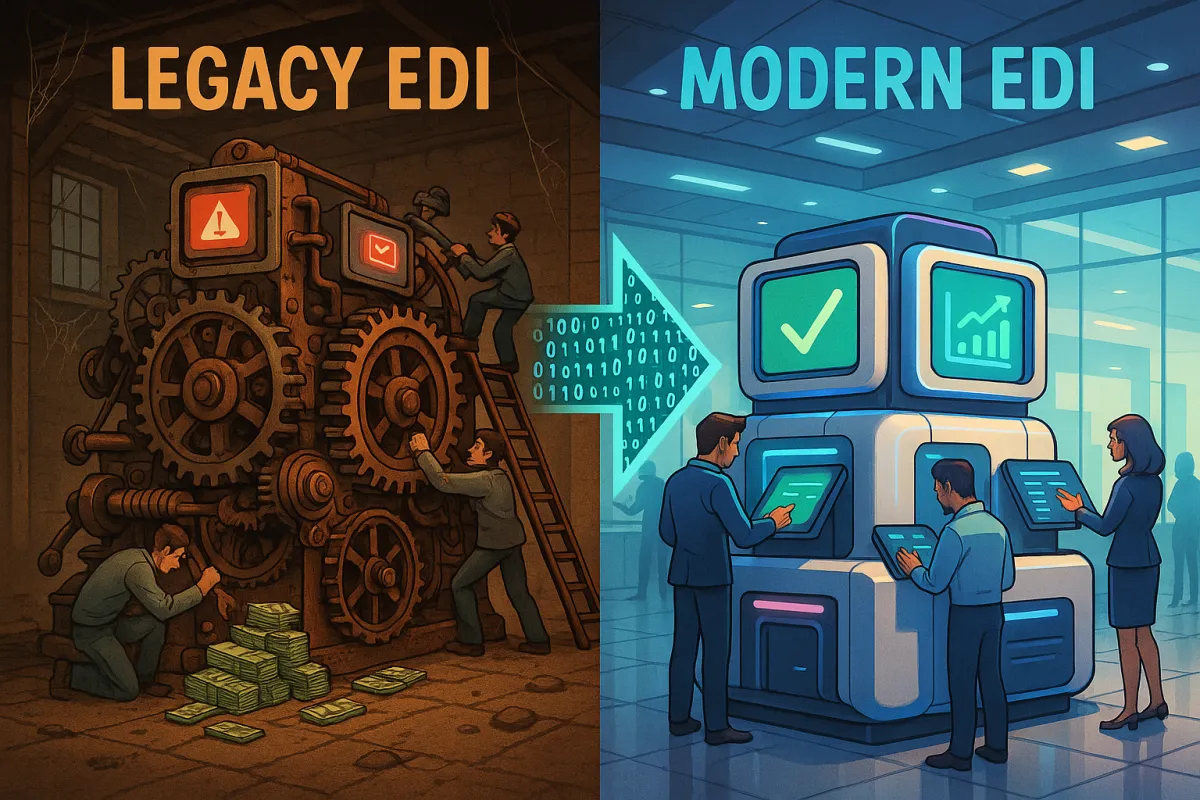

The Hidden $30M Legacy EDI Crisis That's Breaking Supply Chain Budgets

Your EDI maintenance costs aren't just line items anymore. They're strategic liabilities that grow exponentially each year. Maintaining these systems can be 80% pricier than modern solutions, and as legacy systems age, maintenance and support costs climb, often consuming a growing share of the IT budget. This leaves teams with less and less room to invest in modern infrastructure, reinforcing the status quo and delaying long-term progress.

The real trap isn't the software license. It's the ecosystem of dependencies that legacy EDI creates. Traditional EDI software often comes with recurring maintenance contracts or license renewal charges that don't necessarily deliver added value. Delays that drive up internal labor costs: The more time your team spends wrestling with an EDI integration, troubleshooting errors, resending files, or waiting on support, the more those indirect costs add up.

Consider the hidden costs most organizations miss:

- Specialized talent scarcity: Maintaining and supporting legacy EDI systems can be challenging as personnel familiar with older technologies become scarce.

- Batch processing penalties: Batch processing lags of 15 to 60 minutes lead to overselling, fulfillment errors, and chargebacks that cost suppliers 1 to 3 percent of annual revenue.

- Partner onboarding delays: Traditional EDI partner onboarding takes weeks to months due to manual configuration, while modern platforms with pre-built connectors can reduce onboarding time by up to 95 percent.

One manufacturing company discovered they were spending $180,000 annually just keeping their 1990s-era EDI system operational, not including the opportunity cost of delayed customer onboarding.

The Critical Assessment Framework: Scoring Your EDI Modernization Readiness

Before calculating ROI, you need a systematic method to evaluate your current position. The most effective approach combines technical auditing with business impact scoring across six key dimensions.

Technical Infrastructure Assessment (Score 1-10):

Start with your code base quality. How many custom scripts are holding your system together? For many companies, maintaining legacy systems means supporting outdated codebases, navigating end-of-life products, or dealing with brittle integrations. And these challenges are often compounded by limited documentation and shrinking institutional knowledge from natural turnover.

Architecture dependencies matter more than most realize. Map every integration point, every manual handoff, every custom translation table. Systems scoring below 4 typically have more than 15 critical dependencies with no documented fallback procedures.

Business Criticality Evaluation:

Measure transaction volume trends over the past 24 months. Legacy EDI systems may struggle to handle increasing transaction volumes, hampering organizational growth. If your system processes more than 10,000 documents monthly and response times are increasing, score this below 5.

Partner satisfaction provides the clearest signal. Survey your top 10 trading partners about EDI performance. Complaints about delayed acknowledgments or frequent reprocessing requests indicate systems scoring below 3.

Security and Compliance Risk:

Older systems may lack robust security features, making them vulnerable to cyber threats and compliance issues. Run a security audit focusing on encryption standards, access controls, and audit logging capabilities. Systems without multi-factor authentication or end-to-end encryption automatically score 2 or lower.

Total Cost of Ownership Analysis:

Calculate your true annual spend including software licenses, infrastructure, internal labor, vendor support contracts, and downtime costs. Direct costs include software licensing, VAN fees, or per-document charges that are common in traditional EDI systems. Indirect costs often appear as IT labor, error resolution, or manual business processes that tie up staff time. Opportunity costs cover lost revenue from delays in onboarding partners or processing transactions.

Organizations spending more than $50,000 annually on systems handling fewer than 50 partners typically score below 4 on cost efficiency.

Building the Financial Business Case: ROI Calculations That Win Board Approval

ROI calculations fail when they focus only on direct software costs. The winning formula combines three categories of savings: immediate cost elimination, productivity gains, and revenue acceleration.

Direct Savings Calculation:

Start with your current annual EDI spend. Include everything: software maintenance, VAN fees, infrastructure costs, and dedicated staff time. Cloud EDI typically reduces total cost of ownership by 40% to 60% or more compared to on-premise systems. Cloud platforms eliminate capital expenses for hardware, servers, and infrastructure maintenance. They replace software license fees with predictable operational costs through subscription pricing.

A typical mid-market company saves $30,000-$80,000 annually by eliminating traditional VAN charges and reducing IT maintenance hours by 60%.

Productivity Multiplier Effects:

Calculate your current partner onboarding time in hours. Multiply by your fully-loaded IT hourly rate. Traditional EDI partner onboarding takes weeks to months due to manual configuration, while modern platforms with pre-built connectors can reduce onboarding time by up to 95 percent. Modern EDI platforms have reduced onboarding times by up to 95 percent through self-service portals and pre-built trading partner profiles.

One logistics company reduced their average partner onboarding from 23 days to 3 days, saving $12,000 per partner in internal labor costs.

Revenue Impact Modeling:

Focus on cash flow acceleration. Legacy systems often slow the pace of revenue recognition, especially when onboarding delays extend timelines. Modern EDI platforms streamline these processes, helping organizations move from order placement to payment more quickly. Shorter cycles increase cash flow and improve working capital.

A three-month implementation with 18-month payback period delivering 335% ROI becomes compelling when you demonstrate specific revenue acceleration scenarios.

The TMS Integration Cost-Benefit Analysis

Transportation management systems represent one of the highest-value modernization opportunities, yet most organizations underestimate the integration complexity and cost savings potential.

Modern TMS platforms like MercuryGate, Descartes, and Transporeon require real-time data exchange for optimal routing and carrier selection. Legacy EDI systems with batch processing create scheduling gaps that inflate transportation costs by 8-15% annually.

Cloud-native solutions like Cargoson, Manhattan Active, Blue Yonder, and nShift offer API-first architectures that eliminate batch processing delays. The integration cost-benefit analysis typically shows:

- Reduced carrier onboarding time from 4-6 weeks to 2-3 days

- Real-time load tendering eliminates manual intervention in 80% of shipments

- Automated tracking updates reduce customer service inquiries by 40%

Organizations integrating modernized EDI with advanced TMS platforms report 12-18% improvements in transportation efficiency within six months.

The Three-Strategy Decision Matrix: Strangler Pattern vs. Big Bang vs. Incremental

Your modernization strategy determines both risk levels and implementation timelines. Each approach offers distinct advantages depending on your technical constraints and business priorities.

Strangler Pattern Approach:

Build new functionality alongside existing systems, gradually routing traffic away from legacy components. Modernizing legacy EDI systems without replacing ERP is possible by decoupling EDI translation, adopting real-time data flows, and layering API capabilities on top of existing protocols and workflows. Replacing your ERP to fix these issues is expensive, risky, and usually unnecessary. The EDI layer itself is where the problems originate, and that is where modernization should focus.

This strategy works best for organizations with complex ERP integrations where full replacement isn't feasible. Timeline: 6-18 months. Risk level: Low to moderate. Investment: $50,000-$200,000.

Big Bang Replacement:

Complete system replacement during planned downtime windows. High risk but fastest time-to-value for organizations with simpler architectures. Timeline: 3-6 months. Risk level: High. Investment: $100,000-$500,000.

Best suited for companies processing fewer than 25,000 transactions monthly with fewer than 50 trading partners.

Incremental Migration:

Partner-by-partner or document-type-by-document migration over 12-24 months. In some cases, leaving your legacy EDI platform in place and introducing new features can be an effective strategy for modernizing EDI. If needed functionalities are available as addons from your current EDI provider, you can license them to gain modern EDI capabilities without severely denting your budget.

Lowest risk but longest timeline. Ideal for organizations with regulatory compliance requirements or complex partner certification processes.

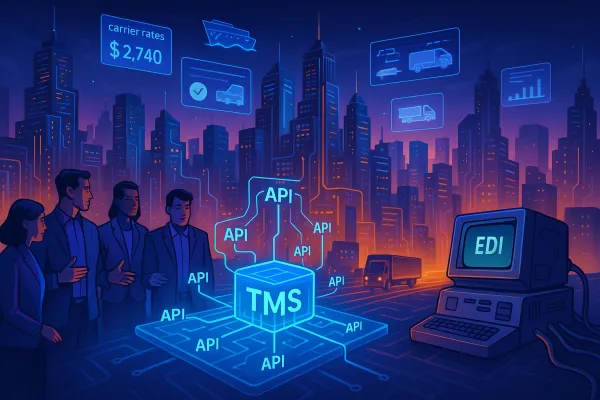

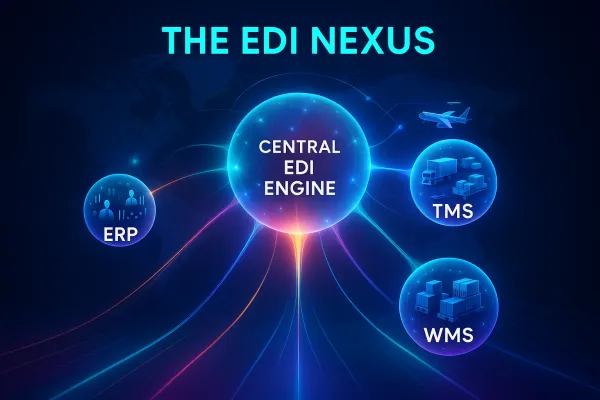

The Hybrid EDI-API Future: Positioning for 2026 Technology Evolution

The future isn't EDI vs. APIs. It's hybrid architectures that combine EDI's regulatory compliance with API flexibility for real-time operations.

Modern EDI modernization leverages cloud-native platforms, real-time data exchange, and seamless integration with ERP, CRM, and cloud applications. This shift enhances agility, scalability, and compliance.

Leading organizations are implementing dual-protocol strategies:

- EDI for regulated transactions: Purchase orders, invoices, and compliance-heavy documents remain on traditional EDI protocols

- APIs for real-time updates: Inventory levels, shipment tracking, and status notifications move to REST APIs

- Hybrid document processing: Single transactions trigger both EDI acknowledgments and API status updates

Modern platforms enable this hybrid approach without doubling infrastructure costs. Organizations implementing hybrid architectures report 25% faster order-to-cash cycles and 40% reduction in manual data entry.

TMS platforms like Cargoson already support these hybrid models, allowing traditional EDI for load tenders while providing real-time API updates for shipment visibility.

Implementation Roadmap: The 90-Day Modernization Launch Framework

Successful modernization projects follow predictable patterns. The most effective implementations break into four distinct phases with specific deliverables and success metrics.

Phase 1: Assessment and Strategy (Days 1-30):

Complete technical audit using the scoring framework above. Document all trading partner requirements, transaction volumes, and integration dependencies. Select modernization strategy based on risk tolerance and timeline constraints.

Key deliverables: Technical assessment report, business case with ROI projections, vendor selection, and project charter approval.

Phase 2: Pilot Implementation (Days 31-60):

Select 3-5 high-volume, low-complexity trading partners for pilot testing. Configure new platform for pilot partners while maintaining parallel operations with legacy system.

Establish a realistic timeline for the migration, considering the complexity of your existing system, the size of your organization and the availability of resources.

Phase 3: Migration Waves (Days 61-120):

Migrate trading partners in groups of 8-12, starting with highest-volume relationships. Run parallel operations for 2-4 weeks per migration wave to ensure data integrity.

Phase 4: Stabilization and Optimization (Days 121-180):

Complete migration of remaining partners, decommission legacy infrastructure, and optimize new platform configuration. Focus on automation opportunities and advanced features.

Typical timeline ranges from 4-12 months depending on complexity, with most organizations achieving positive ROI within 6-9 months of completion.

Avoiding the 73% Failure Rate: Critical Success Factors and Risk Mitigation

Most EDI modernization projects fail due to predictable issues, not technical complexity. Understanding these patterns dramatically improves your success probability.

The Testing and Validation Trap:

Insufficient testing accounts for 40% of project failures. Plan for extensive parallel operations during migration phases. Waiting until a legacy platform fails often leads to rushed, patchwork solutions and costly downtime. Proactive modernization reduces risk, improves long-term ROI, and avoids fire-drill emergencies.

Establish automated testing for all document types with each trading partner. Budget 20-30% of project time for testing and validation activities.

Partner Communication and Change Management:

Trading partner resistance creates delays in 55% of projects. Develop communication plans 60 days before migration begins. Provide partners with specific cutover dates, testing windows, and support contact information.

Create partner-facing testing portals and documentation. Schedule regular checkpoint calls during migration waves.

Resource Allocation and Project Management:

Dedicate internal resources specifically to the modernization project. Organizations trying to manage modernization as a "spare time" activity see 80% higher failure rates.

The most successful projects assign a dedicated project manager and technical lead for the entire implementation timeline.

Compliance and Regulatory Requirements:

It may be difficult for a custom-built EDI system to adhere to strict EDI standards like ANSI X12, EDIFACT, HIPAA, GDPR, and FSMA 204 to avoid regulatory penalties. Ensuring that your in-house EDI system meets these standards without third-party support is often a complex task, requiring constant updates and compliance checks. This can be especially challenging for businesses without an IT team dedicated to staying on top of regulations.

Work with providers that maintain compliance certifications and provide regular updates for changing regulatory requirements.

The path forward requires decisive action based on data, not assumptions. Start with the assessment framework to understand your current position, build the financial business case using the ROI calculation methods outlined above, and select the modernization strategy that aligns with your risk tolerance and timeline constraints.

Organizations that delay modernization face escalating maintenance costs and increasing competitive disadvantage. Those that act now position themselves to capture the 335% ROI potential while eliminating the hidden costs that are consuming their IT budgets.

The question isn't whether to modernize legacy EDI systems. It's whether you'll lead the modernization or let competitors gain the advantage while you're trapped in the maintenance cycle.