The Critical TMS Vendor EDI Evaluation Crisis: How 73% of Implementation Projects Fail Due to Poor Integration Assessment and Your Complete Prevention Framework for 2026

European TMS vendors are colliding with one of the most dangerous implementation crisis patterns in modern logistics technology. 70% of digital transformation initiatives still fail to meet their objectives in 2025, despite years of effort and trillions spent, and TMS implementations face similar odds. Yet the real disaster isn't the headline failure rate.

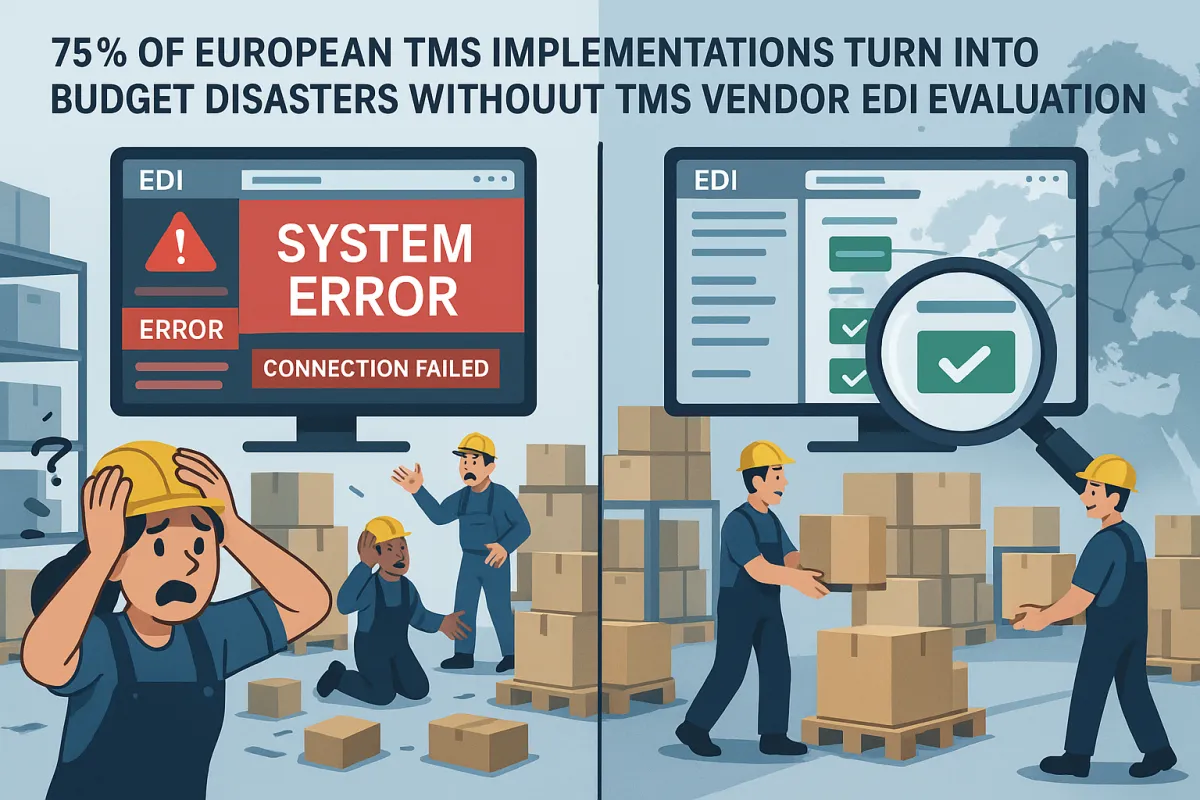

The crisis lies in what happens when your TMS vendor EDI evaluation framework misses the five critical gaps that separate successful implementations from the 75% of European TMS implementations that turn into budget disasters. Companies with complex cross-border operations discover too late that their evaluation process focused on feature checklists while ignoring the EDI integration complexity that actually determines success or failure.

The $2.3 Million EDI Integration Crisis Breaking TMS Implementations

A German automotive parts manufacturer thought they had completed due diligence on their €800,000 TMS implementation. Six months into deployment, they realized their new system couldn't handle their complex carrier network across 12 European countries. The culprit wasn't missing features or poor project management.

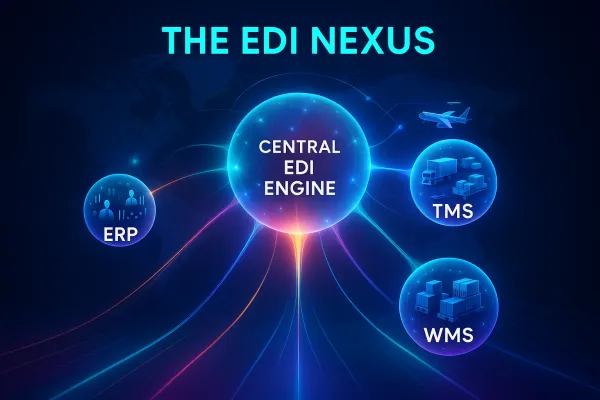

Their evaluation framework completely missed the EDI integration architecture assessment. The TMS handled standard EDI transactions perfectly in demonstration environments, but couldn't manage the reality of 100-200 partners, and 400-500 maps across different European standards, protocols, and partner-specific requirements.

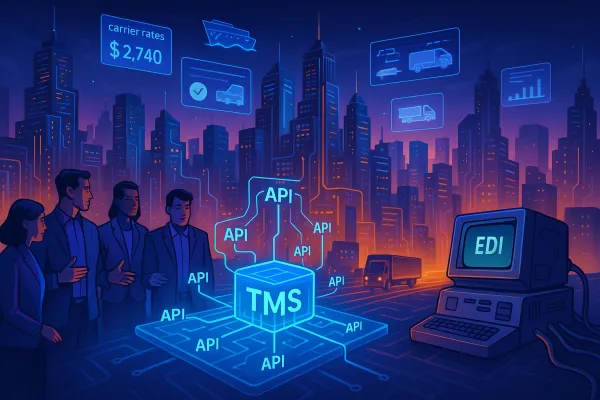

This pattern repeats across European implementations because most TMS vendor EDI evaluation processes treat integration as a technical checkbox rather than the business-critical foundation it actually represents. EDI and TMS systems are tightly intertwined. Everything from tendering a load to confirming delivery relies on structured, automated data flows between shippers, carriers, and brokers.

The hidden cost multipliers hit companies in three phases. Initial implementation costs range from €30,000 to €900,000, and for shippers with freight spend exceeding $250M annually, implementation can cost 2-3 times the subscription fee. Then integration complexity creates ongoing maintenance burdens that weren't factored into ROI calculations. Finally, trading partner onboarding delays cascade through operations when EDI capabilities don't match partner requirements.

What makes 2026 particularly dangerous is the collision between these EDI integration risks and unprecedented vendor consolidation. WiseTech's acquisition of e2open for $3.30 per share in cash equating to an enterprise value of $2.1 billion marks the largest TMS industry acquisition to date, while Descartes Systems Group has acquired Columbus, Ohio-based 3Gtms for $115 million USD in cash, reshaping vendor options for European buyers.

The Five Critical EDI Evaluation Gaps Most TMS Buyers Miss

Legacy protocol support creates the first hidden trap. Older EDI connections often rely on protocols like FTP or AS2. If the new TMS doesn't support those methods or supports them differently, message delivery can fail entirely. Your evaluation must test actual data flows using your existing protocols, not just confirm that protocols are "supported."

Trading partner onboarding timelines represent the second gap. Standard evaluations focus on how quickly you can configure the TMS internally, but ignore the reality that basic API integrations cost €5,000-€15,000, while complex ERP connections exceed €50,000. A basic domestic shipper requires 10-15 integrations minimum, potentially totaling 1,000-1,500 hours of labor.

SAP S/4HANA integration readiness demands specific attention because most European manufacturers are managing simultaneous ERP and TMS migrations. SAP migration expertise is already in high demand, and consulting costs will increase by 30-50% in 2026-27. Fewer ECC-trained professionals will be available, making it expensive to maintain legacy systems. Your TMS evaluation must include specific testing of S/4HANA integration patterns, not just general SAP compatibility.

Real-time versus batch processing architecture represents the fourth evaluation gap. Most legacy EDI systems integrations leave you in the dark when something goes wrong. A file fails, but you're not told why, or worse, you find out after your customer does. Modern operations require real-time visibility, but many TMS platforms still operate on batch processing models that create visibility gaps.

The fifth gap involves hybrid EDI-API capability assessment. EDI is still widely used, especially in industries like logistics and retail. But if your platform supports both EDI and modern APIs, you're in a better place long-term. Your evaluation framework must test both capabilities because your partner ecosystem will require both approaches simultaneously.

The Complete TMS Vendor EDI Assessment Framework

Start your evaluation with a pre-implementation audit that maps your current EDI infrastructure complexity. Document every trading partner relationship, protocol requirement, and data mapping currently in use. This isn't documentation for documentation's sake.

Every TMS platform structures its data differently. Without precise mapping between new and existing fields, critical information can be dropped or misrouted. Your audit must identify where data structure differences will require custom mapping versus standard field matching.

Partner requirement analysis should categorize your trading relationships by integration complexity rather than just volume or importance. High-volume partners might use standard EDI formats that are easy to implement, while smaller partners might require complex custom mappings that consume disproportionate implementation resources.

Create an integration complexity scoring system that weighs protocol requirements, data transformation needs, and error handling capabilities. Simple direct connections score lower risk than middleware-dependent integrations. Cloud-based EDI management capabilities score higher than on-premises requirements that increase IT maintenance overhead.

Cost projection models must include hidden maintenance expenses that don't appear in initial vendor quotes. Hidden costs in TMS procurement consistently add 25-30% more than initial estimates, turning what looked like smart investments into budget disasters. Factor in ongoing trading partner changes, protocol updates, and integration maintenance when building total cost of ownership models.

When evaluating vendors, position solutions that handle complex European scenarios naturally. Descartes, Cargoson, and Alpega each bring different strengths to cross-border EDI management, while newer platforms like nShift and traditional players like Blue Yonder offer varying levels of protocol support and partner onboarding capabilities.

Critical Integration Architecture Questions Every Buyer Must Ask

Protocol support matrices require testing, not just vendor confirmation. Ask for demonstrations using your actual EDI files and partner connections. You also need to make sure that your system is able to accommodate a number of different transmission protocols. These include repurposed protocols such as FTP, SFTP, and HTTP, and EDI-specific protocols like OFTP, X.400 and AS2.

Data mapping and transformation capabilities must handle European complexity. For example if you are a supplier for only US based retailers, the X12 standard will be the one you will need to support. On the other hand if you are a global supplier, you may need to support both X12 and EDIFACT for different partners. Your TMS must manage these requirements simultaneously without forcing you to choose between standards.

Error handling and monitoring systems determine operational reality after go-live. Look for tools that show you what's happening in real time. Some platforms give you a live dashboard where you can see failed transactions, reasons for failure, and where things got stuck, without digging through logs or waiting on IT.

Scalability and performance benchmarks should reflect peak processing demands. Cloud-native platforms usually handle spikes better because they scale automatically. So, during a busy period, like Black Friday or quarter-end, you won't see delays or failed messages just because volume increased.

Security and compliance framework assessment becomes more critical with European regulatory requirements. Adhering to industry standards and regulations (e.g., HIPAA, FDA, GDPR) is critical for businesses implementing EDI. Failure to comply with these requirements can result in fines, legal liabilities, and reputational damage.

The SAP S/4HANA Migration Risk Factor

SAP modernization creates unique TMS-EDI challenges that most evaluations completely ignore. Mainstream support for SAP ECC ends in December 2027. And extended support runs only until 2030 that would then come at a significantly higher cost. Your TMS implementation timeline must coordinate with SAP migration schedules to avoid double integration work.

IDoc versus API decision frameworks require specific attention in S/4HANA environments. This phase involves complex data model conversion from ECC's traditional row-based tables to S/4HANA's simplified schema. Key activities include eliminating redundant aggregate tables, converting material ledger structures, and implementing Universal Journal for real-time financial reporting.

Migration timing coordination between ERP and TMS upgrades determines implementation risk levels. With R3 and S/4HANA standard interfaces, you have the flexibility to start the TMS implementation before your S/4 Hana migration without any disruptions. Our approach ensures that our customers are "Always On" and have a TMS in place and optimize their business regardless of the SAP solution in place.

XML data format handling in SAP TM environments requires specific testing. The recent enhancements on the SAP S/4 HANA embedded TM give out a simplified supply chain landscape, reduced redundancies on documents, seamless integration of finance and order management into S/4 HANA and does not require any duplicity for configuration.

Successful S/4HANA-TMS coordination requires vendors that understand both environments. Platforms like Blue Yonder, Cargoson, and Alpega offer proven integration patterns for SAP environments, while cloud-native solutions may require more complex integration architecture.

Hybrid EDI-API Strategy Implementation Guide

Choose hybrid approaches when your partner ecosystem spans different technological capabilities. EDI is a standardized format for document exchange, ensuring compliance and security. API-based integration allows real-time connectivity but may lack standardization across all trading partners.

Partnership assessment requires cataloging EDI requirements by individual trading partner. Large retailers typically mandate specific EDI formats and protocols, while smaller carriers might prefer API connections or hybrid approaches. Your TMS must handle both simultaneously without forcing partners to change their preferred communication methods.

Phased migration planning prevents business disruption by maintaining existing EDI connections while gradually implementing API capabilities. When a TMS system is swapped out or reconfigured without an EDI continuity plan, the result is often delays, chargebacks, or failed deliveries, which can damage partner relationships. This guide explains how to maintain control of your EDI environment during a TMS migration.

Future-proofing considerations must account for evolving partner needs without over-engineering initial implementations. Rather than fading into obsolescence, EDI is evolving alongside AI's cutting-edge innovations, making transactions between trading partners even more efficient.

Modern TMS platforms like MercuryGate (now Infios), Cargoson, and cloud-based solutions offer varying levels of hybrid capability. Evaluate based on your specific partner mix rather than theoretical capabilities.

The 90-Day Implementation Success Roadmap

Week 1-30 focuses on infrastructure assessment and gap analysis. A phased implementation strategy can help manage the complexity by breaking down the migration into manageable stages. This allows for more focused attention on data migration, customization and integration at each step, reducing the risk of errors and ensuring a smoother transition.

Week 31-60 emphasizes partner onboarding and testing protocols. For example, don't underestimate the challenge of onboarding a supplier with little experience using EDI. Allocate additional time and resources for partners with limited EDI capabilities.

Week 61-90 coordinates go-live activities and performance monitoring. Avoiding chargebacks and maintaining smooth operations starts with keeping your EDI connections reliable. Implement comprehensive monitoring before processing live transactions.

Rapid deployment capabilities vary significantly between TMS platforms. Solutions like Cargoson and cloud-native platforms typically offer faster implementation timelines than traditional on-premises solutions, but integration complexity ultimately determines real-world deployment schedules.

Avoiding the Most Common Implementation Failure Patterns

Trading partner management complexity scales exponentially with partner count. The average company that performs EDI has anywhere from 100-200 partners, and 400-500 maps—all of which will be impacted by the switch. This is a huge challenge and workload to tackle for any company.

Data quality issues and mapping errors create ongoing operational problems that compound over time. EDI requires absolute consistency in how data is formatted, cross-referenced, and validated. A missing customer number, an incorrect unit of measure, or an improperly formatted date can cause an entire order to fail—or worse, be processed incorrectly.

Insufficient testing environments and protocols lead to production failures that damage partner relationships. Insufficient planning before kicking off an EDI implementation can lead to various issues, including unrealistic timelines, poorly defined objectives, and unforeseen challenges.

Change management and team training gaps create user resistance that undermines technical success. These companies learned the hard way that SAP S/4HANA migration is far more than just a technical upgrade – it's a business transformation that requires comprehensive change management strategies. Without proper user preparation and support, even technically successful migrations can fail due to user resistance and productivity losses.

Vendor support and ongoing maintenance considerations determine long-term success more than initial implementation quality. Companies that recognize this gap early invest in change management and technical training before platform selection. They partner with vendors like Cargoson, FreightPOP, or 3Gtms that offer comprehensive implementation support rather than just software licensing.

Cost overrun prevention requires understanding that for shippers with annual freight under management exceeding €250M, implementation costs often run 2-3x the subscription fees. Budget for complexity, not just software licensing.

Your TMS vendor EDI evaluation framework determines whether your implementation joins the successful 27% or becomes another cautionary tale. The difference lies in evaluating integration architecture rather than feature checklists, testing real-world scenarios rather than demonstrations, and choosing vendors based on implementation support rather than just technology capabilities.

Start your evaluation by auditing your current EDI complexity, map partner requirements individually, and test integration scenarios using your actual data. The vendors that survive scrutiny will prove their value through successful deployment, not just impressive presentations.