The Critical TMS Vendor EDI Integration Evaluation Framework: How to Avoid the 73% Implementation Failure Rate by Properly Assessing Hybrid EDI-API Capabilities Before You Sign in 2026

When an enterprise grows and implements a new TMS, the switch impacts EDI with trading partners - with the average company having 100-200 partners and 400-500 maps. Yet 66% of technology projects end in partial or total failure, and the transportation management system vendor selection process rarely addresses the integration architecture that will make or break your implementation.

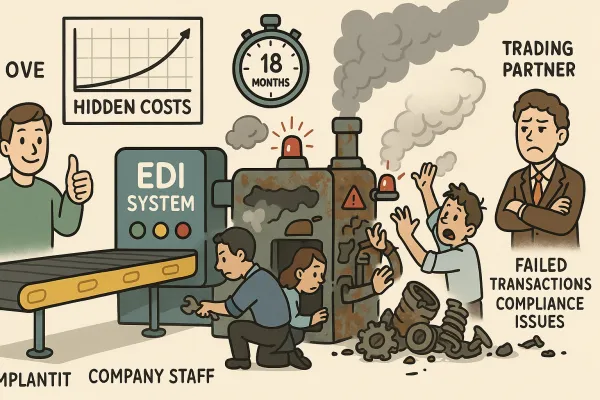

Here's the problem: you evaluate TMS vendors based on route optimization and carrier management features while the real risk sits in connectivity. Because TMS and EDI systems are deeply connected, even minor mismatches between the two systems can lead to costly disruptions. More than 50% of TMS adopters see positive ROI within 18 months, but that leaves a substantial portion of companies wrestling with disappointing results.

This evaluation framework helps you assess hybrid EDI-API integration capabilities upfront - because fixing integration problems after contract signature costs exponentially more than preventing them during vendor selection.

The Hybrid Integration Reality: Why Pure EDI or Pure API Strategies Create Blind Spots

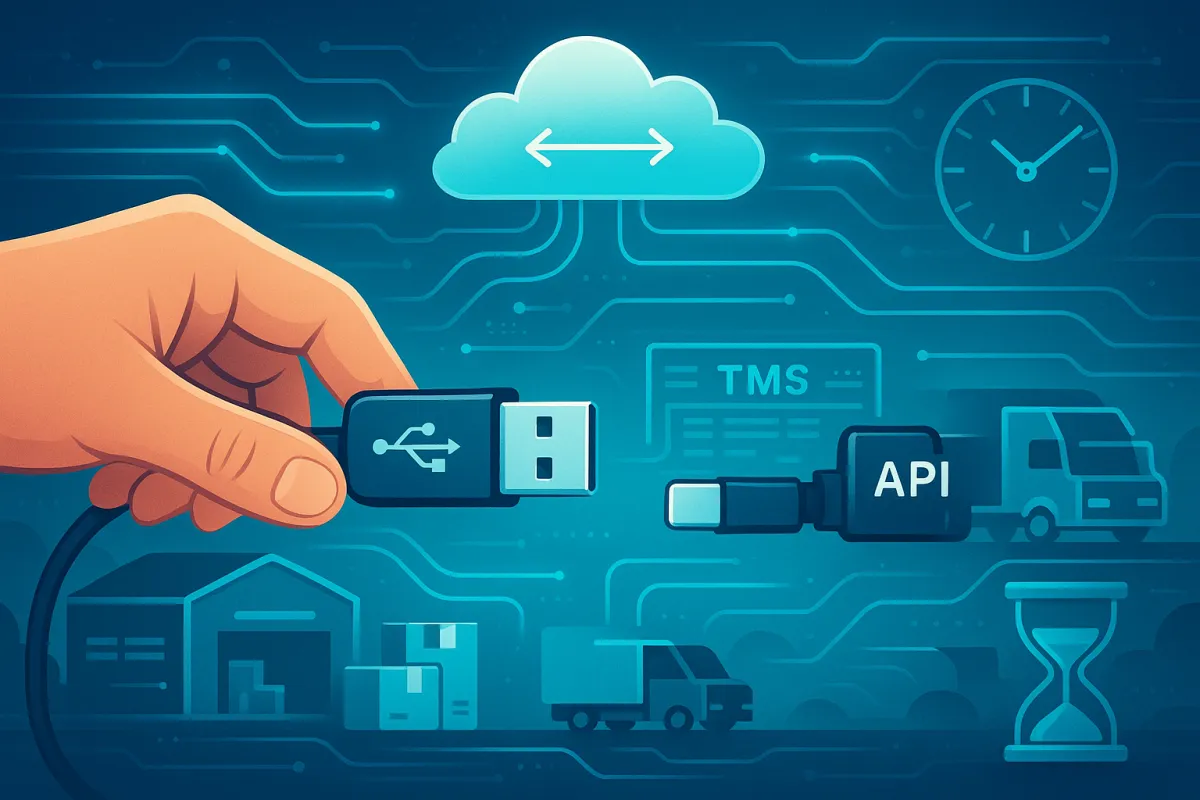

The TMS vendor landscape has fundamentally changed. While EDI is leading in terms of connecting technologies used in TMS deployment, API connectivity is increasing, especially among parcel and LTL freight carriers, though it's unlikely that APIs will fully replace EDI as the standard means for connection in the next several years.

Your integration strategy faces three critical alignment requirements: Partner Readiness - every carrier and customer can send/receive APIs or at least use a self‑service web portal. System Limits - your WMS, TMS, or ERP can send and receive API messages without messy workarounds. Compliance Comfort - finance and quality teams are confident using digital logs in place of traditional EDI control reports. Until all three align, a compromise is necessary. Plenty of shippers use both EDI and API.

Consider how platforms like Cargoson, alongside solutions from Transporeon, nShift, and others, have responded by offering dual-mode capabilities. This approach acknowledges that European shippers don't have the luxury of choosing just one integration standard.

Live, decision-driving data travels via API while audit-critical records that make more sense in a document anyway stay on EDI. For deeper visibility, some add a middleware gateway. This cloud service takes in an API call and quietly converts it to X12 or EDIFACT (and back again) so every partner sees its preferred format.

The Seven-Point Vendor Evaluation Framework for Integration Architecture

When evaluating TMS vendors, these seven capabilities separate robust integration platforms from systems that will cause post-implementation headaches.

Protocol and Communication Support Assessment

Support for multiple protocols and formats: AS2, FTP, APIs, and standardized formats such as ANSI X12 should all be supported. It supports EDI protocols such as AS2, SFTP, and FTPS. During vendor demos, ask specifically about protocol flexibility - can their platform handle your current carrier mix without requiring wholesale partner re-onboarding?

Test this by providing your actual partner communication requirements. Does the vendor support your existing FTP connections with regional carriers while enabling API integration with major parcel services? Legacy protocol issues: Older EDI connections often rely on protocols like FTP or AS2. If the new TMS doesn't support those methods or supports them differently, message delivery can fail entirely.

System Integration Architecture Verification

EDI tools should easily connect with ERP, accounting, WMS, or TMS systems like SAP, Oracle, Microsoft Dynamics, or NetSuite to automate workflows. But integration capability claims need validation beyond vendor presentations.

Request proof-of-concept integration with your specific ERP system. This is crucial: if EDI and ERP are "loosely coupled," you'll end up with manual rekeying and reconciliation, which defeats the purpose of automation. Solutions like Cargoson, alongside established platforms from MercuryGate and Descartes, provide direct system connectors, but you need to verify compatibility with your particular setup.

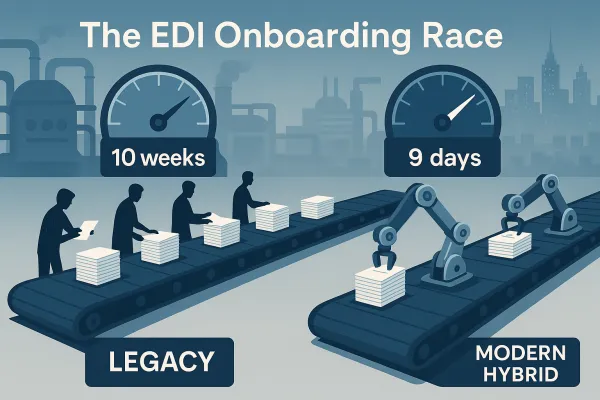

Partner Onboarding Speed and Complexity

Simplify the onboarding and configuration of trading partners with support for custom rules and document formats for each. The difference between platforms becomes clear when you examine actual onboarding processes.

Fast trading partner onboarding: New trading partner connections shouldn't require custom development or extended lead times, especially under tight transportation deadlines. Prebuilt TMS document flows: Templates for common documents, such as 204s and 210s, can shorten implementation time and improve reliability.

During evaluation, request specific timelines for onboarding a new carrier with custom EDI requirements. Vendors claiming "rapid onboarding" should provide evidence - what's the typical timeline from partner agreement to live transaction flow?

Monitoring and Exception Management

Real-time dashboards and customizable alerts help track the flow of transactions and quickly detect any failures or issues. Real-time dashboards of all EDI transactions across partners and business systems. Configurable notifications on failures, SLAs, or specific partner flows. Exception queues with root-cause context and tools to automatically fix and retry.

The monitoring capability determines whether integration issues get resolved quickly or escalate into partner relationship problems. Test the vendor's exception handling by asking about their most common failure scenarios and resolution workflows.

Scalability and Cloud-Native Architecture

Cloud-native deployment: A cloud-based system offers better scalability, real-time monitoring, and fewer on-premise maintenance headaches. Ease of deployment across cloud, on-premise, or hybrid environments. Your TMS integration needs will grow - both in transaction volume and partner complexity.

Evaluate how the platform handles volume spikes during peak shipping seasons. Fleets can securely share data, link systems, and improve workflow efficiency without large IT commitments. The manufacturer says the platform's built-in analytics and scalability help operations adapt as business needs grow.

Cost Structure Transparency

Consider the pricing structure per transaction, per partner, or flat-rate and evaluate total cost of ownership, including setup, support, and scaling. Hidden integration costs surface after contract signature, so demand transparent pricing models during evaluation.

Ask vendors for total cost examples based on your partner count and transaction volumes. Include costs for map development, testing environments, and support during partner onboarding. More accessible projects‑running an API alongside EDI or starting with dock‑scheduling data‑begin in the low five figures and often pay back inside a year through faster gate turns and fewer chargebacks.

Future-Proofing and API Integration Capability

New EDI use cases like API integration and management of SLAs for different document flows will not be supported by platforms that treat API as an afterthought. Your evaluation should assess whether the vendor has a coherent modernization strategy.

The portal doesn't kill EDI, it supplements it with data EDI can't deliver in real time. Moving status-heavy documents (163, 214, appointment notes) to API is optional and partner-by-partner.

The Due Diligence Question Framework

During vendor presentations, these specific questions reveal integration architecture strengths and weaknesses that standard RFPs miss:

Technical Integration Questions: "Walk us through your most complex integration implementation from the past six months. What made it complex and how was it resolved?" This reveals actual capability versus marketing claims.

"Show us how you handle EDI map versioning when trading partners update their requirements." Versioning and change management to prevent updates to partner requirements from breaking downstream logic separates mature platforms from those that create ongoing maintenance headaches.

Connectivity Scope Verification: "Which of our current carriers can you support without map development?" Request specific carrier connectivity lists rather than general capability statements.

"How do you handle carriers that use proprietary document formats outside standard EDI?" This question identifies whether the vendor has experience with your industry's specific requirements.

Red Flag Responses: Watch for vendors who deflect technical integration questions to "implementation teams" - this suggests the sales team doesn't understand their own platform limitations. Similarly, be cautious of vendors who claim universal compatibility without acknowledging the complexity of legacy system integration.

Implementation Risk Mitigation Strategy

EDI issues during a TMS migration can usually be traced back to one of these root causes: Mapping mismatches: Every TMS platform structures its data differently. Without precise mapping between new and existing fields, critical information can be dropped or misrouted.

Your risk mitigation approach should include parallel testing with critical carriers before full migration. The implementation process involves assessing current systems, selecting the right EDI solution, and conducting thorough testing. Test the integration:Conduct testing to ensure that the TMS EDI integration is functioning correctly and that data is being transmitted accurately between the systems.

When a TMS system is swapped out or reconfigured without an EDI continuity plan, the result is often delays, chargebacks, or failed deliveries, which can damage partner relationships. Build fallback options into your integration architecture - maintain existing EDI connections until new system stability is proven.

Contract terms should include service level agreements for integration support, with penalties for extended outages that impact partner relationships. Include provisions for additional technical resources if integration complexity exceeds initial estimates.

Building Future-Ready Integration Architecture

This hybrid approach lets you modernize internally while maintaining compatibility with traditional carrier systems. This hybrid approach lets you modernize internally while maintaining compatibility with traditional carrier systems. It's, therefore, unlikely that APIs will fully replace EDI as the standard means for connection in the next several years.

Your 2026 TMS selection should anticipate the integration landscape three years forward. Leading platforms from vendors like Cargoson, MercuryGate (now part of Körber), and Descartes are evolving toward unified integration management that handles both EDI and API workflows through single interfaces.

APIs and IoT broaden what TMS platforms can do: Ram says TMS connectivity has improved significantly, with vendors shipping more prebuilt connectors and cleaner links between TMS applications and enterprise systems. Tasks that once required custom development, like connecting a TMS to an ERP system, are easier because of more mature application programming interfaces (APIs) and standardized data flows. "The API-fication of TMS has evolved far beyond where it was just a few years ago," says Ram.

Your 90-Day Implementation Validation Plan

Post-implementation success depends on systematic validation of integration performance. During your first 30 days, establish baseline metrics for transaction success rates, partner response times, and exception resolution cycles.

At 60 days, conduct trading partner surveys to identify any service degradation from their perspective. Service levels often decline during the 12-18 months following acquisition as resources focus on technical integration rather than customer support - this applies equally to TMS implementations.

Your 90-day review should include performance analysis against pre-implementation baselines and identification of optimization opportunities. Even the most powerful TMS can fail if implementation is rushed, onboarding is weak, or users resist change. In 2026, businesses cannot afford long, painful, and disruptive implementations.

The TMS vendor selection process requires the same rigor for integration architecture evaluation as you apply to functional requirements. The real success depends on how well the system is implemented, adopted, and embedded into daily operations. By properly assessing hybrid EDI-API capabilities during vendor selection, you avoid becoming part of the implementation failure statistics and build the integration foundation your supply chain operations need for sustainable growth.