The EDI Procurement Disaster Prevention Guide: 12 Critical Mistakes That Cost Companies Millions (And How to Avoid Them in 2025)

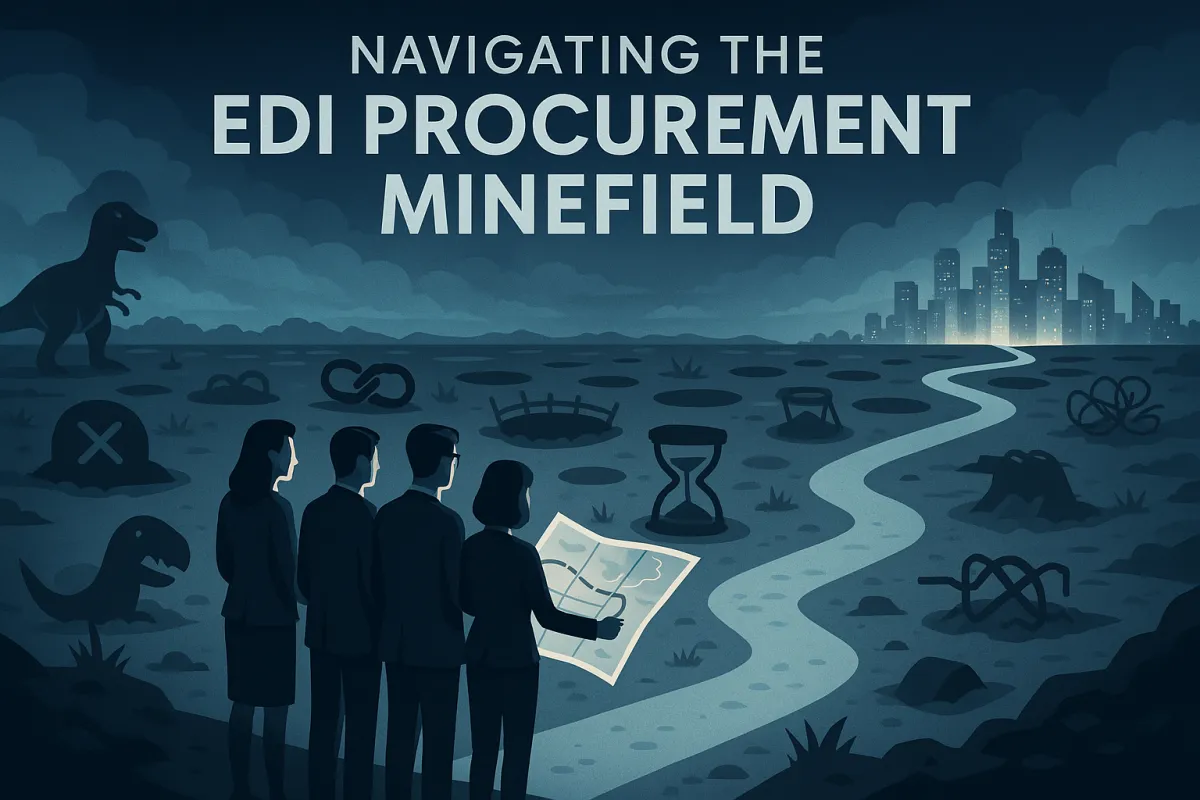

Your EDI procurement decision will determine whether you spend the next five years buried in support tickets or enjoying smooth data flows. EDI performance bottlenecks cost companies an average of $62,000 per day in delayed shipments and processing errors. Successful EDI implementation can reduce costs over 90% compared to manual processing, but only when you avoid the twelve catastrophic mistakes that plague most procurement processes.

The stakes have never been higher in 2025. The global EDI market is projected to reach $49,213.1 million by 2027, and larger organizations like Walmart demand new trading partners adopt EDI as the base price of entry. Yet 40% of businesses struggle with software integration during EDI implementation, turning what should be efficiency gains into expensive technical debt.

This guide examines the real-world disasters that happen when EDI vendor selection goes wrong, and more importantly, how to prevent them. You'll discover the specific red flags that signal trouble ahead, the pricing traps that inflate costs by 300%, and the evaluation framework that separates genuine solutions from vendor marketing noise.

The Pre-Selection Phase: Setting Yourself Up for Success

Before you send out a single RFP, your team needs to understand what you're actually buying. EDI isn't just software - it's a business process transformation that touches procurement, warehousing, accounting, and customer service. Organizing requirements into "must-have" and "nice-to-have" categories prevents scope creep and keeps evaluations focused on what matters.

Start by mapping your current data flows. Document every purchase order, invoice, advance ship notice, and payment that moves between you and your trading partners. Note the volumes, frequencies, and seasonal spikes. Your transportation management needs deserve special attention - if you're shipping products, you need EDI providers who understand carrier integrations and can handle 204 (motor carrier shipment information) and 210 (freight details and invoice) transactions without manual intervention.

Cross-functional evaluation teams make better decisions than IT-only groups. Include representatives from procurement, logistics, finance, and your biggest customer-facing departments. Each group brings different perspectives on data accuracy, timing requirements, and integration priorities that IT alone might miss.

Mistake #1-3: The Foundation Failures

Mistake #1: Staying Trapped with Legacy EDI Providers

Many companies stick with legacy EDI providers who charge premium prices for outdated technology. Most EDI implementations today take months rather than days, with suppliers waiting four to six weeks just to get onboarded with traditional EDI vendors. The theoretical 1-2 week timeline often stretches to 1-2 months or longer while you lose potential revenue every day those partnerships remain inactive.

Legacy providers often bundle unnecessary services you'll never use while charging separately for features you need daily. They lock customers into multi-year contracts with automatic renewals, making it expensive to switch even when service quality declines.

Mistake #2: Ignoring Future State Requirements

Not considering the future state of your EDI program means missing lucrative trading partners you don't even know about. Your EDI solution needs to handle today's 50 trading partners and scale to 500 without requiring a complete rebuild. Consider geographic expansion, new product lines, and acquisition plans when evaluating capacity.

Technical debt accumulates quickly when solutions can't adapt. The vendor who seems perfect for your current needs might force expensive customizations or platform migrations when your business evolves in eighteen months.

Mistake #3: Misunderstanding Connectivity Models

Not understanding the difference between VAN and point-to-point connectivity has implications for support burden and increasing solution complexity. Value-Added Networks (VANs) act as intermediaries, providing translation services and managing connections to multiple trading partners through a single interface. Point-to-point connections link directly to each partner, offering more control but requiring individual setup and maintenance for each relationship.

VAN solutions typically cost more per transaction but reduce your internal support workload. Point-to-point connections offer lower per-transaction costs but demand more technical expertise to maintain. The choice affects everything from staffing requirements to disaster recovery planning.

Mistake #4-6: The Technical Evaluation Traps

Mistake #4: Superficial Technical Assessment

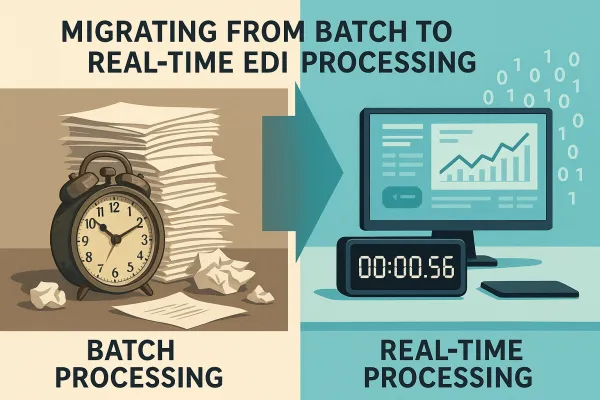

Technical capabilities determine whether your EDI solution enhances operations or creates bottlenecks. Many buyers focus on standard features without testing real-world integration scenarios. Your ERP system might support EDI in theory, but can it handle 10,000 transactions per hour during peak seasons without performance degradation?

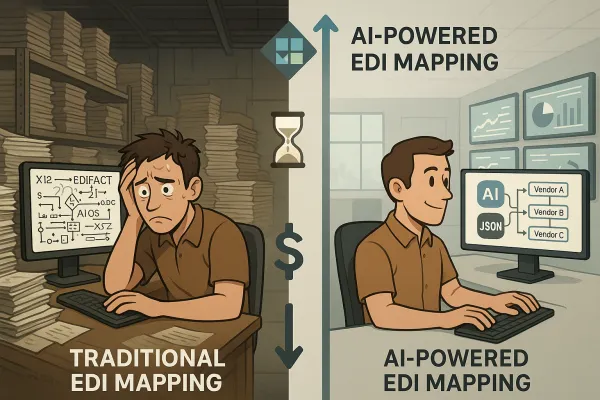

Test data mapping capabilities with actual documents from your trading partners. Generic demo scenarios don't reveal how the solution handles non-standard formats, custom fields, or the variations that real partners inevitably introduce.

Mistake #5: Overlooking Transportation-Specific Features

Transportation data requires specialized handling that general EDI providers often underestimate. Freight charges, delivery dates, and shipment weights need validation against contractual terms and carrier capabilities, with a single misplaced decimal point in weight data triggering costly routing errors.

Look for providers with prebuilt templates for transportation documents and existing integrations with major transportation management systems. Solutions like Cargoson, MercuryGate, and Descartes offer TMS-specific EDI capabilities that generic providers struggle to match. These platforms understand carrier-specific requirements and can handle the complexity of multi-modal shipping scenarios.

Mistake #6: Inadequate Data Quality Planning

Poor data quality causes issues that directly impact customers such as billing errors and shipment delays, plus internal problems like compliance failures and financial losses. Master data maintenance becomes critical when automated systems process thousands of transactions without human oversight.

Your evaluation should include data validation rules, error handling processes, and reporting capabilities that identify patterns in data quality issues. The best EDI solutions catch problems before they propagate to trading partners and internal systems.

Mistake #7-9: The Commercial and Contractual Catastrophes

Mistake #7: Falling for Deceptive Pricing Models

EDI pricing complexity creates opportunities for vendors to hide true costs. Per-transaction pricing seems straightforward until you discover separate charges for failed transmissions, retries, and acknowledgments. Monthly minimums that appear reasonable for current volumes become expensive when business slows or you optimize transaction efficiency.

Some providers quote low base prices but charge premium rates for "non-standard" documents that represent 40% of your actual traffic. Others bundle services you don't need while charging extra for essential features like real-time monitoring or automated partner onboarding.

Mistake #8: Weak Contract Protection

EDI contracts often contain terms that favor providers at customer expense. Service level agreements might promise 99.9% uptime but exclude scheduled maintenance windows that happen during your peak processing hours. Termination clauses can lock you into paying for services months after cancellation while data export fees make switching providers expensive.

Review liability terms carefully. Many EDI providers limit their liability to monthly service fees, leaving you responsible for business losses caused by their system failures or data breaches.

Mistake #9: Underestimating Support Requirements

EDI solutions require regular care and attention, with data mapping between trading partners and integrations to backend systems like ERP, CRM, and SCM creating a living system that needs expert testing and configuration updates whenever fields change or partners are added.

Support quality varies dramatically between providers. Some offer 24/7 technical support with guaranteed response times. Others provide email-only support during business hours with no escalation procedures for urgent issues.

Mistake #10-12: The Operational and Strategic Oversights

Mistake #10: Insufficient Trading Partner Network Assessment

Your EDI provider's existing trading partner network affects onboarding speed and connection reliability. Providers with established relationships to your key partners can activate connections in days rather than weeks. Those without existing connections might need to build integrations from scratch, extending timelines and increasing costs.

Financial stability matters when you're trusting a provider with critical business processes. Small EDI providers might offer attractive pricing but lack resources to invest in platform modernization or survive economic downturns.

Mistake #11: Inadequate Support Quality Evaluation

Support quality determines your daily experience with EDI operations. Ask potential providers about their average response times, escalation procedures, and staff technical expertise. Test their knowledge by discussing your specific industry requirements and technical environment.

Request contact information for current customers in similar industries and transaction volumes. Their experiences with support responsiveness, problem resolution capabilities, and proactive monitoring will reveal more than vendor presentations.

Mistake #12: Service Model Misalignment

Companies often fail to determine whether EDI represents a core competency they want to develop internally or a utility service they prefer to outsource. This decision affects everything from staffing requirements to technology architecture choices.

Managed EDI services handle day-to-day operations, partner onboarding, and system maintenance for companies who prefer to focus on core business activities. Self-managed solutions offer more control but require internal expertise and dedicated resources.

The Smart Procurement Framework: A 6-Step Evaluation Process

The RFP creates a level playing field where all vendors respond to the same set of questions, making comparison easier. Your RFP should address technical capabilities, commercial terms, implementation methodology, and ongoing support structure.

Structure your evaluation using a weighted scoring matrix that reflects business priorities. Technical capabilities might represent 40% of the total score, with commercial terms at 30%, support quality at 20%, and strategic fit at 10%. Adjust weights based on your specific situation and risk tolerance.

Include scenario-based questions that reveal how vendors handle real-world challenges. Ask about their approach to partner onboarding delays, system outages during peak processing periods, and data format changes from major trading partners.

Reference checks provide insights that RFP responses can't match. Speak with customers who implemented similar solutions within the past year. Focus on implementation experience, ongoing support quality, and unexpected costs or challenges.

Leading vendors like Cleo, TrueCommerce, and SPS Commerce have established track records with large-scale implementations. For transportation-specific needs, consider specialized solutions like Cargoson that understand TMS integration requirements and carrier-specific document flows.

Pilot programs reduce implementation risks by testing vendor capabilities with a subset of trading partners before full deployment. Successful pilots validate technical performance, support responsiveness, and operational procedures under real-world conditions.

Red Flags: When to Walk Away From an EDI Vendor

Slow response times during the sales process indicate future support problems. Vendors who take days to respond to technical questions or schedule follow-up meetings probably lack the resources to support your implementation effectively.

Reluctance to provide customer references early in the process suggests problems with customer satisfaction or solution performance. Reputable providers offer reference calls readily and can connect you with customers in similar industries or business situations.

Vendors who don't allow self-service capabilities or restrict customer ownership of data maps create dependencies that make switching difficult and expensive. Look for solutions that provide direct access to configuration settings and export capabilities for all customizations.

Aggressive sales tactics, including high-pressure pricing offers with short deadlines, often indicate vendors focused on closing deals rather than delivering value. Quality EDI implementations require careful planning and thorough evaluation - rushed decisions lead to expensive mistakes.

Lack of industry-specific knowledge becomes apparent when vendors struggle to discuss your sector's unique requirements, document types, or regulatory compliance needs. Generic EDI providers might handle basic transactions but fail when specialized requirements emerge.

2025 Implementation Success: Modern Best Practices

Modern EDI implementations integrate with carrier management platforms and multi-modal shipping solutions to provide end-to-end supply chain visibility. Solutions like nShift, Transporeon, and Cargoson offer prebuilt connectors to major shipping carriers, reducing implementation time and ongoing maintenance requirements.

Tiered onboarding processes recognize that different trading partners have varying technical capabilities and urgency levels. Major retailers might require full EDI implementation within 30 days, while smaller suppliers might start with web-based forms and graduate to direct EDI connections over time.

API-first architectures prepare for the eventual transition from traditional EDI to modern integration approaches without requiring complete system replacement. EDI is here to stay and its relevance will grow as we move into 2025, but forward-thinking companies are building hybrid approaches that support both legacy EDI standards and modern API connections.

Cloud-native solutions offer better scalability and disaster recovery capabilities than on-premise implementations. They also reduce internal IT requirements and provide faster access to new features and security updates.

The most successful 2025 EDI implementations treat data integration as a strategic capability rather than a technical necessity. They choose providers who understand business requirements, offer proactive support, and invest in platform innovation rather than simply maintaining legacy systems.

Your next EDI procurement decision will affect operations for years. Avoid these twelve mistakes, follow the evaluation framework, and choose a provider who treats your success as their primary objective. The right vendor becomes a strategic partner in supply chain optimization - the wrong one becomes an expensive lesson in the true cost of inadequate due diligence.