The EDI Vendor Consolidation Crisis: Why Supply Chain Professionals Must Act Now to Secure Their Integration Future

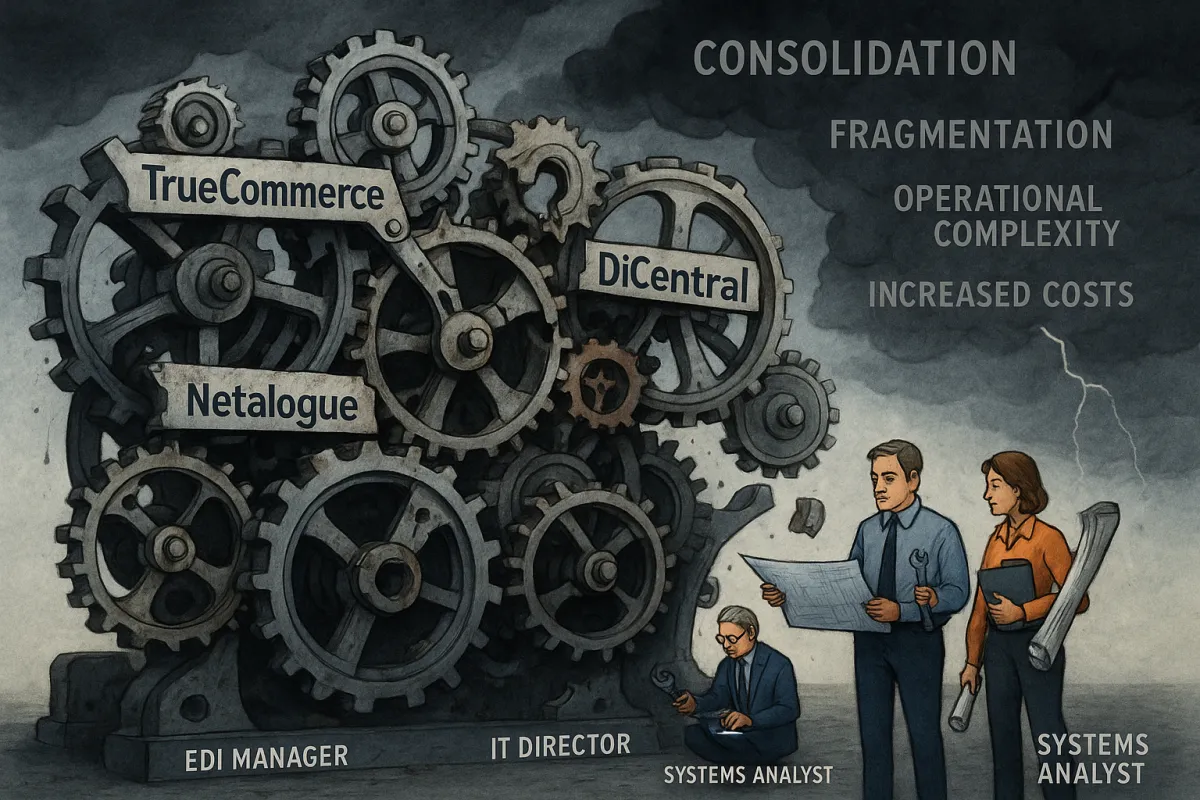

Supply chain leaders are facing an unprecedented challenge: 68 percent of technology leaders are planning to consolidate their vendor landscape, but at the same time, there are "less and less EDI companies out there for clients or consultants to choose from". This creates a perfect storm where businesses need fewer vendors while fewer EDI providers remain available to serve them.

The timing couldn't be worse. Seventy-five percent of organizations pursued vendor consolidation in 2022, up from 29 percent in 2020, driven by mounting pressure to reduce operational complexity and control costs. Meanwhile, acquisitions have steadily shrunk the EDI vendor landscape. TrueCommerce has made 5 acquisitions across sectors such as SCM Software, E-Commerce Enablers, Logistics Tech and others. DiCentral, B2BGateway and Netalogue are its latest acquisitions, while other major players continue similar consolidation strategies.

The Hidden Costs of EDI Vendor Fragmentation (And Why Companies Are Finally Taking Notice)

Companies running multiple EDI vendors pay a steep price for fragmentation. Managing separate relationships means duplicate support contracts, inconsistent documentation standards, and complex integration challenges that multiply exponentially as your trading partner network grows.

The impact goes beyond internal costs. When you're juggling different EDI providers for different partners, you're creating bottlenecks that affect your entire supply chain. One vendor might process purchase orders in two hours while another takes eight. Your warehouse team never knows which timeline to expect, leading to scheduling conflicts and delayed shipments.

Consider the real-world scenario: A manufacturing company using three different EDI providers to serve various retail partners discovers that each system requires separate staff training, different error monitoring processes, and unique troubleshooting procedures. When a critical order fails to transmit during peak season, the IT team wastes precious hours determining which system failed and which support team to contact.

This complexity becomes even more challenging when integrating transport management software. Many companies find themselves maintaining separate EDI connections for logistics providers while using different systems for retail partners, creating data silos that prevent end-to-end visibility.

Warning Signs Your EDI Vendor Strategy Is at Risk

How do you know if your current EDI setup leaves you vulnerable in this consolidating market? Here are five indicators that signal immediate action:

Multiple vendor relationships without clear ownership. If different departments manage different EDI connections, you lack centralized oversight. This fragmentation makes it impossible to negotiate better terms or coordinate upgrades across your network.

Inconsistent performance across trading partners. Some EDI connections work flawlessly while others require constant manual intervention. This suggests you're dependent on providers with varying capabilities and support levels.

Limited scalability options. Your current vendors can't accommodate new trading partners without significant lead times or custom development work. In a consolidating market, providers prioritize their largest customers for new features and integrations.

Rising support costs despite static functionality. You're paying more each year but receiving the same service level. As the vendor landscape shrinks, remaining providers often increase prices without corresponding value improvements.

Transport management system integration gaps. Your EDI solution doesn't properly integrate with modern TMS platforms, forcing manual data entry between systems. This creates delays and errors that impact customer satisfaction.

The Strategic EDI Consolidation Playbook for 2025

Smart supply chain leaders are using this market shift as an opportunity to build more resilient EDI architectures. Start by auditing your current EDI landscape to identify redundancies and gaps.

Map every EDI connection across your organization. Document which vendor handles each trading partner, what message types flow through each connection, and the associated costs. You might discover that 80% of your transaction volume flows through one provider while the remaining 20% requires three different vendors.

Evaluate potential consolidation candidates based on three critical factors: technical capabilities, trading partner network reach, and integration ecosystem. The EDI market is projected to grow from USD 2.81 billion in 2025 to USD 6.79 billion by 2034, with transportation and logistics generating the most income. This growth creates opportunities for providers who can handle diverse requirements.

Consider transport management software integration as a core requirement, not an afterthought. Platforms like Cargoson, Alpega, and Manhattan Active offer varying levels of EDI integration that can simplify your technology stack.

Create a transition timeline that prioritizes high-volume trading partners first. Moving your largest EDI relationships to a consolidated platform provides immediate cost benefits and operational improvements that fund additional migrations.

Future-Proofing Your EDI Architecture Against Market Consolidation

New businesses are moving away from batch-based EDI and toward real-time API-based EDI architectures. API-EDI hybrid models are becoming more popular in fast-paced markets because they make it easier to scale, enroll partners quickly, and follow new digital rules.

Building vendor-agnostic integration strategies protects you from future market consolidation. Instead of creating deep dependencies on proprietary systems, focus on standards-based connections that can be transferred between providers if needed.

Cloud-native EDI solutions offer better flexibility than traditional on-premises systems. More companies will adopt cloud-based EDI services, allowing businesses to reduce costs and increase efficiency. By moving to the cloud, companies can scale their EDI operations as their business grows.

API-first architectures enable faster partner onboarding and better integration with modern supply chain systems. When your transport management system can directly exchange data with your EDI platform through standardized APIs, you eliminate manual processes that slow operations.

The Transport Management Software Advantage: Why TMS-Integrated EDI Beats Standalone Solutions

The most successful supply chain organizations are moving beyond separate EDI and TMS solutions toward integrated platforms that handle both functions seamlessly.

Cargoson is a modern European TMS that bridges the gap between complex enterprise systems and simple shipping tools. It offers direct API/EDI integrations with carriers across all transport modes, allowing you to compare rates, book shipments, and track imports and deliveries from a single platform.

Integrated TMS-EDI platforms eliminate data silos between transportation planning and trading partner communications. When your shipping instructions automatically generate the correct EDI messages for each carrier, you reduce errors and speed up the entire fulfillment process.

Consider the operational benefits: instead of maintaining separate systems for EDI document processing and transportation execution, you manage everything through one interface. This consolidation reduces training requirements, simplifies troubleshooting, and provides end-to-end visibility that standalone systems can't match.

Enterprise solutions like SAP Transportation Management and Oracle TMS offer comprehensive integration but require significant implementation investments. Specialized providers like Cargoson, 3Gtms, and Alpega provide more focused functionality that may better serve mid-market companies.

Action Steps: Securing Your EDI Future Before Options Disappear

Don't wait for your current EDI vendor to be acquired or discontinue services. Take action now while you still have negotiating power and multiple options.

Begin with an immediate assessment of your EDI vendor dependencies. Create a risk matrix that identifies which trading partner relationships would be most severely impacted if a specific vendor disappeared overnight. Prioritize these high-risk connections for immediate consolidation or backup planning.

Open conversations with potential consolidated EDI providers before you need them. Make sure you have a specialist or consultant on hand to help navigate the EDI market as it grows. Understanding their capabilities, pricing models, and integration timelines gives you leverage in negotiations.

Negotiate favorable terms while vendors are still competing for business. A majority of organizations are targeting a 20 percent reduction in vendor count, creating opportunities for providers who can demonstrate comprehensive capabilities.

Consider transport management software integration as part of your consolidation strategy. Platforms that combine EDI and TMS functionality can eliminate vendor relationships while improving operational efficiency.

The EDI vendor consolidation crisis isn't going away. Supply chain professionals who act decisively to consolidate their EDI architecture will emerge stronger, while those who delay risk getting trapped with limited options at higher costs. The question isn't whether to consolidate your EDI vendors, but whether you'll do it on your terms or be forced into it by market dynamics.