The Geopolitical EDI Crisis: How to Build Trading Partner Networks That Survive Blacklisting, Sanctions, and Supply Chain Weaponization in 2026

The No. 1 risk facing supply chains tops out with a 97% threat level according to Everstream Analytics' 2026 Risk Report: "Geopolitical Fragmentation and Strategic Use of Trade Regulations." Export controls on critical minerals doubled from 2023 to 2025, while other trade restrictions increased 167%. Your EDI trading partner network isn't just managing routine business documents anymore—it's navigating a battlefield where suppliers can be blacklisted overnight, tariff structures change weekly, and entire trading relationships can vanish due to geopolitical tensions.

The reality hits differently when you're responsible for keeping goods flowing across borders that are increasingly militarized by trade policy. Recent evidence includes the United States' military operations in Venezuela, underscoring "the rapid pace at which geopolitical shifts can occur," leaving altered trade relationships, upset political alliances, and logistical disturbances in their wake. "The pattern of 2025—sudden tariff announcements, reversals and escalations—should be the baseline expectation for 2026."

The Hidden Cost of Single-Point EDI Dependencies

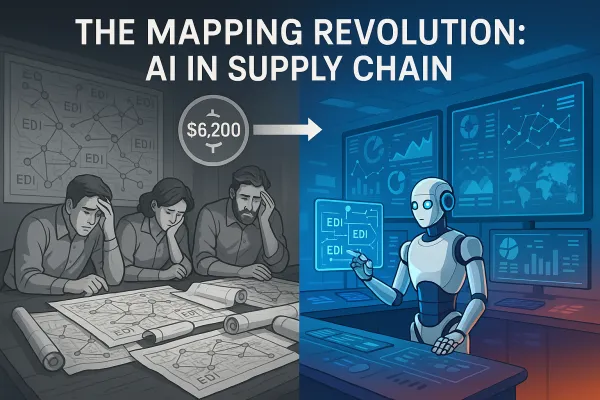

When Nexperia got blacklisted, companies discovered suppliers they didn't even know existed in their extended networks. That's the hidden vulnerability in traditional EDI architectures: you're only as resilient as your least geopolitically stable partner. According to a recent survey, nearly two-thirds (63%) of IT decision-makers say that the EDI onboarding process takes too long because of customized requirements demanded by trading partners. Up to 47% of IT managers say that slow EDI supplier onboarding is currently keeping their businesses from capturing new revenue opportunities.

Calculate the real impact: if a major supplier representing 15% of your procurement volume gets blacklisted tomorrow, how fast can you redirect that flow? Traditional EDI networks require weeks or months to onboard replacement partners. Scenario planning must now include rapid, unexpected cost increases of 15-25% on critical inputs. That's not just a tariff problem—that's an EDI agility problem.

Your current EDI provider might excel at processing 850 purchase orders, but can they help you pivot to three new suppliers across different jurisdictions within 48 hours? Most can't, because they weren't designed for crisis response—they were built for steady-state efficiency.

Geographic and Political Diversification: Beyond Dual Sourcing for EDI Networks

Corporate boards are demanding "meaningful geographic and political diversification" beyond dual sourcing, with 73% of companies reporting progress on dual-sourcing and 60% regionalizing supply chains to minimize dependency on single geographies. Apple exemplifies this shift, assembling $14 billion worth of iPhones in India in 2024. Your EDI strategy needs to support this regionalization movement, not constrain it.

Think beyond backup suppliers. You need backup EDI pathways that can handle different regional standards, compliance requirements, and communication protocols. China controls 85% of rare earth processing, while 95% of semiconductor-grade silicon comes from just four companies globally. When concentration risk is this extreme, your trading partner network architecture becomes a national security consideration.

The smartest companies are building regional EDI hubs—not just diversifying suppliers, but diversifying their integration infrastructure. That means EDIFACT capabilities for European operations, ANSI X12 for North American partnerships, and API-first approaches for fast-moving Asian suppliers who prioritize speed over standardization.

The Asia-Pacific Shift in EDI Infrastructure

The APAC region is expected to grow EDI at 14.04% CAGR through 2030, making it the fastest-growing EDI market globally. But here's the twist: many Asian suppliers prefer API-first communication over traditional EDI document exchange. They want real-time inventory updates, instant order confirmations, and dynamic pricing—capabilities that traditional EDI handles poorly.

If your current EDI setup can't accommodate this hybrid demand, you're going to lose competitive suppliers to companies that can handle both protocols seamlessly. The future isn't EDI versus API—it's EDI and API working together for maximum flexibility.

Real-Time Contingency Planning: Rapid Trading Partner Substitution Frameworks

Here's what most supply chain managers miss: traditional models built around just-in-time inventory, global sourcing, and cost optimization are being tested by new layers of uncertainty. From regional instability and export controls to cybersecurity threats and regulatory shifts, the landscape has become more volatile and less predictable.

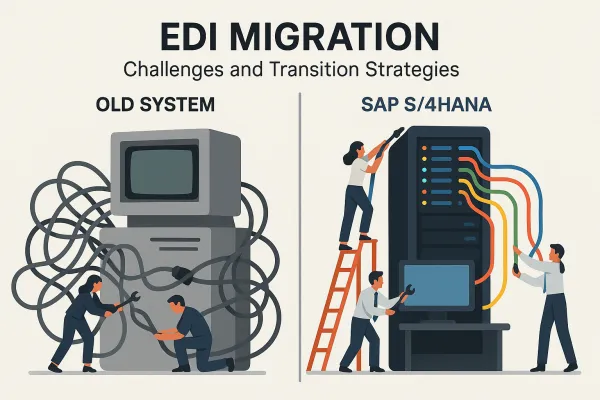

Your contingency planning needs to move at the speed of modern geopolitics. Modern EDI platforms can facilitate rapid onboarding of new trading partners through pre-connected networks, which eliminate the need for extensive manual setup. Companies can now go live in under 9 days with prebuilt connections.

Build your rapid substitution framework around three principles: pre-qualified alternatives, standardized onboarding processes, and automated compliance checking. Instead of scrambling to find new suppliers during a crisis, maintain a warm bench of pre-approved partners who can scale up quickly. Modern platforms can automate partner onboarding in hours and resolve disruptions 85% faster, with some companies reducing new partner onboarding time by 75%.

The key difference: platforms like Cargoson, alongside solutions from Cleo, Orderful, and OpenText Trading Grid, enable you to maintain dormant connections that can be activated within hours rather than weeks. When a crisis hits, you flip a switch rather than fill out forms.

Automated Threat Monitoring and Partner Health Scoring

Stop reacting to disruptions—start predicting them. AI-powered platforms can now proactively identify supply chain errors and provide clear, actionable steps to resolve them before they impact your business. This includes geopolitical risk scoring for your trading partners.

Implement partner health scores that factor in financial stability, geographic risk, regulatory compliance status, and geopolitical exposure. When a partner's score drops below your threshold, automated systems can begin pre-warming backup relationships. AI-powered tools can identify anomalies, forecast demand, and alert your team before small problems become big ones, empowering companies to respond faster and make better decisions.

The Hybrid EDI-API Strategy for Crisis Resilience

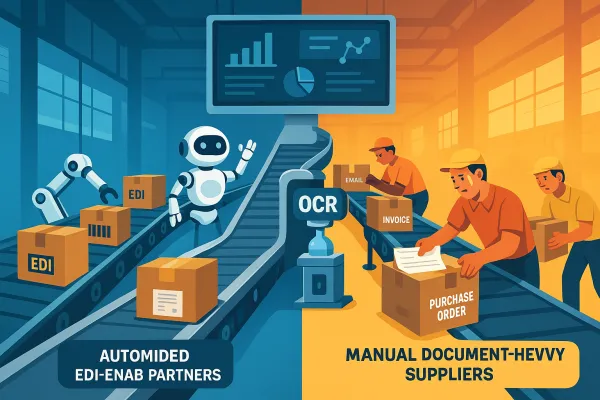

The debate isn't EDI versus API anymore—it's about orchestrating both technologies for maximum resilience. The decision between EDI and API isn't always an either/or scenario. Most modern supply chains benefit from using both technologies, depending on the nature of the data being exchanged and the preferences of trading partners. When used together, they can deliver powerful results.

Hybrid integration maximizes technology strengths by combining EDI's standardized reliability with API's real-time speed. In practice, this means a retailer might receive a purchase order via traditional EDI, then use APIs to instantly update inventory and trigger fulfillment processes in real-time.

The crisis resilience advantage becomes clear during disruptions. When your primary EDI connection to a major supplier fails due to sanctions or infrastructure attacks, your hybrid system can automatically route critical communications through API endpoints. Conversely, when API systems are overwhelmed or compromised, EDI's batch processing provides a reliable fallback.

Companies successfully implementing this approach use Cargoson and similar platforms that support both protocols natively, alongside traditional providers like IBM Sterling and emerging solutions from Cleo and TrueCommerce. The key is choosing platforms that treat both protocols as first-class citizens rather than afterthoughts.

Emergency Protocol Implementation for Sudden Partner Loss

Your 24-48 hour partner substitution playbook should include pre-scripted EDI configurations, automated compliance documentation, and direct phone numbers for emergency escalation. Support teams ready to help 24/7 with guaranteed 1-hour response times provide essential backup during crisis situations.

When a partner gets blacklisted, you don't have time to negotiate new EDI specifications from scratch. Pre-configure multiple connection types (AS2, SFTP, API endpoints) with standardized mapping templates that can be rapidly deployed to replacement suppliers. Store these configurations in secure, geographically distributed systems so they remain accessible even during regional disruptions.

Compliance Automation for Multi-Jurisdiction Trading

Cross-border trade is increasingly affected by shifting political landscapes, tariffs, and evolving compliance requirements. E-invoicing mandates in Poland, France's PDP system, and other new requirements force businesses to stay compliant or face delays and penalties.

Manual compliance management becomes impossible when regulations change weekly. Tariff structures themselves are becoming increasingly unpredictable, with products like semiconductors now being tariffed based on their Country of Design (COD) rather than traditional Country of Origin (COO), introducing new layers of complexity.

Automated compliance systems need to monitor multiple regulatory sources in real-time, automatically update trading partner configurations, and flag potential violations before documents are transmitted. The cost of non-compliance isn't just fines—it's the complete disruption of trading relationships during critical periods.

Future-Proofing Against 2026+ Regulatory Volatility

Under the current administration, tariffs have evolved from a narrow trade instrument into a broader tool of geopolitical leverage. As national security interests and foreign policy priorities shift, tariff actions are increasingly deployed with little notice, making them a constant strategic risk.

Your EDI systems need to be regulation-agnostic and rapidly reconfigurable. Build compliance frameworks that can adapt to new requirements without requiring complete system overhauls. This means modular architectures, API-driven configuration management, and automated testing of regulatory changes in sandbox environments before production deployment.

Implementation Roadmap: 90-Day Geopolitical Resilience Program

Days 1-30: Risk Assessment and Partner Mapping

- Conduct comprehensive geopolitical risk assessment of all current trading partners

- Map critical dependencies and single-point failures in your EDI network

- Identify backup suppliers for high-risk relationships

- Evaluate current EDI provider's crisis response capabilities

Days 31-60: Infrastructure Modernization

- Implement hybrid EDI-API platform supporting rapid partner onboarding

- Configure automated compliance monitoring for key jurisdictions

- Establish emergency communication protocols with 24/7 support capabilities

- Test rapid partner substitution procedures with low-risk scenarios

Days 61-90: Network Diversification and Testing

- Onboard pre-qualified backup suppliers in diverse geographic regions

- Conduct full-scale crisis simulation with partner substitution exercise

- Implement AI-powered partner health monitoring and risk scoring

- Establish ongoing threat intelligence integration and response procedures

Budget considerations typically range from $150K-$500K for mid-market companies, with ROI calculated primarily through risk avoidance rather than operational efficiency gains. However, companies implementing modern EDI platforms report cutting onboarding time by 75% and achieving go-live times that are 400% faster, allowing them to adapt quickly to demand shifts and establish competitive advantages.

The question isn't whether geopolitical disruption will impact your supply chain—it's whether your EDI trading partner network can adapt fast enough to keep your business running when it does. Choose platforms that prioritize crisis resilience over feature completeness, and partners who understand that in 2026, network agility isn't just a competitive advantage—it's a survival requirement.