The GS1 Sunrise 2027 EDI-TMS Integration Crisis: How to Build Dynamic Packaging Data Architecture Without Breaking Transportation Workflows or Trading Partner Networks in 2026

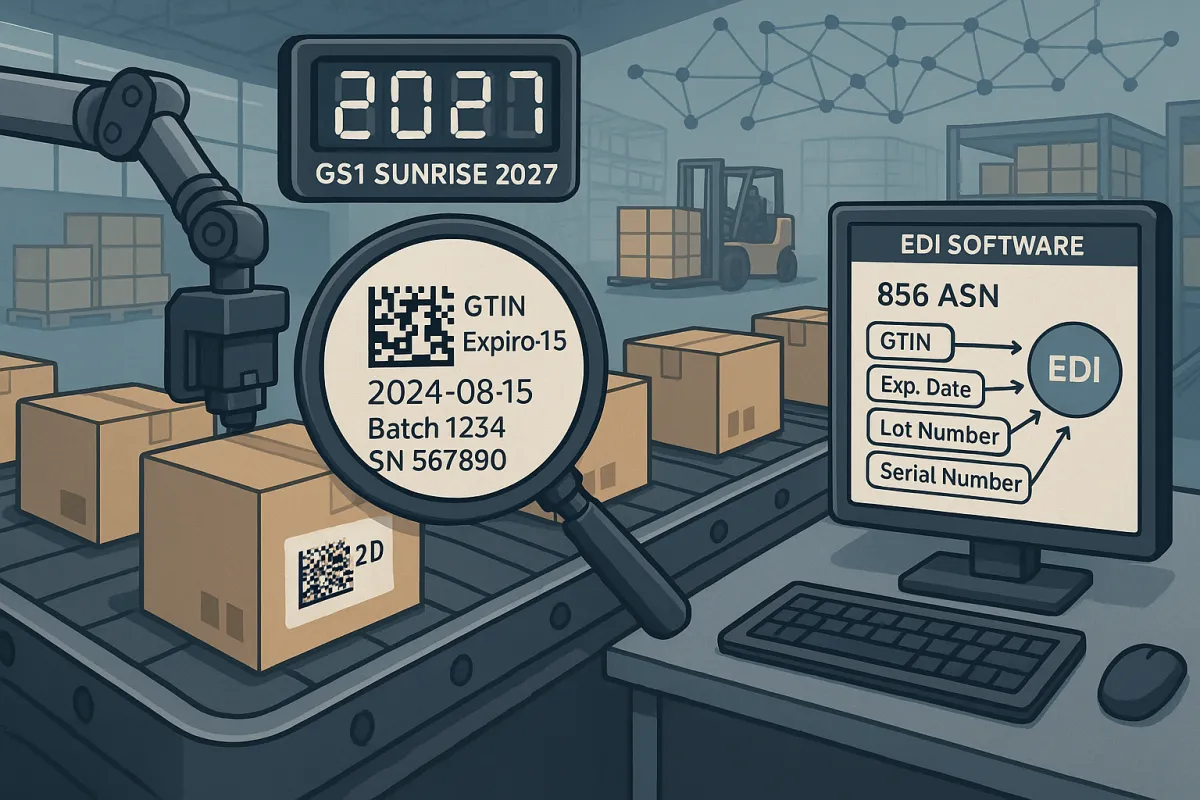

Your TMS integration team isn't ready for what's coming. By the end of 2027, retailers would need to ensure their POS systems are equipped with scanners capable of reading both traditional barcodes and 2D barcodes. The shift has already begun with the new technology being tested in 48 countries across the world, representing 88% of the world's GDP. While everyone focuses on point-of-sale scanning, real-time printing directly on the packaging line allows the inclusion of lot and batch numbers, expiration dates, and serial numbers within the code. This dynamic packaging data needs to flow through your transportation workflows without breaking existing EDI connections or creating data mapping nightmares.

The complexity goes far beyond adding QR codes to boxes. In modern supply chains, all partners — from manufacturers to retailers — will rely on 2D codes for product identification. But if a simple scan of a 2D code at point of sale is going to do everything from price lookup functionality to sell by dates, we have to know how best to print them! Your EDI 856 ASN needs to carry GS1 Digital Link URLs, batch data, and expiration dates that get printed dynamically at your production line. Meanwhile, your TMS still needs to process EDI 204 load tenders and 214 status updates that reference these dynamic identifiers.

The Hidden Complexity Behind GS1 Sunrise 2027's EDI Requirements

Traditional EDI transactions assume static product identifiers. Your current 856 ASN carries a GTIN, quantity, and maybe a lot number if you're lucky. GS1 recommends that brands looking to align with GS1 Sunrise 2027 join the transition by adding 2D codes to their packaging along with the existing EAN/UPC barcodes. This means that the GS1 Digital Link is the most powerful of the GS1 barcode syntaxes. It eliminates the need to add separate QR codes to a package for consumer engagement and other marketing functions.

A 2D code can store up to 7,000 numeric characters, including: net weight, expiration dates, serial and batch numbers. All of this data can be embedded in a single 2D symbol that is faster and easier to scan from any angle. But here's the catch: this data gets generated at print time, not at order creation. Your MES system determines the actual expiration date based on production conditions. The batch number comes from your quality control system. The serial number increments with each unit produced.

Your EDI system needs to handle what I call "late-binding data." Unlike traditional static barcodes where the GTIN never changes, GS1 Digital Link URLs contain dynamic elements that only get finalized when the product physically leaves your production line. This breaks the standard EDI data flow where you send an 856 ASN before the shipment even gets picked up.

Traditional TMS platforms like Oracle TM handle this poorly. No proprietary carrier network; relies on standard EDI connections rather than direct carrier integrations. Adding new carriers requires significant implementation effort, typically through Oracle partners. Compare this with more flexible platforms like Cargoson, which was designed to handle dynamic data flows through API-first architecture, or MercuryGate's hybrid EDI-API approach.

The Critical TMS Integration Architecture Decisions for 2D Barcode Data

Integrating EDI with TMS can be technically challenging, especially for organizations with outdated systems or limited IT resources. Businesses may need to invest in middleware solutions to bridge the gap between legacy systems and modern EDI requirements. Now add GS1 Application Identifiers (AIs) that contain production timestamps, and you've got a data mapping nightmare.

The AI structure for GS1 Digital Link isn't just about carrying more data. AI (01) contains your GTIN, AI (17) carries the expiration date, AI (10) has the batch/lot number, and AI (21) includes the serial number. But these aren't fixed-length fields like traditional EDI segments. The batch number could be 3 characters or 20. The serial number might be numeric or alphanumeric. Your TMS needs to parse these variable-length fields and map them correctly to EDI transactions.

Most EDI translators choke on this variability. If EDI is bundled inside core ERP, businesses may not be able to seamlessly process EDI for WMS or TMS, such as 940s, 204s, or 214s. This is because ERPs may not have fields or modules applicable to leverage or store the data. Your ERP knows about products and orders, but it doesn't understand dynamic packaging contexts.

Here's where architecture decisions matter. Oracle TM requires extensive customization to handle variable GS1 data. Kuebix' Integrationsfähigkeiten sind erstklassig und erzielen eine Bewertung von 79 in unserer Auswahlplattform, höher als führende Konkurrenten wie Manhattan TMS (69) und Oracle Transportation Management (59). Das Tool integriert nahtlos mit allen Drittanbieter- oder internen Systemen MercuryGate handles this better through its flexible data structure, but still requires significant mapping work. Cargoson builds true API/EDI connections with carriers, not just accounts in software or standardized EDI messages that carriers must implement themselves.

Avoiding the 73% Integration Failure Rate with Hybrid Data Flows

EDI integration projects fail at alarming rates when they encounter unexpected data structures. These hybrid connectors enable automated workflows where EDI handles standardized transactions while APIs ensure ERP systems always have the most current data available. Moreover, this approach dramatically simplifies partner onboarding, improves visibility, and reduces the complexity of legacy systems.

The solution isn't choosing between EDI and APIs. It's building parallel data pipelines that handle both static and dynamic product information. Your 856 ASN still contains the traditional product data that your trading partners expect. But you add a supplementary data stream that carries the GS1 Digital Link URLs and associated metadata.

Smart TMS platforms handle this through what I call "progressive data enrichment." The initial EDI transaction carries placeholder values for dynamic fields. As products move through production and get their final 2D codes printed, the TMS updates these transactions with actual values. Platforms like Cargoson alongside nShift and Manhattan Active have built this capability natively, while legacy systems require expensive customization.

The Transportation Document Transformation Challenge

EDI serves as a bridge that connects various stakeholders within the freight and trucking ecosystem. Whether it's manufacturers, shippers, carriers, or customs authorities, EDI facilitates seamless communication, leading to improved collaboration and reduced misunderstandings among parties. But GS1 Sunrise 2027 changes how products get identified throughout the transportation process.

Your EDI 204 Load Tender currently references products by GTIN and maybe a customer part number. Post-2027, carriers need access to the dynamic data embedded in 2D codes for proper handling, temperature control, and expiration date management. This isn't just nice-to-have information. Transitioning to 2D barcodes enables businesses to: Enhance Traceability: Capture and store more data, including expiration dates, lot numbers, and product origins.

The EDI 214 Transportation Carrier Shipment Status Message becomes particularly complex. Traditionally, this transaction reports "arrived," "departed," or "delivered" for a shipment. Now it needs to validate that 2D barcode data remains consistent throughout the transportation process. If a pharmaceutical shipment's temperature exposure affects the expiration date, the TMS needs to update the GS1 Digital Link URL and propagate these changes back through EDI.

EDI 990 Response to a Load Tender transactions also need updating. Carriers accepting loads must confirm they can handle the dynamic packaging requirements. This means validating scanner capabilities, temperature control for products with time-sensitive expiration dates, and proof-of-delivery systems that can capture 2D barcode data.

Blue Yonder and SAP TM handle these requirements through their enterprise-grade workflow engines, but require significant configuration. Cargoson's unified solution approaches this differently, building 2D barcode support into core transportation transactions rather than treating it as an add-on feature.

Building Future-Proof EDI-TMS Integration Architecture

The transportation industry isn't standing still, and neither should your EDI-TMS integration. Keep these points in mind: Stay flexible with your integration architecture to accommodate new trading partners · Keep up with EDI standards updates and industry changes · Plan for scaling - make sure your system can handle growth · Consider cloud-based solutions for better accessibility and updates

Microservices architecture solves the GS1 Sunrise 2027 integration challenge by separating static product data from dynamic packaging intelligence. Instead of cramming everything into monolithic EDI transactions, you build specialized services that handle different aspects of the data flow.

Your product master service manages GTINs and basic product attributes. A separate packaging service handles 2D barcode generation and GS1 Digital Link URLs. The transportation service orchestrates EDI transactions while consuming data from both upstream services. This separation lets you update packaging logic without touching transportation workflows.

Container orchestration becomes critical here. In supply chain management, EDI efficiently processes routine documents like orders and invoices, while APIs deliver real-time tracking and inventory updates. Similarly, eCommerce operations benefit from EDI's batch processing for back-end functions combined with API-powered customer-facing features like dynamic pricing and immediate order status.

Platforms like Cargoson work with E2open, Alpega, and FreightPOP to create comprehensive coverage. But the key is ensuring your architecture can swap components without rebuilding everything. Your EDI translator should connect to any packaging service through standard APIs. Your TMS should consume dynamic product data without caring whether it comes from internal systems or external platforms.

The Trading Partner Onboarding Crisis for Dynamic Data

Backed by retailers around the world it marks a global shift in product identification, requiring businesses to adopt GS1-standards based 2D barcodes for enhanced product information transparency, traceability and authentication, allowing consumers to access detailed product data via smartphone scans. Retailers and manufacturers must now prepare by upgrading systems and product packaging to support 2D barcodes, ensuring a smooth transition and improved supply chain efficiency.

Here's the onboarding nightmare: you'll be operating in mixed 1D/2D environments for years. Some trading partners will be ready for GS1 Digital Link data in their EDI transactions. Others will still expect traditional GTINs. Your smaller suppliers might not have 2D printing capabilities until 2028 or later.

GS1 recommends that brands looking to align with GS1 Sunrise 2027 join the transition by adding 2D codes to their packaging along with the existing EAN/UPC barcodes. In their 2D Barcodes at Retail Point-of-Sale Implementation Guideline, GS1 provides this chart to compare the code options during the transition period and the 2027 ambition goal: Transition Period: Dual-marking transition phase with EAN/UPC and a 2D code · Ambition for 2027: EAN/UPC or a 2D code (preferred)

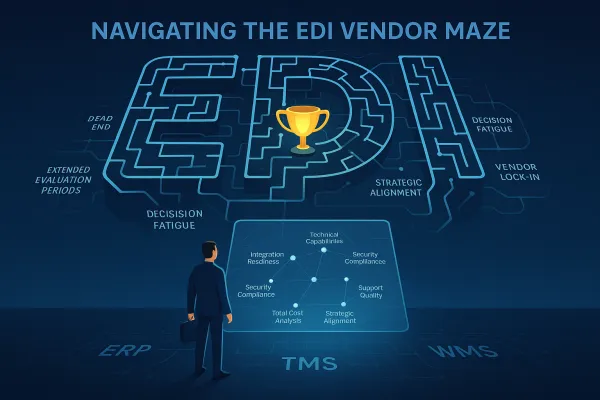

Your TMS integration needs to handle partner capability discovery automatically. When onboarding a new carrier, the system should detect whether they support GS1 Application Identifiers in EDI transactions, what 2D barcode formats they can process, and which dynamic data elements they can handle.

Traditional EDI onboarding assumes capabilities are static. You test once, then rely on the same data structures forever. Dynamic packaging data requires continuous capability validation. A carrier might support temperature monitoring for pharmaceuticals but not batch tracking for food products. Your TMS needs to route shipments based on these dynamic capabilities.

Cargoson's partner onboarding capabilities handle this through automated capability testing, while traditional platforms like 3Gtms/Pacejet and Uber Freight still require manual configuration for each new dynamic data requirement.

Implementation Roadmap: From Static EDI to Dynamic Packaging Intelligence

By preparing now, businesses can take advantage of value creation opportunities presented by the move from 1D to 2D barcodes, including streamlining operations, improving consumer safety, and future-proofing their supply chains. Acting early not only mitigates risks but also positions your business for long-term success in a rapidly evolving market.

Q1 2026: Establish your hybrid data architecture. Build the microservices that separate static product data from dynamic packaging intelligence. Test GS1 Digital Link generation with a small product line. Don't try to boil the ocean.

Q2 2026: Pilot dynamic EDI transactions with one major trading partner. Focus on simple products first, then add complexity gradually. Validate that your TMS can handle variable-length GS1 Application Identifiers without breaking existing workflows.

Q3 2026: Scale to multiple product lines and trading partners. This is where your architecture decisions get tested. Can you onboard new carriers without custom development? Can you add new GS1 AIs without rebuilding EDI maps?

Q4 2026: Optimize and prepare for full deployment. Instead, with GS1 Sunrise guidance, all POS systems and retailer software should meet requirements for scanning 2D codes starting in 2027. For now, it is estimated that by 2027, a critical mass of point-of-sale systems (POS) will be capable of handling the data encoded in the GS1 2D codes.

Cost analysis shows early adopters save 30-40% versus reactive implementations. Building hybrid architecture costs $200,000-500,000 for mid-market companies, but avoiding emergency retrofitting saves $1-2 million in 2027-2028.

ROI comes from three sources: reduced manual data entry (15-25% cost savings), improved inventory accuracy through better batch tracking (5-10% carrying cost reduction), and enhanced customer service through real-time product information (3-5% revenue increase from faster issue resolution).

Your technology ecosystem matters. Complete solutions require coordination between TMS, EDI platforms, and packaging systems. Cargoson, Transporeon, and multi-carrier shipping solutions like ShippyPro and Shippo offer integrated approaches, while traditional enterprise vendors require extensive custom integration work.

The companies that start building dynamic packaging intelligence into their EDI-TMS architecture today will have competitive advantages that late adopters can't match. Those who wait until 2027 will be paying premium prices for tactical fixes instead of strategic transformation.