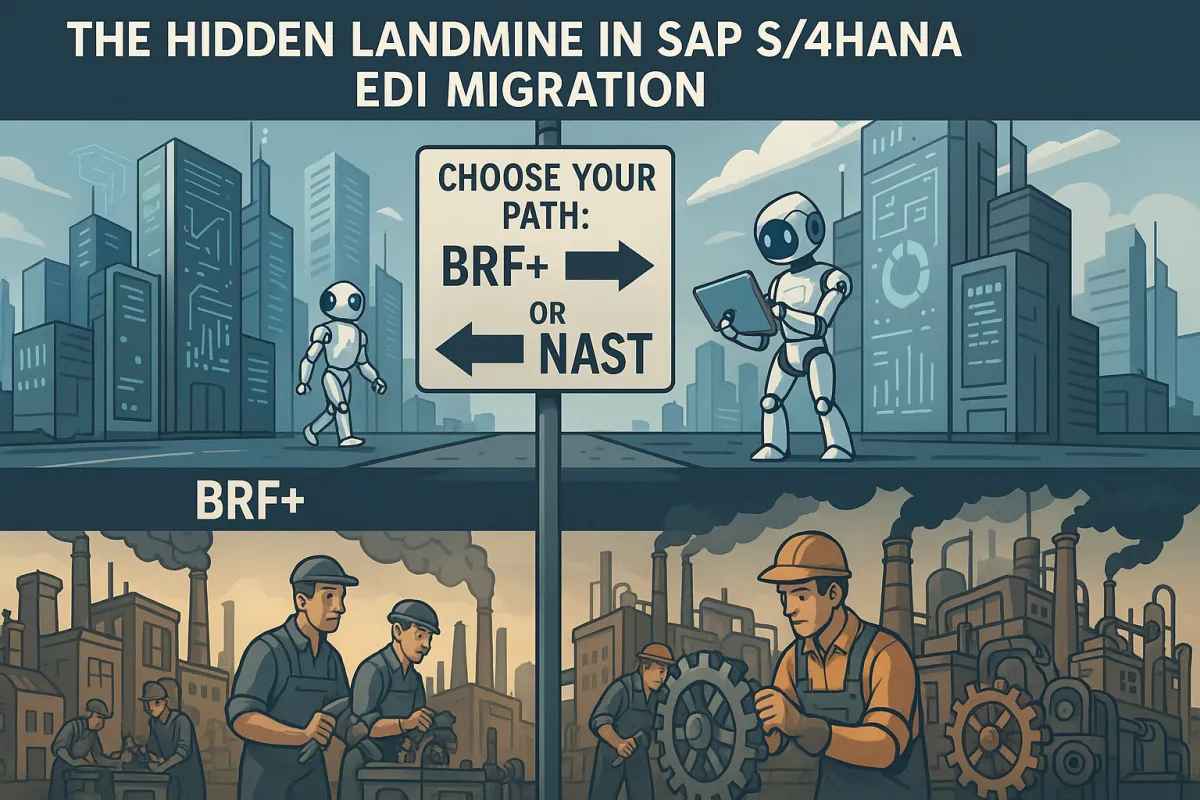

The Hidden SAP S/4HANA EDI Output Crisis: Your Complete BRF+ vs NAST Decision Framework to Prevent Trading Partner Disruptions and EDI Workflow Failures in 2026

Twenty-four months after SAP's 2027 support deadline, most EDI teams are discovering their S/4HANA migration includes a hidden landmine that can stop trading partners from receiving critical documents like ASNs or invoices, causing order disruptions and SLA violations. The problem? A fundamental shift in how S/4HANA manages EDI output that has driven migration costs 17% above expectations for nearly half of all companies.

The technical reality behind this SAP S/4HANA EDI migration challenge centers on a critical decision most teams face too late in their project timelines: choosing between BRF+ (Business Rule Framework Plus) and legacy NAST for EDI output management. Early versions of BRF+ lacked full IDoc support, which often forced a fallback to NAST for business-critical flows, creating a complex decision framework that directly impacts trading partner integrations.

The Invisible S/4HANA Migration Landmine: Why 73% of EDI Teams Discover Output Issues Too Late

Here's what happens in a typical S/4HANA migration: Your project team focuses on data conversion, interface updates, and user training while assuming EDI output management will "just work" in the new system. With only 39% of the 35,000 SAP ECC customers having moved to S/4HANA by late 2024, the pressure to migrate quickly often overshadows the technical complexities of output determination.

The problem emerges during user acceptance testing when teams realize that companies must reconfigure EDI output logic from scratch. Your purchase orders, advance ship notices, and invoices suddenly stop flowing to trading partners because S/4HANA's new output management framework operates fundamentally differently than the NAST-based system your EDI workflows depended on.

Transportation management systems like MercuryGate and Descartes, along with integration platforms including Cargoson, have adapted to support both output approaches, but the migration path isn't automatic. SAP migration expertise is already in high demand, and consulting costs will increase by 30-50% in 2026-27, making early planning for output management decisions financially critical.

BRF+ vs NAST: The Technical Reality Behind SAP's "Strategic Direction"

While NACE offers backward compatibility, BRF+ is SAP's strategic direction for Output Management in S/4HANA. It offers superior flexibility, a modern user experience, and aligns with the cloud-first strategy. But the reality of EDI implementation tells a different story.

BRF+ presents significant limitations for EDI workflows. IDocs are not fully supported by the new output management. Their use is restricted to business applications that previously used NAST. More specifically, only output types which can be mapped 1:1 to the NAST-KSCHL can use IDoc, and there's no support for communication to logical systems or ALE.

The technical constraints become apparent when you need complex output scenarios. BRF+ can handle multiple output versions, but expect to be knee-deep in complex rules. Extending BRF+ to accommodate weird, custom conditions can feel like trying to teach a cat to fetch. For EDI teams managing hundreds of trading partners with varying document requirements, this complexity multiplies exponentially.

NAST, meanwhile, provides the flexibility EDI teams actually need. It's the muscle car of output management: pop the hood, and you can tinker with everything. Whether you want your forms to look like fine art or just something a little more you, NAST lets you rev up those Smart Forms and SAPscript with ease.

When Each Approach Makes Sense

Choose BRF+ when your EDI requirements are straightforward: standard document types, minimal customization, and highly granular and dynamic output determination. You can define complex conditions without writing ABAP code, empowering functional consultants to manage business rules.

Stick with NAST when you need maximum flexibility for complex EDI scenarios, custom field integration, or when managing multiple output versions for different trading partners requires condition-based framework that can handle complex vendor categories, approval levels with easy condition records.

The Critical Decision Matrix: When to Choose BRF+ vs NAST for Your EDI Flows

Your decision framework should evaluate three key factors: EDI complexity, trading partner requirements, and long-term maintenance strategy.

Simple EDI Scenarios: If your trading partners receive standard ASNs, purchase orders, and invoices without custom fields or complex routing logic, BRF+ provides a modern, maintainable solution. The Fiori-based configuration interface reduces the learning curve for business users.

Complex EDI Requirements: When you need custom fields, multiple document versions, or integration with Smart Forms modifications, NAST delivers the flexibility your EDI workflows demand. You can easily enhance SAPscript or Smart Forms and flexibly bring in those custom fields without a lengthy approval process.

Hybrid Approach: Many successful migrations use both approaches strategically. Keep simple, high-volume EDI flows on BRF+ while migrating complex, customized outputs to NAST. This provides immediate migration benefits while preserving critical EDI functionality.

Transportation management platforms like Descartes, MercuryGate, and Cargoson support both output determination methods, allowing flexibility in your migration strategy.

The 11 Critical EDI Challenges That Break S/4HANA Migrations (And Proven Solutions)

Beyond output management, S/4HANA migrations face eleven known EDI challenges that can derail trading partner relationships:

IDoc Structure Changes: Field mappings shift between ECC and S/4HANA, requiring translator updates across your EDI infrastructure. Test early with production-like data volumes to identify mapping issues before go-live.

Business Partner Model Overhaul: S/4HANA's unified Business Partner model affects partner determination logic. Ensure correct roles are assigned and CVI framework handling is properly configured for EDI partner identification.

Partner Profile Complexity: WE20 configurations need updates to work with new output management approaches. Standard SAP CL_BILLING_OUTPUT_CONTROL class sets default V3 application area and RD00 condition type for IDOC and SMART form processing. You can set up WE20 using RD00 output type.

Middleware Adjustments: Your existing EDI translators and communication protocols may need updates to handle S/4HANA's data structures. Integration platforms including Cargoson provide migration support for these technical transitions.

Implementation Roadmap: Your Step-by-Step Migration Strategy

Start your EDI migration strategy six months before S/4HANA go-live with these concrete steps:

Month 1-2: Discovery and Inventory

- Inventory all NAST-based outputs and map to S/4 equivalents

- Document trading partner requirements and SLA commitments

- Identify custom fields and complex output scenarios

Month 3-4: Architecture Decisions

- Decide case-by-case whether to use BRF+ or retain legacy NAST for specific IDocs

- Design hybrid approach balancing complexity with maintainability

- Select integration partners that support both output methods

Month 5-6: Testing and Validation

- Build comprehensive testing frameworks covering all trading partner scenarios

- Validate output determination logic under production-like conditions

- Test failover scenarios and error handling procedures

Keep EDI aspects simple during migration by not reinventing existing workflows that function well. There can not be one approach to cover the conversion of all Output Integration frameworks. For that reason, the recommendation is not to accomplish a conversion but to establish a coexistence of old and new output management.

The Future-Proof Architecture: Hybrid Integration Platforms and Modern API Approaches

Smart EDI teams are building for the post-migration future by implementing hybrid integration platforms that protect supply chains during the transition while enabling gradual API adoption.

Traditional EDI will persist for years, but 59% of companies are now fully or partially live on SAP S/4HANA, though automation adoption has plateaued at 57% as migration demands divert resources. This creates an opportunity to pivot gradually from legacy EDI to APIs for specific use cases like real-time rate access and smoother trading partner onboarding.

Modern integration platforms including IBM Sterling, Cleo, TrueCommerce, and Cargoson provide the flexibility to maintain EDI connectivity while enabling API-based integrations where they add value. This hybrid approach protects existing trading partner relationships while positioning for future digital transformation.

Cloud versus on-premise considerations become critical as private cloud environments are the leading choice for S/4HANA, with 17% of organizations already using RISE with SAP S/4HANA Cloud private edition. Your EDI output management decisions should align with your overall cloud strategy.

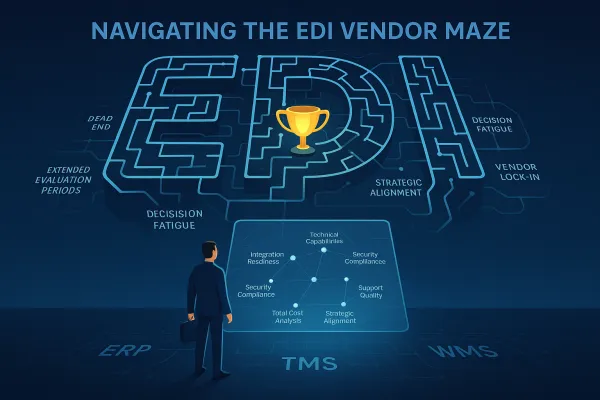

Vendor Selection and Success Metrics: Ensuring Long-term EDI Stability

Evaluate integration partners based on their support for both BRF+ and NAST output methods, not just their claims about "modern" approaches. Look for vendors with proven S/4HANA migration experience and flexible architectures that can adapt as SAP's output management evolves.

Key evaluation criteria include:

- Support for hybrid BRF+/NAST environments during transition periods

- Integration with major TMS platforms like MercuryGate, Descartes, and Cargoson

- Proven track record managing EDI disruptions during ERP migrations

- Scalable architecture supporting gradual API adoption alongside EDI

Measure migration success through trading partner satisfaction metrics, not just technical functionality. Track document delivery times, error rates, and partner onboarding velocity to ensure your output management decisions support business objectives.

Timeline considerations matter: last-minute migrations increase failure rates due to compressed project timelines and rushed decision-making, with nearly two-thirds of companies planning to complete migration by end of 2025.

The BRF+ versus NAST decision isn't just about technical architecture; it's about protecting the trading partner relationships that drive your supply chain. Choose based on your specific EDI complexity, maintain hybrid flexibility during transition, and select integration partners who understand both the technical requirements and business impact of your output management approach.