The Hybrid EDI-OCR Integration Strategy: How to Bridge Mixed Trading Partner Networks and Achieve 100% Supply Chain Document Automation Without Breaking Existing Workflows in 2026

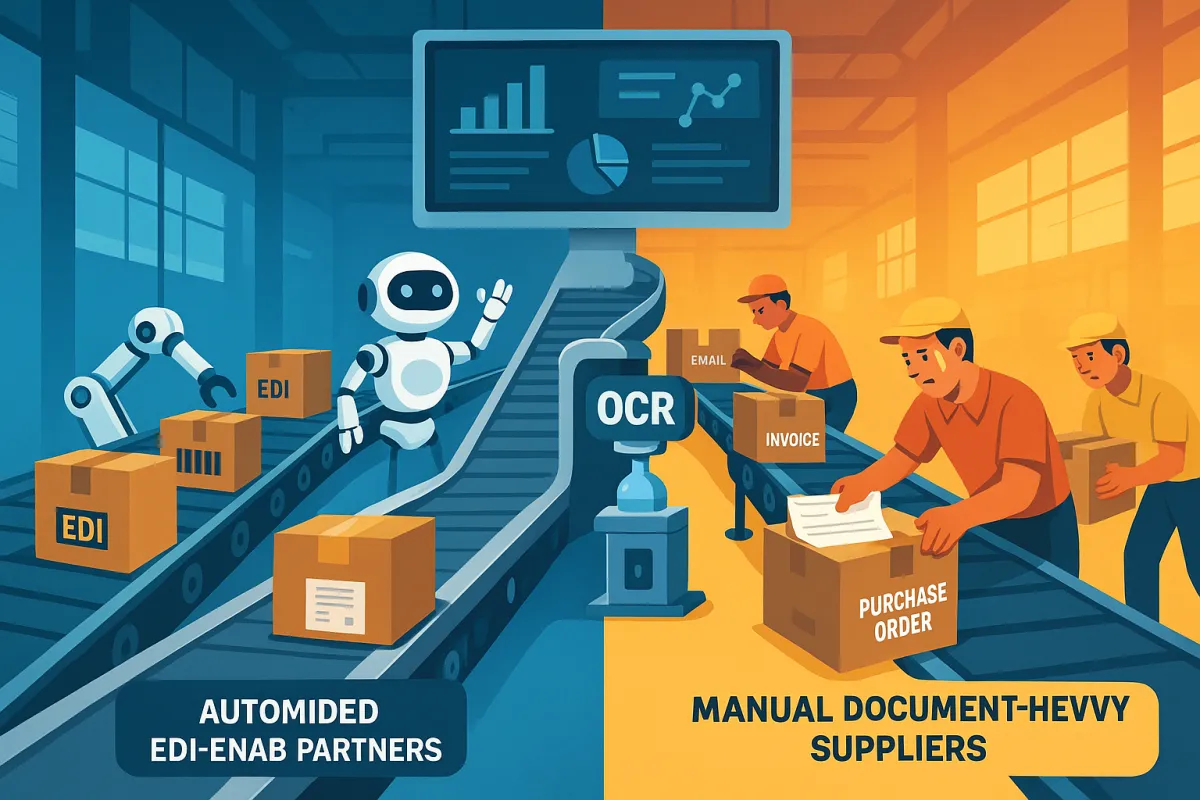

Supply chain managers know the frustration: manual processing costs the average enterprise nearly $10 per invoice and takes roughly 11 days to complete, but not every supplier in your network can handle EDI. While you've automated transactions with 60% of your major partners through structured EDI integration, that remaining 40% still sends purchase orders as PDFs, invoices as scanned images, and shipping notices via email attachments.

The gap between your EDI-enabled partners and document-heavy suppliers creates a processing bottleneck that's more expensive than most realize. Suppliers are losing approximately $27K in yearly revenue per trading partner and paying 35% more in EDI costs when they can't properly integrate their mixed document networks.

Modern business requires innovative combinations with technologies like OCR for end-to-end automation - and the companies implementing unified EDI-OCR strategies are seeing dramatic results. A hybrid approach that bridges structured EDI data with intelligent document processing eliminates the manual processing gap without forcing non-compliant suppliers through costly EDI implementations.

The Critical Mixed Document Processing Gap That's Costing Supply Chains $2.3 Million Annually

Here's what happens in most supply chain networks: Your tier-one suppliers like Bosch or Delphi send clean EDI 850 purchase orders and 856 advance shipping notices. But your regional suppliers, smaller manufacturers, and overseas vendors? They're still operating with PDF invoices, scanned packing slips, and email confirmations.

According to a 2008 Aberdeen Group report, only 34% of purchase orders were then transmitted electronically in North America - and while that number has improved, the fundamental challenge remains. You end up with two separate processing workflows: automated EDI transactions flowing seamlessly into your ERP, and manual document processing creating delays, errors, and resource bottlenecks.

This creates specific pain points in TMS implementations. When Cargoson, MercuryGate, Descartes, or Manhattan Active transport management systems receive structured EDI data, they can automatically trigger load planning, carrier selection, and shipment tracking. But when they encounter unstructured documents, someone has to manually extract the same information - shipment details, delivery addresses, special instructions - and key it into the system.

The financial impact adds up quickly. Businesses that adopt document processing tools report significant time savings (up to 80%) and reduced processing costs, but only when they process both structured and unstructured data through a unified approach.

Why Traditional EDI-Only Strategies Fail in Modern Mixed Trading Partner Networks

The reality is stark: most networks operate on what I call the 70/30 rule. Roughly 70% of your transaction volume comes from EDI-capable partners, while 30% of your suppliers still rely on traditional document formats. But that 30% often represents critical suppliers you can't afford to lose - specialized manufacturers, regional distributors, or international suppliers without the infrastructure for EDI integration.

The high IT investment required to deploy and maintain EDI systems often limits participation to only the largest partners. As a result, many smaller suppliers are excluded, forcing them to rely on manual exchanges such as email or spreadsheets.

Traditional approaches create integration bottlenecks when connecting to transportation management systems. Blue Yonder, nShift, and other TMS platforms expect structured data for optimal performance. When your TMS receives EDI 214 shipment status messages, it can automatically update delivery windows and alert customers. When it receives a PDF delivery receipt, someone needs to read it, extract the relevant information, and manually update the system.

The cost implications go beyond processing time. Up to 47% of IT managers say that slow EDI supplier onboarding is currently keeping their businesses from capturing new revenue opportunities. Nearly a quarter of companies (24%) are losing $500K or more to integration issues related to their supply chains.

The OCR Revolution: From Simple Text Recognition to Intelligent Document Processing

OCR technology has evolved far beyond basic text recognition. AI models used out-of-the-box achieve around 50–70% accuracy in data validation tasks. However, when combined with a human-in-the-loop (HITL) validation process, accuracy improves dramatically to over 95%.

Modern intelligent document processing combines OCR with artificial intelligence to understand document context, not just read text. This means the system can differentiate between a purchase order and an invoice, extract line items from tables, and validate extracted data against business rules - all automatically.

The integration possibilities with existing EDI workflows are significant. Instead of maintaining separate processing systems, you can route all documents through a unified processing layer that outputs standardized data to your TMS, whether the source was an EDI 856 or a scanned delivery receipt. Shipping software providers like ShippyPro and Sendcloud can consume this standardized output regardless of the original document format.

Building Your Unified EDI-OCR Integration Architecture

A successful hybrid strategy starts with an API-first architecture that treats both EDI and OCR as data sources feeding a common processing pipeline. Here's the technical framework:

Document Ingestion Layer: This handles incoming data from multiple channels - EDI transactions via AS2 or HTTPS, email attachments, FTP uploads, and direct API calls. The key is normalizing the intake process so your downstream systems don't care about the original format.

Classification and Routing Logic: Use machine learning to automatically classify documents by type and route them to appropriate processing engines. EDI transactions go to your existing translation software, while PDFs and images flow to OCR processing engines.

Data Standardization: Both EDI and OCR outputs feed into a common data model that matches your internal business objects. Whether a purchase order arrives as EDI 850 or a PDF, the output contains the same standardized fields: supplier ID, line items, delivery dates, special instructions.

For TMS platform integration, this approach provides consistent data feeds. Cargoson can receive shipment data in a predictable format whether it originated from an EDI 214 or an OCR-processed delivery receipt. The same applies to Transporeon, E2open, and Alpega integrations.

Pre-Processing and Data Standardization Layer

Document quality significantly impacts OCR accuracy. It's essential to have high-quality documents and to preprocess them effectively to ensure the OCR can accurately capture the text and data. Your pre-processing layer should handle image enhancement, rotation correction, and format standardization before OCR analysis begins.

Quality enhancement algorithms can improve poor scans and fax images automatically. Validation rules check extracted data against expected patterns - does the supplier ID exist in your master data? Do line totals match the invoice total? Are delivery dates reasonable based on lead times?

Exception handling is crucial. When OCR confidence scores fall below acceptable thresholds or validation rules fail, the system should route documents to human reviewers rather than creating bad data in your downstream systems. This includes integration with carrier systems that expect clean, validated data for shipment processing.

Intelligent Data Mapping and Transformation

AI technologies such as Natural Language Processing (NLP) and Machine Learning (ML) are deployed to classify, extract, and validate data. For example, IDP can differentiate between a purchase order and an invoice by analyzing the document's context.

AI-powered field extraction goes beyond simple text recognition. The system learns to identify purchase order numbers in different locations on different supplier forms, extract line items from complex table formats, and map supplier-specific terminology to your standardized field names.

Real-time validation and error correction prevent bad data from entering your TMS workflows. The system can cross-reference extracted supplier information against your master data, validate delivery addresses using postal databases, and flag unusual amounts for review before processing.

This connects seamlessly to transport execution software workflows. When the system extracts shipping information from a supplier's PDF packing list, it can automatically format that data to match the input requirements of your TMS, whether that's Manhattan Active or a shipper TMS solution.

TMS Integration Strategies: Connecting Hybrid Document Flows to Transportation Systems

Transportation management systems expect structured, clean data to function optimally. Whether you're using enterprise solutions or specialized transport management platforms, the integration approach remains consistent: provide standardized data feeds regardless of source document format.

For API connectivity, design your integration to present a unified data interface. Your TMS doesn't need to know whether shipment information came from EDI or OCR processing - it just needs accurate data in the expected format. This works well with modern cloud-based solutions that emphasize API-first design.

Real-time processing creates better user experiences but requires careful architecture. OCR processing takes more time than EDI translation, so design your workflows to handle mixed processing speeds. Consider batch integration for high-volume document processing while maintaining real-time feeds for critical EDI transactions.

A retailer might receive a purchase order via traditional EDI, then use APIs to instantly update inventory and trigger fulfillment processes in real-time. This synchronization creates a seamless connection between legacy processes and modern systems.

Carrier Connectivity and Multi-Modal Support

Different carriers use different document formats, creating complexity in multi-carrier environments. Some carriers provide structured EDI 214 status updates, others send PDF delivery receipts, and still others communicate via email notifications. A unified processing approach handles all these formats consistently.

Parcel courier integration benefits significantly from this approach. Services like ShipStation, Shippo, and AfterShip can receive normalized data whether the original shipping information came from EDI or extracted from carrier PDFs. This creates more reliable tracking and status updates across your entire carrier network.

Freight broker and 3PL document processing often involves complex, multi-page documents that combine shipping instructions, compliance documentation, and billing information. Intelligent document processing can extract and route different data elements to appropriate systems - shipping details to your TMS, compliance information to regulatory tracking systems, and billing data to accounts payable.

Implementation Roadmap: From Pilot to Full-Scale Deployment

Phase 1: Infrastructure and Pilot Testing (Months 1-3) Set up your document ingestion and processing infrastructure. Choose a subset of suppliers with high document volumes but relatively standardized formats for initial testing. Focus on one document type - perhaps purchase order confirmations or delivery receipts - to validate your processing pipeline.

Phase 2: Core Document Types (Months 4-8) Expand to handle the primary document types in your network: purchase orders, invoices, advance ship notices, and delivery confirmations. This phase should include integration with your primary TMS and ERP systems to ensure processed data flows correctly through existing workflows.

Phase 3: Advanced Document Types and Complex Formats (Months 9-12) Add support for complex documents like bills of lading, customs paperwork, and compliance documentation. This phase often requires more sophisticated AI models and additional validation rules but provides the greatest ROI for transportation-heavy industries.

Risk mitigation should focus on data quality controls and fallback procedures. Always maintain manual processing capabilities for critical suppliers while building confidence in automated systems. Document processing automation reduces costs by minimizing manual labor, cutting down on errors, and speeding up processing times. With AI and automation handling repetitive tasks, businesses can lower operational expenses, reduce the need for additional personnel, and eliminate the costs associated with human error.

Performance metrics should track both processing accuracy and business impact: document processing times, error rates, manual intervention requirements, and cost per processed document. Include transportation spend management KPIs to measure the impact on logistics operations.

Vendor Selection Criteria and Technology Stack

Evaluate OCR and IDP solutions based on accuracy rates, processing speed, integration capabilities, and total cost of ownership. The best choice depends on your document volume, integration needs, and industry regulations. In 2026, Klippa leads for high-volume, AI-driven workflows, while OCRSoftware.co excels in compliance-heavy use cases.

Integration capabilities are crucial - the best OCR engine won't help if it can't connect to your existing TMS infrastructure. Look for solutions that provide REST APIs, support standard data formats like JSON and XML, and include pre-built connectors for common business systems.

Scalability requirements should account for peak processing loads. Document processing volumes often spike during certain business cycles, so ensure your chosen solution can handle 3-5x your average volume without performance degradation. This applies whether you're choosing between solutions like Cargoson and competitors or evaluating document processing platforms.

Real-World Case Studies and ROI Analysis

Manufacturing Company Reduces Processing Time by 85% A mid-sized automotive parts manufacturer implemented EDI-OCR integration to handle mixed supplier document formats. By processing 40% EDI transactions alongside 60% paper-based documents through a unified system, they reduced average processing time from 6 hours to 55 minutes per document batch. The investment paid back within 18 months through reduced labor costs and fewer processing errors.

Retail Chain Achieves 100% Supplier Connectivity A regional retail chain with 200+ suppliers used hybrid EDI-OCR to eliminate manual document processing. Instead of requiring expensive EDI implementations from smaller suppliers, they processed supplier invoices and delivery confirmations through intelligent document processing. This enabled automated accounts payable processing for all suppliers while maintaining existing supplier relationships.

3PL Provider Scales Without Headcount Increases A third-party logistics provider handling diverse client requirements implemented unified document processing to manage everything from EDI 856 advance ship notices to handwritten delivery receipts. Manual invoice entry can take 10–30 minutes per invoice, whereas AI-augmented systems can reduce that to 1–2 seconds per invoice, while cutting cost per invoice from ~$12–20 down to ~$2.36. They scaled document processing volume by 300% while increasing staffing by only 25%.

Financial impact calculations show consistent ROI patterns: initial implementation costs of $100K-300K typically pay back within 12-24 months through reduced processing costs, faster document turnaround times, and fewer errors requiring correction.

Future-Proofing Your Hybrid Strategy: AI, Automation, and Beyond

AI transforms EDI from reactive to predictive: Machine learning automates data mapping, handles exceptions intelligently, and enables autonomous supply chain decisions through predictive analytics. The next evolution combines document processing with predictive analytics to anticipate supply chain disruptions before they occur.

Agentic AI systems will transform document processing from simple extraction to intelligent decision-making. Instead of just extracting delivery dates from supplier documents, AI systems will evaluate delivery feasibility, suggest alternative shipping methods, and automatically negotiate delivery schedules with suppliers.

Next-generation EDI standards are incorporating JSON and XML formats that bridge traditional EDI with modern API architectures. Hybrid integration maximizes technology strengths: Combining EDI's standardized reliability with API's real-time speed creates seamless workflows that satisfy both legacy and modern system requirements.

Long-term technology roadmap considerations should include preparing for increased automation in transportation management. Forward-looking TMS vendors are building AI-powered decision engines that will consume unified document data to make autonomous routing, carrier selection, and delivery optimization decisions.

The most successful implementations today focus on creating flexible, API-driven architectures that can adapt to changing business requirements. Whether you're processing EDI transactions or extracting data from supplier PDFs, the key is building systems that can evolve with both your business needs and advancing technology capabilities. Companies that implement unified EDI-OCR strategies now position themselves to take advantage of future AI and automation advances while maintaining compatibility with existing trading partner networks.