The Mixed EDI-PDF Order Crisis: How to Bridge Non-EDI Trading Partners into Your Omnichannel Fulfillment Strategy Without Breaking Supply Chain Automation in 2026

The retail supply chain has hit a critical juncture where suppliers face a landscape that can "feel impossible to keep up" with. 2026 continues to be considered the throne of the omnichannel trend, making omnichannel fulfillment increasingly indispensable for retailers who want to stay competitive. Yet here's what most people miss: if you're like many suppliers and 3PLs, you work with a mix of retailers and clients who still send orders by PDFs, spreadsheets, emails and attachments, managing orders from non-EDI customers becomes a step backwards into the inefficiencies of manual workflows.

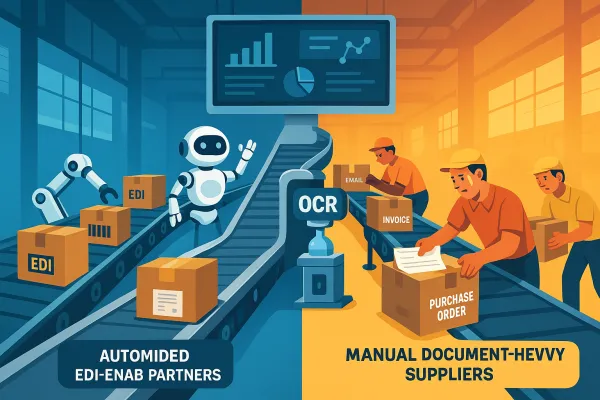

Many suppliers find themselves managing EDI connections for major retail partners while simultaneously processing PDF orders from smaller clients or different channels with the same retailer. You have higher operational costs and an extra layer of difficulty when it comes to scaling and growing your business, with manual entry slowing down receiving, creating downstream errors and adding cost to every order you handle.

The Growing Omnichannel-EDI Disconnect That's Fragmenting Retail Supply Chains

Retail supply chains are transitioning from linear, single-channel fulfillment to what experts call a networked, multi-path ecosystem. Omnichannel retail moves from strategy to baseline expectation where consumers no longer distinguish between ecommerce, stores, marketplaces, or drop-ship models expecting speed and accuracy everywhere, and for suppliers, that translates into managing more order types across more systems, often with little tolerance for error.

The challenge isn't just technical complexity. Suppliers find themselves in reactive mode, juggling orders from EDI retailers, disparate marketplaces, direct customers and more. You might receive a perfectly formatted EDIFACT 850 purchase order from Target through SPS Commerce, while the same day processing a PDF order from a growing DTC brand, plus handling API calls from a marketplace integration—all for the same product line but requiring different data formats and workflows.

Why Traditional EDI-Only Approaches Create Fulfillment Bottlenecks

Focusing on channels independently creates the exact problem you're trying to solve. The challenge for businesses is focusing on channels independently—if a retailer's various supply chain processes are not firing on the same cylinder, then how can they ensure entirely customer satisfaction?

Consider this scenario: Your EDI system processes a bulk order from Dick's Sporting Goods flawlessly, but meanwhile, your team is manually entering a rush order from a Shopify retailer because their PDF format doesn't match your system's expectations. Best-in-class omnichannel operations can fulfill orders within two hours of customer purchase, but a single missed manual entry cascades into stockouts, order cancellations, and damaged relationships.

Solutions from TrueCommerce, Cleo, IBM Sterling, and Cargoson handle EDI requirements well, but they don't address the PDF order processing gap that many suppliers face daily.

The Real Cost of Mixed EDI-PDF Order Processing in Omnichannel Operations

Here's what the numbers tell us. Over 75% of manufacturing firms process their procurement and shipping data through EDI platforms, with logistics companies reporting an average 33% reduction in document turnaround time through digitization, while the retail sector reports a 21% decline in out-of-stock events as a direct result of improved forecasting driven by timely EDI updates.

But what about the other 25%? Many businesses continue to receive purchase orders via email, creating delays and manual work, with new PDF order automation converting those documents into ERP-ready transactions, allowing partners to respond faster as omnichannel volume increases.

The operational impact hits multiple levels. Manual entry doesn't just slow receiving—it creates a bottleneck that affects your entire operation. When you're processing orders from companies like nShift or ShippyPro alongside traditional EDI feeds, the inconsistency becomes expensive. Companies with optimized order management processes report 25% higher customer satisfaction scores and 30% reduction in operational costs compared to those relying on manual processes.

The Three-Channel Fulfillment Complexity Problem

Omnichannel fulfillment means DTC orders, retail replenishments, and marketplace fulfillment each have unique requirements while you must maintain operational consistency. Your pick strategies need to adjust based on order profile: wave picking for bulk B2B orders, batch picking for similar DTC orders, and zone picking for high-SKU complexity marketplace orders.

Optimizing complex, omnichannel fulfillment is very difficult because any change to process in one area can have negative repercussions on another—for example, batching your order picking for in-store pickups might provide cost savings, but the additional wait time might discourage customers from ordering from your stores.

Integration with transportation management systems becomes another challenge layer. Solutions from E2open/BluJay, Alpega, or Cargoson can handle the shipping coordination, but they need clean, structured data input—which PDF orders typically don't provide without manual intervention.

How AI-Powered PDF Order Automation Bridges the EDI Gap

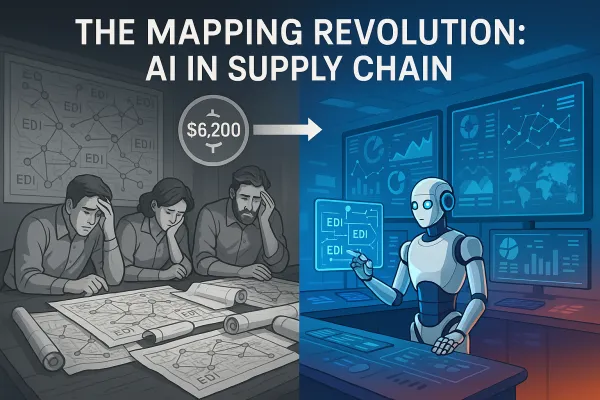

SPS PDF Order Automation is not OCR—their solution uses AI, so instead of just reading characters, their system actually understands the structure and meaning of the documents, with AI-assisted mapping that learns how to match the fields in each unique PDF to the fields in your order system.

This represents a fundamental shift from traditional optical character recognition approaches. OCR behaves like a scanner: it recognizes characters, not meaning, and for 3PLs, where order accuracy determines pick efficiency and shipment correctness, that's a problem.

This proprietary technology extracts data with near-perfect accuracy, ensuring your PDF orders are processed just like EDI orders—precisely, consistently and reliably enough for warehouse execution. The technology understands context, meaning it can distinguish between a shipping address and billing address even when they're formatted differently across various PDF layouts.

Alongside solutions from FreightPOP, 3Gtms/Pacejet, and Cargoson, AI-powered order automation creates a bridge between legacy ordering methods and modern fulfillment systems.

Integration Architecture for Mixed Order Types

When you manage your EDI processes with SPS Commerce Fulfillment, you already have access to 400+ pre-built system integrations for ERP, OMS, WMS solutions and more, with their PDF Order Automation using your existing Fulfillment integrations to map and translate non-EDI orders directly into your EDI workflow.

The architecture works by creating a unified ingestion layer. Whether orders arrive via EDI 850 transactions, API calls, or PDF attachments, they get normalized into the same internal format before hitting your warehouse management system. AI-assisted mapping and translation seamlessly integrates your orders into Fulfillment.

This matters when you're connecting to ERP systems like SAP TM, Oracle Transportation Management, or Microsoft Dynamics. Modern platforms now offer pre-built connectors that integrate EDI directly with major ERP systems, including SAP, Oracle, NetSuite, and Microsoft Dynamics, with these hybrid connectors enabling automated workflows where EDI handles standardized transactions while APIs ensure ERP systems always have the most current data available.

Implementation Strategy: Building Unified Order Processing That Handles Both EDI and PDF

Successful omnichannel EDI fulfillment requires treating inventory as a single pool serving every sales channel dynamically. Omni-channel fulfillment is a customer-centric strategy that unifies inventory and operations across all sales channels, instead of siloed stock for online, retail, and marketplaces, treating inventory as one pool.

Your automated routing system needs to evaluate multiple factors simultaneously: order priority, real-time inventory availability, proximity to destination, and fulfillment capacity. This means when a PDF order comes in for the same SKU as an EDI order, your system allocates stock based on business rules, not order format.

When evaluating vendors, consider how solutions from Blue Yonder, Transporeon, or Cargoson handle mixed order types. The key question isn't whether they support EDI—it's whether they can process non-EDI orders with the same speed and accuracy as structured data exchanges.

Testing and Validation Framework for Mixed Order Types

Running thorough tests before going live becomes critical when you're processing mixed order formats. The challenge many teams face is limited testing environments where migration teams lack staging environments that accurately mirror production complexity.

Your validation approach should include parallel processing tests—run the same orders through both your legacy PDF handling process and the new automated system to compare results. Test order prioritization rules when mixed formats arrive simultaneously. Verify that your inventory allocation logic works correctly regardless of order source.

Reference testing methodologies from solutions like Uber Freight or Shiptify to ensure your validation covers edge cases that only appear in production environments.

Future-Proofing Your Omnichannel Strategy for the Post-EDI World

Hybrid API/EDI integration enables businesses to maintain EDI's structured document exchange while adding API-driven speed—in practice, this means a retailer might receive a purchase order via traditional EDI, then use APIs to instantly update inventory and trigger fulfillment processes in real-time, creating a seamless connection between legacy processes and modern systems.

Combining EDI's standardized reliability with API's real-time speed creates seamless workflows that satisfy both legacy and modern system requirements. This hybrid approach acknowledges that EDI isn't disappearing—it's evolving to work alongside newer technologies.

AI orchestration is the key enabler that propels brands, retailers, 3PLs, carriers, and all supply chain participants to harness trends where regional supply chains will cut lead times, clean data flows will enable rapid AI-driven decisions, and stores will become micro-fulfillment centers near customers, with businesses able to meet instant commerce expectations.

Looking ahead, consider how forward-thinking vendors like ShipStation/ShipEngine, Sendcloud, and Cargoson are building for this hybrid future. The companies that thrive will be those that can seamlessly handle traditional EDI transactions, modern API integrations, and everything in between—including those PDF orders that aren't going away anytime soon.

Your competitive advantage lies not in choosing between EDI and modern alternatives, but in creating a unified system that handles all order types with equal efficiency. SPS Commerce PDF Order Automation is the key to seamlessly processing non-EDI orders across your entire network, reducing effort, eliminating errors and enabling faster, more reliable fulfillment. The retailers and suppliers who master this mixed approach will find themselves better positioned for whatever changes 2026 and beyond bring to supply chain automation.