The Multi-System EDI Fragmentation Crisis: How to Build Unified Integration Architecture That Serves ERP, TMS, and WMS Without Breaking Supply Chain Workflows in 2026

Your multi-system EDI integration is falling apart. The average company that performs EDI has anywhere from 100-200 partners, and 400-500 maps—all of which will be impacted by the switch. Every time you upgrade your TMS, implement a new WMS, or transition ERP systems, your carefully built EDI connections break. Orders get stuck between systems. ASNs fail to route properly. Your trading partners start calling.

This isn't just an IT headache. Up to 47% of IT managers say that slow EDI supplier onboarding is currently keeping their businesses from capturing new revenue opportunities. When your EDI architecture can't adapt to multiple backend systems, you're not just dealing with technical debt—you're losing business.

The Hidden Multi-System EDI Crisis Breaking Supply Chain Operations

Most companies today run their supply chains on multiple specialized systems. Orders flow through ERP. Warehouse operations depend on WMS. Transportation gets managed through TMS. Each system handles what it does best, but here's the problem: If EDI is bundled inside core ERP, businesses may not be able to seamlessly process EDI for WMS or TMS, such as 940s, 204s, or 214s. This is because ERPs may not have fields or modules applicable to leverage or store the data.

Take warehouse transfers. Your WMS needs to process 940 warehouse transfer orders, but if your EDI system sits inside your ERP, those transactions can't reach the warehouse system directly. You end up building workarounds, manual processes, or entirely separate EDI connections for each system.

The complexity multiplies with every system in your tech stack. An order may go to the core ERP, stock transfers may go to the WMS, and shipping information may go to the TMS. When these systems can't communicate through a unified EDI architecture, you create data silos that break supply chain visibility.

Sound familiar? Companies with 100+ suppliers face this reality daily. You can't onboard new trading partners quickly because each requires custom integration with multiple backend systems. Your trading partners get frustrated with inconsistent data formats. Your IT team spends more time maintaining integrations than building new capabilities.

Why Traditional EDI Approaches Fail in Multi-System Environments

The root cause isn't your systems—it's how EDI gets implemented alongside them. ERP, TMS, and WMS tend to have very lightweight EDI processing. These systems excel at their core functions, but EDI becomes an afterthought.

Here's what happens in practice. A company may have a different communication software to support various protocols—scripts to complete EDI processing, scripts for database table lookups, or integration between different databases to pick up certain attributes and values. You end up with a patchwork of solutions trying to make your systems talk to each other.

Each system has different data structures, different field mappings, and different processing capabilities. Your TMS might handle 204 load tenders perfectly, but struggle with 214 status updates that need real-time visibility. Your WMS processes inventory transactions efficiently but can't route shipping data to your TMS without custom development.

The Three Critical Failure Patterns

**System-specific processing limitations**: The EDI software market is large but a lot of players are not innovative; especially integrated EDI solutions inside ERPs, TMSs, and WMSs. For ERP, TMS, and WMS providers, it would not be worthwhile investment to innovate their EDI modules as it is not their main service, capability, or function.

**Data routing complications**: When order data, inventory updates, and shipping information all need different system destinations, integrated EDI can't handle the complexity. You either lose visibility or build expensive custom integrations.

**Visibility gaps**: Each system maintains its own EDI connections and data, creating blind spots across linked transactions. When a purchase order in your ERP generates a warehouse transfer in your WMS and creates a shipment in your TMS, tracking that flow becomes nearly impossible.

The Unified EDI Architecture Solution Framework

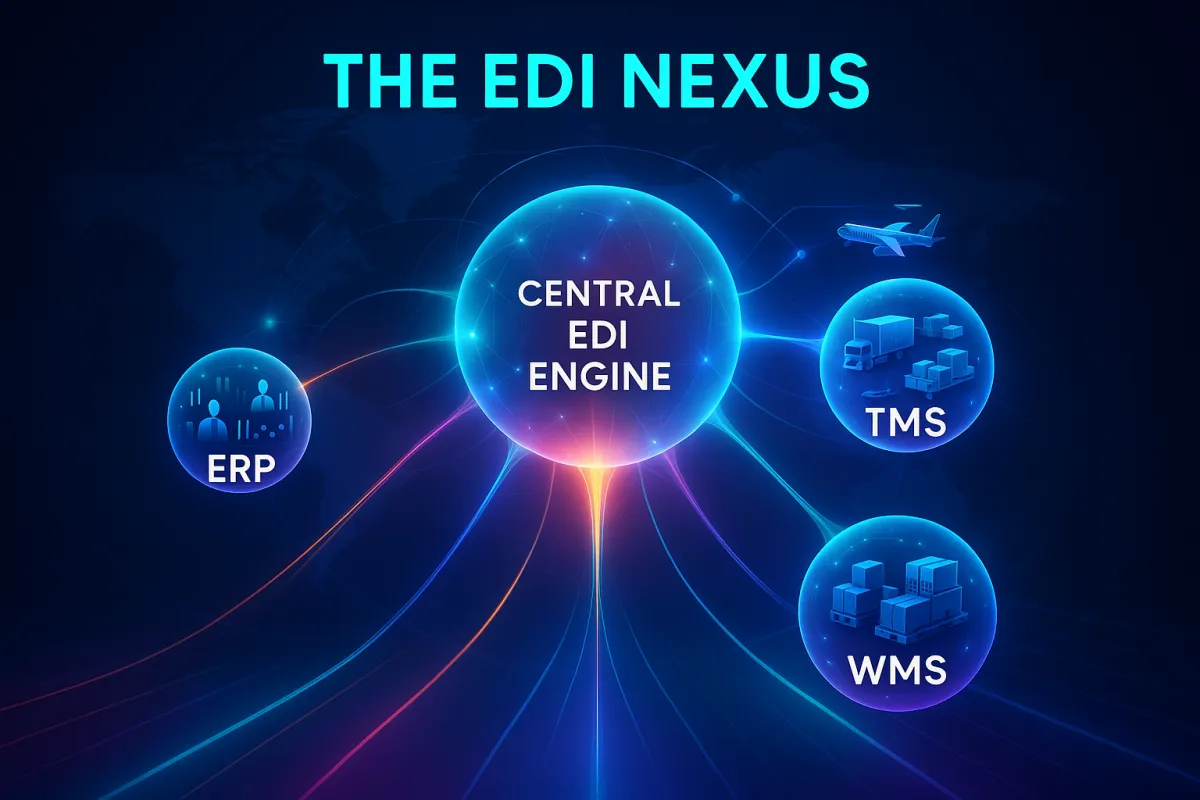

The answer isn't better integration between systems—it's a standalone EDI infrastructure that connects to all systems independently. Standalone EDI systems are critical business applications that most organizations treat as tier 1 applications, since more than half of their business revenue goes through this platform.

Think of it as an EDI hub that sits between your trading partners and your backend systems. Instead of EDI being buried inside each system, you have a central platform that handles all B2B communications and routes data to the appropriate system based on transaction type and business rules.

This architecture includes several key components:

**Central EDI Engine**: Cleo offers deep integration capabilities that extend directly into your back-office systems. Whether you're using an ERP, TMS, WMS, FMS, or another critical system, Cleo can seamlessly connect your EDI processes to ensure data flows smoothly and efficiently. The platform handles all EDI processing, communication protocols, and data transformation in one place.

**System-Specific Connectors**: Instead of relying on each system's limited EDI capabilities, you build connectors that translate EDI data into each system's native format. Your ERP gets purchase orders in its expected format. Your WMS receives inventory updates. Your TMS gets shipping instructions.

**Unified Data Flows**: All EDI transactions flow through the same infrastructure, giving you complete visibility into document status, processing times, and error handling across all systems.

Modern platforms like those from Cleo, SPS Commerce, TrueCommerce, and integrated solutions like Cargoson provide this unified approach, supporting multiple backend systems through standardized connectors and APIs.

Implementation Strategy for Multi-System EDI Integration

Start with a complete system assessment. Before implementing EDI, the first step is to evaluate your current supply chain processes. This helps identify where inefficiencies exist and where EDI can bring the most value. Begin by mapping out all document exchanges within your supply chain, from purchase orders to invoices and shipping notices.

Document every EDI transaction type currently processed by each system. Which documents go to your ERP? Which ones need WMS processing? What requires TMS integration? This mapping reveals the complexity you're actually dealing with and identifies where unified architecture provides the biggest impact.

Next, evaluate data compatibility between systems. Each backend system has different field requirements, validation rules, and data structures. Your unified EDI platform needs to transform the same EDI document into system-specific formats without losing critical information.

Plan a phased rollout starting with your highest-volume transaction types. Most EDI implementations today take months rather than days. Your suppliers wait four to six weeks just to get onboarded with traditional EDI vendors, and in practice, the theoretical 1-2 week timeline often stretches to 1-2 months or longer. By focusing on core transactions first, you can demonstrate value while building confidence in the new architecture.

Consider working with specialists who understand multi-system complexity. Whether you choose established platforms like IBM Sterling B2B Integrator, modern solutions like Orderful, or comprehensive TMS platforms like Cargoson that include built-in EDI capabilities, ensure they can handle your specific system integration requirements.

Real-Time Monitoring and Visibility Across Multiple Systems

Unified EDI architecture delivers something impossible with system-specific implementations: complete visibility into multi-system transactions. This interconnectivity provides customers with a truly unified business ecosystem, eliminating data silos and enabling end-to-end visibility.

Your dashboard shows the complete transaction lifecycle. A purchase order received from a trading partner gets acknowledged by your ERP, triggers inventory allocation in your WMS, and generates shipping instructions for your TMS. Instead of checking three different systems, you see the entire flow in one place.

Real-time alerts catch issues before they impact operations. When a 940 warehouse transfer fails because of data formatting issues, you get notified immediately instead of discovering the problem days later when inventory discrepancies appear. They sends alerts or notifications to stakeholders as well as trading partners to seize bad data before it brings the ERP system to ruin.

Exception handling becomes proactive instead of reactive. Configure rules that automatically retry failed transmissions, route exceptions to the appropriate teams, and maintain audit trails for compliance reporting. This prevents the cascade failures that occur when EDI problems in one system impact connected processes.

Modern platforms like Orderful, Cleo, and integrated TMS solutions like Cargoson provide sophisticated monitoring capabilities that give you operational insights across all connected systems.

Future-Proofing Your Multi-System EDI Strategy

The biggest advantage of unified EDI architecture isn't today's capabilities—it's tomorrow's flexibility. When an enterprise grows and is looking to implement a new ERP or TMS, the switch will impact EDI with its trading partners. With standalone EDI, system migrations become manageable instead of catastrophic.

When you need to replace your ERP, your EDI connections stay intact. The unified platform can route transactions to your new ERP while maintaining connections to existing WMS and TMS systems. Your trading partners don't experience disruption. Your data flows continue without interruption.

API integration becomes a natural extension instead of a separate project. The BIS Platform is more than just an EDI translator; it supports any-to-any integrations directly into your ERP, TMS, CMS and WMS systems, giving you a unified foundation for all your integration needs and every integration style. Modern EDI platforms support both traditional EDI protocols and modern APIs, letting you migrate trading partners to API-based integration at your own pace.

Scalability planning becomes straightforward. This scalability ensures businesses can grow without concerns about EDI capabilities becoming a bottleneck. Adding new systems, trading partners, or transaction types doesn't require rebuilding your entire integration architecture.

Consider platforms that balance established EDI capabilities with modern integration approaches. Whether you choose traditional providers like IBM Sterling and SPS Commerce, modern cloud-native solutions like TrueCommerce and Cleo, or comprehensive logistics platforms like Cargoson that integrate EDI with TMS functionality, ensure they can grow with your multi-system requirements.

Cost-Benefit Analysis and ROI Framework

Multi-system EDI fragmentation costs more than you think. Unfortunately, many legacy EDI systems operate with delays. This slows down operations, makes it harder to respond to changes, and limits visibility across the ecosystem. Every delayed transaction, failed integration, and manual workaround adds operational overhead that compounds over time.

Calculate the true cost of your current approach. Include IT resources spent maintaining multiple EDI connections, business impact from integration failures, and opportunity cost from delayed trading partner onboarding. Research by Ovum shows that 53% of enterprises experience limitations with their current B2B integration solutions when onboarding trading partners, with approximately 40% requiring over 30 days to bring a new partner online.

Unified architecture delivers quantifiable benefits across multiple areas. Faster order processing and delivery times. Improved customer satisfaction due to timely and accurate fulfillment. Operational efficiency improves because your team manages one EDI platform instead of multiple system-specific implementations.

Compare total cost of ownership across different approaches. Traditional EDI providers might have lower upfront costs but higher ongoing maintenance overhead. Modern platforms may require higher initial investment but provide faster ROI through improved operational efficiency and reduced IT overhead.

Modern integrated platforms often provide the best balance. Solutions like Cargoson combine TMS functionality with native EDI capabilities, eliminating the need for separate EDI infrastructure. Established providers like Cleo, SPS Commerce, and IBM Sterling offer proven scalability for complex multi-system environments.

The question isn't whether you can afford unified EDI architecture—it's whether you can afford not to implement it. Your multi-system environment will only get more complex. Your trading partner requirements will continue growing. Start building the foundation for sustainable EDI operations before the next system upgrade breaks your current integrations.