The Omnichannel EDI Integration Crisis: How to Build a Unified Multi-Channel Order Processing Strategy That Eliminates Data Silos and Prevents Revenue Loss in 2026

Your supplier network processes 847 EDI purchase orders monthly, handles API calls from three major retailers, and still receives 23% of orders as PDF attachments via email. Each channel demands different response times, data formats, and integration protocols. Welcome to the omnichannel EDI integration crisis that's costing suppliers millions in lost orders and damaged relationships.

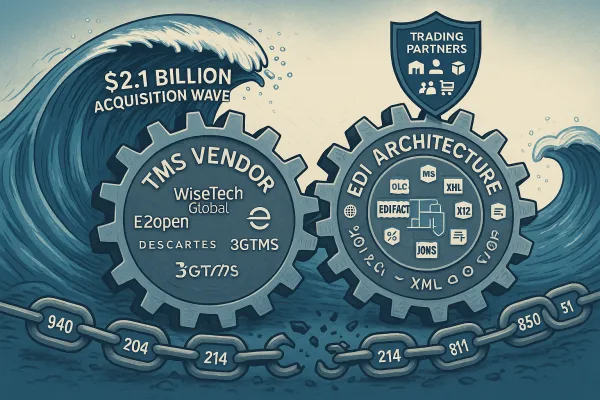

SPS Commerce's 2026 Demand Report reveals something most suppliers already know but few want to admit: "the retail supply chain is transitioning from linear, single-channel fulfillment to a networked, multi-path ecosystem where every supplier must function as a precision node." The problem? Your existing EDI infrastructure wasn't built for this reality.

The Hidden Crisis: When Multi-Channel Success Creates EDI Chaos

The numbers tell the story. A mid-size automotive parts supplier recently discovered they were processing the same retailer's orders through four different channels: EDI 850s for bulk orders, REST API calls for rush shipments, PDF email orders for specialty parts, and web portal entries for returns. Each system maintained separate inventory counts. The result? Overselling by 340 units in October alone.

This isn't an isolated case. A single missed update can cascade into stockouts, order cancellations and damaged relationships. The challenge multiplies when you consider that most suppliers now serve multiple retailers, each with their own preferred integration methods and update frequencies.

The traditional approach of treating each channel as a separate system creates data islands. Your EDI system knows about bulk orders, your API integration tracks real-time inventory, but your email inbox still receives PDFs that someone manually enters into your ERP. Meanwhile, your retailer's omnichannel demands require synchronized data across all touchpoints.

The Revenue Impact of Disconnected Systems

Data synchronization failures cost more than processing delays. Consider these real impacts from suppliers managing disconnected systems:

- Average order cancellation rate of 12% when inventory data lags across channels

- Processing time increases from 4 hours to 2.3 days for multi-channel order reconciliation

- Manual intervention required for 67% of orders that cross multiple fulfillment channels

- Penalty fees averaging $847 per late shipment due to synchronization delays

A consumer electronics supplier calculated their annual loss at $2.3 million from omnichannel data mismatches. Half came from cancelled orders, the other half from expedited shipping costs to meet promises made with outdated inventory data.

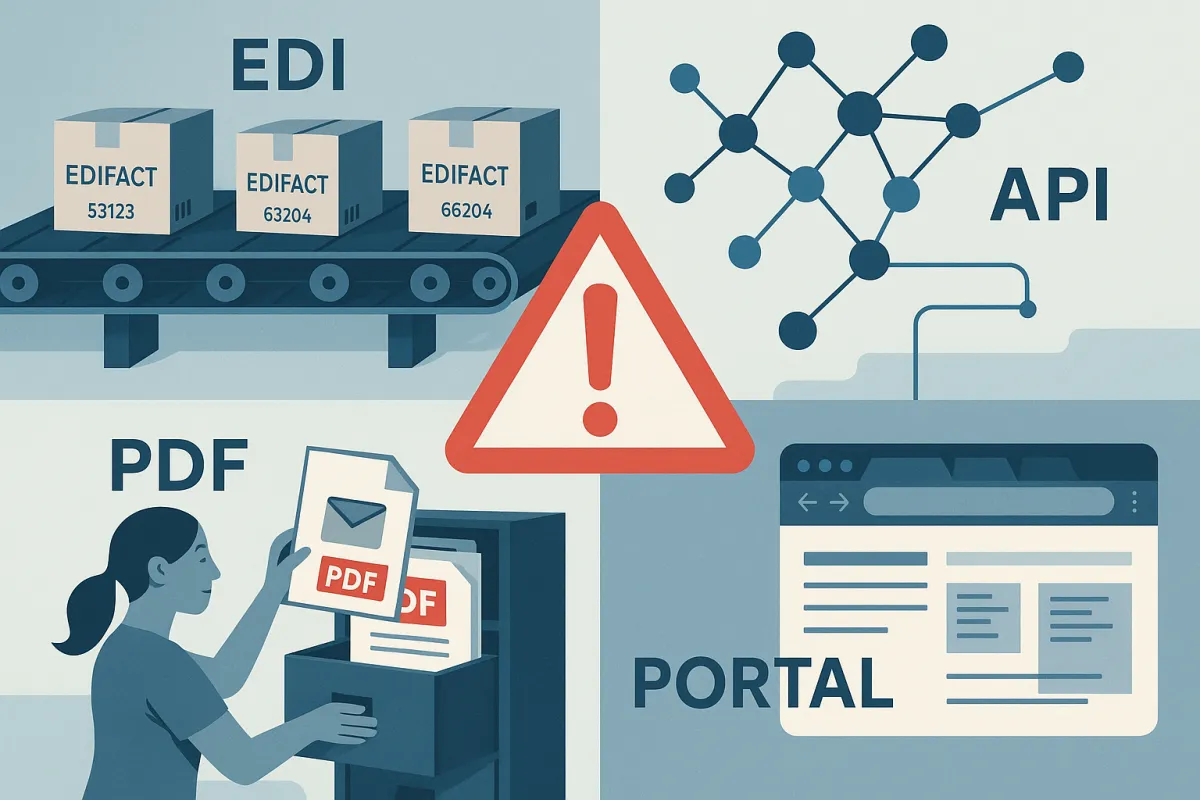

The Four-Channel Challenge: EDI, API, PDF, and Portal Orders

Understanding each channel's characteristics helps explain why unified integration matters. EDI 850 purchase orders arrive in predictable batches, typically requiring acknowledgment within 24 hours. API calls demand real-time responses but offer flexible data structures. PDF orders, which many businesses still receive through email, require conversion into ERP-ready digital transactions. Web portals add another layer with their own authentication and session management requirements.

Each channel operates on different assumptions about data freshness, response time, and error handling. Your EDI system might batch updates hourly while your API integration expects real-time inventory levels. PDF orders processed manually introduce delays measured in hours or days, not minutes.

The complexity compounds when dealing with order modifications. An EDI 860 change order might arrive while you're manually processing a related PDF order. Your API integration receives an inventory inquiry for the same product. Which system has the authoritative data? How do you prevent overselling while ensuring timely responses across all channels?

Solutions providers like MercuryGate, nShift, and Cargoson have developed approaches to handle mixed order types, but most require significant configuration to achieve true synchronization across channels.

Why Traditional EDI Can't Handle Omnichannel Demands

"EDI is not disappearing, but it showed its limitations in 2025" when retailers demanded real-time visibility alongside traditional batch processing. EDI excels at structured, predictable transactions but struggles with the dynamic requirements of omnichannel fulfillment.

The timing mismatch creates the biggest challenge. EDI operates on scheduled transmission windows while omnichannel demands immediate updates. A retailer's inventory management system might query your API for availability while you're still processing EDI updates from the same retailer's procurement system.

Traditional EDI also lacks the granular detail required for omnichannel operations. An 850 purchase order specifies quantities and delivery dates but doesn't indicate whether items are for store replenishment, direct-to-consumer fulfillment, or click-and-collect orders. This context matters for inventory allocation and shipping decisions.

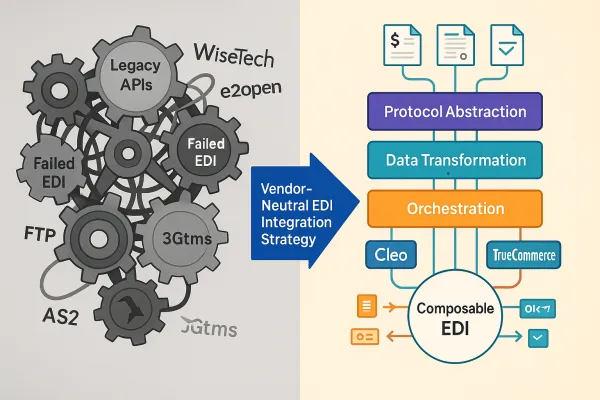

Modern providers like Descartes, Transporeon, and Cargoson address these gaps by building hybrid systems that maintain EDI compatibility while adding real-time capabilities through API layers.

Building the Unified Integration Architecture

Successful omnichannel EDI integration requires treating all order channels as inputs to a single, authoritative system. Rather than maintaining separate processes for EDI, API, PDF, and portal orders, you need a unified framework that normalizes all inputs into a common format while maintaining channel-specific response protocols.

The architecture starts with a message broker that receives orders regardless of format. EDI 850s, API POST requests, parsed PDF content, and portal exports all feed into the same queue. A transformation layer converts each order type into your internal format while preserving source-specific metadata needed for appropriate responses.

Your business logic layer processes all orders using consistent rules for inventory allocation, pricing, and fulfillment routing. This ensures that a product allocated to an EDI order isn't double-booked by an API call received milliseconds later.

The response layer handles channel-specific acknowledgments. EDI orders receive 855 acknowledgments, API calls get JSON responses, PDF orders trigger email confirmations, and portal orders update status dashboards. All use the same underlying data but formatted for their respective channels.

Implementation approaches from Manhattan Active, Blue Yonder, and Cargoson vary in complexity, but all focus on maintaining data consistency while respecting channel-specific requirements.

The API-First Transition Strategy

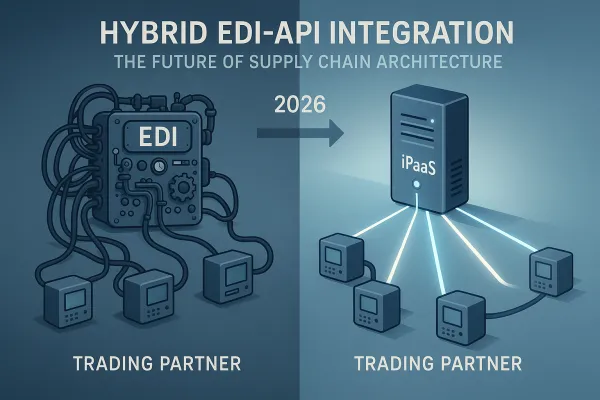

Moving toward unified integration doesn't require abandoning existing EDI investments. "APIs will handle real-time operations while EDI becomes the fallback, not the foundation" represents the emerging best practice for managing this transition.

Start by identifying your highest-volume, most time-sensitive trading partners. These candidates benefit most from API integration while your established EDI relationships continue unchanged. Gradually expand API adoption based on partner capabilities and business value.

The hybrid approach lets you offer real-time capabilities to partners who want them while maintaining compatibility with partners who prefer traditional EDI workflows. Your internal systems treat both as equivalent inputs, but external interfaces match partner preferences.

Oracle TM, SAP TM, and Cargoson offer different migration paths, but successful implementations focus on maintaining business continuity while adding capabilities rather than replacing working systems wholesale.

Real-Time Data Synchronization Framework

Real-time synchronization across multiple channels requires more than fast processing. You need consistent data models, conflict resolution protocols, and automated reconciliation procedures. "Seamless SAP connections keep order information flowing across all retail channels at the speed of omnichannel expectations" but only when properly architected.

The synchronization framework starts with a single source of truth for inventory, pricing, and order status. All channels read from and write to this central repository using standardized APIs, even when the external interface uses EDI or PDF formats.

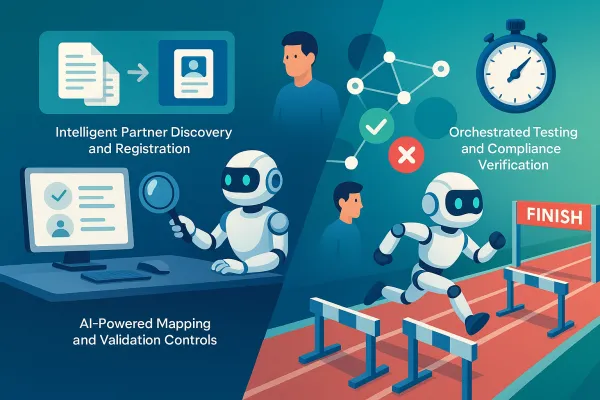

Conflict resolution becomes critical when multiple channels attempt simultaneous updates. Your framework needs rules for handling scenarios like an EDI order modification arriving while an API call allocates the same inventory to a different order. Time stamps, transaction IDs, and business priority rules help resolve these conflicts consistently.

Automated reconciliation procedures run continuously to identify and correct discrepancies between channels. These might include comparing EDI acknowledgments with API responses or validating that PDF orders entered manually match the original attachments.

Solutions from 3Gtms, Alpega, and Cargoson provide different approaches to real-time synchronization, with varying levels of automation and customization options.

Automated Error Detection and Recovery

Omnichannel environments generate more potential failure points than single-channel systems. Automated monitoring becomes essential for maintaining data consistency across channels. "Automated checks identify overages that should be billed back to retailers and provide the information needed to address issues quickly."

Your error detection system should monitor data consistency across channels, response time performance, and business rule violations. Set up alerts for scenarios like inventory discrepancies between EDI and API systems, orders missing required acknowledgments, or PDF processing failures.

Recovery procedures should handle common failures automatically where possible. If an API call fails, retry with exponential backoff. If an EDI transmission is delayed, send interim status updates. If PDF parsing encounters errors, route orders for manual review while maintaining processing timelines.

More complex failures require escalation procedures that involve human intervention while preserving audit trails and maintaining partner communication. Document resolution steps and update automated procedures based on recurring issues.

FreightPOP, E2open, and Cargoson offer different monitoring capabilities, from basic alerting to sophisticated machine learning-based anomaly detection.

Implementation Roadmap and Success Metrics

Rolling out unified omnichannel EDI integration requires careful phasing to avoid disrupting existing operations. Start with your largest-volume trading partners who already express interest in improved integration capabilities.

Phase one involves establishing the unified data architecture without changing external interfaces. Continue processing EDI, API, PDF, and portal orders through existing channels but route all data through your new central system. This validates your architecture while maintaining business continuity.

Phase two adds real-time capabilities for willing partners while maintaining backward compatibility for others. Offer API access to partners who want it while continuing EDI for those who prefer it. Monitor performance and gather feedback to refine your approach.

Phase three optimizes based on operational experience and partner adoption. Expand automated capabilities, reduce manual intervention requirements, and add sophisticated features like predictive inventory allocation across channels.

Success metrics should focus on business outcomes rather than technical achievements. Track order processing times, inventory accuracy across channels, error rates, and partner satisfaction scores. Measure the reduction in manual intervention and the increase in same-day order processing capabilities.

Deployment strategies from Shiftify, Uber Freight, and Cargoson emphasize different aspects of the implementation process, but all stress the importance of maintaining partner relationships throughout the transition.

The omnichannel future demands integrated approaches to order processing. Your choice is between building unified integration capabilities now or continuing to fight data synchronization crises while competitors offer seamless experiences across all channels.