The PEPPOL-EDI Integration Blueprint: Building ViDA-Compliant Systems for EU Cross-Border Trade by 2030

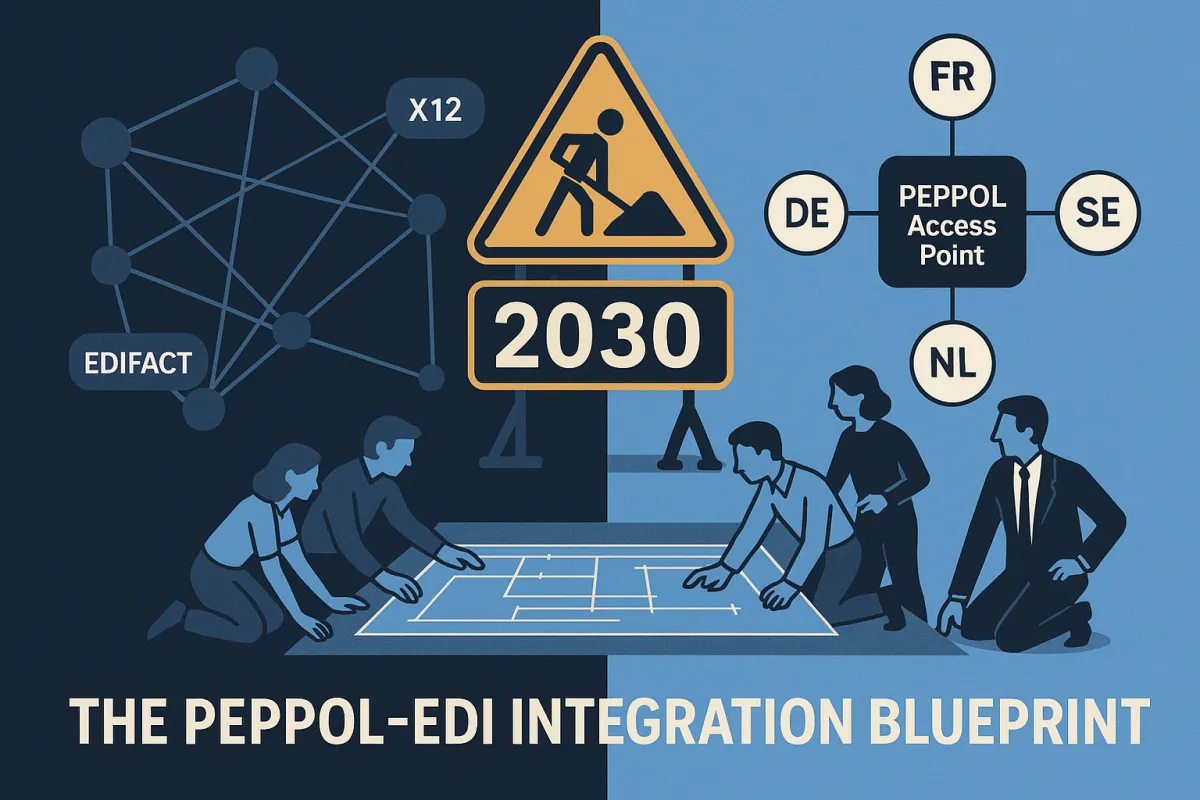

The July 2030 deadline for Digital Reporting Requirements will affect cross-border B2B transactions across the EU, and here's what most EDI managers haven't grasped yet: each member state will be free to develop their own reporting protocols and technical specifications. This is an important point for businesses to consider operating across multiple jurisdictions since schema's and connectivity protocols will differ.

Building a PEPPOL-EDI integration strategy isn't just about compliance anymore. The new system introduces real-time digital reporting for cross-border trade, based on e-invoicing. The move to e-invoicing will help reduce VAT fraud by up to €11 billion a year and bring down administrative and compliance costs for EU traders by over €4.1 billion per year over the next ten years.

Understanding the ViDA Digital Reporting Requirements Impact on EDI Systems

The VAT in the Digital Age (ViDA) package has been adopted on 11 March 2025 following reconsultation of the European Parliament and will be rolled out progressively until January 2035. The technical reality behind these dates? These will require e-invoicing between businesses, as well as digital reporting to tax authorities for B2B intra-community supplies. The Digital Reporting Requirements (DRRs) will establish a near real-time reporting system for intra-community transactions.

Your existing EDI infrastructure faces a fundamental challenge. Countries that had domestic transaction-based reporting systems in place before 1 January 2024 can continue to use them until 2035. However, any new systems introduced after this date must comply with the ViDA requirements by July 2030. This creates a two-speed compliance landscape where legacy systems get extended runway while new implementations must hit stricter standards immediately.

The compliance complexity goes deeper than most realize. Companies will have to report the headline data of the transactions and bank details to enable tax authorities to track payments, and the summary of total sales by customers will not be sufficient. This granular reporting requirement means your current EDI transaction summaries won't cut it post-2030.

The PEPPOL Network vs. Traditional EDI: Architecture and Compatibility Challenges

PEPPOL and traditional EDI operate on fundamentally different connection models. The four-corner model that PEPPOL utilises solves these issues completely. Because both Access Points are controlled by PEPPOL, there are no concerns about compatibility for either of the trading partners. Instead, they enjoy seamless and secure information exchange with anyone on the network.

Traditional EDI systems rely on point-to-point connections or value-added networks where you negotiate specific protocols with each trading partner. PEPPOL flips this model entirely. Instead of requiring you or your provider to build an EDI (electronic data interchange) connection to your partner from scratch, Peppol utilises a four corner model and enforces the use of specific standards and protocols, meaning there is less work required for each connection.

The data format differences create immediate integration headaches. Peppol, just like EDI, is built on agreed standards. These standards cover both the rules for how documents should be structured and the formats used to exchange them. That's what makes it easy for different systems and companies to exchange documents. However, mapping between traditional EDIFACT or X12 formats and PEPPOL's UBL-based structures requires significant technical work.

Why Legacy EDI Systems Struggle with PEPPOL Requirements

The biggest challenge with EDI is 'mapping' data between internal systems and EDI formats. This requires: EDI translator software: Such as IBM Sterling B2B, Seeburger BIS, or open source alternatives · Mapping expertise: Specialists who translate business processes into EDI structures. PEPPOL adds another layer to this complexity because its document validation rules differ from traditional EDI standards.

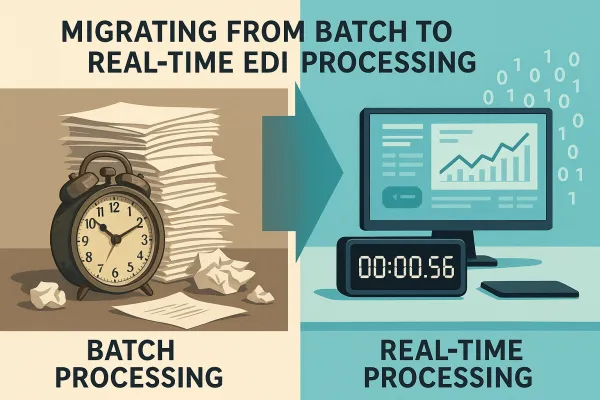

Peppol's standards are designed to ensure traceability and auditability, which is why it typically requires one invoice per transaction. This can be a challenge for businesses that are used to sending grouped or batch invoices. Many legacy EDI systems were designed around batch processing for efficiency, creating a fundamental architectural mismatch.

Timing constraints add another pressure point. The reporting deadline has been extended to '10 days' from '2 working days' from issuance of the e-invoice. While this extension provides some breathing room, it still requires near real-time processing capabilities that many traditional EDI systems lack.

The 5-Phase PEPPOL-EDI Integration Strategy

Building hybrid systems that can handle both traditional EDI and PEPPOL requires a structured approach. Here's the implementation strategy that actually works in practice:

Phase 1: Architecture Assessment (4-6 weeks)

Start with a complete inventory of your current EDI landscape. Document every trading partner connection, message format, and business process. Multiple data sources, such as ERP or billing systems and complex supply chains, can complicate matters, leading to inconsistent and poor-quality tax data. Now is the time to develop a thoughtful and complete request for proposal that not only addresses ViDA compliance but also allows you, over time, to streamline processes.

Phase 2: Technology Selection and Architecture Design (6-8 weeks)

Choose integration platforms that can handle both traditional EDI and PEPPOL simultaneously. Look for solutions that support API-based connectivity for PEPPOL while maintaining existing VAN and AS2 connections. Major providers like TrueCommerce, Cleo, and Cargoson offer hybrid approaches, though their implementation philosophies differ significantly.

Phase 3: Pilot Implementation (8-12 weeks)

Build your integration layer with a small subset of trading partners. Focus on partners who already use PEPPOL to minimize variables during testing.

Phase 4: Partner Onboarding (12-16 weeks)

Roll out PEPPOL connectivity to partners who require it while maintaining existing EDI connections for others. This hybrid approach becomes your competitive advantage during the transition period.

Phase 5: Full Deployment and Compliance Validation (16-24 weeks)

Scale the solution across all trading partners while implementing ViDA-specific reporting capabilities for EU transactions.

Phase 3 Deep Dive: Technical Implementation and Testing

The technical implementation phase determines whether your integration succeeds or creates ongoing headaches. Integrating your invoicing or enterprise resource planning (ERP) system with the Access Point. Ensuring your documents follow Peppol Business Interoperability Specifications (BIS) standards. Once connected, you can send and receive structured e-documents securely across the network.

API gateway setup becomes critical for managing both EDI and PEPPOL traffic. Unlike traditional EDI systems that often rely on batch processing, PEPPOL's real-time nature requires different error handling and retry mechanisms. Before deploying your solution, test the integration in a sandbox environment provided by your Access Point provider. This allows you to simulate various scenarios, such as submitting orders, receiving responses, and managing despatch advice messages.

Message transformation logic needs careful design. EDI standards such as EDIFACT, TRADACOMS and PEPPOL use their own unique structure and syntax, which is not readily known to ERP software. However, EDI data is clearly valuable for an ERP and vice-versa — it's just a matter of integrating the EDI front-end to the ERP back-end. Building transformation rules that can convert between traditional EDI formats and PEPPOL's UBL structures while maintaining data integrity requires specialized expertise.

Managing Multi-Country Compliance Complexity

The fragmented landscape of EU member state requirements creates operational complexity that goes beyond simple technical integration. Each member state will be free to develop their own reporting protocols and technical specifications. This is an important point for businesses to consider operating across multiple jurisdictions since schema's and connectivity protocols will differ.

Germany's approach differs significantly from Belgium's B2G requirements, and both vary from the emerging frameworks in other EU countries. Belgium, France, Italy, Portugal, and Spain are just a few markets that have already established infrastructures for receiving invoices on behalf of public buyers. Some countries have selected Peppol as the mandatory exchange mechanism within the centralized model. In these cases, the mandatory platform in the country receives Peppol invoices on behalf of every public entity.

This creates a technical challenge where your integration layer needs to route documents to different national systems based on transaction details. Solutions from providers like Descartes, MercuryGate, and Cargoson handle this routing complexity through configurable business rules engines, though the implementation approaches vary in flexibility and maintenance overhead.

The validation rules differ by country as well. Among the primary requirements for Digital Bookkeeping Systems (DBS) are the following: the ability to automatically issue and receive e-invoices via both Nemhandel and Peppol, the capability to register and e-archive all transactions and attachments. Under the new Bookkeeping Law in Denmark, two types of DBS will be recognized: Standard and Specially Developed. Managing these country-specific requirements requires either multiple system integrations or a unified platform that can adapt to different national standards.

Cost-Benefit Analysis: ROI of Hybrid PEPPOL-EDI Integration

The financial justification for hybrid integration goes beyond compliance costs. Key actions proposed under ViDA will help EU countries collect up to €18 billion more in VAT revenues annually (€11 billion as a result of anti-fraud measures) while helping businesses, including SMEs, to grow. The move to e-invoicing will help reduce VAT fraud by up to €11 billion a year and bring down administrative and compliance costs for EU traders by over €4.1 billion per year over the next ten years.

Implementation costs vary significantly based on your current EDI maturity and chosen approach. Overall, you can say that there is a one-off start-up cost to link your organisation and your systems with Peppol. In addition, you have a transaction cost for sending or receiving each message via Peppol. Amista applies a degressive pricing model: as the number of invoices increases, the transaction cost decreases.

The total cost picture includes software licensing, integration development, testing, and ongoing operational costs. Managed service providers like SPS Commerce and TrueCommerce offer different pricing models compared to platform solutions from IBM Sterling or Cargoson. The key difference lies in long-term flexibility versus immediate deployment speed.

Penalty avoidance becomes a major ROI driver. With VAT penalties in EU member states often ranging from 10-40% of the tax amount, compliance failures can quickly exceed your entire integration investment. The ViDA package is expected to generate substantial economic benefits, ranging between EUR 172 billion and EUR 214 billion over a 10-year period, including a significant EUR 51 billion in savings for businesses.

Operational efficiency gains compound over time. The capabilities that come with the deployment of these modern solutions can provide businesses with a wide range of benefits, including: Increased speed: EDI streamlines communications throughout supply chains. Transferring business documents and data electronically is far superior to manual processing, increasing business cycle speed by 61%. Cost savings: Increased business cycle speed ensures better outcomes across the entire supply chain.

Future-Proofing Your Integration: Beyond 2030

The 2030 ViDA deadline is just the beginning of a longer digital transformation in EU trade. The proposal to require existing domestic e-invoice reporting regimes to harmonise to the ViDA e-invoicing standard has been changed to January 2035 (originally 2027). This separation from the main e-invoicing launch date of July 2030 reflects member states (e.g. Italy) concerns that tax authorities and taxpayers had invested extensively in the already launch/planned domestic regimes.

API evolution continues accelerating beyond traditional EDI capabilities. Conducting Peppol with the help of an API connection simply takes this streamlining to the next level (just as an API connection is able to boost the efficiency of traditional EDI). An API basically specifies how different applications shall interact with each other, by defining the exchange format, exchange protocol, security requirements, etc. Thereby, APIs can help businesses connect their own internal IT landscape to other third party services.

Blockchain integration possibilities are emerging for audit trail and compliance verification. We are working on further increasing Peppol's global coverage by developing an international Peppol standard – PINT – to connect Europe and Asia, as well as connecting tax authorities continuous transaction controls (CTCs) in a Peppol 5-corner model. The five-corner model introduces direct tax authority integration that could fundamentally change compliance reporting.

Your integration architecture should anticipate these changes. Solutions that provide API-first connectivity, flexible data transformation, and extensible partner onboarding will adapt more easily to future requirements. Providers like Uber Freight, Shiptify, and Cargoson are building platforms with this forward compatibility in mind, though their specific implementation approaches vary in complexity and scalability.

The key to future-proofing lies in building integration capabilities that can handle multiple protocols and standards simultaneously without requiring complete system replacements. Large retailers and manufacturers maintain EDI for order-to-cash processes but adopt Peppol/UBL for invoicing. While hybrid models offer maximum flexibility, they also bring complexity. Consider: higher management costs, multiple SLAs to manage, more complex error handling, and training staff on multiple systems.

Start your ViDA compliance planning now. The July 2030 deadline isn't as far away as it seems when you factor in the complexity of multi-country integration requirements and the need for extensive testing across different trading partner environments.