The Strategic Hybrid EDI-API Integration Framework: How to Modernize TMS Connectivity Without Breaking Trading Partner Networks in 2026

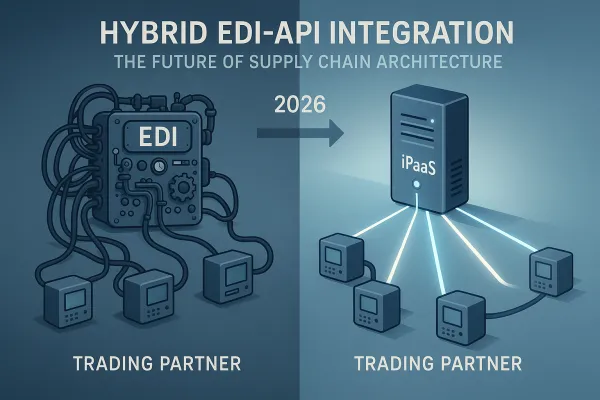

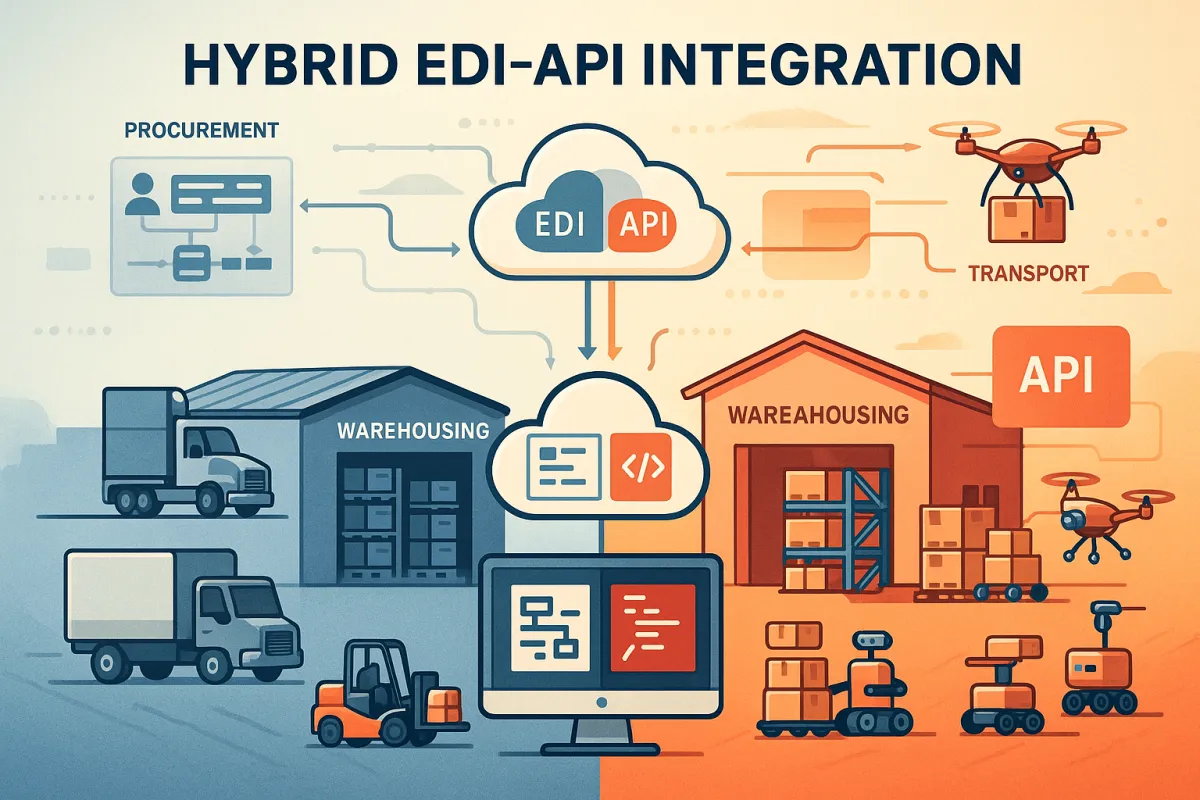

Most transportation management system implementations fail during one specific phase: the attempt to replace EDI entirely with APIs. While 85% of supply chain transactions are still managed through EDI, companies continue pursuing binary migration strategies that break established trading partner networks. The solution isn't choosing between legacy protocols and modern connectivity—it's building strategic hybrid EDI-API integration frameworks that deliver modernization benefits while maintaining operational stability.

The Reality Check: Why Pure API Migration Isn't Happening

European logistics managers know this better than most. Most companies use a hybrid approach because rebuilding every partner integration is not realistic. Three years into widespread API adoption, major retailers still require EDI for purchase orders, ASNs, and invoices. Meanwhile, your newest trading partners expect real-time API connectivity for tracking and exception handling.

The numbers tell the story. Gartner estimates that by 2023, 50% of transactions will be through APIs. That means 50% of all transactions will still be supported by EDI. This isn't a temporary transition phase—it's the new normal. Companies like Cargoson, alongside established platforms like MercuryGate and Transporeon, are building their TMS architectures around this dual reality rather than fighting it.

The Three Critical Barriers to Full API Adoption

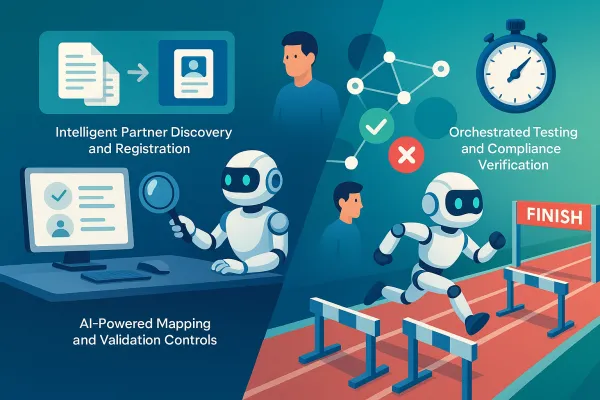

Full EDI retirement only becomes viable when three specific conditions align. Partner Readiness - every carrier and customer can send/receive APIs or at least use a self‑service web portal. System Limits - your WMS, TMS, or ERP can send and receive API messages without messy workarounds. Compliance Comfort - finance and quality teams are confident using digital logs in place of traditional EDI control reports.

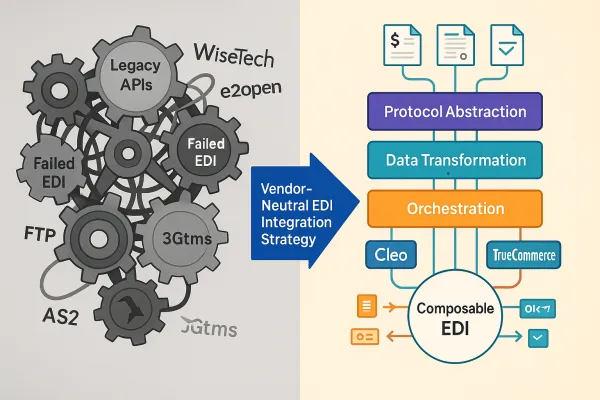

Partner buy-in remains the biggest challenge. While carriers can easily join the platform through their portal, requesting completely new carrier API/EDI integrations is more complex and costly. Alpega typically doesn't build custom carrier integrations themselves but acquires companies with existing connections or provides standard EDI interfaces that carriers must implement. This creates a chicken-and-egg problem where TMS providers wait for carrier API readiness while carriers wait for shipper demand.

Building Your Hybrid Integration Strategy: The Four-Phase Framework

Smart logistics operations split workloads strategically instead of forcing universal migration. The simple approach is just to split workloads. Live, decision-driving data travels via API while audit-critical records that make more sense in a document anyway stay on EDI. This creates two parallel data streams that complement rather than compete with each other.

The most successful implementations follow a structured four-phase approach: strategic assessment, pilot implementation, gradual expansion, and ongoing optimization. Each phase addresses specific technical and business challenges while building toward a more flexible integration architecture.

Phase 1: Strategic Workload Assessment

Start by categorizing your integration needs based on data characteristics and business requirements. Time‑sensitive events like dock appointments, GPS pings and on‑hand stock benefit from API speed, while invoices and customs forms sit comfortably in EDI's structured format. This isn't about technology preferences—it's about matching communication patterns to business processes.

Build a cost-benefit matrix for each integration type. EDI excels at batch processing of mission-critical transactions that require audit trails and regulatory compliance. APIs deliver real-time data exchange for operational decisions that affect customer experience. Modern platforms like Cargoson, alongside IBM Sterling and Cleo, enable this dual approach without requiring separate infrastructure investments.

Phase 2: Technology Platform Selection

Choose unified platforms that handle EDI natively and extend to API connectivity seamlessly. The future of EDI lies in hybrid cloud platforms that combine traditional EDI with API-based integrations. This allows businesses to modernize without disrupting their existing trading partner networks. This eliminates the complexity of managing separate EDI and API systems while providing consistent monitoring and troubleshooting capabilities.

Compare cloud EDI hubs versus hybrid gateways based on your specific requirements. Many businesses choose cloud-based EDI because it's flexible, cost-effective, and easy to scale. It eliminates the need for expensive on-premise IT systems, making data exchange faster and more accessible. Large companies like Amazon and Walmart use cloud EDI to optimize their approach to handling high transaction volumes. Pricing models vary significantly between per-kB traditional VAN fees and per-call API charges—factor both into your TCO calculations.

Cost Control and ROI Optimization in Hybrid Environments

Modern cloud solutions have fundamentally changed the economics of B2B integration. Sub-$500/month packages now provide manufacturers with pre-mapped EDI templates and API connectivity that previously required enterprise-level investments. These platforms combine EDI translation capabilities with API management tools, eliminating the need for separate middleware or custom development.

The ROI calculation extends beyond direct software costs. According to a recent Gartner study, companies that have adopted an API-connected TMS have seen their productivity increase by 27% and their operational costs decrease by 23% on average. However, these benefits only materialize when hybrid architectures replace fragmented point-to-point integrations.

Hidden Cost Analysis Framework

Factor in the total cost of custom carrier integrations when evaluating platforms. No proprietary network; relies on EDI/API connections and partners like MetaPack for parcel carriers. Adding new carriers can be complex and costly, often requiring third-party integration partners. Platforms with pre-built carrier networks—like Cargoson's European logistics focus—reduce these development costs significantly.

Security, compatibility, and ongoing maintenance represent hidden cost centers that many organizations underestimate. Professional services for hybrid integration projects range from $50,000 to $500,000 depending on system complexity and trading partner requirements. Choose platforms with managed services that include proactive monitoring, automated error resolution, and scalable support processes.

Implementation Best Practices and Risk Mitigation

Ensure data consistency across both EDI and API workflows through unified monitoring and testing protocols. The future lies in hybrid connectivity where EDI and APIs coexist to support diverse IT ecosystems. A hybrid approach offers flexibility, which helps organizations modernize without disrupting existing workflows or supply chain operations. This requires comprehensive testing of API connectivity with existing EDI systems and validation that data flows consistently between both channels.

Implement phased rollouts that maintain EDI connections as safety nets while gradually expanding API usage. Start with non-critical trading partners or specific document types before migrating high-volume, mission-critical transactions. Document rollback procedures and maintain parallel processing capabilities during transition periods.

Technical Integration Success Factors

Adopt managed services approaches that provide proactive monitoring and automated error resolution across both integration types. Successful implementations from MercuryGate, Transporeon, and Cargoson share common patterns: unified dashboards for monitoring both EDI and API transactions, automated failover between communication protocols, and consistent data mapping that works regardless of transport method.

Test API connectivity extensively with existing EDI systems before going live. By connecting various software applications, TMS APIs enable seamless data exchange, enhancing efficiency and reducing manual errors. This integration facilitates real-time communication between transportation management systems and other enterprise applications, such as ERP and CRM systems, providing a unified platform. Validate that real-time API updates don't conflict with scheduled EDI transmissions and that error handling works consistently across both channels.

Future-Proofing Your Integration Architecture

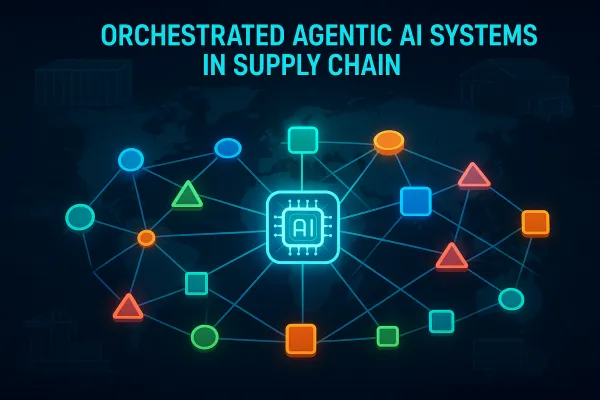

Cloud-based hybrid platforms position organizations for rapid scaling and adaptation to next-wave digital transformation initiatives. The rise of Agentic AI is redefining what EDI can do. ANSI X12, EDIFACT) and EDI data exchanges means less data cleaning is likely required before feeding it into AI models. AI can also more easily extract patterns and insights from EDI across different trading partners and business networks. With structured, complete, and accurate EDI data, supply chain leaders can embed autonomous AI agents into EDI workflows to alert, interpret, act on, and optimize data.

The convergence of AI-powered automation with hybrid integration architectures creates opportunities for autonomous supply chain intelligence. Modern platforms are beginning to incorporate machine learning algorithms that can automatically route transactions through the optimal channel—EDI for compliance-sensitive documents, APIs for time-critical updates—based on trading partner capabilities and business rules.

The 2026+ Technology Roadmap

Prepare for the emergence of Integration Operations (IntOps) models that support both legacy EDI requirements and modern API capabilities. Integration Operations (Integration Ops) represents the best alternative transforming B2B integrations from rigid, project-based implementations into continuously managed, automated services that adapt to business needs without constant manual intervention. This operational model treats integration as a service rather than a one-time implementation project.

Regulatory considerations will continue driving EDI requirements even as API adoption accelerates. European GDPR compliance, customs documentation, and financial audit requirements favor structured EDI formats for their standardization and traceability. Future-ready platforms like Cargoson, alongside innovative vendors like Orderful and TrueCommerce, are building architectures that automatically handle regulatory routing—APIs for operational data, EDI for compliance documentation.

Your hybrid integration strategy should start with a clear understanding of which transactions truly need real-time processing versus those that benefit from EDI's structured reliability. Don't migrate for migration's sake—modernize strategically while maintaining the operational stability that keeps your trading partner networks functional. The goal isn't to eliminate EDI but to optimize how both technologies work together in your specific business context.