The TMS-EDI Automation Blueprint: How Freight Brokers Are Eliminating Manual Data Entry Bottlenecks and Cutting Processing Time by 90% in 2025

Globally, as much as 90% of data extraction and data entry still occurs manually. In 2019, only 55 billion of the world's 550 billion invoices were exchanged on a paperless basis. For freight brokers handling hundreds of loads daily, this translates to crushing operational bottlenecks. Labor costs alone hit $48,000 annually for entry-level positions, but that's just the beginning. Manual data entry creates a cascade of delays, errors, and missed opportunities that can torpedo profit margins in an already tight market.

The problem runs deeper than most freight brokers realize. A DAT white paper noted that "calculating prices manually requires quite a bit of work. It's not impossible, but it takes time and patience – and it can quickly get out of hand as your brokerage grows. After all, you'll need to calculate rates for every potential shipment." When your team spends hours each day transferring load details between systems, updating tracking information, and manually processing invoices, you're not just burning money on labor costs. You're losing loads to competitors who can quote faster and provide real-time updates.

The traditional way of doing things is manual-based and relies on manual data entry through every system. For example, users might export data in an Excel spreadsheet and share this with others. Sound familiar? This approach worked when freight brokers handled 20 loads per week, but it falls apart at scale. Today's market requires an aggressive yet data-informed pricing approach. Shippers won't wait for you to reach out to various carriers and collect rates.

Why Standard TMS-EDI Integration Falls Short for Growing Brokerages

Most freight brokers discover their TMS limitations when they try to integrate with major shippers. The first challenge of EDI inside an ERP, TMS, or WMS is that it will be tightly tied to the ERP. When an enterprise grows and is looking to implement a new ERP or TMS, the switch will impact EDI with its trading partners. The average company that performs EDI has anywhere from 100-200 partners, and switching systems means rebuilding every single connection.

ERP, TMS, and WMS tend to have very lightweight EDI processing. Your TMS vendor probably marketed their EDI capabilities heavily, but what they delivered was basic document translation with limited customization options. Need to handle custom fields for a major shipper? Want to implement automated exception handling? You'll quickly hit the walls of what these built-in EDI modules can actually do.

The setup complexity makes matters worse. EDIs can be time-consuming and complex to set up. Doing so involves coordinating with many people, and entails detailed technical specifications of how those computer-readable documents should appear. And, it can often involve dealing with multiple vendors at the same time. While EDI integrations may take several months, whereas, API integrations can take a matter of weeks, if not days, most TMS platforms only offer the slower option.

Here's what really stings: The EDI software market is large but a lot of players are not innovative; especially integrated EDI solutions inside ERPs, TMSs, and WMSs. For ERP, TMS, and WMS providers, it would not be a worthwhile investment to innovate their EDI modules as it is not their main service, capability, or function. Additionally, without innovation, new EDI use cases like API integration and management of SLAs for different document flows will not be supported. Enterprises are then forced to build workarounds using other applications and scripts, or do manual processing to support these particular requirements.

The Hybrid EDI-API Automation Framework: Best of Both Worlds

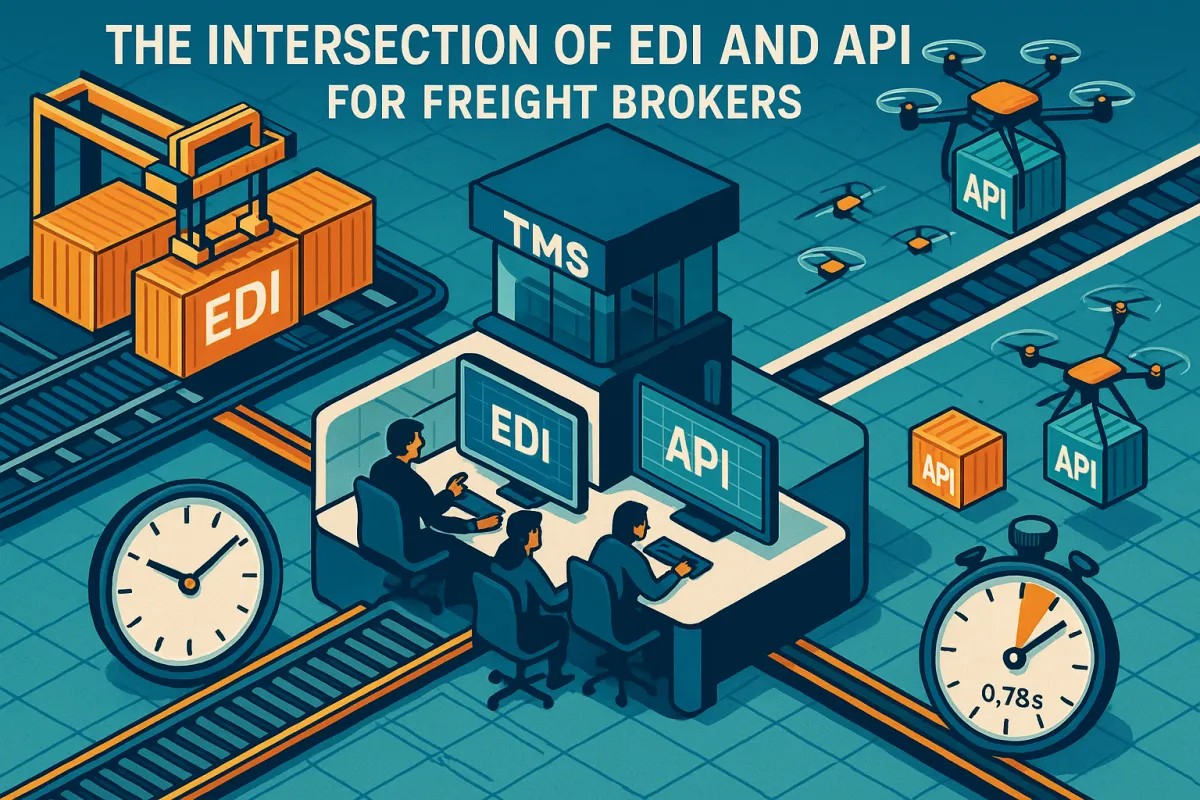

Often playing the role of the intermediary, freight brokers will stand a far better chance if their TMS systems utilize both API and EDI integrations. In doing so, they will make the best use of both worlds, API being the interface and EDI providing an engine. This isn't about choosing sides in some technology battle. Smart freight brokers are discovering that hybrid approaches solve real problems that neither technology handles alone.

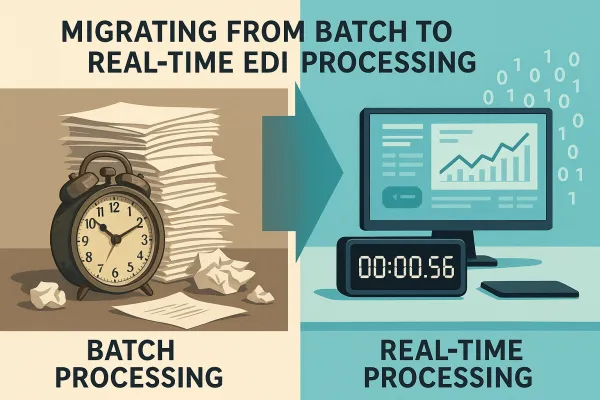

Think about how different workloads need different tools. APIs work great for low volume tasks like bulk uploads, while EDIs are better suited to high volume tasks like sending individual invoices. When you need real-time rate quotes to compete on spot market loads, APIs deliver responses in milliseconds. When you're processing hundreds of invoices overnight, EDI batch processing handles the volume efficiently.

A hybrid approach provides the benefit of using the best B2B technology for the circumstance. For partners that have not signed up for EDI due to costs or complexity, APIs provide an alternative way to transact. And whereas EDI is ideally suited for batch processing of mission-critical transactions like financial documents, APIs work well when you need to connect directly to transactional systems or enable real-time data exchange.

The architecture makes sense when you see it in action. One of the best API-EDI TMS integrations is an API that serves as a data feed for EDI software, which does all the heavy lifting when getting orders from your API up and running in a freight broker's system. Your shipper connects via API for immediate load tendering and tracking updates, while your back-office systems process the compliance documentation through EDI workflows.

APIs will expand a company's ability to automate manual pieces of their business that cannot be offered through EDI connections. This flexibility becomes crucial when major shippers demand custom integrations or when you're trying to automate appointment scheduling at warehouses that only offer web portals.

Practical Implementation: 5-Step Automation Roadmap

Step 1: Audit Your Manual Touchpoints

Start by tracking where your team manually enters data throughout a typical day. Load entry from shipper emails, carrier status updates, tracking information, invoice processing - document everything. The most obvious cost of manual data entry is the time your staff spend on inputting data into your systems. Every minute of that time contributes to your wage bill. You'll probably discover that 60-70% of your operational staff time goes to moving data between systems.

Step 2: Start with Loading Dock Automation

Inventory-centric documents (943, 856, 945, 846) keep riding EDI until your ERP and trading partners are ready for a broader API leap. Because the portal is already API-first, it's the easiest, lowest-risk foothold for modernising your wider integration landscape. In short, dock scheduling software gives you live dock intelligence that EDI never could. By exposing that intelligence through APIs you can gradually shift status and appointment traffic off traditional EDI, making this the perfect starter project.

Loading dock automation solves daily operational headaches while giving your team experience with API integrations in a controlled environment. Start with one major shipper's appointment scheduling system and expand from there.

Step 3: Implement Phased Partner Onboarding

Don't try to convert every trading partner at once. Trading partners could be onboarded in just a few days with the right automation platform, but you need a systematic approach. Begin with your highest-volume shippers who already have API capabilities, then work backward through your partner list based on transaction volume and technical readiness.

Solutions like Cargoson, alongside platforms like Bitfreighter, TrueCommerce, and Cleo, offer different approaches to rapid partner onboarding that can dramatically reduce integration timelines.

Step 4: Deploy Real-Time Exception Handling

APIs transmit data in milliseconds. This allows a transportation management system (TMS) to run on real-time data, whether you're getting tracking updates, building loads or getting spot quotes. Use this speed advantage to build automated workflows that handle common exceptions without human intervention.

When a carrier reports a delay, your system should automatically notify affected customers, calculate revised delivery windows, and trigger rebooking processes for time-sensitive freight. This level of automation separates professional brokerages from their manual competitors.

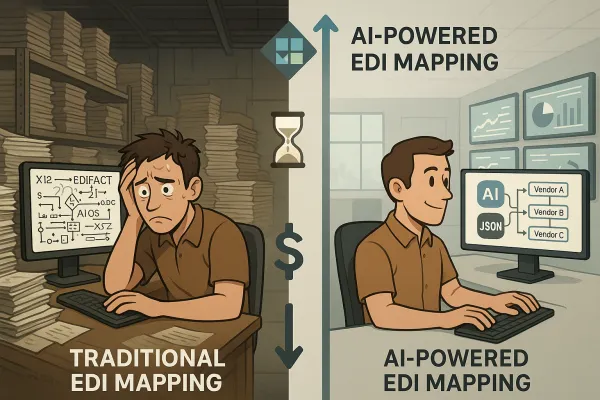

Step 5: Scale with AI-Powered Processing

Once your basic automation workflows are running smoothly, layer in machine learning for predictive analytics and document processing. Navix leverages machine learning and AI to flag errors instantly, facilitate auto-resolutions, and streamline dispute management—all without searching for a single document. Similar capabilities can handle routine customer service inquiries, freight claims, and carrier performance monitoring.

Technology Stack Requirements and Vendor Selection

Your integration platform needs to handle both worlds seamlessly. EDI integration with transportation management systems (TMS) and enterprise resource planning (ERP) systems further improves supply chain visibility and control. Look for solutions that can accept API calls on your side while translating to X12 or EDIFACT formats for partners who aren't ready for modern integration methods.

Cloud-based platforms offer significant advantages over on-premise deployments. Cloud solutions offer scalability and cost savings compared to on-premise systems, making them ideal for growing businesses. You can scale processing capacity during peak seasons without buying hardware, and updates deploy automatically without downtime.

When evaluating vendors, consider integration breadth alongside technical capabilities. Bitfreighter is connected to over 90% of the largest Broker/carrier TMS providers and all of the Shipper TMS platforms, allowing bitfreighter to provide the largest scalable network in the logistics industry. Compare this connectivity against platforms like Cargoson, SPS Commerce, IBM Sterling, and TrueCommerce to find the best match for your existing tech stack.

Pricing models vary dramatically. Unlike providers like Kleinschmidt, CLEO and IBM that charge based on data volume or character count, Bitfreighter offers flat-rate pricing with unlimited transactions. This predictability matters when you're scaling operations quickly and can't predict transaction volumes month to month.

Measuring Success: ROI and Performance Metrics

The numbers tell the story of successful automation implementation. On average, integrated TMS platforms save 20–30% on admin labor and reduce billing/invoicing errors by 40–50%, leading to thousands in annual savings. For a mid-sized brokerage processing 500 loads monthly, this translates to six-figure annual savings within the first year.

Processing speed improvements create competitive advantages beyond cost savings. With Drumkit, a broker can instantly input load details into their transportation management system (TMS) directly from the platform, eliminating manual data entry. This automation accelerates the load booking process, reduces errors, and frees up valuable time for brokers to focus on strategic tasks, enabling faster response times to shipper requests.

Customer satisfaction metrics improve alongside operational efficiency. Real-time tracking updates, automated exception notifications, and faster quote turnaround times directly impact shipper retention rates. One success story shows companies leveraging proper TMS automation growing from $13M to $51M in revenue within a single year, though results will vary based on market conditions and execution quality.

Key performance indicators to track include: load processing time from tender to confirmation, partner onboarding speed, error rates in documentation, and customer complaint volume. By reducing the order-to-cash cycle by a minimum of three days, Navix improves cash flow, enabling reinvestment in business growth. This cash flow improvement often provides the capital needed to fund further automation investments.

Future-Proofing Your Automation Strategy

The future of EDI is hybrid, flexible, and API-ready. If you're thinking about upgrading your EDI technology, now's the time to explore options that won't disrupt your operations—but will prepare you for what's next. The companies that will thrive in the next five years are building integration architectures that can adapt to new technologies without requiring complete overhauls.

Artificial intelligence integration will reshape how freight brokers handle routine tasks. Drumkit automates workflows with AI to help freight brokers increase capacity by 30-40%, reduce errors, and bolster customer relationships. Machine learning algorithms will predict optimal carrier selection, identify potential delays before they happen, and automate complex pricing decisions based on market conditions.

Across many industries and supply chain networks, a core set of EDI transaction types has been widely adopted to support mission-critical business processes. Companies need to support both or risk missing out on important opportunities to drive revenue, growth and competitive differentiation. This dual-track approach means your integration strategy should accommodate both traditional EDI requirements and emerging API-first platforms.

Blockchain integration possibilities are moving from experimental to practical applications. Smart contracts could automate dispute resolution, payments, and compliance monitoring. IoT sensors will feed real-time freight condition data directly into your TMS, enabling proactive exception management and enhanced customer service.

Platform providers like Cargoson are developing next-generation transport management capabilities alongside established players like nShift and Shippo. The key is choosing solutions that provide upgrade paths rather than technological dead ends.

Start planning your automation roadmap today, but build it for tomorrow's requirements. The freight brokers who eliminate manual data entry bottlenecks now will be the ones capturing market share as the industry continues its digital transformation.