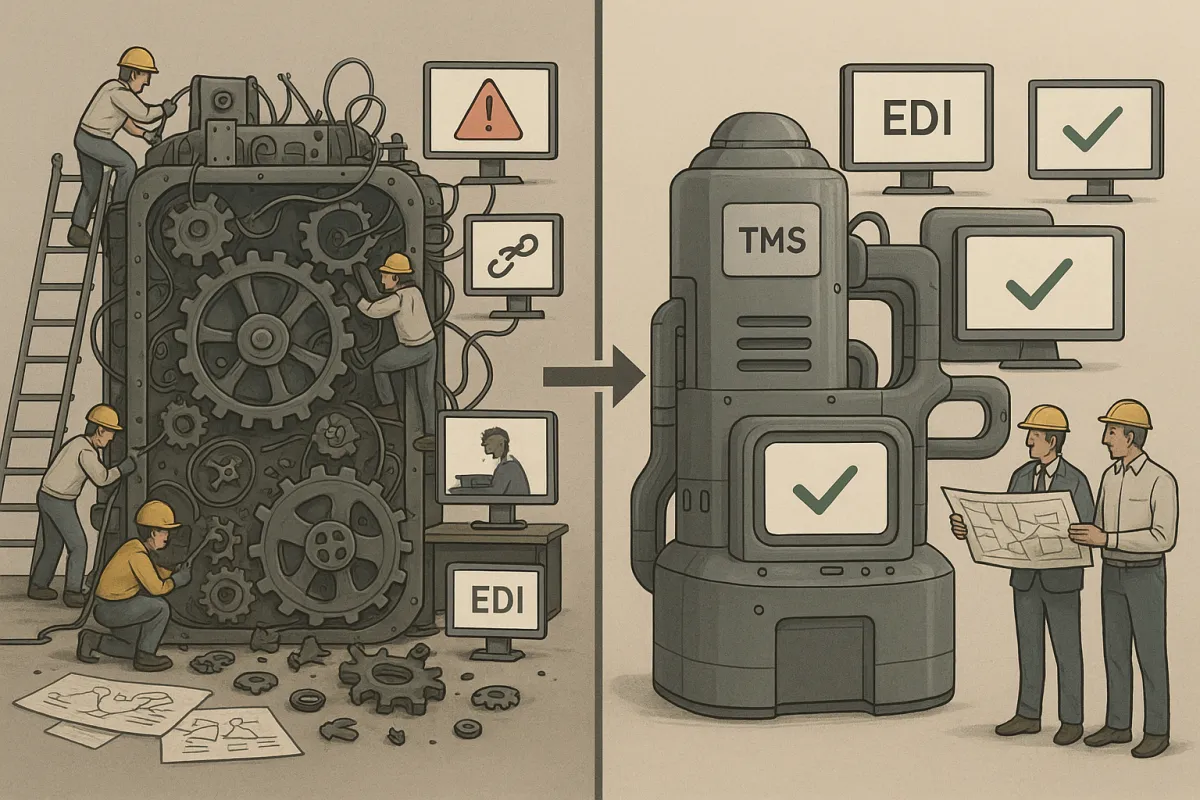

The TMS Migration EDI Catastrophe: Your Complete Prevention Framework to Avoid the 76% Failure Rate and Protect Trading Partner Relationships During System Upgrades in 2026

The TMS migration problem isn't just another IT headache waiting to happen. The 76% who struggle skip the planning, underestimate the complexity, and treat their TMS like a simple software purchase rather than a strategic transformation. When a German automotive parts manufacturer discovered after six months that their new system couldn't handle their complex carrier network across 12 countries, they'd already burned through €800,000 and faced the nightmare scenario every logistics manager dreads: broken EDI connections across their entire supply chain.

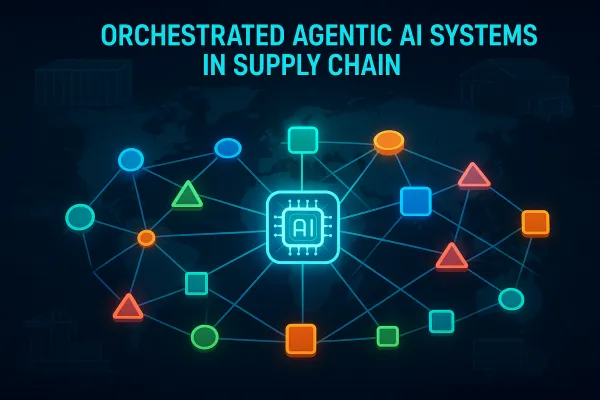

When transportation management systems are upgraded or replaced, EDI connections often break without warning. EDI and TMS systems are tightly intertwined—everything from tendering a load to confirming delivery relies on structured, automated data flows. When systems are swapped out without an EDI continuity plan, the result is often delays, chargebacks, or failed deliveries. The stakes couldn't be higher with the EDI market anticipated to reach USD 74.36 billion by 2030 and companies relying more heavily than ever on automated data exchange.

The Hidden Crisis Behind Failed TMS Migration EDI Integration

Here's what happens when TMS migrations go sideways. A German automotive parts manufacturer just learned what a €800,000 TMS implementation mistake looks like. They chose a North American-focused platform six months before discovering their primary carriers couldn't integrate without costly custom development. Notice the pattern? The issue wasn't the TMS itself—it was the EDI integration gaps that nobody mapped during planning.

Carriers, shippers, brokers, and third-party logistics (3PL) providers all depend on accurate, timely EDI data to plan routes, confirm pickups, monitor exceptions, and complete deliveries. A single missing or unreadable EDI message can trigger delays, missed appointments, or rejected shipments. For high-volume transportation environments, like ecommerce fulfillment, even small disruptions can cascade into larger issues downstream.

The financial impact compounds quickly. Research by Ovum shows that 53% of enterprises experience limitations with their current B2B integration solutions when onboarding trading partners, with approximately 40% requiring over 30 days to bring a new partner online. When your TMS migration breaks existing connections, you're not just dealing with implementation delays—you're potentially losing trading partners who can't afford weeks of downtime.

Why TMS and EDI Systems Create Dangerous Dependencies

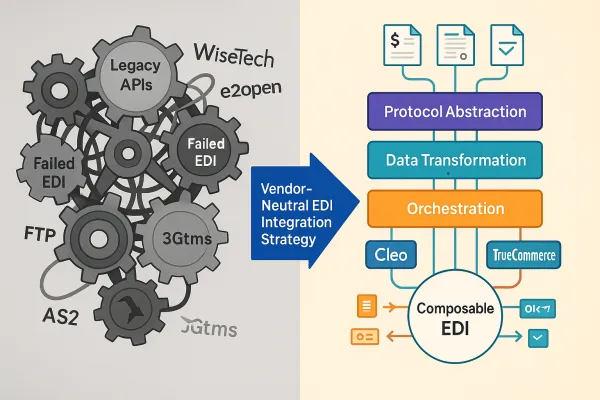

EDI issues during a TMS migration can usually be traced back to one of these root causes: Mapping mismatches: Every TMS platform structures its data differently. Without precise mapping between new and existing fields, critical information can be dropped or misrouted.

The technical reality runs deeper than data mapping. ERP, TMS, and WMS tend to have very lightweight EDI processing. Companies may need different communication software to support various protocols, scripts to complete EDI processing, scripts for database table lookups, or integration between different databases. Your TMS isn't really handling EDI—it's passing data through a complex chain of dependencies that breaks when you change any link.

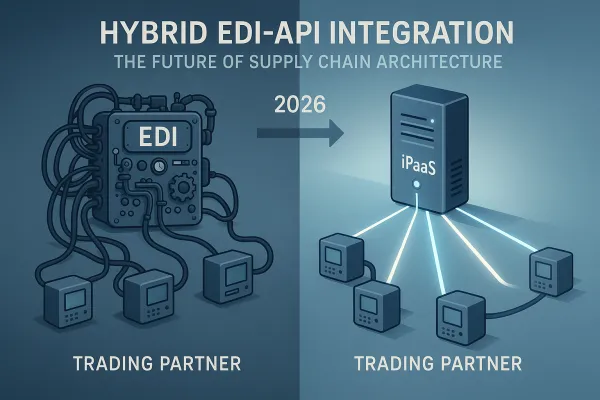

Legacy protocol issues: Older EDI connections often rely on protocols like FTP or AS2. If the new TMS doesn't support those methods or supports them differently, message delivery can fail entirely. Modern TMS platforms from vendors like Cargoson, Descartes, MercuryGate, and Blue Yonder offer API-first architectures, but they still need to maintain backward compatibility with trading partners using older protocols.

The Re-Onboarding Nightmare

Some organizations are forced to re-onboard all trading partners when switching systems. Imagine explaining to your top three carriers that they need to reconfigure their EDI connections because you're upgrading your TMS. The conversation gets uncomfortable when they ask why you didn't plan for EDI continuity.

Limited testing environments: Migration teams often lack a staging environment that accurately mirrors production, making it more challenging to identify issues before going live. These problems are especially common for companies running homegrown systems, heavily customized platforms, or brittle integrations built years ago.

The Pre-Migration EDI Audit Framework

Before touching your TMS, you need a complete inventory of everything that talks to it. Start with your EDI document flows: 850 purchase orders, 214 transportation carrier shipment status, 856 advance ship notices, 210 freight details and invoice, and 997 functional acknowledgments. Document which trading partners send what, how often, and through which protocols.

Map your current data transformations. Your existing TMS probably converts incoming 204 load tenders into internal formats, then transforms shipment updates back to 214s for your customers. Document these mappings because your new TMS will handle them differently. Include field-level details—a shipment weight field in your current system might map to three different fields in the new platform.

Test environment setup requires mirroring your production EDI flows without impacting live trading partners. Create a parallel environment that can receive test messages from all your current EDI protocols: AS2, SFTP, FTP, and any proprietary connections. Platforms like MercuryGate, Descartes, and Cargoson offer robust middleware that can communicate with multiple core systems simultaneously.

The 60-Day TMS Migration EDI Continuity Planning Protocol

Your EDI continuity plan needs to run parallel to your TMS migration timeline, not after it. Start communications with trading partners 60 days before your planned cutover. Share your migration timeline and potential impact windows. Most carriers appreciate advance notice and can often suggest ways to minimize disruption based on their experience with other customer migrations.

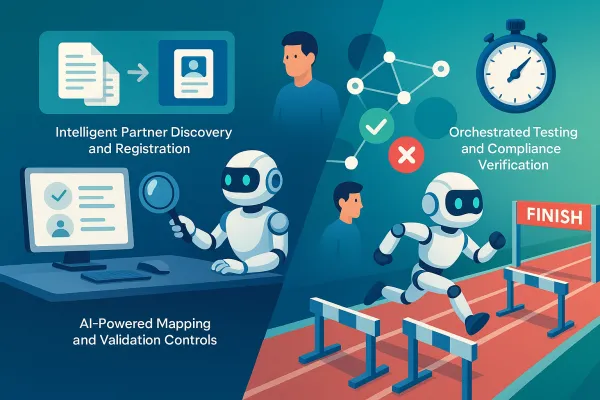

Days 60-45: Complete your EDI audit and share technical specifications with your new TMS vendor. Confirm which EDI documents and protocols they support natively versus requiring custom development. Look for prebuilt TMS document flows and templates for common documents like 204s and 210s to shorten implementation time and improve reliability.

Days 45-30: Build and test your parallel EDI environment. Configure message routing so you can simultaneously send test transactions through both old and new systems. Document any data transformation differences and plan workarounds for missing functionality.

Days 30-15: Execute partner testing protocols. Send test 204s through your new TMS and confirm your carriers can receive and process them correctly. Test the full round-trip: tender acknowledgment, status updates, and final delivery confirmation. Any failures here need immediate attention.

Days 15-0: Finalize cutover procedures and rollback plans. Your rollback strategy should include the ability to instantly revert EDI connections to your old TMS without data loss. Plan for a staged cutover by carrier volume—start with your smallest trading partners and work up to your largest.

Vendor Selection Criteria That Prevent EDI Disasters

API-first TMS platforms offer better EDI integration flexibility, but you need more than marketing promises. Ask potential vendors to demonstrate live EDI message processing during their demo. Watch them configure a new 214 shipment status message and explain how they handle EDI version conflicts.

Implement a best-of-breed EDI solution that sits independently from your TMS and ERP systems. Consider how your TMS and EDI tools will work with other core systems—a solution that can simplify ERP/EDI integration will reduce duplication and help you adapt faster as your tech stack evolves.

Cloud deployment models require different evaluation criteria than on-premise solutions. Cloud deployment held 63% of transportation management system market share in 2024 and is advancing at 14.92% CAGR through 2030. Cloud TMS platforms like Cargoson, E2open, and Alpega typically offer better EDI scalability but require careful security review for sensitive customer data.

Vendor EDI support quality varies dramatically. Some platforms offer comprehensive pre-built trading partner profiles for major carriers and 3PLs. Others require custom development for each connection. A modern EDI integration platform makes it easy to onboard and maintain partners: Libraries of prebuilt trading-partner profiles (e.g., Walmart, Target, Costco) with ready-to-use maps and rules. Self-service tools that allow internal teams to add new partners or documents without long service projects. Versioning and change management to prevent updates to partner requirements from breaking downstream logic.

Questions That Separate EDI-Ready TMS Vendors

Ask these specific questions during vendor evaluations:

- How do you handle AS2 certificate renewal without breaking existing connections?

- Can you demonstrate real-time EDI transaction monitoring and error notification?

- What's your average implementation time for adding a new carrier with custom EDI requirements?

- How do you maintain EDI continuity during TMS upgrades or maintenance windows?

The answers reveal whether the vendor truly understands EDI integration challenges or just checks boxes on an RFP response.

The Post-Migration EDI Validation Framework

Your go-live validation needs to extend beyond basic connectivity testing. Execute full transaction cycles with each trading partner: send a test 204 load tender, receive the acceptance, generate a 214 status update, and process the final delivery confirmation. Document response times at each step—performance degradation often appears weeks after migration when transaction volumes increase.

Real-time dashboards of all EDI transactions across partners and business systems. Drill down to document-level status (accepted, rejected, in error, reprocessed). Configurable notifications on failures, SLAs, or specific partner flows. Exception queues with root-cause context and tools to automatically fix and retry.

Monitor for silent failures—transactions that appear successful but contain incorrect data. A common migration issue involves decimal precision differences between old and new systems. Your new TMS might round freight charges to two decimal places while your old system used four, creating discrepancies that appear as billing disputes weeks later.

Establish baseline performance metrics immediately after migration: average document processing time, transaction failure rates, and partner response times. This is where modern EDI automation strategy pays off. The platform should resolve most errors automatically (retries, reformatting, enrichment), with only edge cases needing human review.

Future-Proofing: Building TMS-Independent EDI Architecture

EDI runs companies' most critical business revenue so the technology powering these transactions cannot be compromised. However, organizations often consolidate EDI with peripheral systems of record, such as an ERP or TMS. These consolidations can lead to significant shortcomings and unintended consequences.

Standalone EDI platforms provide insurance against future TMS migrations. Standalone EDI engines are also helpful when enterprises grow and have to switch to a new ERP. This is because until the migration is complete, a standalone EDI solution can flow data based on the partner product migration to either the new or old ERP, until the migration is complete. The same principle applies to TMS migrations.

Standalone EDI systems are critical business applications that most organizations treat as tier 1 applications, since more than half of their business revenue goes through this platform. Companies want 100% uptime, even when performing upgrades to their ERP or TMS systems.

Hybrid integration strategies combine traditional EDI with modern APIs where trading partners support both. When Tesla chose to skip EDI in favor of API-based integrations, many carriers found themselves in a bind. Kleinschmidt stepped up to the plate, creating a repeatable process for their customers to transform carriers' existing data into API-compatible formats, making onboarding quick and painless.

As Dan Heinen, CEO of Kleinschmidt, pointed out, "The push is going to continue to be digital, digital, digital." Fleets need to embrace this shift to stay competitive. By integrating EDI with a cutting-edge TMS like PCS, you're not just keeping up—you're setting the pace for the industry. The future belongs to platforms that support both legacy EDI protocols and modern API connections, letting you migrate trading partners at their pace rather than forcing bulk transitions.

Your next TMS migration doesn't have to join the 76% failure statistic. Start with honest EDI assessment, budget for integration complexity, and choose vendors who demonstrate real EDI expertise beyond basic connectivity. The cost of getting it right is far less than the price of getting it wrong.