TMS EDI Integration Showdown: 15 Transport Management Systems Compared for Supply Chain Professionals in 2025

Most supply chain managers face a similar challenge when evaluating TMS platforms: systems promise seamless carrier integrations, but adding new carrier integrations costs approximately $3,000 per carrier, with carriers typically implementing standard EDI/XML messages themselves. The reality hits harder when you discover that your chosen platform's "robust EDI capabilities" actually mean outsourced connections with limited control over error handling. EDI performance bottlenecks cost companies an average of $62,000 per day in delayed shipments and processing errors. With stakes this high, choosing a TMS based on native EDI capabilities rather than bolted-on solutions becomes mission-critical for operational success.

We've analyzed 15 leading TMS platforms specifically through the lens of EDI integration depth, implementation costs, and real-world effectiveness. For most shippers with annual freight under management (FUM) greater than $250M, the implementation line item can be 2-3x the subscription. Furthermore, the "long pole of the tent" of implementation time, and therefore cost, resides in the design, build, and testing of integrations.

The EDI Integration Evaluation Framework

Technical depth matters more than marketing promises. Does the TMS offer true, direct API/EDI connections with your carriers, or just emails / standard EDI messages carriers must implement themselves? This question separates platforms that own their integration stack from those that merely facilitate it.

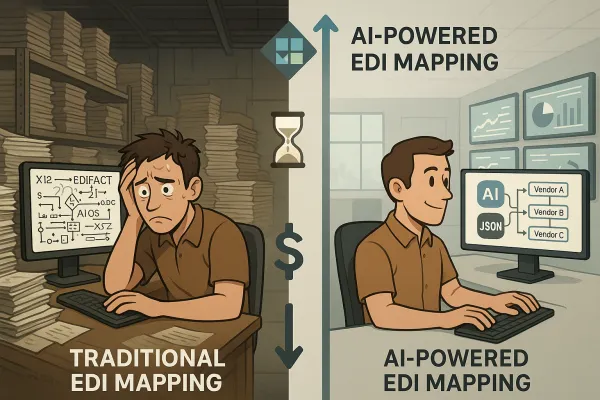

Choose the right EDI standards (like X12 or EDIFACT) based on your industry and partner requirements. Run thorough tests before going live to ensure everything works smoothly. However, older formats of EDI such as EDIFACT and IMP were unable to handle bad data proactively, leading to erroneous B2B transactions.

The evaluation framework extends beyond technical compatibility. The average company that performs EDI has anywhere from 100-200 partners, and 400-500 maps—all of which will be impacted by the switch. This is a huge challenge and workload to tackle for any company.

Error handling capabilities separate enterprise-grade solutions from basic offerings. Some solutions offer error notifications where the platform will text or email users when and where an error is occurring. Users can then quickly jump into the platform and fix the issue before it disrupts the supply chain.

Enterprise TMS Platforms with Advanced EDI

SAP TMS excels in dock scheduling and yard management with a score of 84 from our analysts, higher than competitors like MercuryGate (74) and Manhattan (81). It contains helpful process automation that can take care of transportation requirements while freeing employees for strategic work.

SAP's EDI approach leverages their broader integration ecosystem. Businesses in the transport logistics sector, which use the SAP® Transportation Management (SAP TM) application, can benefit from the advantages of comprehensive B2B connectivity. The network comprises preconfigured profiles based on a service-oriented architecture (SOA), which enables businesses to exchange transport-related data with their business partners on an ad-hoc basis.

The financial commitment reflects enterprise-grade capabilities. Pricing depends on a contract duration of 3 to 36 months and is structured in annual blocks of $2,500,000. This pricing structure makes SAP TMS viable primarily for large enterprises with complex, multi-modal operations.

MercuryGate offers automated EDI for carrier communication, is highly customizable for unique workflows, and provides strong document and carrier management. However, the struggles involve the API's. MercuryGate has not always balanced well the service delivery model with exposing the data and methods to their customers.

MercuryGate pricing reflects its positioning between mid-market and enterprise segments. Monthly costs starting at $500 for 1 user. For 10 users, the price is $4,500 per month, and for 100 users, it is $40,000 per month. Implementation process can take several weeks to a few months, with costs ranging from $5,000 for small businesses to $50,000 for larger enterprises.

Manhattan Active Transportation commands premium pricing but delivers comprehensive integration with warehouse management systems. TMS comes out of the box with integrations into the Manhattan supply chain applications, though total cost of ownership (TCO) is high in comparison to other TMS platforms.

Mid-Market TMS Solutions with Strong EDI

Cargoson represents the European approach to TMS EDI integration. Cargoson is a modern European TMS that bridges the gap between complex enterprise systems and simple shipping tools. It offers direct API/EDI integrations with carriers across all transport modes (FTL, LTL, parcel, air, and sea freight), allowing you to compare rates, book shipments, and track imports and deliveries from a single platform.

The platform's carrier network approach differs from traditional models. Builds true API/EDI connections with carriers, not just accounts in software or standardized EDI messages that carriers must implement themselves. This approach reduces implementation complexity for shippers while maintaining integration depth.

Descartes Aljex features a user-centric design and cloud-based nature that make learning easier for new users. The dashboard-driven TMS is popular with freight brokers, 3PLs, shippers, and intermodal users. Descartes leverages its extensive carrier network, though integration costs can accumulate with platform growth.

Transporeon focuses on European carrier connectivity, providing access to established networks across multiple countries. However, their EDI capabilities vary by region and carrier type, requiring careful evaluation of coverage in your operational areas.

Emerging TMS Platforms with Native EDI

Alvys TMS software has its own native EDI engine for seamlessly integrated communication. No need for a third party EDI, costly custom integrations, or per-transaction charges. Our TMS software has its own native EDI engine for seamlessly integrated communication, helping you save valuable time and improve your shipper scorecards.

Alvys positions itself as addressing traditional EDI pain points. By using our native EDI trucking software, Alvys customers reduce overhead, accelerate turnaround times, avoid per-transaction fees, reduce complications, and improve shipper scorecards, which translates to happier shippers and higher profits.

The platform's approach to EDI onboarding differs from traditional models. We don't charge onboarding fees or nickel and dime you for new integrations or additional features. However, user experiences vary. "A lot of false promises from sales team, EDI team... they never fallow thru" appears in some recent reviews, indicating implementation challenges.

Rose Rocket supports Electronic Data Interchange (EDI), so you can receive inbound orders and send outbound confirmations. While it can take some time to set up preferences for each customer, it helps make transactions and communications smooth.

Rose Rocket recently launched TMS.ai, positioning themselves as the first AI-native platform. Rose Rocket announced the launch of TMS.ai at the Manifest 2025 conference in Las Vegas. TMS.ai represents a monumental shift in transportation management systems, embedding artificial intelligence (AI) at the core of a business's system-of-record. This shift allows AI to have the complete context of a business, solving AI's biggest weakness while delivering unparalleled value to every operations team.

The Hidden Costs of TMS EDI Integration

Implementation costs extend far beyond initial licensing fees. For a "basic" domestic shipper looking for a TMS to automate planning, execution and payment... we would estimate at a minimum to be between 10-15 integrations. For each integration object, there needs to be a design, documentation, the integration coding, and unit test. Depending on complexity, 10 integrations could total between 1000-1500 hours of labor.

The complexity multiplies with business growth. Most shippers today are prioritizing requirements for an average of 40 integrations. Some implementations reach extreme complexity: In 2022, one of our more complex implementations recorded over 140 objects, most of them integrations.

Most EDI implementations today take months rather than days. Your suppliers wait four to six weeks just to get onboarded with traditional EDI vendors, and in practice, the theoretical 1-2 week timeline often stretches to 1-2 months or longer.

Trading partner onboarding represents another significant cost center. Nearly two-thirds (63%) of IT decision-makers say the EDI onboarding process takes too long because of all the different customized requirements demanded by trading partners. Up to 47% of IT managers say that slow EDI supplier onboarding is currently keeping their businesses from capturing new revenue opportunities.

Ongoing maintenance costs often surprise organizations. EDI software and hardware don't come cheap. Licensing fees, infrastructure costs, and IT staff to keep everything running, it adds up fast. As business grows, these costs tend to rise.

Integration Challenges and Limitations

The first challenge of EDI inside an ERP, TMS, or WMS is that it will be tightly tied to the ERP. When an enterprise grows and is looking to implement a new ERP or TMS, the switch will impact EDI with its trading partners.

System upgrades create particularly challenging scenarios. Your EDI system just broke three trading partner connections after upgrading your TMS last weekend... Your TMS migration just turned into an EDI nightmare. Companies want 100% uptime, even when performing upgrades to their ERP or TMS systems.

Integrating EDI with TMS can be technically challenging, especially for organizations with outdated systems or limited IT resources. Businesses may need to invest in middleware solutions to bridge the gap between legacy systems and modern EDI requirements.

Format compatibility remains a persistent challenge. With dozens of formats in circulation, from X12 and EDIFACT to XML, JSON, and even proprietary in-house templates... Companies often resort to "middleware" or custom scripts to bridge the gaps, which adds complexity and cost, not to mention, these fixes are rarely future-proof.

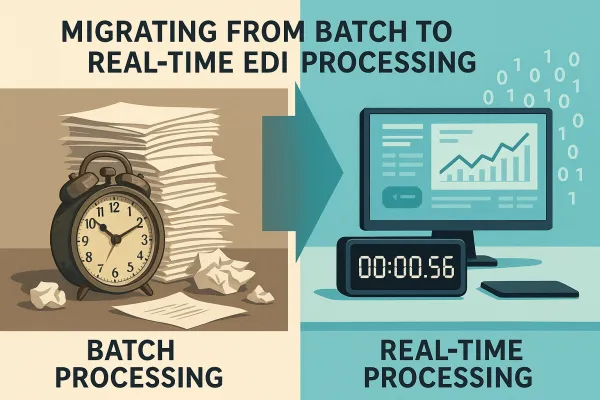

Real-time processing expectations clash with traditional EDI capabilities. Today's supply chains run on real-time data, not batch uploads or overnight reports. Unfortunately, many legacy EDI systems operate with delays. This slows down operations, makes it harder to respond to changes, and limits visibility across the ecosystem.

The Verdict: Choosing the Right TMS for Your EDI Needs

Enterprise organizations with complex, multi-modal operations and substantial IT resources should evaluate SAP Transportation Management or Manhattan Active Transportation. These platforms provide comprehensive EDI capabilities but require significant implementation investments and long-term commitments.

Mid-market companies benefit from platforms like Cargoson or MercuryGate that balance functionality with implementation complexity. Cargoson's European focus and direct carrier integrations suit manufacturers and retailers operating across multiple transport modes.

Growing carriers and brokers should consider Alvys or Rose Rocket for their native EDI engines and transparent pricing models. However, verify EDI implementation timelines and support quality through reference calls rather than relying solely on marketing promises.

The hybrid approach increasingly makes sense for established operations. A growing trend in supply chain IT is the fusion of traditional EDI systems and modern APIs. For businesses entrenched in EDI, APIs extend their existing capabilities with interactivity and integration with cloud-based services. This blend allows for maintaining critical EDI-based relationships and processes while opening doors to new, more powerful forms of system interconnectivity.

Future-proofing considerations matter more than current capabilities alone. EDI is here to stay, and its relevance will grow as we move into 2025. However, unlike EDI, which is largely constrained to batch processing, APIs enable immediate data transfer. This real-time exchange is vital in industries where timely information is crucial for decision-making and operational efficiency.

Evaluate platforms based on their integration roadmap, not just current EDI capabilities. The best TMS platforms will support both traditional EDI requirements and modern API connectivity, providing flexibility as your trading partner ecosystem evolves. Your choice today determines whether you'll lead digital transformation in your supply chain or struggle to keep pace with more agile competitors.