(Untitled)

SAP ECC customers running systems with enhancement packages 1-5 face an even tighter squeeze than most realize. While companies using enhancement packages 6-8 have until December 31, 2027, those on packages 1-5 lose mainstream maintenance by December 31, 2025. Gartner's data shows that by late 2024, only 39% of the 35,000 SAP ECC customers had moved to S/4HANA, meaning nearly 17,000 organizations will still run the legacy ERP by 2027.

The problem runs deeper than calendar dates. Late adopters face 30-50% higher consulting fees in 2026-27 as demand surges and experienced implementation resources become scarce. Unlike legacy SAP systems with monolithic structures, S/4HANA leverages an in-memory architecture that requires a fundamental shift in EDI integration strategies.

Why Traditional TMS-Coupled EDI Strategies Fail During Migrations

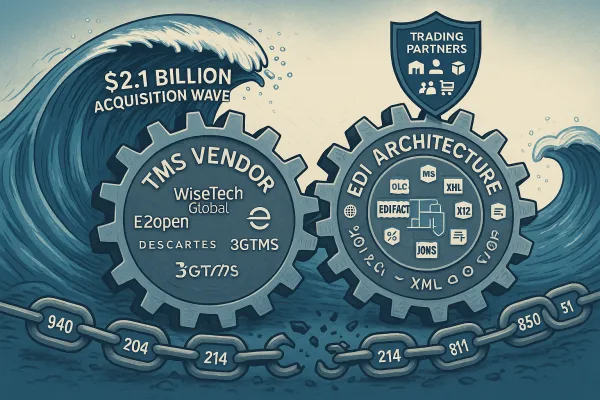

The first challenge of EDI inside an ERP or TMS is that it will be tightly tied to the system - when an enterprise implements a new ERP or TMS, the switch will impact EDI with its trading partners. The average company performing EDI has anywhere from 100-200 partners and 400-500 maps, all of which will be impacted by the switch - a huge challenge for any company.

SAP S/4HANA migration brings specific EDI disruption risks. Companies must ensure existing EDI processes are technically migrated and enhanced to leverage new S/4HANA capabilities, while outdated processes that served as workarounds can now be optimized using S/4HANA's advanced automation features. IDoc format changes can break existing EDI maps or cause silent data corruption with truncated fields and unmapped attributes.

Transport management platforms like SAP TM, MercuryGate, Descartes, and Manhattan Active become particularly vulnerable during these migrations. When TMS systems are swapped out without an EDI continuity plan, the result is often delays, chargebacks, or failed deliveries that damage partner relationships. Even modern platforms like Cargoson must navigate these integration challenges when customers undergo ERP transitions.

Case Study: Multi-Vendor EDI Disruption Scenarios

Consider a manufacturing company with 150 trading partners across automotive and retail channels. During their SAP S/4HANA migration, their TMS-embedded EDI connections to major customers like Volkswagen and IKEA experienced mapping failures. Adding new carrier integrations costs approximately $3,000 per carrier, with carriers typically implementing standard EDI/XML messages themselves. The company faced revenue disruptions from delayed purchase orders and shipping confirmations while scrambling to rebuild connections.

The Hidden Costs of TMS-Dependent EDI During System Migrations

Budget overruns hit 75% of European TMS implementations, with implementation costs ranging from €30,000 to €900,000 - for shippers with freight spend exceeding $250M annually, implementation can cost 2-3 times the subscription fee. These figures don't include EDI migration complexity costs.

A full ECC to S/4HANA migration typically spans 18 to 36 months or longer for large enterprises, making early project initiation essential given the approaching 2027 deadline. The "long pole of the tent" of implementation time and cost resides in the design, build, and testing of integrations.

While many TMS solutions offer published APIs, carriers are often unwilling or unable to create connections themselves, and even when they can, they typically charge integration costs back to the shipper. Adding new carriers can be complex and costly, often requiring third-party integration partners.

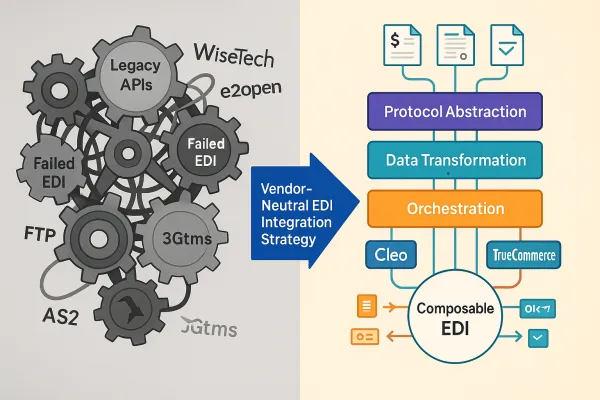

The complexity multiplies when replacing legacy EDI solutions simultaneously with SAP migrations. Integrating EDI with TMS can be technically challenging, especially for organizations with outdated systems or limited IT resources, requiring investment in middleware solutions to bridge gaps between legacy systems and modern EDI requirements.

Building a TMS-Independent EDI Architecture Strategy

A hybrid integration platform (HIP) allows on-premise solutions to seamlessly integrate with cloud-based applications, enabling IT teams to fast-track innovation, enhance efficiency, and lower risk factors associated with integration. HIP provides integration services in various forms, including application integration, data integration, B2B integration, cloud integration, and managed file transfer.

The architecture principle involves decoupling B2B/EDI integration from core ERP or TMS functions. SEEBURGER enables seamless integration through flexible mapping technologies, standardized interfaces (IDoc, API) and hybrid operational models. SAP provides several tools including Process Orchestration (PO), Process Integration (PI), and cloud-native SAP Integration Suite for supporting EDI workflows.

Modern platforms recognize this need. Cargoson offers direct API/EDI integrations with carriers across all transport modes, building true API/EDI connections with carriers rather than requiring standardized EDI messages that carriers must implement themselves. This approach contrasts with platforms like Transporeon and nShift that require carriers to implement standard EDI interfaces themselves.

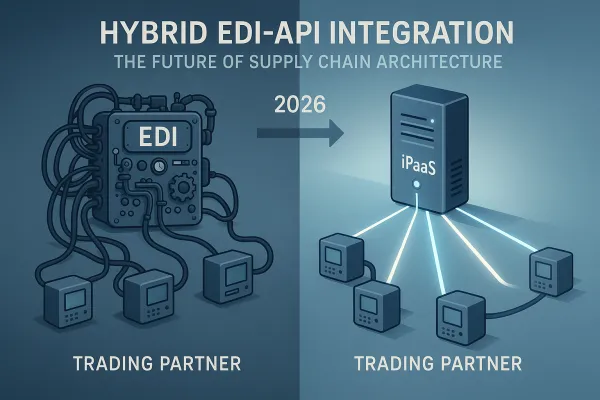

The Hybrid EDI-API Future Architecture

Roughly 25% of EDI connections have been replaced with APIs as of 2020, but legacy applications still handle the majority of connections - freight brokers benefit when TMS systems utilize both API and EDI integrations. Combining EDI's standardized reliability with API's real-time speed creates seamless workflows that satisfy both legacy and modern system requirements.

The future belongs to intelligent orchestration. API allows transportation management systems to transmit data in less than a second and helps freight brokers access TMS data like shipment status updates without intermediary systems. Meanwhile, EDI provides the established backbone for high-volume, batch-oriented transactions that major retailers and manufacturers still require.

Implementation Framework: 6-Step TMS-Independent EDI Migration

Step 1: Current State EDI Inventory and TMS Dependency Assessment

Evaluate existing TMS and EDI systems to understand current capabilities and limitations for determining the best integration approach. Document which trading partners connect through TMS-embedded EDI versus standalone platforms.

Step 2: Trading Partner Communication Protocols Documentation

Choose the right EDI standards (like X12 or EDIFACT) based on industry and partner requirements. Map current message types, frequencies, and data validation rules to ensure compatibility post-migration.

Step 3: Standalone EDI Platform Selection

Select appropriate EDI solutions considering specific needs and operation scale - choose between fully managed EDI services for comprehensive solutions or EDI web services for cost-effective options with in-house technical resources.

Step 4: Parallel Migration Testing

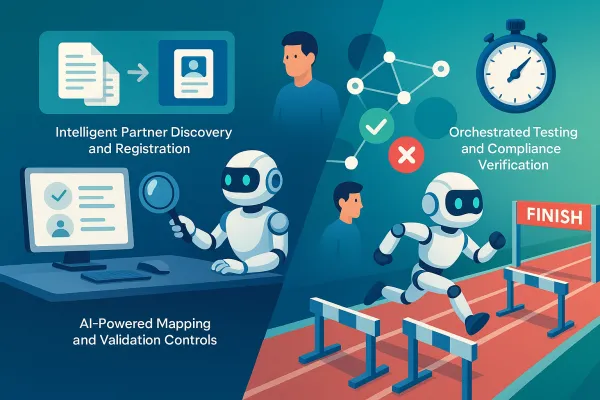

Run thorough tests before going live to ensure everything works smoothly. Migration teams often lack staging environments that accurately mirror production, making it challenging to identify issues before going live.

Step 5: Go-live Orchestration

TMS upgrades should include clear EDI continuity plans, applying similar risk mitigation strategies used in ERP transitions. Coordinate cutover timing to minimize trading partner disruption.

Step 6: Post-migration Optimization and API Roadmap

Implement hybrid EDI-API capabilities progressively. APIs can automatically handle tasks like sending bills to accounting software like QuickBooks, while maintaining EDI reliability for core B2B transactions.

Critical Success Factors and Risk Mitigation

Process mismatches can disrupt core business operations. Up to 74% of integration failures stem from inconsistent data standards or faulty mappings between systems - the fix begins with defining explicit, standardized data schemas and careful field mapping.

Maintaining established protocols proves essential. The brownfield approach allows existing EDI architecture integration into new S/4HANA environments with minimal disruption, while SEEBURGER supports this process with tools that simplify existing EDI data flow integration.

2026 Market Implications and Vendor Landscape

The global electronic data interchange market is anticipated to reach USD 67.35 billion by 2030, growing at a 6.94% CAGR from USD 34.02 billion in 2024. The EDI software market size is projected to reach USD 4.54 billion by 2030, representing an 11.8% CAGR.

The hybrid integration platform market is forecast to reach $66.62 billion by 2030, at a CAGR of 16.31%. This explosive growth reflects the urgent need for platforms that bridge legacy and modern systems during the SAP migration wave.

European procurement teams face unprecedented TMS vendor consolidation in 2026, with WiseTech Global's $2.1 billion acquisition of E2open and Descartes' $115 million acquisition of 3GTMS representing the most significant consolidation wave. This consolidation creates both opportunities and risks for EDI continuity strategies.

Transport management software vendors are adapting their integration approaches. Solutions like Cargoson focus on European manufacturers with direct API/EDI integrations, while Blue Yonder and Manhattan Active implementations typically require extensive project management resources. Platforms like FreightPOP, 3Gtms, and Shiptify each take different approaches to carrier connectivity and EDI integration.

Future-Proofing Your EDI Investment

AI and machine learning capabilities represent game-changing developments in the EDI ecosystem, transforming static systems into intelligent platforms capable of predictive analytics, autonomous decision-making, and self-improving processes. Integrating OCR with EDI creates end-to-end automation by converting unstructured documents into standardized digital workflows.

Organizations that invest in TMS-independent EDI architectures today position themselves for multiple technology transitions ahead. Whether it's the next SAP upgrade cycle, TMS vendor consolidation, or the gradual shift toward API-first integration, decoupled EDI strategies provide the flexibility needed to adapt without massive re-implementation projects.

The companies that emerge strongest from the 2027 SAP deadline will be those that treat EDI as a strategic asset requiring dedicated architecture attention, not just another checkbox in their TMS feature comparison spreadsheet.