The $500K EDI Trading Partner Onboarding Tax: How Supply Chain Leaders Are Cutting Setup Time from 30 Days to 5 Days While Eliminating Revenue Loss in 2025

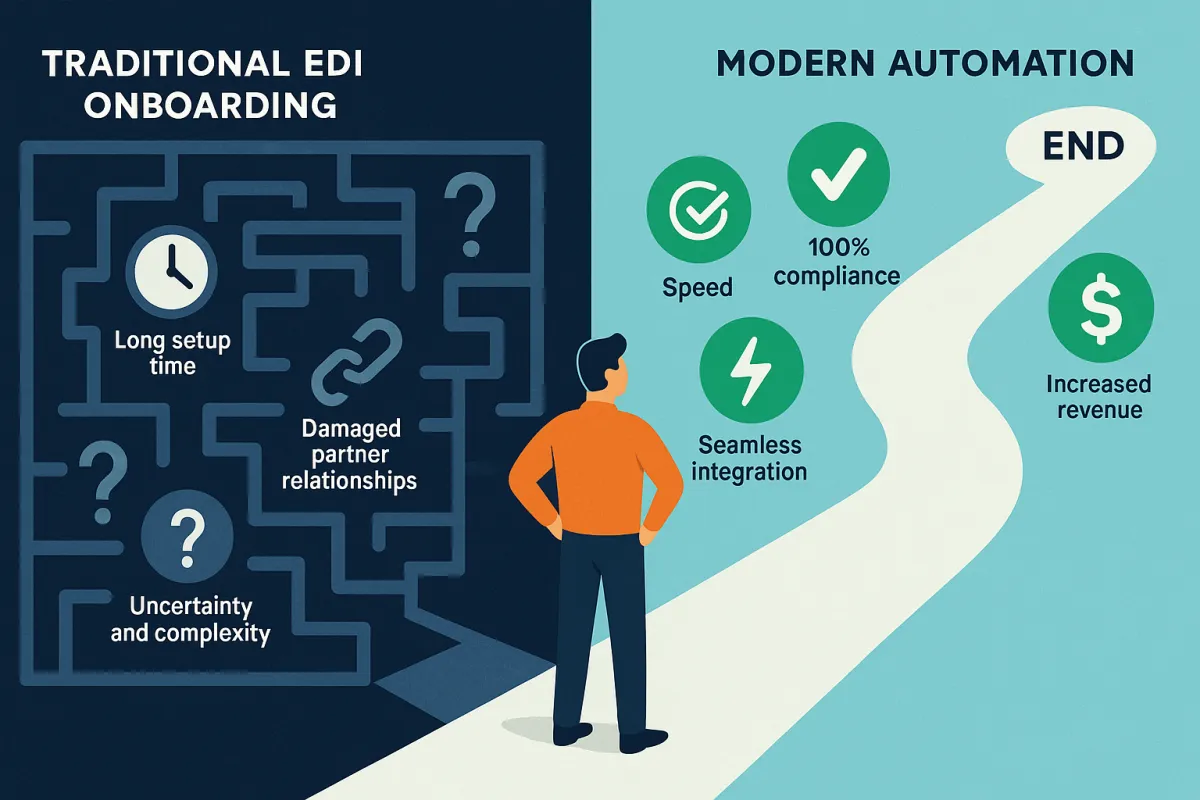

Most supply chain leaders know EDI trading partner onboarding takes too long, but few realize just how much money they're bleeding. Nearly 24% of companies are losing $500K or more to integration issues, while approximately 40% of enterprises require over 30 days to onboard a new trading partner. This isn't just an IT problem—it's a revenue killer that's silently undermining your competitive advantage.

The numbers paint a stark picture. Failing to meet trading partner requirements in a timely fashion results in the loss of new sales and missed revenue opportunities, with slow or broken EDI partner onboarding being crippling to businesses, particularly those in the supply chain that regularly stand up new EDI partners.

The Hidden Cost Crisis of Slow EDI Trading Partner Onboarding

When a Fortune 500 manufacturer recently calculated their EDI onboarding costs, they discovered something alarming. Each delayed partner integration was costing them an average of $42,000 per week in lost orders. Multiply that across multiple partner onboardings happening simultaneously, and you're looking at hundreds of thousands in missed opportunities.

Consider a low-cost solution that takes three months to onboard a single partner. A system with an attractive upfront cost can still end up costing more than a modern system that gets you set up within days. The hidden costs extend beyond just delayed revenue—they include internal resource strain, opportunity costs, and damaged partner relationships.

The financial impact compounds when you factor in the ripple effects. When delays mean missed revenue, compromised trust, or compliance penalties, cheap software quickly becomes more expensive than you originally anticipated. Many companies don't realize this until peak season hits and they're scrambling to meet demand with partners who should have been onboarded months earlier.

What makes this particularly painful is how predictable these delays have become. Due to oversight, both customers and their business partners don't gain any benefit from using EDI for yet another month, further delaying any ROI that could be derived.

Why Traditional EDI Onboarding Takes So Long: The 6-Step Bottleneck Analysis

The onboarding process requires coordination among four distinct entities: your staff, each trading partner, the EDI provider, and aACE developers. This can make it difficult to estimate timeframes. Of these four, trading partners tend to have the slowest response time since they typically have less incentive to complete the integration.

Here's where traditional processes break down:

Requirements Gathering Nightmare: Most companies treat each partner as a unique snowflake, manually gathering specifications that often exist somewhere buried in a partner portal. Companies do not know what their trading partner profile looks like or how to demonstrate it, keeping important EDI information behind a firewall and away from public view until the opportunity to connect has arrived, which is certainly counterintuitive to making business work.

Mapping Mayhem: Data mapping is a critical part of EDI onboarding, as different systems use varying data formats. For instance, retailers and suppliers may have different product codes or pricing structures. If these discrepancies aren't mapped correctly, it can lead to costly errors like incorrect inventory or delayed shipments.

Testing Coordination Hell: EDI testing requires both partners to collaborate in the same time frame. When you're dealing with partners across different time zones, this becomes a logistics nightmare. Experience from past EDI integrations has shown that there will be errors on the early interchanges of every document.

The coordination challenge extends beyond technical issues. Onboarding a trading partner is a slow, iterative process. Consistent coordination among the four business entities and careful testing is required for getting the data exchanges correct. This effort requires patience because many of the moving parts are out of any single group's control.

The Modern Automation Solution: How Leading Companies Cut Onboarding to Days

Forward-thinking companies are abandoning the traditional approach entirely. They're embracing automation platforms that treat onboarding as a scalable, repeatable process rather than a custom project.

When modern platforms onboard a trading partner, they do it once. This means taking their guidelines and communication channel requirements and publishing them onto the platform. This process takes less than a day. Once the new trading partner is set up in the network, anyone can reuse those requirements immediately.

Companies like Orderful have proven this works at scale. Their cloud EDI platform streamlines EDI onboarding from months to less than 5 days, simplifying integrations while ensuring 100% compliance. Some providers like Cargoson alongside TrueCommerce and Cleo are taking this even further with AI-powered automation tools.

Best practice employs automation tools with pre-built templates and validation processes to expedite onboarding and minimize errors. Streamlining partner onboarding through automation is essential to reduce complexity and accelerate integration.

The automation advantage extends to error handling. AI-driven tools monitor EDI transactions and automate error handling, significantly reducing reliance on manual processes. This means fewer late-night emergency calls and more predictable onboarding timelines.

Cost-Benefit Analysis: Manual vs. Automated EDI Partner Onboarding

The financial case for automation becomes clear when you break down the numbers. Traditional manual onboarding typically costs between $15,000-$25,000 per partner when you factor in internal resources, consultant fees, and lost opportunity costs. Automated platforms can reduce this to $2,000-$5,000 per partner.

But the real savings come from time compression. Decreasing EDI onboarding times from months to days means going live sooner, resulting in increased revenue and an improved bottom line.

Here's what the math looks like for a typical mid-market manufacturer onboarding 12 partners annually:

- Traditional approach: 30-45 days per partner, $240,000-$300,000 total cost, 6-12 weeks of delayed revenue per partner

- Automated approach: 3-5 days per partner, $24,000-$60,000 total cost, immediate revenue recognition

The hidden costs of manual processes add up quickly. TCO often involves integration costs, onboarding delays, ongoing support, internal resource strain, and even opportunity costs.

Some providers now offer 12-day onboarding guarantees with no delays and no exceptions, completely changing the economics of partner expansion.

The 5-Day Onboarding Framework: Implementation Roadmap

Companies achieving rapid onboarding follow a consistent pattern. They've standardized their approach and eliminated the variables that cause delays.

Day 1: Instant Requirements Validation Pre-configured templates eliminate the requirements gathering phase. Standardized templates reduce the setup time for new partners and ensure that all necessary information is in one place. Templates ensure consistency and compliance with EDI standards, as well as provide a single source of truth for things like EDI IDs and AS2 IDs.

Days 2-3: Automated Mapping and Configuration Integration assistance makes EDI data mapping simple by consolidating trading partner's inbound unique requirements into one format which includes a super-set of all the data you will receive. This enables developers to integrate back end systems once to an API, consuming data from all trading partners in a common format.

Day 4: Parallel Testing Instead of sequential testing phases, modern platforms run validation tests in parallel. Automating validation processes reduces errors and ensures smooth transactions.

Day 5: Production Deployment With automated validation complete, production deployment becomes a simple switch activation rather than a complex migration.

Companies like Cargoson, along with Cleo and TrueCommerce, have built their platforms around this accelerated framework. Using no-code solution and an extensive AI-powered network of pre-configured connections, you can accelerate growth and streamline your business by onboarding new trading partners in hours.

Measuring Success: KPIs and Performance Monitoring for EDI Onboarding

You can't optimize what you don't measure. Leading companies track specific metrics to ensure their onboarding process stays on track.

Time-to-Revenue Metrics: Track the days from contract signature to first successful transaction. Efficient EDI onboarding means accelerating time-to-revenue.

Onboarding Velocity: Tracking the duration and costs of the onboarding process is essential for assessing its efficiency. Successful EDI onboarding should be completed within the established timeline and budget. If there are delays or cost overruns, businesses can refine their approach for future partnerships.

Error Rates and Data Accuracy: Post-onboarding, it's essential to monitor data accuracy to ensure that the system continues to operate smoothly. Tracking error rates and resolving discrepancies quickly is critical to maintaining the integrity of the data exchange process.

Partner Satisfaction Scores: Survey partners about their onboarding experience. Companies with 5-day onboarding processes typically see satisfaction scores 40-60% higher than those with traditional timelines.

Modern platforms provide real-time visibility into these metrics. Monitoring and reporting tools provide insights into transaction statuses, allowing businesses to track documents, identify errors, and manage exceptions in real-time.

Future-Proofing Your Onboarding Process: 2025 Trends and Preparation

The onboarding landscape continues to evolve rapidly. As we move into 2025, businesses are embracing the future of seamless digital communication by modernizing their EDI processes. From automation and API integration to enhanced security with blockchain, key EDI trends are revolutionizing supply chain management.

AI-Powered Onboarding: Artificial Intelligence (AI) and Machine Learning (ML) are being utilized to enhance data accuracy within EDI systems. These technologies can detect and correct data anomalies, provide predictive analytics, and optimize workflows.

API-First Integration: The integration of Application Programming Interfaces (APIs) with EDI systems is enabling real-time data exchange, enhancing transparency and responsiveness across supply chain networks. This development ensures that information flows seamlessly between systems.

Cloud-Native Scalability: The adoption of cloud-based EDI solutions is providing businesses with greater flexibility and scalability. These platforms facilitate easier integration with various enterprise systems, support multi-channel communications, and enable rapid onboarding of trading partners.

Companies positioning themselves for future success are investing in platforms that support these emerging capabilities. Solutions from Cargoson, Orderful, and Cleo are already incorporating many of these features, giving early adopters a competitive advantage.

The message is clear: the days of month-long EDI onboarding processes are numbered. Companies that cling to outdated approaches will find themselves at an increasing disadvantage as competitors leverage automation to expand their partner networks faster and more cost-effectively. The question isn't whether to modernize your onboarding process—it's how quickly you can implement the changes needed to stay competitive.