The Blockchain-EDI Convergence Revolution: How Smart Contracts and Immutable Ledgers Are Solving the $2.3 Trillion Supply Chain Trust Crisis in 2025

Your EDI system processes thousands of purchase orders, invoices, and shipping notices daily. But when a $2.3 trillion supply chain trust crisis hits your trading partner network, those traditional point-to-point connections suddenly feel fragile. The EDI market is projected to reach $74.36 billion by 2031, yet fraud, document tampering, and multi-party visibility gaps continue plaguing even the most sophisticated implementations.

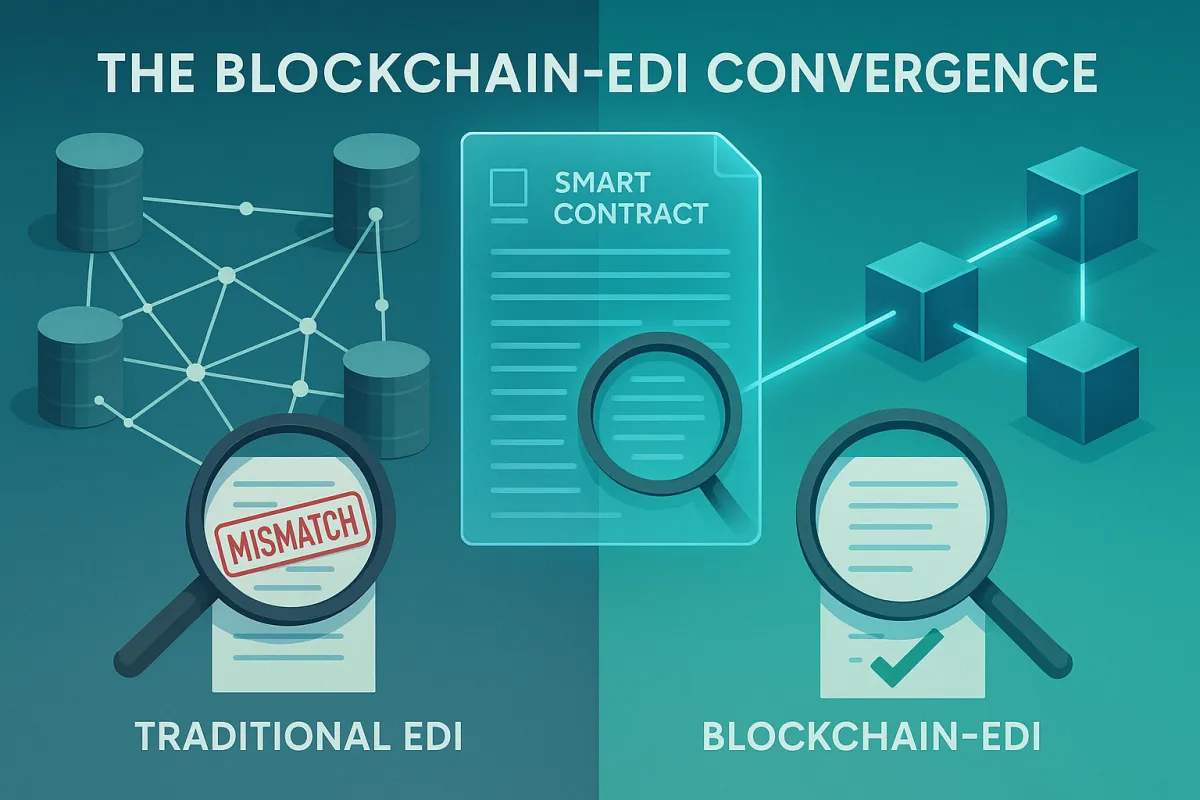

Enter blockchain technology. Not as an EDI replacement, but as the missing verification layer that transforms your existing blockchain EDI integration into an audit trail no one can manipulate.

The Trust Crisis Plaguing Modern EDI Systems

You know the scenario. A shipping container arrives at port, but the bill of lading doesn't match the purchase order. The EDI 856 Advanced Ship Notice claims 1,000 units, but only 800 appear in inventory. Traditional EDI networks handle these discrepancies through lengthy exception processes and manual verification calls.

The problem isn't the EDI standards themselves. EDIFACT, X12, and TRADACOMS work perfectly for structured data exchange. The weakness lies in the sequential, point-to-point architecture. When Company A sends an EDI 850 Purchase Order to Company B, Company C (the logistics provider) and Company D (the customs broker) operate in information silos.

Container fraud alone costs the global supply chain an estimated $52 billion annually. Document tampering adds another layer of risk. Your EDI transactions travel through multiple intermediary systems, each representing a potential manipulation point.

Consider automotive supply chains, where a single vehicle contains parts from 200+ suppliers across six continents. When a quality issue surfaces, tracing the problem backward through traditional EDI logs becomes an exercise in connecting disparate data islands. Each supplier maintains their own records, with no shared source of truth.

Why Blockchain Provides the Verification Layer EDI Never Had

Blockchain doesn't replace your EDI infrastructure. According to SEEBURGER's analysis, blockchain forms the foundation for optimized EDI processes by adding immutable verification to existing message flows.

Here's what changes: When your EDI system generates an 850 Purchase Order, the blockchain layer creates a cryptographic hash of the essential data elements. Order number, quantities, delivery dates, and terms become part of an immutable ledger entry. Your trading partners can verify this information without accessing your internal systems.

The transparency benefits multiply across complex supply networks. Instead of bilateral EDI connections, you create a consortium blockchain where authorized parties view relevant transaction histories. The pharmaceutical industry particularly benefits from this approach, where drug serialization requirements demand end-to-end traceability.

Smart contracts add automation capabilities your current EDI workflows lack. When goods arrive at a distribution center, IoT sensors trigger automatic EDI 856 generation. The blockchain verifies the shipment details against the original purchase order before releasing payment authorization. No human intervention required for routine transactions.

Multi-Party Consensus Eliminates Information Asymmetry

Traditional EDI creates information imbalances. The buyer knows their purchase orders, the supplier knows their production schedules, but the logistics provider operates with limited visibility into either dataset. Blockchain consensus mechanisms ensure all authorized parties share the same transaction history.

This shared ledger approach particularly benefits complex manufacturing scenarios. When BMW sources brake components from Brembo, ships them via Kuehne + Nagel, and processes customs through multiple intermediaries, blockchain provides a single source of truth for all parties.

Technical Architecture for Blockchain-Enabled EDI Systems

The integration architecture preserves your existing EDI investments while adding blockchain verification layers. Most implementations use hybrid models where EDI handles the bulk data transfer, and blockchain manages critical data points and verification hashes.

IBM Sterling B2B Integrator now includes blockchain modules that automatically generate ledger entries for high-value transactions. As EDI Academy notes, only the data relevant to solving trust problems gets written to the blockchain, keeping transaction costs manageable.

Smart contracts written in Solidity or Chaincode can parse EDI message segments and enforce business rules automatically. When an EDI 810 Invoice references a blockchain-verified purchase order, the smart contract validates quantities, pricing, and terms before flagging discrepancies.

API orchestration becomes necessary for connecting traditional EDI networks with blockchain layers. RESTful APIs convert EDI flat files into JSON structures suitable for blockchain transactions. The reverse process reconstructs EDI messages from blockchain data for legacy system compatibility.

Data Architecture Considerations

Not every EDI element belongs on the blockchain. Transaction fees and storage limitations require selective data inclusion. Most implementations focus on:

- Transaction identifiers (PO numbers, invoice numbers, shipment IDs)

- Quantity and pricing information

- Critical dates (ship dates, delivery commitments)

- Party identifications and authorizations

- Document hashes for integrity verification

Detailed product descriptions, shipping instructions, and other verbose EDI segments remain in traditional systems, referenced through blockchain pointers.

Implementation Success Stories and ROI Analysis

Pharmaceutical giant Merck implemented blockchain verification for their EDI-based drug serialization processes. Before blockchain, verifying authenticity across their 200+ distributor network required manual spot checks and reactive investigations. The blockchain implementation reduced verification time from weeks to minutes while eliminating counterfeit infiltration.

The quantified results: 78% reduction in compliance audit costs, 45% faster dispute resolution, and zero confirmed counterfeit incidents in blockchain-verified supply chains. Implementation cost $2.3 million over 18 months, with annual savings exceeding $8.7 million.

Automotive supplier networks show similar benefits. When Tier 1 suppliers implement blockchain verification for their EDI 862 Planning Schedule transactions, OEMs gain real-time visibility into production capacity constraints. Ford's pilot program reduced supply disruption incidents by 34% within the first six months.

The financial services sector sees immediate fraud reduction benefits. Trade finance operations using blockchain-verified EDI documents report 67% fewer fraudulent letter of credit presentations. Processing times dropped from 7-10 days to 2-3 days for routine transactions.

Cost-Benefit Framework for Different Company Sizes

Mid-market companies ($50-500M revenue) typically see 18-24 month payback periods when focusing on high-risk trading relationships. The implementation approach emphasizes partner-specific pilots before network-wide rollouts.

Enterprise implementations ($1B+ revenue) justify costs through operational efficiency gains and regulatory compliance improvements. Risk mitigation benefits often exceed direct ROI calculations, particularly for companies operating in highly regulated industries.

Overcoming Critical Implementation Barriers

Legacy system integration represents the biggest technical hurdle. Your existing EDI infrastructure wasn't designed for blockchain connectivity. Most successful implementations use middleware approaches that preserve current EDI workflows while adding blockchain verification as a parallel process.

Scalability concerns affect public blockchain implementations. Ethereum's current throughput limitations make it unsuitable for high-volume EDI environments. Private or consortium blockchains offer better performance characteristics, with transaction costs under $0.01 per verification.

Trading partner resistance creates organizational challenges. Your suppliers invested heavily in their current EDI capabilities and view blockchain requirements as additional compliance burdens. Phased rollouts that demonstrate value before mandating participation improve adoption rates significantly.

Regulatory and Privacy Considerations

GDPR compliance requires careful attention to personal data handling within blockchain structures. Most implementations use data minimization techniques, storing only business-relevant information on the blockchain while maintaining personal data in traditional, deletable systems.

Industry-specific regulations add complexity. FDA requirements for pharmaceutical traceability align well with blockchain capabilities, while financial services face additional anti-money laundering considerations that affect implementation approaches.

Strategic Roadmap From Pilot to Production

Start with your highest-risk, highest-value trading relationships. Identify suppliers or customers where transaction disputes occur frequently or where fraud risk justifies additional verification costs. These scenarios provide clear value demonstration for broader rollouts.

Select blockchain platforms based on your integration requirements rather than technology novelty. Hyperledger Fabric offers enterprise-grade privacy controls and integration capabilities. R3 Corda specializes in financial services applications. Ethereum provides the largest developer ecosystem but requires careful scalability planning.

Transportation management systems are already preparing for blockchain integration. Forward-thinking solutions like Cargoson, alongside established players like MercuryGate and Descartes, are developing blockchain-ready APIs that complement their existing EDI capabilities.

Trading partner onboarding requires careful change management. Create incentive structures that reward early adoption rather than penalizing resistance. Shared cost models where blockchain benefits reduce overall network costs help justify participation to reluctant partners.

Technical Implementation Phases

Phase one focuses on read-only blockchain integration. Your existing EDI processes continue unchanged, while blockchain provides additional audit trails and verification capabilities. This approach minimizes disruption while demonstrating value.

Phase two introduces smart contract automation for routine transactions. Purchase order acknowledgments, shipping confirmations, and invoice validations can execute automatically when blockchain conditions are met.

Phase three enables full multi-party workflows where blockchain consensus replaces traditional EDI acknowledgment processes. This phase requires the highest level of trading partner coordination but provides maximum efficiency benefits.

Preparing for the Blockchain-Enabled Supply Chain Future

Industry predictions for 2025 indicate blockchain will become a vital component of transparent supply chains, with end-to-end fraud reduction as the primary driver. Companies that build blockchain-EDI integration capabilities now position themselves advantageously for regulatory changes and competitive requirements.

Regulatory evolution will likely mandate blockchain verification for specific industries and transaction types. The European Union's proposed supply chain due diligence directive includes transparency requirements that align perfectly with blockchain capabilities.

Internal capability development requires cross-functional team building. Your EDI specialists need blockchain knowledge, while your blockchain developers must understand supply chain requirements. According to HubBroker's analysis, companies succeeding with blockchain-EDI integration invest heavily in training programs that bridge these knowledge gaps.

Managed service providers are developing blockchain-as-a-service offerings that reduce implementation complexity for mid-market companies. These services handle the technical blockchain infrastructure while preserving your existing EDI workflows and trading partner relationships.

The competitive advantages extend beyond operational efficiency. Companies with blockchain-verified supply chains can offer enhanced transparency to their customers, command premium pricing for validated authenticity, and access new markets with stringent compliance requirements.

Your next step involves identifying pilot scenarios within your current trading partner network. Focus on relationships where trust issues create operational friction or where regulatory requirements demand enhanced traceability. The convergence of blockchain and EDI isn't replacing your current infrastructure, but it's enhancing its reliability and extending its capabilities in ways that traditional EDI alone cannot achieve.