The Critical EDI Integration Ecosystem Fragmentation Crisis: Your 2025 Framework to Unify Disconnected Systems and Unlock AI-Powered Automation

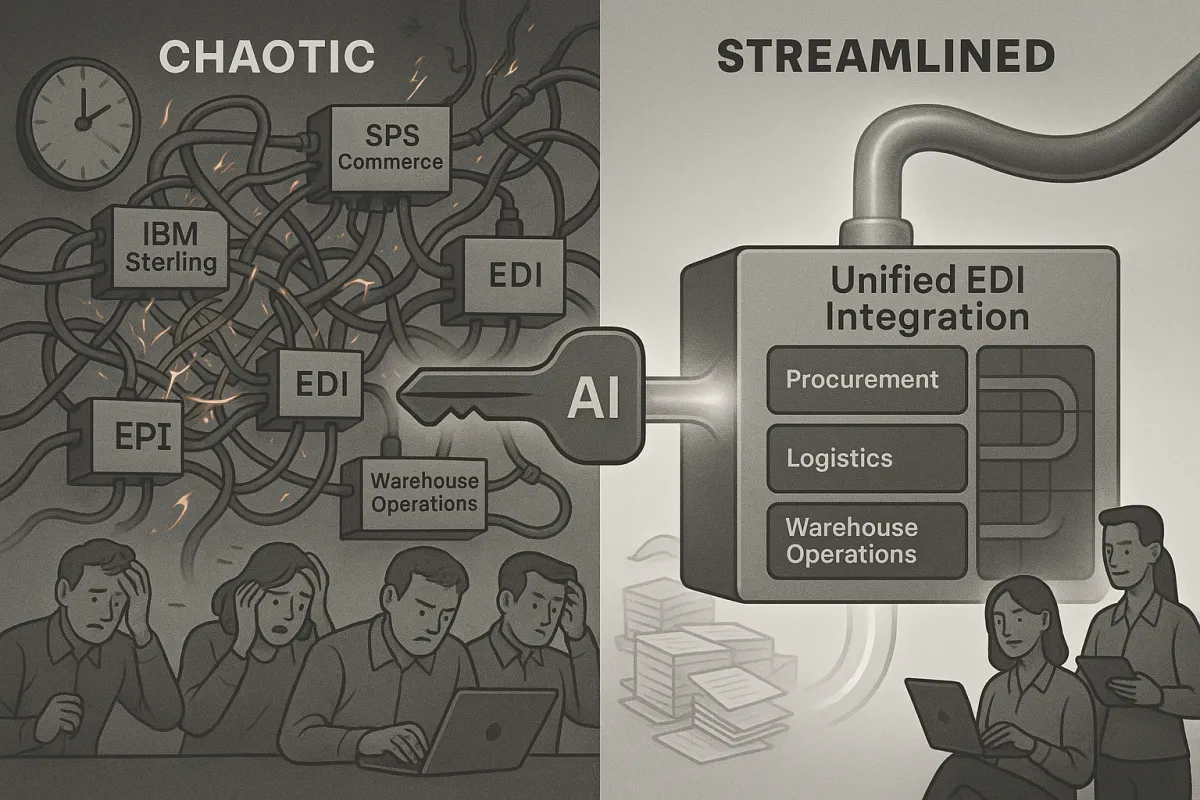

Your enterprise processes 50,000 EDI transactions monthly across six different systems, yet your procurement team still manually reconciles discrepancies between purchase orders in your ERP and shipping notifications in your TMS. This scenario plays out daily in organizations where EDI integration ecosystem fragmentation has created data silos that block automation and drain resources.

The problem runs deeper than most IT leaders realize. When trading partners send the same purchase order data to multiple disconnected systems within your organization, each system interprets and stores that information differently. The result? Your warehouse management system shows different inventory levels than your ERP, your transportation management system can't automatically match shipments to orders, and your finance team spends hours reconciling invoices that should match automatically.

The Hidden Cost of EDI Ecosystem Fragmentation

McKinsey research shows that enterprise data fragmentation costs large organizations an average of $3.1 million annually in processing delays and manual interventions. For EDI-heavy industries like automotive and retail, these costs multiply rapidly when trading partner data flows into isolated systems that don't communicate effectively.

Consider a typical automotive supplier managing relationships with Ford, GM, and Toyota. Each OEM sends purchase orders, shipping schedules, and invoices through EDI, but your organization processes these transactions across different platforms. Ford's data enters through your legacy IBM Sterling connection, GM's through SPS Commerce, and Toyota's through a custom API integration. When a quality issue requires tracking components across all three suppliers, your quality team manually aggregates data from three separate systems.

The manual effort here represents just the visible cost. Hidden beneath are missed automation opportunities, delayed supplier payments due to invoice matching delays, and the inability to provide real-time visibility to trading partners who increasingly expect instant status updates.

Modern unified platforms like Descartes, Cargoson, and Blue Yonder address these challenges through consolidated integration architectures, but many enterprises remain locked into fragmented approaches due to historical technology decisions and departmental boundaries.

The Root Causes: Why Modern Enterprises Have Multiple EDI Islands

Most EDI fragmentation barriers originate from organizational structure rather than technical limitations. Your procurement department implemented EDI through the ERP system five years ago. Meanwhile, logistics chose a TMS with built-in EDI capabilities to handle freight matching. Warehouse operations selected a WMS that processes ASNs directly from suppliers. Each decision made sense individually, but collectively they created data islands.

Acquisitions compound this fragmentation. When your company acquired a regional competitor last year, they brought their own EDI infrastructure built on different standards and connected to different trading partners. Rather than undertaking a complex migration, most organizations simply maintain parallel systems. The result? You now have two separate EDI environments processing similar transaction types with no data sharing between them.

Vendor-specific implementations create additional barriers. Recent analysis shows that 67% of enterprises use multiple EDI providers because each business unit selected solutions that best fit their specific needs. Your finance team uses one provider for invoice automation, logistics uses another for transportation planning, and procurement relies on a third for supplier onboarding.

The Standards Proliferation Problem

Here's what most people miss about EDI standards: calling them "standardized" is misleading. A single purchase order transaction varies significantly between trading partners, even when both use X12 850 standards. Walmart's version includes specific fields for sustainability metrics that don't appear in Amazon's implementation. Ford requires component traceability data in their purchase orders that Toyota handles through separate ASN transactions.

This EDI standards fragmentation forces organizations to maintain partner-specific mappings and validation rules. Your integration team spends weeks configuring each new trading partner connection, testing their specific flavor of supposedly standard transactions. When you multiply this effort across hundreds of suppliers, the complexity becomes unmanageable.

The proliferation extends beyond transaction formats to communication protocols. Some partners still require AS2 connections, others use SFTP, and newer partners prefer REST APIs. Modern ecosystem integration approaches recognize this reality by supporting multiple protocols simultaneously rather than forcing standardization.

The AI Integration Barrier: How Fragmentation Blocks Intelligence

Artificial intelligence promises to transform supply chain operations through predictive analytics, automated decision-making, and intelligent exception handling. However, AI systems require comprehensive data access to generate meaningful insights. Fragmented EDI ecosystems prevent AI from accessing the complete picture needed for intelligent automation.

Consider demand forecasting across multiple trading partners. AI algorithms need historical order patterns, delivery performance data, inventory levels, and market conditions to generate accurate predictions. When this information exists across six different systems with varying data formats and update frequencies, AI systems can't synthesize comprehensive insights.

The data quality challenges multiply in fragmented environments. Your ERP shows 500 units of product X in inventory, your WMS reports 485 units, and your trading partner portal displays 520 units. AI algorithms trained on this inconsistent data produce unreliable recommendations, leading teams to disable automated features and revert to manual processes.

Leading TMS providers like nShift, Alpega, and Cargoson solve this by creating unified data lakes that consolidate information from multiple EDI sources, providing AI systems with consistent, real-time data access across the entire trading partner ecosystem.

The Modern Solution: Ecosystem Integration Architecture

Traditional EDI implementations follow an "inside-out" approach, extending your internal systems to accommodate trading partner connections. Unified EDI platforms reverse this model, creating an external integration layer that connects multiple internal systems to diverse trading partners through a single point of control.

Ecosystem integration architecture recognizes that modern businesses need both EDI and non-EDI connectivity. Your largest suppliers may prefer traditional X12 transactions, emerging partners might use REST APIs, and marketplace connections require platform-specific formats. Rather than maintaining separate integration paths for each approach, unified platforms like Transporeon, Blue Yonder, and Cargoson provide multi-protocol connectivity through a single management interface.

This approach delivers immediate benefits for enterprise data integration efforts. Trading partner data flows into a centralized hub where it's normalized, validated, and distributed to appropriate internal systems. Your procurement team sees real-time purchase order status regardless of whether suppliers use EDI or APIs. Warehouse operations receive standardized ASN data even when suppliers send information in different formats.

The architecture also enables new capabilities like cross-partner analytics and automated exception handling. When a supplier's delivery performance drops below acceptable levels, the system can automatically identify alternative sources and suggest purchase order adjustments, drawing data from across your entire trading partner network.

The Hybrid EDI-API Framework

While API adoption accelerates across industries, EDI remains essential for established trading relationships. Major retailers like Walmart and Target continue requiring EDI for core transactions while simultaneously offering API access for newer capabilities. Successful organizations implement hybrid connectivity strategies that support both approaches seamlessly.

The implementation roadmap for unified connectivity starts with mapping your current integration landscape. Document which trading partners use which protocols, identify data overlaps between systems, and prioritize connections based on transaction volume and business impact. Most organizations discover they can consolidate 70% of their EDI traffic through a single platform while maintaining specialized connections only where truly necessary.

Modern platforms handle protocol translation automatically. A supplier sends an X12 856 ASN through traditional EDI, the platform converts it to JSON format and delivers it to your warehouse management system via REST API. Your internal systems receive data in their preferred format while trading partners continue using their established processes.

Your 2025 Implementation Roadmap

Start with a comprehensive assessment of your current EDI ecosystem challenges. Map every trading partner connection, document which systems handle which transaction types, and identify where manual processes compensate for integration gaps. Most enterprises discover integration blind spots they didn't know existed.

Create a prioritization matrix based on transaction volume, business impact, and technical complexity. High-volume, low-complexity connections offer quick wins, while complex, high-impact integrations require longer-term planning. Focus initial efforts on consolidating similar transaction types across multiple trading partners rather than attempting complete system overhauls.

Consider platform options that match your organization's technical capabilities and growth plans. SAP TM and Oracle TM provide comprehensive capabilities for large enterprises with dedicated integration teams. Modern solutions like FreightPOP, Shiptify, and Cargoson offer faster implementation for organizations prioritizing time-to-value over extensive customization.

Plan for phased migration rather than big-bang replacements. Industry analysis shows that phased approaches reduce implementation risk by 60% while maintaining business continuity throughout the transition.

Establish data governance standards early in the process. Define how master data synchronization will work across systems, establish data quality metrics, and create processes for handling exceptions and discrepancies. These standards become more critical as integration scope expands.

Measuring Success: KPIs for Unified EDI Ecosystems

Integration velocity provides the clearest measure of ecosystem consolidation success. Track how quickly you can onboard new trading partners and implement new transaction types. Unified platforms should reduce new partner setup time from weeks to days, with some connections achievable in hours for standard transaction types.

Data consistency metrics reveal integration quality improvements. Monitor discrepancy rates between systems, track how often manual reconciliation becomes necessary, and measure time-to-resolution for data quality issues. Successful ecosystem integration should reduce manual data reconciliation by 80% or more within six months.

Automation rates indicate whether unified data access enables new capabilities. Measure the percentage of transactions processed without human intervention, track exception handling automation, and monitor how often AI-driven recommendations get accepted. These metrics demonstrate whether ecosystem integration delivers operational improvements beyond just technical consolidation.

Calculate ROI by combining hard savings from reduced manual effort with soft benefits like improved customer service and faster partner onboarding. Recent studies indicate that ecosystem integration typically delivers 200-300% ROI within 18 months through combination of direct cost savings and new business capabilities.

Your next step? Audit your current integration landscape this week. Map where trading partner data enters your organization, identify the manual processes that compensate for integration gaps, and calculate the true cost of maintaining fragmented systems. The business case for unified EDI ecosystems typically becomes compelling once you quantify these hidden costs accurately.