The Critical Web EDI Scalability Crisis: How to Recognize When Your Portal-Based EDI System Has Become a Growth Bottleneck and Your Step-by-Step Migration Framework to Full TMS Integration in 2026

Web EDI portals seemed like a practical compromise when retailers mandated electronic data interchange in the 2010s. Supply chain teams could log into browser-based portals, manually process purchase orders, and satisfy compliance requirements without expensive software implementations.

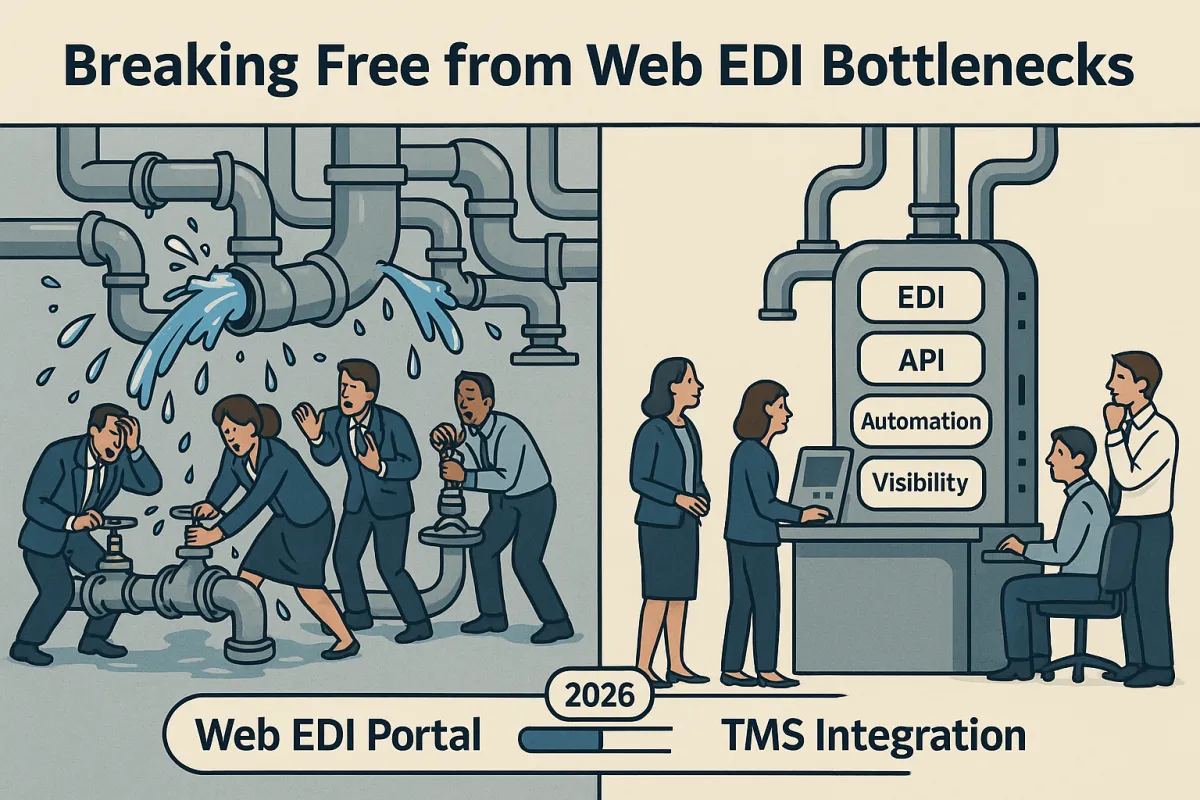

But those manual workarounds are now creating unexpected bottlenecks as volumes increase and operations become more complex, businesses need orchestration—bringing EDI, APIs, automation, and visibility together in one platform. Companies that started with simple Web EDI solutions find themselves trapped in labor-intensive processes that can't scale with modern supply chain demands.

The Hidden Web EDI Trap That's Limiting Growing Businesses in 2026

The problem is straightforward: Web EDI typically requires suppliers to manually input data into a retailer's portal, creating a labor-intensive process that contradicts the core purpose of EDI—automation. What began as a quick compliance fix becomes a scalability nightmare when order volumes exceed manual processing capacity.

Consider a manufacturer processing 500 orders monthly through multiple retailer portals. Each purchase order requires manual data entry, order acknowledgment creation, advance ship notice preparation, and invoice submission. Staff spend hours daily switching between different portal interfaces, re-keying order details, and manually tracking compliance deadlines.

While straightforward, the basic web EDI portal requires significant manual data entry for high-volume suppliers, limiting automation benefits. The situation worsens when you factor in error correction, chargeback disputes, and the time spent training staff on multiple portal systems.

Major EDI providers like Cleo and SPS Commerce have recognized this limitation, with Cleo noting that as volumes increase and operations become more complex, businesses need orchestration—bringing EDI, APIs, automation, and visibility together in one platform. Solutions like Cargoson's TMS platform offer integrated EDI capabilities that eliminate portal switching by connecting directly with ERP and WMS systems.

Why Retailers Push Web EDI (But It's Not Built for Your Growth)

Retailers mandate EDI adoption primarily to streamline their own operations. By enforcing Web EDI portals, they ensure structured data exchange, reduce invoice discrepancies, and accelerate order fulfillment. However, this is beneficial for retailers, it often places a disproportionate burden on suppliers.

The retailer's perspective makes sense: standardized electronic documents reduce processing costs, improve inventory visibility, and enable automated matching of purchase orders with invoices. But suppliers bear the operational cost of manual portal management while retailers capture the efficiency benefits.

This creates a fundamental mismatch between retailer expectations and supplier operational reality. Retailers assume EDI means automation, but many suppliers remain stuck with manual processes that become more burdensome as business scales.

The 5 Critical Scalability Breaking Points: When Web EDI Becomes Your Bottleneck

Web EDI scalability issues become apparent at predictable volume thresholds. Based on industry analysis, here are the critical breaking points:

Volume Threshold: 1,000+ orders monthly

Manual portal processing becomes unsustainable when staff spend more than 50% of their time on data entry. Error rates increase, compliance deadlines get missed, and chargebacks accumulate.

Multi-Channel Complexity

Dropshipping, marketplace channels, and 3PL operations add coordination layers that portal-based systems struggle to manage. Each channel requires different data formats, timing requirements, and compliance rules.

Integration Gaps: ERP Disconnection

Manual data entry: Web portals often require suppliers to re-key orders, invoices, and shipping notices, leading to human errors and wasted labor hours. Without direct ERP integration, order information gets entered multiple times, creating accuracy problems and inventory discrepancies.

Trading Partner Proliferation

Managing 10+ retailer relationships through separate portals becomes unmanageable. Each portal has different interfaces, document requirements, and submission deadlines.

Visibility Limitations

Portal-based systems provide limited end-to-end visibility. You can see individual transaction status but lack comprehensive supply chain analytics needed for strategic decision-making.

The Real-Time Data Crisis: When Batch Processing Breaks Modern Supply Chains

Without real-time data exchange, suppliers may experience delays in order processing, leading to stock shortages and fulfillment issues. Modern customers expect instant order updates, inventory visibility, and delivery tracking – capabilities that batch-processed portal systems can't deliver.

The competitive disadvantage becomes clear when comparing portal-based operations with integrated EDI systems. API-first foundation enables real-time document exchange, automated validation, and seamless integration with existing systems, while portals operate on outdated batch processing models.

Real-time processing enables automatic inventory updates, instant order confirmations, and immediate exception handling. Portal-based systems typically process data in daily or hourly batches, creating delays that compound throughout the supply chain.

TMS Integration vs. Web EDI: The Complete Cost-Benefit Analysis Framework

The true cost of Web EDI extends far beyond subscription fees. While Web EDI fulfills retailer mandates, it often leaves suppliers burdened with manual processes, inefficiencies, and hidden costs. Here's how to calculate your actual costs:

Web EDI Hidden Costs:

- Staff time: 2-4 hours daily for portal management at mid-volume operations

- Error correction: 10-15% of transactions require manual intervention

- Compliance penalties: Many retailers impose chargebacks for EDI non-compliance, and suppliers using Web EDI are more susceptible to these penalties due to manual errors

- Training costs: New staff require 2-3 weeks to learn multiple portal systems

- Opportunity costs: Staff time diverted from strategic activities

TMS-integrated EDI systems like those offered by Orderful, Cleo Integration Cloud, and Cargoson eliminate most manual processing through direct system integration. This powerful combination ensures real-time data exchange, eliminates manual errors, enhances data accuracy, improves transaction speeds, and optimizes transportation logistics.

The Hidden Labor Tax: Calculating Your True Web EDI Costs

Most companies underestimate Web EDI operational costs because labor expenses are distributed across multiple staff members and aren't tracked as EDI-specific costs. A typical mid-sized supplier processes 2,000 orders monthly across 5 major retailers.

Manual processing breakdown:

- Order processing: 15 minutes per order × 2,000 orders = 500 hours monthly

- ASN creation and submission: 10 minutes per shipment

- Invoice preparation and portal submission: 5 minutes per invoice

- Error resolution and chargeback management: 20+ hours monthly

- Training and system management: 10 hours monthly

At $25/hour loaded labor costs, this represents $15,000+ monthly in hidden EDI processing costs – often exceeding the total cost of integrated EDI-TMS solutions.

The Strategic Migration Decision Matrix: Build vs. Buy vs. Hybrid Approaches

Migration decisions require evaluating your current architecture, trading partner requirements, and growth trajectory. Choosing the right electronic data interchange platform is less about feature checklists and more about fit with your architecture, trading-partner landscape, and modernization goals.

TMS-Integrated EDI (Recommended for Growth)

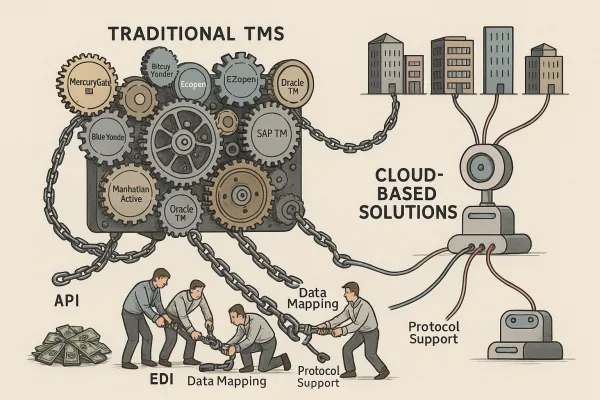

Platforms like Cleo Integration Cloud, Orderful, and Cargoson provide end-to-end automation. Direct API/EDI integrations with carriers across all transport modes (FTL, LTL, parcel, air, and sea freight), allowing you to compare rates, book shipments, and track imports and deliveries from a single platform.

Standalone EDI Platforms

Traditional EDI providers like TrueCommerce and SPS Commerce offer comprehensive document management but require separate TMS solutions for transportation optimization.

ERP-Integrated EDI

Organizations often consolidate EDI with peripheral systems of record, such as an ERP or TMS. These consolidations can lead to significant shortcomings and unintended consequences. ERP-embedded EDI often lacks the specialized features needed for complex supply chain operations.

The Vendor Lock-in Risk: Why TMS-Independent EDI May Be Your Best Strategy

One major migration risk involves EDI systems tightly coupled with specific TMS or ERP platforms. If EDI is bundled inside core ERP, businesses may not be able to seamlessly process EDI for WMS or TMS, such as 940s, 204s, or 214s.

When switching TMS providers, tightly integrated EDI systems create migration challenges affecting 100-200 trading partners and 400-500 transaction maps. Independent EDI platforms maintain trading partner connections during TMS transitions, reducing implementation risks.

The EDI software market is large but a lot of players are not innovative; especially integrated EDI solutions inside ERPs, TMSs, and WMSs. For ERP, TMS, and WMS providers, it would not be a worthwhile investment to innovate their EDI modules as it is not their main service, capability, or function.

Implementation Roadmap: From Web EDI Portal to Full Integration in 90 Days

Successful EDI-TMS migration follows a proven methodology that minimizes disruption while maximizing automation benefits. Based on successful implementations, here's the practical roadmap:

Phase 1: Assessment (Days 1-14)

- Assess Current EDI Processes – Identify bottlenecks and inefficiencies in existing Web EDI workflows

- Document trading partner requirements and transaction volumes

- Map current manual processes and time allocations

- Identify ERP/WMS integration points

Phase 2: Platform Selection & Setup (Days 15-45)

- Choose the Right EDI Solution – Opt for an EDI provider that offers direct integration with your ERP, WMS, or other back-end systems

- Configure trading partner connections

- Set up document templates and mapping rules

- Establish communication protocols

Phase 3: Testing & Validation (Days 46-75)

- Test and Optimize – Conduct rigorous testing to ensure seamless data flow and make refinements as needed

- Parallel processing with existing portals

- Trading partner certification

- Performance validation

Phase 4: Rollout & Optimization (Days 76-90)

- Train Staff and Monitor Performance – Educate teams on the new automated processes and continuously track performance metrics to maximize ROI

- Gradual portal deactivation

- Performance monitoring and optimization

- Process refinement based on initial results

Modern TMS platforms like Cargoson enable rapid trading partner onboarding through pre-built API and EDI integrations that significantly compress traditional implementation timelines.

Critical Success Factors: Avoiding the 73% Implementation Failure Rate

Industry research shows that 73% of EDI implementations face significant delays or require scope reduction. Common failure points include:

Technical Complexity Underestimation

Integrating EDI with TMS can be technically challenging, especially for organizations with outdated systems or limited IT resources. Businesses may need to invest in middleware solutions to bridge the gap between legacy systems and modern EDI requirements.

Trading Partner Coordination

Successful implementations require coordinated testing with multiple trading partners. Allow 2-4 weeks per major trading partner for certification processes.

Change Management Resistance

Employees may resist adopting new technologies due to fear of the unknown or concerns about job security. It is essential to address these concerns through effective communication and training.

Insufficient Testing

Surging transaction volumes, complex transformations and large EDI documents can cause bottlenecks and challenge integrations. Addressing such questions up front, and following up with rounds of load testing, help highlight bottlenecks before they impact business workflows.

The most successful implementations involve dedicated project teams, executive sponsorship, and clear communication about automation benefits rather than job displacement. For suppliers to fully capitalize on EDI and achieve a meaningful ROI, full integration with their back-end systems is imperative. By investing in a truly automated EDI solution, suppliers can enhance efficiency, reduce costs, and position themselves for scalable growth.

Companies experiencing Web EDI scalability bottlenecks should evaluate integrated TMS-EDI platforms that eliminate manual portal management while maintaining all trading partner relationships. The investment in automated EDI processing typically pays for itself within 6-12 months through reduced labor costs and improved compliance performance.