The Digital Twin-EDI Integration Cost Analysis Framework: Hidden Implementation Expenses, ROI Calculations, and Decision Criteria for Supply Chain Professionals in 2025

When most supply chain professionals think about digital twin implementations, they estimate a cost range somewhere between $300,000 and $800,000. They're wrong by about 400%. Here's why digital twin development costs can vary between $45,000 to $65,000 for basic implementations, but complex supply chain integrations with EDI systems actually require budgets closer to $3 million to $4.2 million, with ongoing operational expenses that most CFOs never see coming.

The disconnect starts with how companies view this technology. The digital twin market was valued at USD 12.91 billion in 2023 and is expected to reach USD 259.32 billion by 2032, representing a compound annual growth rate (CAGR) of 39.8%. Yet the high cost of implementation poses a significant challenge, with resource-intensive development requiring integration of IoT sensors, data analytics, and simulation software, plus training personnel and maintaining these systems, creating additional costs that can be particularly challenging for small- and medium-sized enterprises.

Understanding the True Architecture: What Digital Twin-EDI Integration Actually Involves

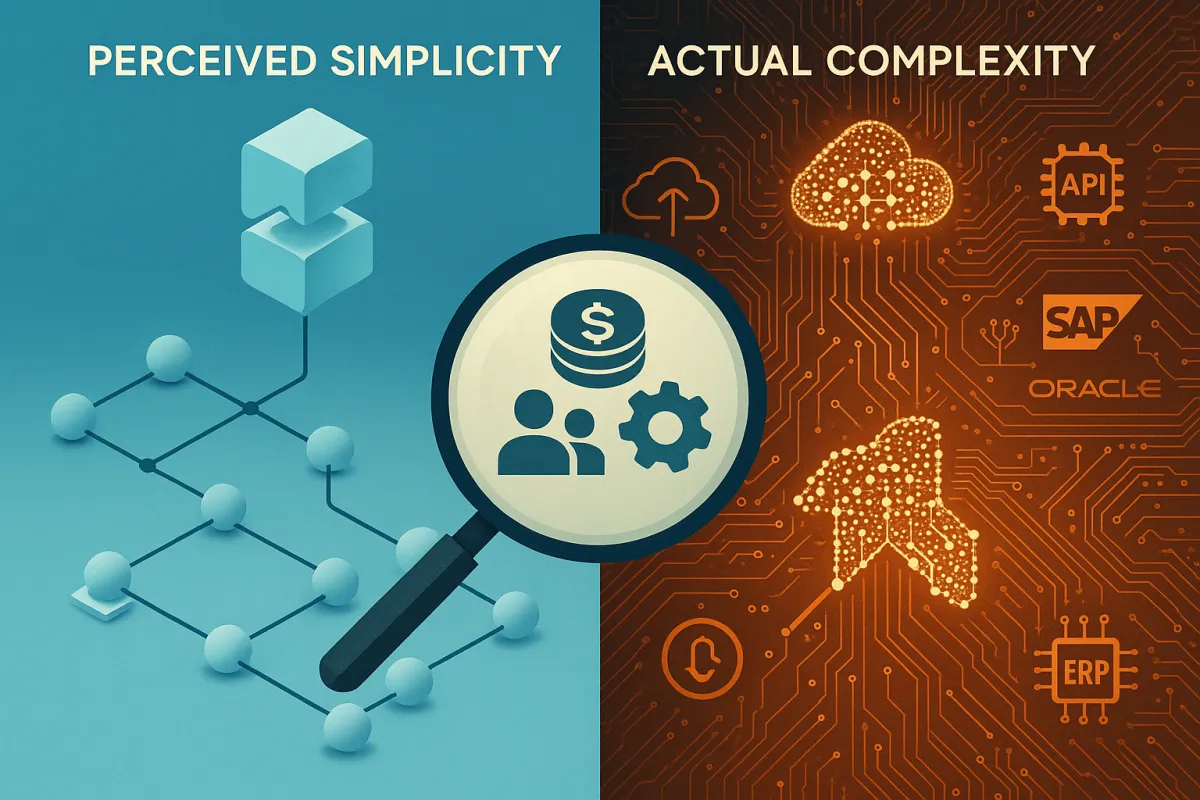

Most companies approach digital twin-EDI integration thinking it's just adding some sensors and connecting APIs. That's like saying brain surgery is just making a small cut. At the core of digital twins lies complex hardware infrastructure, including sensors, IoT devices, and edge computing systems that collect and process real-time data, allowing for digital mirroring of real-world conditions accurately.

The technical stack requires far more than what appears on vendor demo slides. Digital twins are not autonomous systems, and the requirement for seamless integration with current IT and operational technology systems can significantly increase their complexity and expense. You need data validation layers, sensor calibration protocols, middleware solutions that can handle both EDI standards (X12, EDIFACT) and real-time IoT feeds, plus integration points with existing ERP systems like SAP S/4HANA, Oracle Fusion, NetSuite, or Microsoft Dynamics 365.

Core Technology Stack and Dependencies

Cloud computing becomes non-negotiable, not optional. Cloud-based technologies have significant influence on the digital twins market, with technology providers shifting focus to cloud-driven digital twins driven by higher computing needs of industrial operators, manufacturers, and supply chains, offering Virtual Machines (VMs) and containers that ensure computational resources match exactly what the digital twin platform needs.

The integration challenge multiplies when you factor in transport management systems. Companies using Cargoson, MercuryGate, Descartes, or similar TMS platforms discover that their existing EDI workflows weren't designed for the continuous data streams that digital twins generate. Batch EDI and real-time APIs utilize fundamentally different processing techniques, with EDI relying on scheduled batch processing while APIs require on-demand, real-time processing, which can result in performance bottlenecks and inefficiencies as the system struggles to manage conflicting processing requirements.

The Complete Cost Breakdown: Hidden Expenses That Derail Digital Twin-EDI Projects

Here's where finance teams get blindsided. Autodesk offers a 14-day free trial of Tandem, with the software's price being $3425 annually, while Ansys Twin Builder offers a 30-day free trial with limited pricing information, though you can use the platform for a couple of hours for $240. These figures represent software licensing only, before you add infrastructure, integration, and personnel costs.

Infrastructure expenses scale exponentially with complexity. Hardware and sensors are crucial for collecting data in real-time and need to be accurate, dependable, and able to function in the environments to which the asset is exposed, with the kind of sensors and level of necessary monitoring determining the final digital twin price. For a mid-sized distribution center handling 200+ suppliers via EDI, expect sensor deployment costs between $150,000 and $300,000, plus connectivity infrastructure.

Software licensing becomes a moving target. Pricing tiers vary depending on platform credits received - for example, in the premium package, you get 1500 monthly credits for $1.05 a credit, with one credit spending on visualization for one hour. When your digital twin processes real-time EDI transactions from multiple suppliers, those credits disappear faster than expected.

Personnel and Skills Investment

Your existing EDI team can't just pick this up over a weekend. AI systems can detect anomalies and inconsistencies in real-time, ensuring that the data exchanged between partners is accurate and reliable, with improved data quality translating to more accurate B2B transactions, but you need people who understand both traditional EDI mapping and real-time data validation.

Training costs range from $25,000 to $75,000 per team member, depending on their current skill level. Many companies end up hiring specialized talent or engaging managed services providers. Change management becomes another hidden cost, especially when operations teams resist moving from batch processing schedules they've used for decades.

ROI Calculation Framework: Measuring Digital Twin-EDI Integration Value

The ROI calculation gets tricky because benefits emerge at different timelines. Businesses have claimed a 25% decrease in operating expenses when they use digital twins, though the cost can differ significantly based on features, customization, and industry standards. However, this reduction typically takes 18-24 months to materialize.

Quantifiable benefits include reduced processing time for exception handling, improved accuracy in shipment tracking, and predictive maintenance capabilities that prevent costly disruptions. Digital twin software offers powerful analytics tools that allow users to identify trends, predict potential problems, and optimize performance based on data collected from the physical system, with real-time data and insights enabling more informed decisions about everything from maintenance schedules to product design.

Cost avoidance metrics prove harder to measure but carry significant value. When your digital twin predicts a supplier disruption three days before it impacts production, calculating the avoided costs of emergency sourcing, expedited shipping, or production downtime becomes the real ROI driver.

Industry-Specific ROI Considerations

Manufacturing sees the fastest payback, typically 14-18 months, while retail and logistics operations take 24-36 months due to more complex partner ecosystems. Automotive & transport dominated the market with over 21.0% revenue share in 2024, driven by increasing use of digital twin technology thanks to advantages like cost reduction, improved vehicle safety, and higher productivity, supporting manufacturers and operators in making informed decisions on vehicle design, operation, and maintenance while enhancing supply chain efficiency through real-time data and insights.

Companies using comprehensive TMS platforms like Cargoson alongside other solutions report better integration experiences because their existing API infrastructure provides a foundation for digital twin connectivity. However, even with modern TMS platforms, expect 6-12 months of integration work before seeing operational benefits.

Decision Framework: When Digital Twin-EDI Integration Makes Financial Sense

Volume thresholds matter more than company size. If you're processing fewer than 500 EDI transactions per day across all partners, traditional EDI optimization will deliver better ROI. The supply chain digital twin market size surpassed USD 2.6 billion in 2023 and is expected to showcase around 12.5% CAGR from 2024 to 2032, driven by the growing complexities of supply chains.

Risk tolerance becomes a major factor. Companies operating in highly regulated industries or those with supplier bases in geopolitically unstable regions see faster ROI because digital twins provide early warning systems for compliance issues and supply disruptions. Rising costs and risks in supply chain operations significantly boost market growth, with modern supply chains facing numerous challenges including increased transportation costs, supply chain disruptions, and demand volatility.

Competitive positioning adds another dimension. If your major competitors are implementing digital twins, the decision shifts from "should we?" to "how fast can we catch up?" Market pressures in sectors like automotive manufacturing and retail distribution often drive adoption timelines more than internal ROI calculations.

Implementation Staging and Phased Approaches

Smart companies start with pilot programs focused on their highest-value supplier relationships or most critical shipping lanes. For smaller-scale deployments, digital twins focus on individual assets or processes, ideal for businesses testing the concept with lower investment and fewer assets leading to lower costs.

Pilot program costs typically range from $150,000 to $400,000, depending on scope. This approach lets you validate the technology's impact on your specific EDI workflows before committing to full-scale implementation. Modular implementation strategies work best when you can identify discrete value streams, like monitoring temperature-sensitive shipments or tracking high-value components.

2025 Implementation Checklist and Vendor Evaluation Criteria

Technical readiness assessment starts with your current EDI infrastructure. Today's supply chains run on real-time data, not batch uploads or overnight reports, with many legacy EDI systems operating with delays that slow down operations, make it harder to respond to changes, and limit visibility across the ecosystem. If your EDI system still runs primarily on batch processing, expect additional integration complexity.

Vendor selection requires evaluating both digital twin platform capabilities and EDI integration experience. Look for providers who understand the nuances of supply chain EDI standards, not just general IoT platforms. Integration partner evaluation should include transport management software providers who've successfully connected digital twins to existing TMS workflows.

Risk mitigation strategies for cost overruns include setting hard budget caps for pilot phases, establishing clear success metrics before implementation begins, and maintaining fallback plans to your existing EDI processes. A hybrid integration approach that combines batch queues for EDI and real-time queues for APIs is recommended, leveraging the strengths of both technologies and enabling greater scalability, flexibility, efficiency, and innovation.

The key question isn't whether digital twin-EDI integration will transform your supply chain visibility and decision-making capabilities. It will. The question is whether your organization has the budget discipline, technical readiness, and change management capabilities to execute a multi-million dollar, multi-year transformation project successfully. Most companies underestimate at least two of those three requirements, which explains why the technology shows such promise while actual implementations remain concentrated among large enterprises with dedicated digital transformation budgets.

Before committing to digital twin integration, audit your current EDI performance metrics, evaluate your team's technical capabilities, and honestly assess whether incremental improvements to existing systems might deliver 80% of the benefits at 20% of the cost. Sometimes the most advanced solution isn't the most practical one for your specific situation.