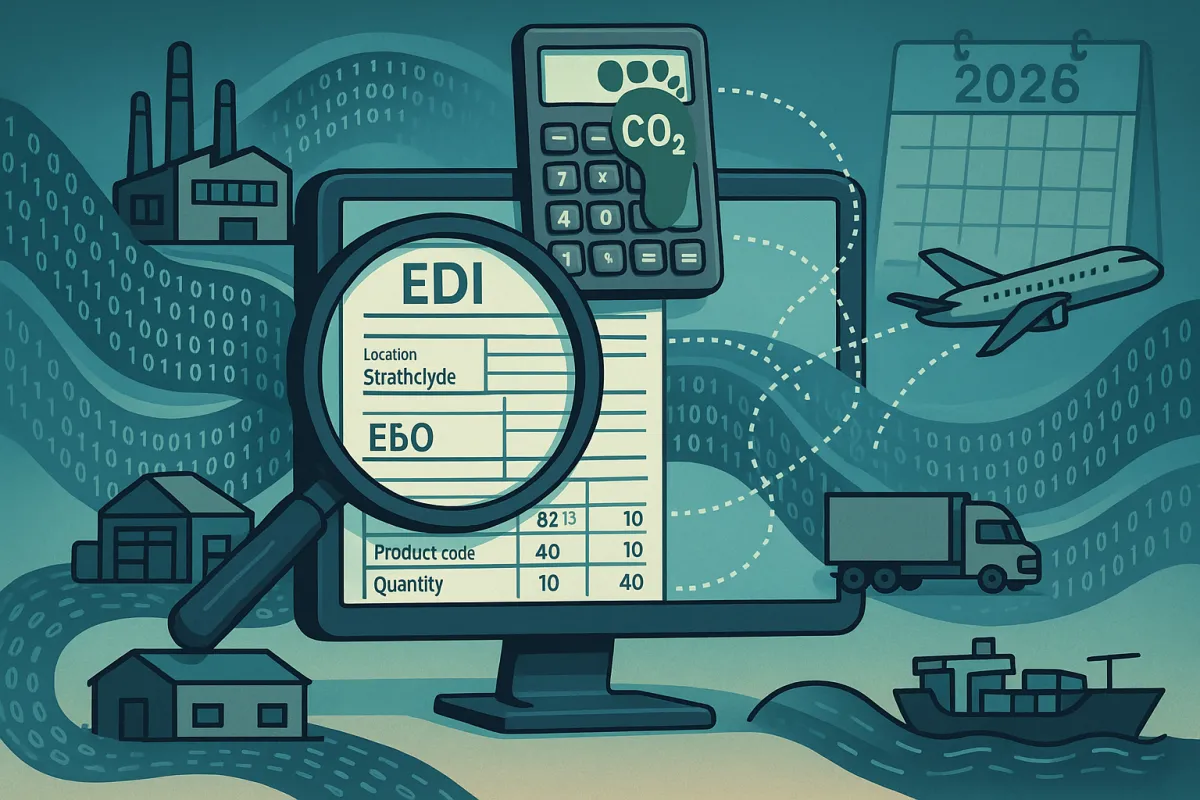

The EDI Carbon Data Goldmine: How to Transform Existing Supply Chain Transactions Into Automated Scope 3 Emissions Reporting for 2026 Compliance Mandates

Your EDI systems are sitting on a treasure trove of carbon data. Every 850 purchase order, every 856 shipment notification, and every 810 invoice contains precise logistics and supplier information that can automatically generate Scope 3 emissions reports required under California's new law affecting companies with over $1 billion in revenue and upcoming EU CSRD requirements. The catch? Most organizations don't realize that Scope 3 emissions represent an average of 84% of their total carbon footprint, yet they're manually scrambling to meet 2026 EU reporting deadlines and California's 2027 Scope 3 disclosure requirements.

The Hidden Carbon Intelligence Sitting in Your EDI Systems

Think about what flows through your EDI connections daily: supplier locations from ASNs, freight modes and weights from shipping notices, purchase volumes from orders. This isn't just transactional data - it's emissions mapping in real time. California's climate disclosure bills could impact more than 10,000 public and private companies, and EU companies began reporting under CSRD in 2025, with requirements extending to other large companies.

EDI usage sits somewhere between 59% and 85% in supply chains, with nearly 70% of manufacturing sales in the USA processed through EDI systems. That data volume represents millions of carbon calculation opportunities sitting unused while companies pay consultants thousands per month for manual emissions tracking.

What EDI Documents Reveal About Your Carbon Footprint

Your EDI 856 Advanced Shipment Notices contain origin and destination zip codes, carrier information, freight class, and package weights. Map these against EPA SmartWay carrier efficiency data and distance calculations, and you've automated most of your Category 4 upstream transportation emissions. EDI 850 purchase orders reveal supplier spend patterns that correlate directly to Category 1 purchased goods emissions using spend-based calculation methods.

Transportation management systems like Cargoson, MercuryGate, and Descartes already parse this EDI data for logistics optimization. The carbon calculation layer requires minimal additional development - mostly database lookups against emission factors and geographic distance calculations.

The 2026 Compliance Tsunami: Why Traditional Approaches Fail

Here's the math problem: large EU companies must report 2025 emissions data in 2026, while California requires Scope 3 reporting starting in 2027. The average Fortune 500 company works with 500+ suppliers across dozens of countries. Manual carbon accounting means chasing supplier questionnaires, reconciling different calculation methodologies, and hoping for 30% response rates.

Supply chain Scope 3 emissions average 21 times greater than direct emissions, and unmanaged Scope 3 could cost over $500 billion annually by 2030. Meanwhile, California's Air Resources Board faced significant opposition at public workshops regarding comprehensive Scope 3 reporting, with proposed rulemaking expected in Q1 2026.

The Resource Drain of Manual Carbon Accounting

Supply chain managers know the drill: Excel templates sent to suppliers who either ignore them, fill them incorrectly, or provide data in different formats than requested. One manufacturing director told me his team spent 40 hours monthly just cleaning supplier sustainability survey responses before any carbon calculations could begin.

The integration challenge multiplies when you're running different TMS vendors across regions. Your European operations might use Descartes, North American facilities could be on Oracle Transportation Management, and third-party logistics providers operate their own systems. Traditional carbon accounting treats each system as a separate data collection exercise.

The EDI-to-Carbon Data Automation Framework

The solution starts with recognizing that EDI transaction sets map directly to GHG Protocol Scope 3 categories. Your existing data flows already contain most variables needed for emissions calculations - you just need to parse them differently.

EDI platforms like SPS Commerce, TrueCommerce, Cleo, and IBM Sterling can be enhanced with carbon calculation modules that process transactions in real-time. The technical implementation involves API calls to emission factor databases (like Climatiq or EPA WARM) triggered by specific EDI document types.

Mapping EDI Transaction Sets to Scope 3 Categories

EDI 850/855 Purchase Order acknowledgments flow directly into Category 1 (Purchased Goods and Services) calculations. Extract supplier location, product codes, quantities, and unit costs. Cross-reference with spend-based emission factors or supplier-specific data where available.

EDI 856 Advance Shipment Notices contain everything needed for Category 4 (Upstream Transportation and Distribution): origin/destination coordinates, carrier SCAC codes, freight mode, weight, and shipment consolidation data. EDI minimizes errors and rework, reducing fuel consumption from unnecessary transportation and lowering emissions.

The calculation logic runs parallel to normal EDI processing. When an 856 posts successfully, the carbon module automatically extracts logistics variables, calculates distance using standard routing algorithms, applies mode-specific emission factors, and posts results to your carbon accounting database.

Real-Time vs. Batch Processing for Carbon Calculation

Real-time processing works for high-volume, standardized transactions like LTL shipments where carrier efficiency data is readily available. API-driven updates provide immediate visibility for transportation planners optimizing routes for both cost and carbon impact.

Batch processing makes sense for complex, multi-leg international shipments requiring detailed freight classification and customs data. Evening batch runs allow time for data enrichment from multiple sources before committing final emission calculations.

Implementation Strategy: Phase-by-Phase Deployment

Smart implementation starts with your highest-impact, most standardized EDI flows. Domestic ground transportation typically represents the easiest carbon automation win - consistent data formats, reliable carrier efficiency ratings, and straightforward distance calculations.

Risk mitigation requires running carbon calculations parallel to existing EDI workflows initially. Your trading partners see no changes to established transaction patterns while you validate calculation accuracy against manual methods or third-party audits.

Phase 1: Data Discovery and Baseline Establishment

Inventory your current EDI connections by transaction volume, data quality, and supplier carbon impact. Most companies discover their top 20% of suppliers by spend generate 80% of their Scope 3 emissions, making them prime targets for automated tracking.

Establish carbon factor databases compatible with your ERP systems. Emission factors should comply with GHG Protocol standards and express results in CO2e taking into account Global Warming Potential. Integration with Microsoft Sustainability Manager or SAP Sustainability solutions provides audit trails regulators expect.

Phase 2: Pilot Program with Key Suppliers

Launch with suppliers already sending high-quality EDI data - typically tier-one automotive suppliers or major retail vendors with established AS2 connections and consistent transaction timing. These partners have technical resources to troubleshoot data mapping issues and provide feedback on calculation accuracy.

Test integration with major TMS providers during pilot phase. Solutions from Cargoson, along with Orderful and IBM Sterling, can be configured to trigger carbon calculations automatically when processing freight audit and payment workflows.

Technology Integration: Making EDI and Carbon Systems Work Together

The architecture centers on event-driven processing. When EDI transactions post successfully, webhook notifications trigger carbon calculation services that query emission factor APIs, perform distance calculations, and update carbon accounting databases - all without disrupting established EDI workflows.

Digital technologies can improve carbon accounting efficiency and accuracy, with automated data sharing beyond organizational boundaries promising to address the huge Scope 3 emissions accounting gap. The key is choosing platforms designed for hybrid EDI-API integration from the start.

Choosing Carbon-Ready EDI Platforms

Evaluate EDI providers based on API extensibility, webhook support, and data retention capabilities. Modern platforms like Orderful and TrueCommerce offer developer-friendly APIs that can trigger carbon calculations without custom EDI mapping changes.

Integration with ERP sustainability modules requires consistent master data management. SAP S/4HANA, Oracle Cloud, and NetSuite all offer carbon accounting capabilities that can consume automated emissions data from enhanced EDI flows, providing the audit trails and controls financial teams expect.

Overcoming Common Implementation Barriers

The biggest obstacle isn't technical - it's convincing trading partners that enhanced data requirements won't disrupt existing EDI relationships. Position carbon automation as a value-added service that improves supply chain visibility without changing core transaction requirements.

Data quality issues emerge when suppliers use different units of measurement, provide estimated rather than actual weights, or inconsistently populate optional EDI segments. Standard data validation rules catch most problems, but manual review processes are needed for high-value or unusual transactions.

Supplier Engagement and Data Collection

Start by asking for enhanced data from suppliers already providing complete, accurate EDI transactions. These relationships can handle additional data requirements without straining technical or business relationships.

Contractual considerations include specifying data accuracy requirements, defining liability for carbon calculation errors, and establishing procedures for updating emission factors as supplier operations change. Most suppliers prefer automated data sharing over quarterly sustainability questionnaires.

Future-Proofing Your Carbon-Enabled EDI Strategy

Blockchain technology is proposed for reliable carbon tracking, with smart contracts automating enforcement procedures and reducing data collection costs while improving quality. The integration of AI-driven predictive analytics with EDI automation represents the next evolution beyond reactive carbon reporting.

Hybrid EDI-API approaches allow gradual migration toward real-time sustainability data exchange while maintaining compatibility with legacy systems. Companies implementing Cargoson and similar next-generation TMS platforms position themselves for seamless integration with emerging carbon tracking technologies.

The 2026 compliance deadlines aren't moving. Organizations that automate carbon data extraction from existing EDI flows gain competitive advantages through accurate emissions reporting, improved supplier relationships, and reduced regulatory risk. The question isn't whether to automate - it's whether to lead or follow the industry transformation.