The EDI Democratization Revolution: How EDI-as-a-Service is Breaking Down SME Barriers and Driving $113 Billion Market Growth in 2025

The global electronic data interchange (EDI) market is projected to reach $113.43 billion by 2034, driven primarily by a transformation happening at the ground level: small and medium enterprises (SMEs) are finally breaking into EDI adoption at unprecedented rates. The growth of SMEs worldwide increases the number of automated transactions, creating demand for EDI solutions among SMEs, with increasing adoption by small and medium businesses expected to drive market growth.

What makes this explosive growth possible? EDI-as-a-Service - a service model that's eliminating the traditional barriers that kept 57% of small businesses locked out of enterprise-grade data integration. The numbers tell the story: 85% of SMEs using cloud services agree that cloud services make it easier for them to compete with larger businesses, and between 59% and 85% of businesses in the supply chain sector now use EDI, with nearly 70% of $6 trillion in U.S. manufacturing sales coming from EDI transactions.

The $113 Billion EDI Market Explosion: SMEs Drive Unprecedented Growth

Multiple research firms project similar explosive growth trajectories for the EDI market. The electronic data interchange market is expected to reach US$ 74.36 billion by 2031 from US$ 34.02 billion in 2024, with the market anticipated to register a CAGR of 11.9% during 2025–2031. Another analysis projects growth from USD 2.31 billion in 2025 to USD 5.30 billion by 2032, exhibiting a CAGR of 12.6% during the forecast period.

The most aggressive projection comes from Expert Market Research, which shows the electronic data interchange (EDI) market valued at USD 36.52 Billion in 2024 and projected to grow at a CAGR of 12.00% between 2025 and 2034. SMEs in the electronic data interchange market are projected to witness the fastest growth over the forecast period.

Behind these numbers lies a fundamental shift. According to European Commission data from July 2024, Europe observed a 5.4% rise in the number of SMEs, with an increase of 4.8% in the employment rate, with total growth of SMEs in the region reaching 4.5% between 2021 and 2023. These growing SMEs need automated transaction capabilities to compete, but traditional EDI solutions kept most of them out.

The Traditional SME EDI Barrier: Why 57% of Small Businesses Stayed Locked Out

The numbers are stark: over 41% of companies have not adopted EDI processes and 21% still rely on web portals. Why? The answer lies in the traditional EDI implementation model that created insurmountable barriers for smaller businesses.

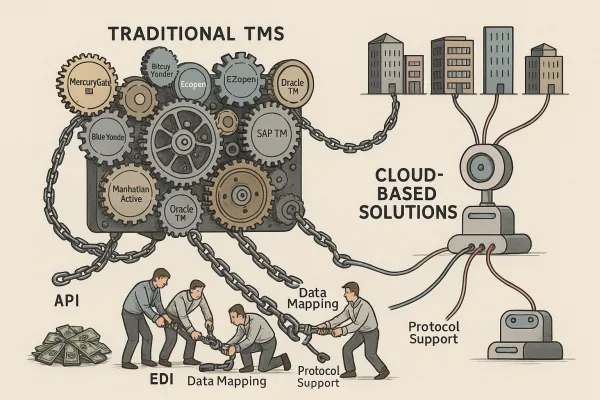

According to a recent LinkedIn poll, 56% of respondents pointed to "initial cost" as the primary obstacle of implementing EDI. Traditional EDI solutions for SMEs needed costly hardware, software, and infrastructure investments which were not affordable by most SMEs. Besides, the system was complicated, requiring skilled expertise for its configuration as well as continuous maintenance.

The skills shortage hits SMEs particularly hard. EDI experts with the skills to translate business needs into specific EDI solutions are becoming harder to find, and this isn't viable for many small- and medium-sized businesses. 22% of respondents cited "lack of resources" as a significant obstacle, reflecting a common challenge faced by businesses when attempting to adopt EDI technology.

Consider the cost comparison: the average paper requisition to order costs a company $37.45 in North America, while with an EDI requisition to order, costs are reduced to $23.83. The savings are clear, but the barrier was getting there.

High implementation costs can be costly, especially for small and medium-sized enterprises (SMEs). The initial investment required for hardware, software, and training, along with ongoing maintenance costs, can pose a barrier to adoption. Traditional solutions also suffered from limited IT resources and expertise, as small organizations may face challenges in deploying and managing EDI systems due to limited IT resources, requiring external support or partnerships to implement and maintain EDI infrastructure effectively.

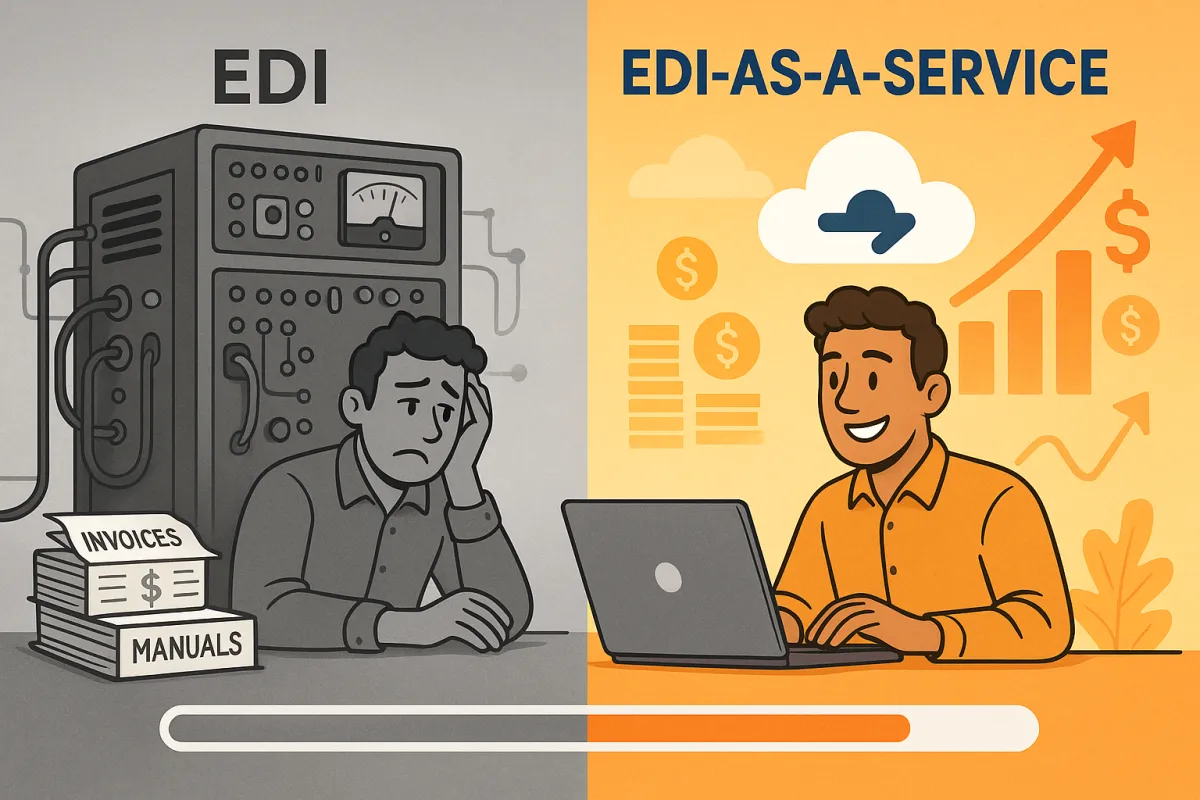

EDI-as-a-Service Defined: The Solution Model Transforming SME Operations

EDI-as-a-Service represents a fundamental shift from traditional EDI deployment. A great example of EDI-as-a-Service in action is Web EDI, which delivers browser-based access to self-service tools, harnessing the simplicity of standard SaaS. However, EDI-as-a-Service extends beyond Web EDI to encompass far more flexible and 'hybrid EDI' models that combine multiple types of EDI delivered as an outcome by managed service providers.

Managed EDI, or EDI-as-a-service, places all EDI responsibility into the hands of the provider. The provider owns the maintenance of the EDI system, including trading partner management, data integration, and implementation. This differs fundamentally from traditional managed EDI by combining software delivery with outcome-focused services.

The core components include cloud-based software delivery, automated data validation and mapping, format translation capabilities, and comprehensive managed services for partner onboarding and support. These easy-to-use tools reduce barriers to entry — particularly for smaller businesses and those lacking in-house EDI skills — and can accelerate the deployment of an EDI system, even within complex supply chain environments.

Leading providers in this space include established players like SPS Commerce, TrueCommerce, Cleo, and OpenText, alongside emerging solutions like Cargoson that specifically target transport and logistics businesses with integrated TMS capabilities.

The Five EDI-as-a-Service Advantages Transforming SME Operations

Cost-effectiveness leads the transformation. SME's can set up EDI without large upfront investments, thus lowering critical setup costs and ongoing maintenance costs. Businesses that switch from SPS Commerce save up to 40% in costs, demonstrating real savings potential when choosing the right provider.

Operational efficiency gets a massive boost through automation. Cloud-based solutions automate many aspects of the EDI process—such as validation, data mapping, format translation, reducing manual data entry. The Electronic Data Interchange (EDI) software aids small and medium organizations in automating several transactions with other companies, significantly increasing productivity, efficiency, and profitability by enabling fully automated transaction processing.

End-to-end visibility becomes possible for SMEs that previously operated blind. EDI solutions allow SMEs to seamlessly exchange key documents such as purchase orders and invoices electronically, avoiding manual processes and paperwork, resulting in faster order processing, fewer errors, and better inventory management.

Easier collaboration with larger partners opens new market opportunities. If small and medium-sized businesses wish to grow, investing in EDI allows them to trade with larger organizations while simultaneously handling more business transactions. Large organizations demand new trading partners adopt and implement EDI as the base price of entry in order to do business.

Scalability without infrastructure investment provides the flexibility SMEs need. Flexible pricing models, such as subscription-based or pay-per-use plans, allow SMEs to choose cost-effective solutions that fit their budgets. Cloud-based self-service EDI solutions offer the flexibility to scale EDI capabilities as business needs grow, without requiring significant infrastructure investments.

Real-World EDI-as-a-Service Implementation: SME Success Stories

The transformation shows up in implementation timelines. Companies like Ergobaby experienced partner onboarding that previously took between 12 weeks to 6 months, but with self-service EDI solutions, partner onboarding time plummeted to just 2-6 weeks, a 500% improvement.

Even more impressive are change implementation speeds. Change implementation time was cut from 90 days to a mere 10 minutes with modern EDI-as-a-Service platforms. Ken Hayes, Senior Director of IT at Ergobaby, describes the business impact: "The driving reason for moving to Epicor EDI was speed to market. Now, onboarding is complete in two to six weeks—a massive improvement."

The technology supports various industries with specific needs. In transport and logistics, solutions like Cargoson integrate directly with TMS platforms, while retail-focused providers like SPS Commerce specialize in marketplace integrations. 10% of the logistics and transportation workflow can be automated with EDI, presenting significant opportunities for efficiency gains.

Choosing the Right EDI-as-a-Service Provider: The 2025 Evaluation Framework

Provider selection requires evaluating multiple factors beyond just cost. When assessing solutions, reviewers found TrueCommerce EDI easier to use, administer, and do business with overall, while reviewers preferred the ease of set up with SPS Commerce Fulfillment EDI.

Deployment speed varies significantly between providers. Pricing for TrueCommerce typically involves a subscription-based model with fees based on factors such as transaction volume and the number of trading partners, while other providers offer different pricing structures. SPS Commerce has 483 reviews and a rating of 4.15 / 5 stars vs TrueCommerce EDI Solutions which has 514 reviews and a rating of 4.26 / 5 stars.

Integration capabilities matter for seamless operations. A key advantage of TrueCommerce is its ability to integrate seamlessly with various business systems, including ERP and WMS platforms. For transport-focused businesses, platforms like Cargoson offer direct TMS integration, while broader solutions like Cleo and OpenText provide extensive protocol support.

Support levels determine success rates. Many businesses opt for EDI managed services rather than keeping expertise in-house, as it ensures EDI is carried out correctly and seamlessly. Managed services provide active EDI support, ensuring new partners are onboarded quickly and professionally, with EDI experts directly supporting businesses to drive efficiency.

The 2025-2030 Outlook: Why EDI-as-a-Service Will Define the Next Decade

Market projections consistently show double-digit growth continuing through the decade. The market is projected to grow at a CAGR of 12.00% between 2025 and 2034, with the market expected to surge from USD 36.52 billion in 2024 to USD 113.43 billion by 2034. The growing inclination of big businesses toward internal processing, digital transformation, and process automation is the main factor propelling the market's expansion, with growing use of electronic data transactions in a variety of industries anticipated to propel market expansion.

AI integration represents the next frontier. AI and EDI are two prominent technologies that can and will be integrated with electronic data interchange to enhance B2B processes. The integration of AI and ML technologies with EDI solutions is gaining traction, helping in data analysis, predictive analytics, and intelligent decision-making, thereby enhancing the efficiency of EDI systems.

Regulatory drivers continue pushing adoption. Peppol was created to outline standards for e-procurement within the European Union, with government organizations and suppliers using this EDI protocol to eliminate unique requirements and standards. As more countries digitize processes, Peppol will increase its adoption rate.

The democratization effect will accelerate. The market presents numerous opportunities, particularly in emerging markets and among SMEs, with increasing affordability of cloud-based EDI solutions and the rise of digital literacy enabling small businesses in developing regions to digitize their operations and participate in global supply chains.

EDI-as-a-Service isn't just a service delivery model - it's becoming the foundation that will enable the next generation of supply chain technologies, from AI-powered optimization to blockchain-secured transactions. For SMEs, this represents the first real opportunity to compete on equal technological footing with enterprise giants, transforming B2B integration from an exclusive club into an accessible business capability.