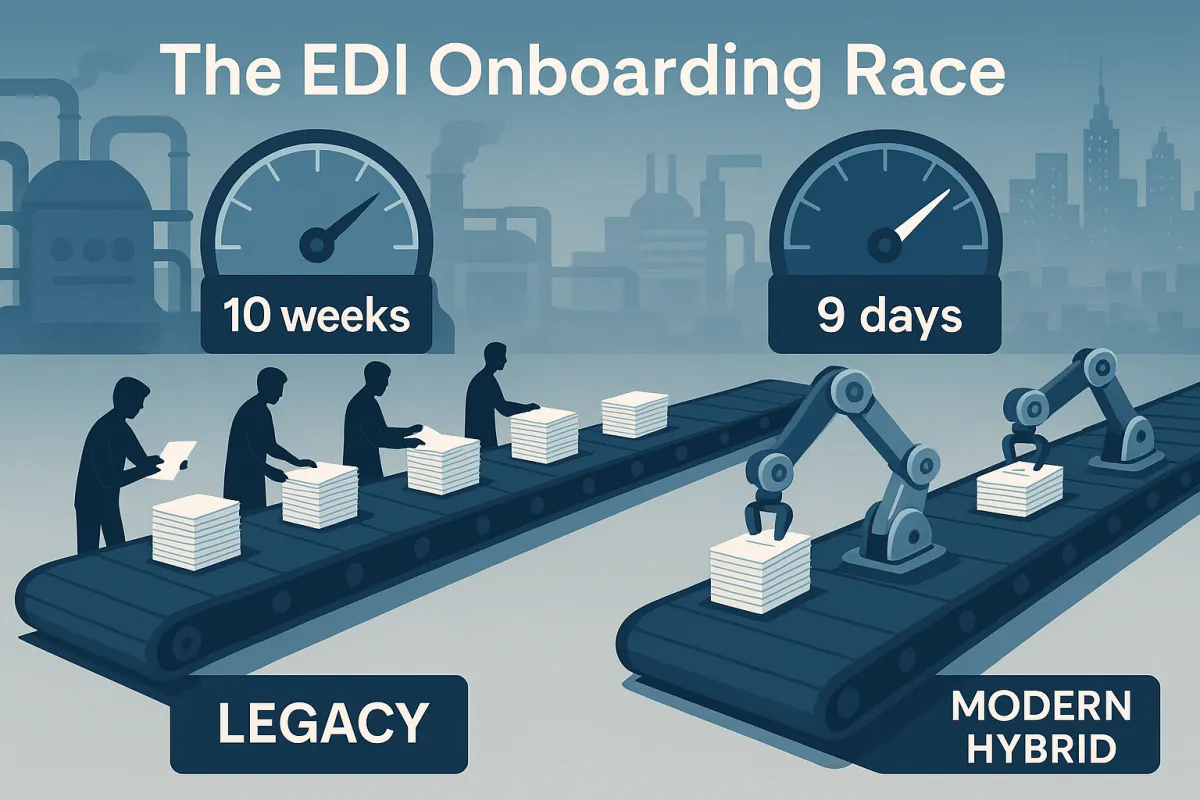

The EDI Trading Partner Onboarding Revolution: How Modern Hybrid Integration Platforms Cut Setup Time from 10 Weeks to 9 Days and Unlock $2.3M in Hidden Revenue

Supply chain leaders face a 63% problem rate where EDI trading partner onboarding automation takes too long due to customized requirements, with 47% of IT managers saying slow EDI supplier onboarding is keeping their businesses from capturing new revenue opportunities. Yet while most companies accept 8-10 week EDI onboarding times, a new generation of hybrid EDI-API integration platforms is proving those delays aren't necessary.

Companies using modern hybrid integration architectures are connecting trading partners in 9 days or less through automated validation, standardized configurations, and real-time monitoring, compared to legacy providers requiring 4-8 weeks for partner onboarding. Liquid Death reduced their time to onboard new trading partners from 4-8 weeks to just 1 week, while achieving go-live times that were 400% faster using modern platforms.

The Critical Trading Partner Onboarding Crisis Choking Supply Chain Growth

Traditional EDI onboarding represents a massive revenue drag. If the onboarding process takes four weeks, that's 28 days of missed revenue, while a single-day process equates to only one day of missed revenue. Yet 53% of enterprises experience limitations with their current B2B integration solutions when rapidly onboarding trading partners, with approximately 40% requiring over 30 days to onboard a new trading partner.

The math gets ugly fast. For a company expecting $500K monthly revenue from a new partner, each week of delay costs $125K in missed opportunities. Failing to meet partner requirements in a timely fashion results in the loss of new sales and missed revenue opportunities, with slow or broken EDI partner onboarding proving crippling to businesses that regularly stand up new EDI partners.

Why Legacy EDI Systems Create Onboarding Bottlenecks

Traditional EDI onboarding suffers from fundamental architectural limitations. EDI onboarding is driven by humans, which includes back and forth feedback loops that aren't in real time, resulting in wasted time and delays. The most time intensive part involves each individual document being validated in the order that your partner defines, requiring sample or test transactions. This process of back and forth can take weeks to ensure each document is valid prior to sending live transactions.

The problem intensifies with coordination among four distinct entities: your staff, each trading partner, the EDI provider, and developers. This makes it difficult to estimate timeframes, with trading partners typically having the slowest response time since they have less incentive to complete the integration.

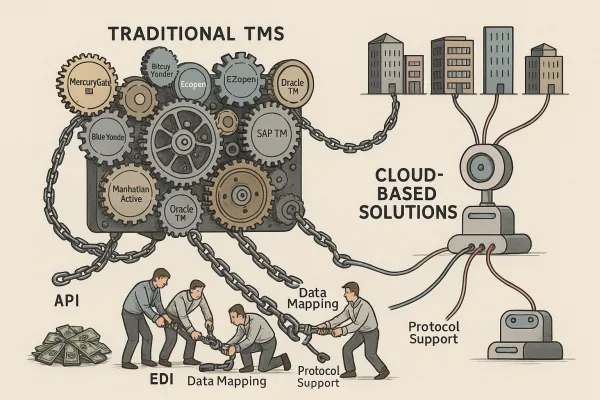

Transport management software faces particular challenges. Legacy platforms like MercuryGate and Descartes often require extensive custom mapping for each carrier relationship, while modern solutions like Cargoson focus on pre-built connectivity reducing integration complexity.

The Hybrid EDI-API Integration Architecture Transforming Partner Connectivity

The emergence of hybrid integration models represents a fundamental shift in how companies approach trading partner connectivity. In a hybrid EDI and API setup, EDI continues to manage transactions that partners require in standardized formats, such as purchase orders (850) and advance ship notices (856), moving through the same trusted channels ensuring compliance and compatibility. The API integration works alongside core EDI software, handling tasks that benefit from speed and flexibility.

This middleware gateway approach converts API calls to X12/EDIFACT formats for compatibility while maintaining modernization benefits. APIs can transmit data directly into ERP or warehouse management systems in real time and trigger automated alerts when exceptions occur. For example, a retailer might send an 850 via EDI, with the platform parsing the document and using an API to push that order into the ERP, then responding with acknowledgments as needed, creating seamless connections between legacy processes and modern integrations.

Modern Platform Capabilities Driving Speed Improvements

Cloud-native, API-first platforms replace point-to-point sprawl with unified integrations connecting thousands of trading partners through single APIs. Built-in automated testing, real-time validation, and prebuilt retailer connections eliminate custom development, manual workflows, and maintenance overhead. The architecture enables partner onboarding in days instead of weeks while scaling automatically.

Modern solutions eliminate the traditional testing bottleneck. Built-in, automated testing protocols allow testing, validating, and approving EDI messages in one place instead of sending files back and forth with partners. You go live faster and with fewer errors.

Companies are implementing these capabilities through platforms like Cargoson alongside established players like nShift, ShippyPro, and Transporeon, each offering different approaches to carrier integration software and transport execution software optimization.

Quantifying the Business Impact: From $500K Revenue Loss to 400% Faster Growth

The financial impact of faster onboarding extends beyond avoiding delays. Liquid Death reduced partner onboarding from 4-8 weeks to just 1 week, allowing the company to be more agile and responsive to market demands. Their results demonstrate go-live times that were 400% faster, without managing custom configurations or engaging third-party providers.

Modern platforms reduce total cost of ownership by 40-60% compared to traditional managed services through transparent per-partner pricing that includes unlimited transactions, eliminating expensive mapping projects and ongoing consultant fees.

The competitive advantage compounds. Companies that can connect faster get products in front of consumers sooner, capturing market share ahead of competitors. Speed signals to retailers that your brand can meet compliance requirements without repeated testing or costly resubmissions.

The Hidden Costs of Delayed Partner Onboarding

Revenue opportunity calculations reveal staggering losses. The impact that onboarding delays have on companies compounds quickly. A slow EDI onboarding process pushes back revenue recognition and limits how fast companies can expand into new channels.

For transportation management system implementations, delayed carrier onboarding creates cascading operational problems. Shipper TMS platforms depend on rapid carrier connectivity to optimize freight management software performance, yet traditional integration approaches often require months of development.

Resource allocation inefficiencies multiply the problem. Teams spend time on manual testing cycles instead of strategic initiatives, while IT resources get consumed by repetitive integration tasks rather than innovation projects that drive competitive advantage.

Implementation Framework: Building Your Hybrid Integration Strategy

Modern platforms uniquely support both EDI and APIs on single platforms, enabling hybrid B2B strategies where legacy partners continue using EDI (X12, EDIFACT) while modern partners use REST APIs, all managed from one interface.

Platform selection should focus on unified EDI, API, and hybrid communication capabilities. Hybrid EDI and API integration platforms like Cleo are designed for companies needing flexibility across multiple systems and trading partners, with ecosystems supporting APIs and file-based connectivity in one environment, bridging modern and legacy EDI integrations.

Companies evaluate solutions from providers like Cargoson, MercuryGate, and Descartes based on technical requirements assessment and system compatibility. The key differentiator becomes migration planning from legacy point-to-point systems without disrupting existing operations.

Avoiding the 73% Implementation Failure Rate

Partner onboarding typically takes hours to days instead of weeks or months with modern solutions. The low-code, configuration-driven approach allows business teams to configure communication preferences, set up mappings, and run test transactions quickly. Reusable templates and guided workflows accelerate the process, with some partners going live in under a day.

Change management requires addressing both technical and cultural challenges. Teams accustomed to weeks-long onboarding cycles need training on self-service capabilities, while business processes must adapt to faster partner connectivity cycles.

Testing and validation best practices center on automated protocols that eliminate manual bottlenecks. Automated testing validates document structure and partner requirements before transactions go live, cutting onboarding from weeks to days. Real-time validation flags issues instantly before transmission, preventing rejections and chargebacks common with batch-based legacy systems.

Modern platforms like Cargoson position themselves as alternatives to established multi-carrier shipping software providers, offering transportation management platform capabilities without the traditional implementation complexity.

Future-Proofing Your Trading Partner Network for 2026 and Beyond

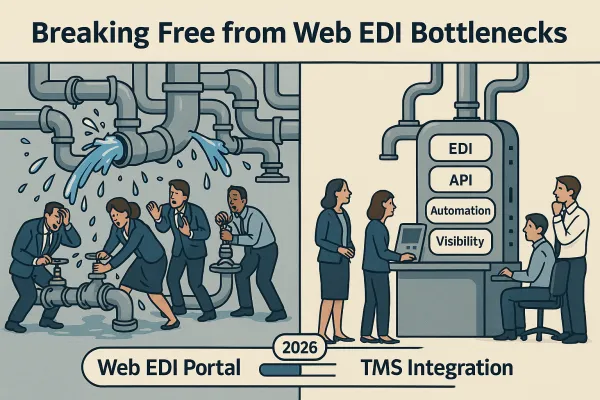

European e-CMR mandates by 2026 are forcing carrier integration upgrades across the continent. Many organizations maintain EDI for established partner relationships and compliance requirements while adopting APIs for new digital initiatives and real-time integration needs. This hybrid approach, while pragmatic, can increase operational complexity and integration management overhead.

API adoption trends show acceleration, yet EDI continues to handle up to 85% of revenue for some companies, with markets like healthcare expected to reach over $9 billion by 2030. The persistence of EDI alongside API growth validates hybrid approaches.

Scalability considerations for growing partner ecosystems demand platforms that support both legacy EDI requirements and modern API integrations. Integration operations enable true flexibility supporting both legacy EDI requirements and modern API-based integrations through unified operational models. Organizations maintain compliance with industry standards while gaining agility to adopt new integration patterns and technologies.

Transportation spend management and transportmanagementsystem concepts will increasingly merge as hybrid platforms enable unified visibility across EDI and API connections, providing single-pane-of-glass management for complex partner ecosystems spanning traditional EDI relationships and modern API-driven partnerships.