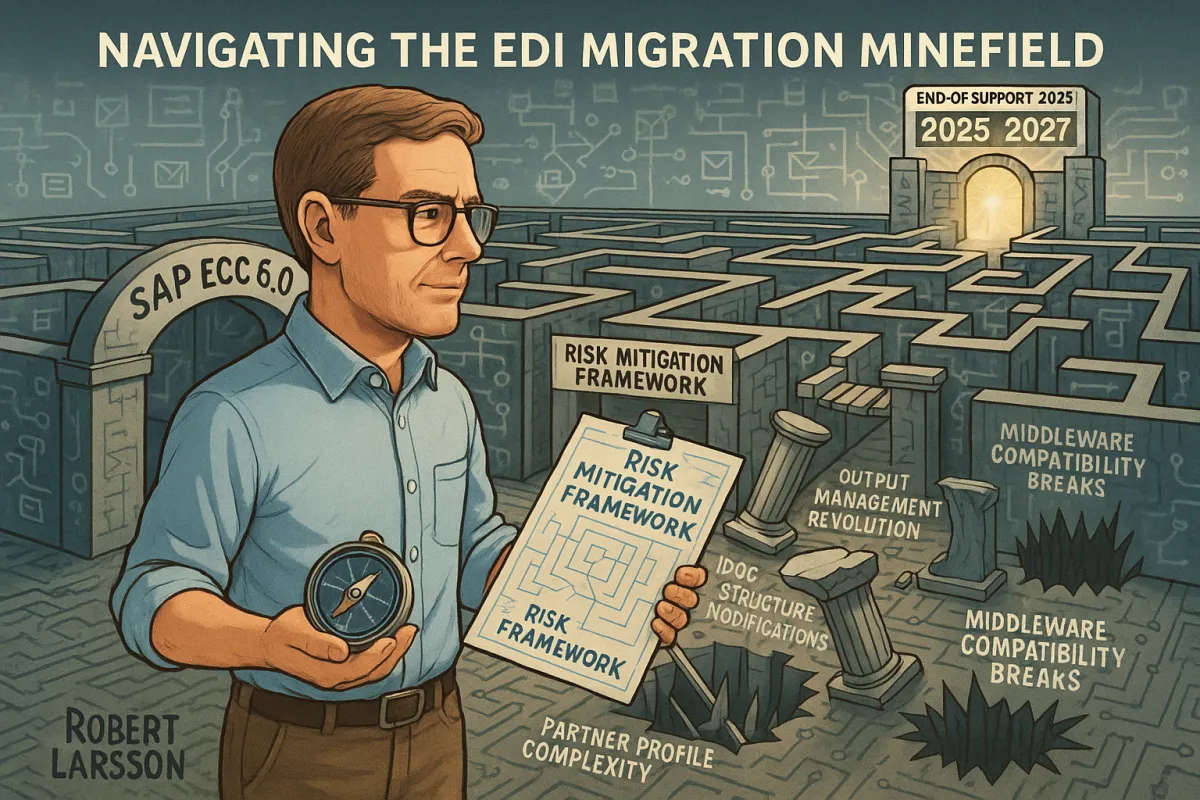

The SAP S/4HANA EDI Migration Crisis: Your Complete Risk Mitigation Framework to Prevent Trading Partner Disruptions During the Critical ECC 6.0 End-of-Support Transition in 2025

With SAP ECC 6.0 mainstream maintenance ending December 31, 2025 for enhancement packs 0-5, and December 31, 2027 for enhancement packs 6-8, thousands of companies face a critical decision: migrate to SAP S/4HANA or risk running unsupported systems. While SAP executives focus on database platforms and cloud subscriptions, your EDI integrations represent the most vulnerable component in this transition. Existing EDI maps can break or silently misbehave, leading to failed transactions, chargebacks, or customer dissatisfaction.

Here's your comprehensive framework to prevent trading partner disruptions during what may be the most challenging ERP migration you'll manage.

The Looming SAP ECC 6.0 End-of-Support Crisis and Its EDI Impact

As the 31 December 2025 deadline for SAP ECC 6.0 EHP0-5 end-of-mainstream support approaches, organisations are confronting a decision point sooner than the anticipated 2027 EHP6 deadline. The numbers are staggering. Most SAP installations still run on ECC 6.0, with many organizations unaware they're on the shorter timeline. SAP ECC 6 EHP 5 or earlier support ends 12/31/25 — that's months away, not years.

Why does this create an EDI crisis? Your trading partner connections depend on stable data flows and consistent message formats. During S/4HANA migration, even subtle IDoc changes in key messages like INVOIC02 or ORDERS can ripple through supply chains. Without proper planning, you risk severing connections with hundreds of suppliers and customers simultaneously.

The challenge extends beyond SAP's timelines. The way S/4HANA changes IDoc structures and how messages are packaged and monitored often requires updates to middleware platforms (like IBM Sterling B2B Integrator, Boomi, Seeburger) and EDI translators. Your current EDI infrastructure — whether you're using TrueCommerce, Cleo, Cargoson, or IBM Sterling — requires compatibility updates that many organizations discover too late.

The 5 Critical EDI Disruption Points in S/4HANA Migration

Every S/4HANA migration creates predictable EDI failure points. Understanding these beforehand prevents the scrambling that kills go-live dates.

Business Partner Model Transformation

S/4HANA replaces the separate customer and vendor records in ECC with a unified Business Partner (BP) model. This means all customer/vendor master data must be migrated into BP entities—each with the correct roles (e.g., "Customer," "Supplier") assigned. SAP's Customer-Vendor Integration (CVI) framework handles this technically, but if roles are missing or mappings are incomplete, EDI processes tied to those records can fail.

The Business Partner conversion isn't just a data exercise. Your EDI partner profiles in WE20 must align with new BP structures. Missing this connection means IDocs route to nowhere.

IDoc Structure Modifications

Fields are longer, new segments added, and some segments deprecated. Existing EDI maps break or worse, silently misbehave (e.g., truncated data, unmapped fields). Segment changes such as E1EDP01, MATNR_LONG and new packaging behavior require revisiting mapping logic.

The silent failures are the killers. Your maps appear to work, but material numbers get truncated or price fields map incorrectly. You discover this when trading partners reject your transactions weeks after go-live.

Output Management Revolution

Challenge 2: Output Management Overhaul (NAST vs. BRF+) Impact: Companies must reconfigure EDI output logic from scratch. Early versions of BRF+ lacked full IDoc support, which often forced a fallback to NAST for business-critical flows. Why It Matters: If output logic fails post-migration, trading partners may not receive critical docs like ASNs or invoices, causing order disruptions and SLA violations.

This technical change has operational consequences. Your current NAST condition records that trigger EDI outputs may not convert cleanly to BRF+ rules. The result? Purchase orders process in SAP but never reach suppliers.

Middleware Compatibility Breaks

SAP Community members confirm that after conversion, IDoc segment versions often change, and middleware will not process them correctly until the updated definitions are imported and remapped. Whether you're running IBM Sterling, Cleo Integration Cloud, OpenText, or platforms like Cargoson, your IDoc dictionaries require updates.

Partner Profile Complexity

In S/4HANA, the EDI partner profile setup via WE20 becomes more complex. You not only define inbound/outbound parameters for a partner but must also account for multiple partner types—including Business Partner (BP), Logical System (LS), Vendor (LI), Customer (KU), and more—each requiring their own profile setup. Without accurate setup, IDocs fail to post or get routed incorrectly. Partner profiles are the tracks your IDocs run on—if they're misconfigured in S/4, nothing moves.

Pre-Migration EDI Risk Assessment Framework

Your migration success depends on understanding exactly what breaks and when. This isn't theoretical planning — it's forensic analysis of your current environment.

Trading Partner Impact Analysis

Start with your transaction volume analysis. Which partners represent 80% of your EDI volume? These require parallel testing and fallback plans. Identify partners using: - Custom IDoc structures or enhanced segments - Real-time processing that can't tolerate delays - Multiple message types per relationship (orders, confirmations, invoices, ASNs) - Critical delivery windows (automotive JIT, retail compliance)

Document current error handling. How do you currently resolve IDoc failures? S/4HANA monitoring differs significantly from ECC's WE02/WE05 tools.

Data Mapping Dependency Identification

Extract your complete IDoc configuration using SPRO and WE30. Compare ECC segment versions against S/4HANA equivalents for each message type you process. Perform a detailed comparison of ECC and S/4 IDoc versions for each message type. Update EDI maps and test each transaction type end-to-end.

Pay special attention to material master integration. S/4HANA's material number handling differs from ECC, particularly for long material numbers and EAN/GTIN processing.

Middleware Compatibility Audit

Contact your EDI platform vendor immediately. Whether you're using TrueCommerce, IBM Sterling, Cleo, or emerging platforms like Cargoson, confirm their S/4HANA certification status. Updating IDoc dictionaries and re-pointing connections is essential to maintain flow.

Request S/4HANA-compatible IDoc definition files. These aren't automatically available — some vendors require specific support contracts or upgrade fees.

Business Partner Model Migration Strategy for EDI Continuity

The Business Partner conversion represents your highest EDI risk. Get this wrong, and trading partners can't match their records to your new identifiers.

Customer-Vendor Integration Framework

SAP's CVI handles technical conversion, but you control the business logic. Preserve existing customer and vendor numbers wherever possible. Trading partners reference these in their own systems — changing them creates coordination nightmares.

Configure Business Partner roles correctly. A single entity may need multiple roles (Customer, Bill-To, Ship-To, Supplier). Missing roles break IDoc processing rules.

Legacy Numbering Preservation

Your 855 Purchase Order Acknowledgments reference customer PO numbers. Your 810 Invoices reference vendor identifiers. These external references must remain consistent during BP conversion.

Test number range behavior in your sandbox. Some S/4HANA installations generate new internal identifiers that don't match partner expectations.

Trading Partner Notification Protocols

Communicate changes proactively. Major trading partners need 30-60 days notice for identifier changes. Retailers like Walmart or Amazon require formal testing windows for EDI changes.

Prepare rollback communications. If testing reveals compatibility issues, partners need immediate notification about delayed timelines.

Middleware and Integration Platform Adaptation Tactics

Your middleware layer requires parallel preparation. Our recommendation is to modernize and consolidate your EDI integration before the main S/4HANA migration project. By doing this, the overall project effort and risk will be much lower.

Platform-Specific Considerations

Direct integration with SAP S/4HANA means businesses no longer need to maintain separate EDI infrastructures or deal with the complexities of middleware solutions, according to TrueCommerce. However, most organizations can't eliminate their existing middleware immediately.

For IBM Sterling users: Request S/4HANA-compatible process definitions and mapping templates. Sterling requires updated IDoc adapters for proper message processing.

For platforms like Cleo or Cargoson: Confirm API integration capabilities. Some newer platforms offer direct S/4HANA connectivity that bypasses traditional IDoc processing.

IDoc Definition Updates

Segment changes such as E1EDP01, MATNR_LONG and new packaging behavior require revisiting mapping logic—otherwise you risk mismatches between SAP and your integration layer. SAP Community members confirm that after conversion, IDoc segment versions often change, and middleware will not process them correctly until the updated definitions are imported and remapped.

Update your IDoc repository before testing begins. Many middleware platforms cache IDoc definitions — forcing manual refresh procedures.

Testing and Validation Framework for Zero-Disruption Migration

Challenge 6: Testing Complexity Across Systems & Partners. We can't stress this point enough. Regression testing must span multiple teams, platforms, and trading partners. This applies especially when ECC and S/4HANA are running in parallel during the migration. With changes to IDoc structures, partner profiles, and middleware mappings, even small gaps in testing can lead to errors that surface in production.

Parallel Environment Strategy

Run ECC and S/4HANA simultaneously during testing phases. Many organizations run ECC and S/4HANA in parallel during migration. They also continue EDI operations. This means maintaining dual environments, maps, and teams simultaneously, but the approach comes with risks. For example, a trading partner onboarding during cutover may receive two different order confirmations—one from ECC and one from S/4—requiring extra middleware logic and partner coordination.

Implement message routing logic to prevent duplicate transmissions. Your middleware must recognize which system generated each transaction.

End-to-End Transaction Validation

Test complete business cycles, not just message translation. Process a purchase order through order acknowledgment, ASN, and invoice. Verify that S/4HANA-generated documents match partner requirements exactly.

Use test IDocs and partner simulations before go-live to validate translations. Many EDI platforms provide partner simulation tools for this purpose.

Rollback Contingency Planning

Prepare for migration delays or failures. Maintain ECC EDI operations capability even after S/4HANA go-live. Running two systems in parallel doubles your risk of EDI errors, but the alternative is complete trading partner disconnection.

Post-Migration Optimization and Modernization Opportunities

S/4HANA migration creates opportunities for EDI modernization. SAP APIs can readily be used today as an alternative to IDocs, for example to transfer orders to SAP ERP that were previously transmitted via EDI.

API-EDI Hybrid Implementation

Consider gradual migration from IDocs to APIs for new trading partners. The B2B API ORDERREQUEST_IN is not a wrapper for IDoc processing but a separate implementation. Partner determination uses EDPAR, similar to IDoc processing.

Platforms like Cargoson, alongside established providers like TrueCommerce and IBM Sterling, are adding native S/4HANA API support.

Cloud-Native Integration Adoption

TrueCommerce was first to market with a direct EDI integration with SAP S/4HANA Cloud Public Edition (and also supports private cloud and on-premises versions) via APIs, enabling seamless connectivity and real-time data exchange with trading partners. This integration streamlines critical processes like order-to-cash, procure-to-pay, and warehouse operations.

Evaluate cloud-based EDI platforms during your migration window. The infrastructure changes required for S/4HANA migration align with cloud EDI adoption timelines.

Real-Time Integration Enhancements

S/4HANA's in-memory processing enables near-real-time EDI scenarios. Instead of batch IDoc processing, consider streaming document flows for high-volume partners.

This becomes particularly valuable for industries requiring immediate confirmations — automotive supply chains, pharmaceutical distribution, or retail compliance programs.

Your S/4HANA migration timeline is non-negotiable, but EDI disruptions aren't inevitable. Start your risk assessment immediately. Contact your EDI platform vendors now. Most importantly, begin trading partner communications before technical changes begin.

The organizations that successfully navigate this transition treat EDI continuity as a business requirement, not a technical afterthought. Your supply chain depends on these connections — protect them accordingly.