The Strategic Guide to Hybrid EDI-API Integration: How to Modernize Supply Chain Data Exchange Without Breaking Your Trading Partner Network in 2025

Most B2B integration projects still fail at the pilot stage. You connect one trading partner, celebrate the success, then discover the second partner uses completely different protocols and data formats. The third one insists on keeping their legacy EDI system. By month six, you're managing three separate integration approaches and wondering where your "unified platform" strategy went wrong.

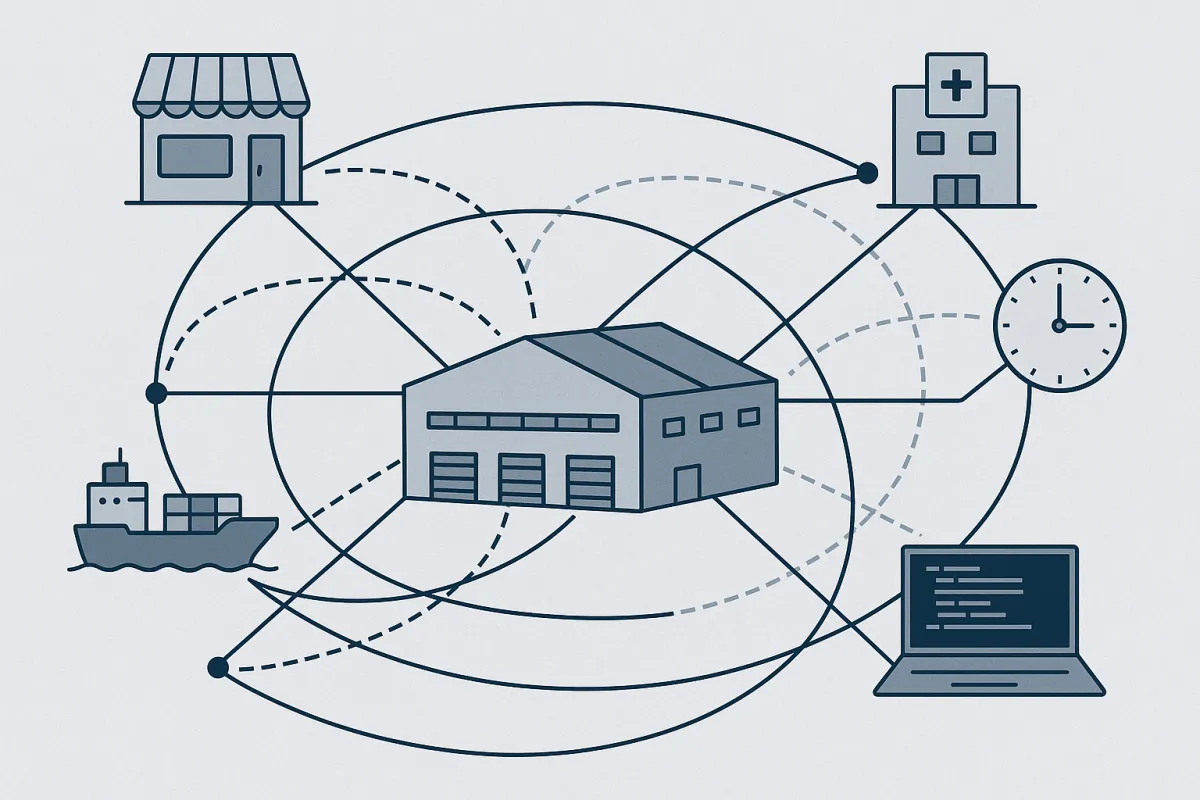

The future lies in hybrid connectivity where EDI and APIs coexist to support diverse IT ecosystems. But getting there requires more than just declaring your organization ready for modernization. While 85% of supply chain transactions are still managed through EDI, and it's a crucial technology, companies need more flexible trading approaches with partners to help with supply chain resiliency.

Why Hybrid Integration is Winning Over EDI vs API Debates in 2025

The technology selection battle between EDI and APIs is largely over. The global EDI market is projected to value at $49213.1 million by 2027, while the market is expected to increase from $2.31 billion in 2025 to $5.30 billion by 2032, with a compound annual growth rate (CAGR) of 12.6% throughout the forecast period. API adoption continues growing across industries, but the reality on the ground looks different than the marketing promises.

Global supply chains will probably make use of both until the last holdouts modernize their systems. Your largest retail customers still demand EDI 850 purchase orders every morning at 6 AM. Your newest suppliers want to send shipment updates through REST APIs. Some partners batch everything through SFTP feeds, while others expect real-time webhook notifications when orders change status.

Healthcare organizations exemplify this mixed reality. They process insurance claims through traditional X12 837 EDI transactions but track patient appointments through modern API integrations with scheduling systems. An enormous amount of what used to be simply EDI-to-EDI transaction flows are being replaced with "Modern EDI," so to speak: EDI-to-API or API-to-EDI or API-to-API.

The Real Cost of Choosing One Technology Over the Other

Organizations that force a single technology approach face expensive consequences. Full EDI retirement happens only when partner readiness, system capability, and audit comfort all line up. Switching gets harder once you look at the network math. Hundreds of supplier and carrier maps already exist.

API setups vary in authentication, data formats, and integration methods, which can cause compatibility issues. Integrating APIs with legacy systems or ERP platforms may require specialized IT support. When your biggest customer changes their API authentication from basic tokens to OAuth 2.0 with custom scopes, you discover the hidden costs of "modern" approaches.

Transport management systems like MercuryGate, Descartes, and Cargoson have evolved to address these complexities by supporting both EDI and API integrations natively within their platforms.

The 5 Critical Challenges Every EDI Manager Must Solve in Hybrid Implementations

Hybrid strategies sound logical until you face the operational reality. Here are the specific obstacles that derail integration projects:

Challenge 1: Protocol Chaos and Format Multiplication

Your ERP speaks SOAP. Partner A sends EDI 856 advance ship notices through AS2. Partner B wants JSON payloads through HTTPS webhooks. Partner C insists on flat CSV files through SFTP. With broad support for B2B integration like spreadsheets, EDI, APIs and flat files, users can exchange information without wasting valuable resources. But managing these connections requires different skill sets, monitoring tools, and error handling approaches.

Challenge 2: API Versioning and Authentication Nightmares

Unlike EDI's batch processing, API feeds provide instant data updates throughout the supply chain. But this real-time capability comes with maintenance overhead. APIs change versions frequently. Authentication tokens expire. Rate limiting policies shift without warning. GraphQL schemas evolve. Each change can break existing integrations.

Challenge 3: Skills Gap and Knowledge Silos

Your EDI specialists understand X12 segments and EDIFACT loops but struggle with REST endpoints and JSON schema validation. Your API developers build elegant microservices but can't debug an EDI 997 functional acknowledgment failure. Cross-training takes months. Recruiting people with both skill sets costs significantly more.

Challenge 4: Partner Readiness Assessment

Not every trading partner can handle your preferred integration method. Small suppliers may lack API development resources. Large retailers have established EDI requirements they won't change. Mid-size distributors might use different systems across regions. Whoever can most quickly adapt to each communication and data requirement - whether it's EDI, non-EDI, or API - will separate themselves and earn new business.

Challenge 5: Limited Flexibility When Requirements Change

Trading partners change systems, get acquired, or modify their integration requirements. Your hybrid platform needs to adapt without requiring complete rebuilds. A translator can hide behind an API gateway so each partner keeps its preferred format. For deeper visibility, some add a middleware gateway. This cloud service takes in an API call and quietly converts it to X12 or EDIFACT (and back again) so every partner sees its preferred format.

Real-World Impact: What Happens When These Challenges Go Unsolved

A furniture manufacturer discovered these problems during their busiest season. Their largest retailer required EDI 850 purchase orders but expected API-based inventory updates. When the retailer's system changed authentication methods, API calls started failing. The EDI connection kept working, but inventory levels showed as unavailable. Orders kept flowing in through EDI while the retailer's website displayed "out of stock" messages.

For example, freight carriers require real-time shipment status and load-tender responses to be competitive. Seconds can make a difference, particularly in shipping marketplaces where the fastest click wins the business. Manual intervention to resolve authentication issues meant losing time-sensitive freight opportunities.

The Proven 7-Step Hybrid Integration Implementation Framework

Based on successful deployments across manufacturing, retail, and logistics organizations, this framework addresses the technical and operational challenges systematically:

Step 1: Trading Partner Readiness Assessment and Categorization

Document each partner's current integration capabilities, preferred communication methods, and technical constraints. Categorize them into groups: EDI-only, API-capable, flexible hybrid, and legacy systems requiring special handling. This assessment drives your implementation priorities and resource allocation.

Step 2: Technology Stack Evaluation

Choose platforms that support multiple protocols natively rather than bolting together separate tools. Leading solutions include IBM Sterling B2B Integrator, Cleo's EDI and API integration platform with complete automation that supports any-to-any integrations directly into your ERP, TMS & WMS systems, TrueCommerce's unified supply chain platform, and transport management systems like Cargoson that handle both EDI and API integrations.

Step 3: Phased Rollout with Safety Nets

Start with your most flexible partners for pilot implementations. Keep existing EDI connections active during testing phases. Because the portal is already API-first, it's the easiest, lowest-risk foothold for modernising your wider integration landscape. By exposing that intelligence through APIs you can gradually shift status and appointment traffic off traditional EDI, unlocking real-time planning and lower overhead.

Step 4: Configuration APIs for Self-Service Partner Onboarding

Build configuration interfaces that let partners set up their own connections without IT intervention. Accelerate go-lives with new trading partners through no-code onboarding. This reduces your support burden and speeds partner activation.

Step 5: Operational APIs for Real-Time Monitoring

Implement monitoring APIs that provide visibility into message flows, error rates, and performance metrics. Include webhook capabilities for proactive alerting. Consider chatbot integration for first-level troubleshooting.

Step 6: Data Quality and Security Framework

EDI uses encryption and strict security protocols to protect business data and prevent unauthorized access. Ensure your hybrid approach maintains these security standards across all communication methods. Implement data validation rules that work regardless of input format.

Step 7: Performance Monitoring and Continuous Optimization

Track integration performance across all protocols. Monitor API response times, EDI transmission success rates, and error recovery effectiveness. Use this data to optimize routing decisions and identify partners ready for protocol upgrades.

Choosing Your Technology Stack: Platform Capabilities Matrix

Evaluate platforms based on these capabilities:

- Pre-built connectors for major ERP systems (SAP, Oracle, NetSuite, Microsoft Dynamics)

- Support for multiple EDI formats (X12, EDIFACT, TRADACOMS, HL7)

- API gateway functionality with rate limiting and authentication management

- Low-code mapping interfaces for business users

- Real-time monitoring and alerting capabilities

Solutions worth evaluating include MercuryGate for transportation-focused implementations, Descartes for complex supply chain requirements, nShift for shipping and logistics, Manhattan Active for warehouse management integration, and Cargoson for transport management systems requiring hybrid EDI-API support.

Regulatory Compliance in the Hybrid Era: PEPPOL and ViDA Readiness

Starting January 2026, every Belgian enterprise with a valid VAT number must issue and receive structured e-invoices that comply with the European EN 16931 (Peppol BIS 3.0) format. This mandate represents a major shift in European B2B data exchange requirements.

Companies that already have another means of communication in an EDI context, can maintain it if both parties agree or if the invoices issued comply with European standards on semantics and syntax EN 16.931-1 and CEN/TS 16.931-2. This creates an opportunity for hybrid strategies that bridge existing EDI systems with new PEPPOL requirements.

The EU's mandatory ViDA e-invoicing has been delayed until July 2030. Under the Digital Reporting Requirement pillar, there is a planned mandatory structured e-invoicing requirement in the EU for intra-community supplies from 2030 or later. Organizations implementing hybrid integration now position themselves ahead of these regulatory changes.

EDI providers are enhancing their platforms to support PEPPOL integration. EDICOM is a certified and fully operational Peppol Access Point, ready to support Belgian companies in integrating and automating electronic invoices. This recognition ensures that EDICOM's technology meets all technical and regulatory requirements established by the Belgian authorities.

ROI Calculation and Success Metrics for Hybrid Integration Projects

Hybrid integration projects require careful cost management. New businesses are moving away from batch-based EDI and toward real-time API-based EDI architectures, but this transition comes with measurable costs and benefits.

Key success metrics include:

- Integration deployment time (target: 50% reduction compared to custom builds)

- Partner onboarding speed (measure time from contract to first successful transaction)

- Error rate reduction across all communication protocols

- Support ticket volume related to integration issues

- System uptime and message throughput capacity

One pharmaceutical distributor reported significant improvements after implementing a hybrid approach. Their automated workflow now shows message acknowledgments in real-time, deflecting 60% of helpdesk calls that previously required manual investigation. This matches industry trends where Duraflame reduced time spent manually fixing EDI orders by 90% and they're now spending less time resolving EDI issues and more time focusing on onboarding new business.

Budget 18-24 months for full implementation across a complex partner network. Factor in training costs, system integration fees, and potential trading partner onboarding delays. TrueCommerce has pre-configured mapping for over 180,000 trading partners, so your IT team won't have to manually build and maintain connections. If a retailer changes its EDI format, TrueCommerce automatically updates the trading partner map. This means no downtime or rework on your end, plus fewer chargebacks from incorrect or incomplete EDI documents.

Common Budget Traps and How Leading Organizations Avoid Them

Hidden costs emerge in testing phases, partner-specific customizations, and ongoing system maintenance. Plan for API rate limiting charges, EDI VAN fees, and additional security compliance requirements. Build contingency budgets for trading partners who require unique integration approaches.

The most successful implementations start with clear partner communication about integration requirements and timelines. Avoid the temptation to customize extensively for each partner's preferences. Instead, establish standard integration patterns and help partners adapt their systems to match your capabilities where feasible.

Success in hybrid EDI-API integration comes from treating it as an operational capability rather than a technology project. Focus on building repeatable processes, investing in team cross-training, and choosing platforms that grow with your partner network complexity. The organizations that master this approach will handle regulatory changes, partner acquisitions, and technology evolution without disrupting their core business operations.