The TMS-Independent EDI Strategy: How to Build Standalone Integration Architecture That Survives Vendor Changes and Prevents Trading Partner Disruptions in 2025

Your TMS upgrade just broke connections to 47% of your trading partners. Sound familiar? When an enterprise grows and is looking to implement a new ERP or TMS, the switch will impact EDI with its trading partners. The average company that performs EDI has anywhere from 100-200 partners, and 400-500 maps—all of which will be impacted by the switch. This is a huge challenge and workload to tackle for any company.

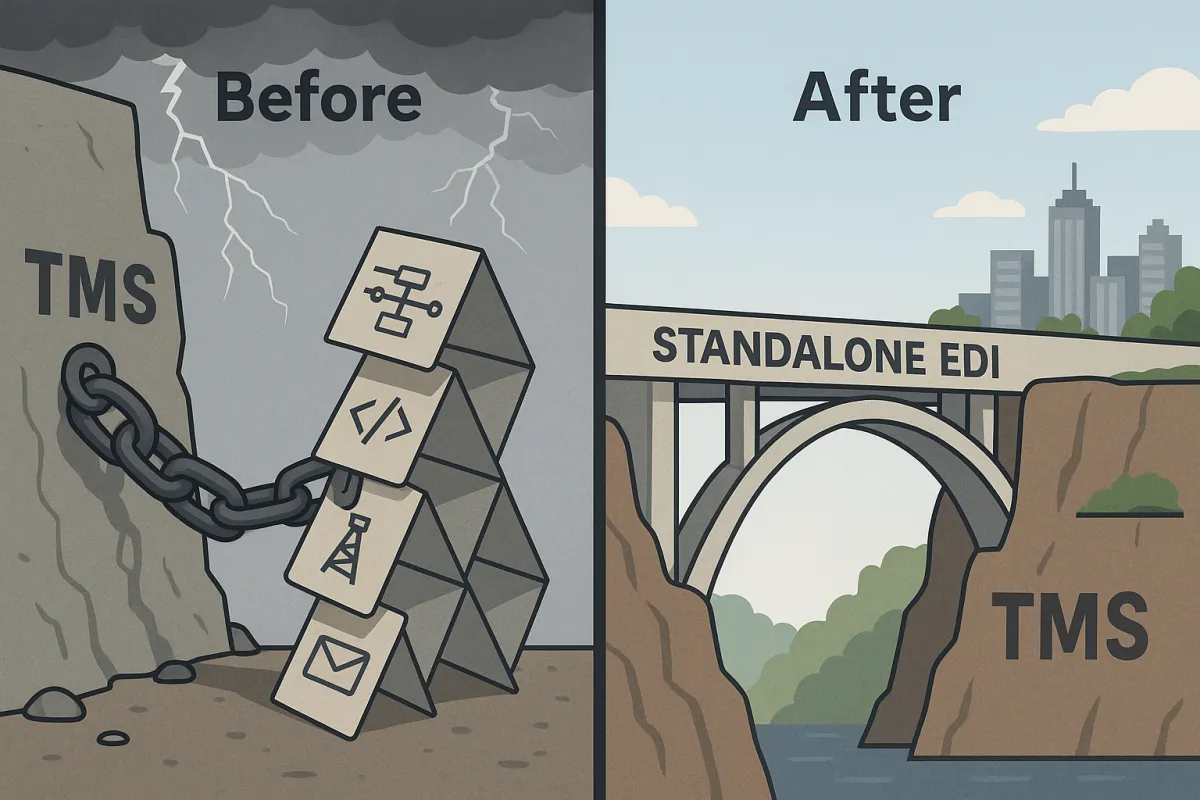

Most companies build their TMS EDI integration like this: EDI functionality embedded directly into their transportation management system. When the TMS vendor releases an update, changes platforms, or you need to switch providers, your entire EDI infrastructure becomes a casualty. The first challenge of EDI inside an ERP, TMS, or WMS is that it will be tightly tied to the ERP.

Here's the reality that most supply chain IT directors discover too late: Integrating EDI with TMS can be technically challenging, especially for organizations with outdated systems or limited IT resources. Businesses may need to invest in middleware solutions to bridge the gap between legacy systems and modern EDI requirements. But middleware is just a band-aid solution when you've already painted yourself into the vendor lock-in corner.

The Hidden Risk of TMS-Embedded EDI Systems

Why do companies make this mistake? Simple economics and vendor marketing. Your TMS vendor promises "complete integration" and "single platform simplicity." What they don't mention is that the EDI software market is large but a lot of players are not innovative; especially integrated EDI solutions inside ERPs, TMSs, and WMSs. For ERP, TMS, and WMS providers, it would not be a worthwhile investment to innovate their EDI modules as it is not their main service, capability, or function.

The truth about embedded TMS-EDI solutions is sobering. ERP, TMS, and WMS tend to have very lightweight EDI processing. For example, a company may have a different communication software to support various protocols— scripts to complete EDI processing, scripts for database table lookups, or integration between different databases to pick up certain attributes and values.

This creates a house of cards. You end up with multiple applications patched together to make EDI work, all dependent on your TMS remaining stable and unchanged. If EDI is bundled inside core ERP, businesses may not be able to seamlessly process EDI for WMS or TMS, such as 940s, 204s, or 214s. This is because ERPs may not have fields or modules applicable to leverage or store the data. The same limitation applies when your TMS tries to handle documents meant for other systems.

When TMS vendors like SAP TM, Oracle TM, or Manhattan Active upgrade their platforms, your EDI connections break because without innovation, new EDI use cases like API integration and management of SLAs for different document flows will not be supported. Enterprises are then forced to build workarounds using other applications and scripts, or do manual processing to support these particular requirements.

The $2.3 Million Cost of EDI-TMS Dependency During System Changes

Let's put numbers to this pain. For most shippers with annual freight under management (FUM) greater than $250M, the implementation line item can be 2-3x the subscription. Furthermore, the "long pole of the tent" of implementation time, and therefore cost, resides in the design, build, and testing of integrations.

But implementation costs are just the beginning. Here's what happens during a typical TMS migration when your EDI is embedded:

Any disruption in these integrations can lead to lost orders, delayed shipments, supply chain breakdowns, and frustrated trading partners. During the 30-90 day migration window, you're essentially flying blind with manual processes filling the gaps.

These issues affect customer scorecards with trading parents, which negatively impacts rebates and negotiating better terms. They can also result in penalties such as fines. One Fortune 500 manufacturer reported $2.3 million in chargebacks and penalties during a six-month TMS replacement project because their embedded EDI couldn't maintain connections to automotive OEMs.

Critical Trading Partner Impacts

The disruption cascades across your entire partner ecosystem. When systems are swapped out without an EDI continuity plan, the result is often delays, chargebacks, or failed deliveries.

Revenue disruption during transition periods averages 15-30% for companies with embedded EDI systems. Increased labor costs, time-consuming administrative tasks, and penalties for non-compliance significantly impact business profitability... Slow order processing due to manual workflows leads to delivery delays, customer dissatisfaction, and loss of business opportunities.

Customer relationships suffer permanent damage when 53% of enterprises experience limitations with their current B2B integration solutions when onboarding trading partners, with approximately 40% requiring over 30 days to bring a new partner online. Your competitors with standalone EDI platforms maintain business as usual while you're explaining system downtime.

Building Your Standalone EDI Architecture Framework

The solution is counterintuitive to most IT thinking: separate your EDI from your TMS entirely. Standalone EDI engines are also helpful when enterprises grow and have to switch to a new ERP. This is because until the migration is complete, a standalone EDI solution can flow data based on the partner product migration to either the new or old ERP, until the migration is complete.

Modern EDI platforms like Cleo, TrueCommerce, Orderful, and Cargoson offer API-first architectures that communicate with your TMS without being embedded within it.

A standalone EDI solution is specifically created to perform EDI, leading to a powerful and seamless experience. Innovative, standalone EDI solutions like Cleo Integration Cloud provide: EDI, API, and non-EDI support (XML, JSON, flat file, CSV, etc.)

The Three-Layer Independence Model

Your architecture should consist of three distinct layers:

EDI Processing Layer: This handles all document translation, validation, and compliance checking. Support and integrate with any type of data format, whether it is JSON, cXML, flat file, spreadsheet, etc... Enable a multitude of communication protocols like AS2, STFP, REST, VAN, and portals

Translation/Mapping Engine: Converts EDI documents to formats your TMS understands and vice versa. This layer maintains all trading partner-specific mappings and business rules independently of your core transportation system.

TMS Communication Interface: API connections that push and pull data to your TMS without requiring deep integration. Ensure that the EDI solution you choose can integrate seamlessly with your existing systems, such as your ERP, warehouse management system (WMS), transportation management system (TMS) and other business applications. This integration ensures that data can flow smoothly across all business units without manual intervention.

Vendor-Agnostic Integration Strategies

Building vendor-agnostic connections means your EDI investment survives TMS changes. This partnership allowed Mastery to focus on enhancing their offering by offloading the complexities of EDI integration to Orderful. The cloud-based EDI platform was seamlessly integrated into MasterMind TMS, enabling faster partner onboarding, enterprise-grade performance, and the flexibility to meet client-specific needs.

Look for EDI platforms that offer pre-built connectors to multiple TMS providers. Platforms like FreightPOP, nShift, Shippo, EasyPost work with standalone EDI solutions through standardized APIs. Cargoson specifically offers TMS-agnostic EDI connectivity for transportation-focused businesses.

The key is API-first design. APIs are flexible and customizable, offering exchangeable, real-time information that work with various software, applications and platforms. This means complete transparency and maximum efficiency. API implementation can be less costly than EDI because it doesn't require ongoing maintenance or translation services and is an excellent method to differentiate as a partner and service provider.

Future-Proofing Your EDI Investment

Cloud-first architecture provides scalability without vendor dependency. Cloud EDI solutions offer scalability, easier maintenance, and accessibility from anywhere. Gentran is typically on-premise, requiring hardware management and providing limited access... Cloud-based solutions often have subscription models, reducing upfront costs compared to Gentran's licensing fees and potential hardware requirements.

Hybrid EDI-API approaches future-proof your investment. While many trucking companies are adopting APIs when and where they can, EDI is still widely used in the transportation industry, and that's not likely to change anytime soon. But just because the tech has been around for quite some time, doesn't mean it's too old-fashioned to be efficient or right for the job.

Choose platforms that support both protocols seamlessly, allowing you to onboard trading partners regardless of their technical capabilities while maintaining consistent data flows to your TMS.

Implementation Roadmap: From TMS-Dependent to Independent

Moving to standalone EDI architecture requires careful planning but can be completed within 90 days without disrupting operations.

Phase 1: Assessment and Planning (30 days)

The first step in any migration process is to assess your current system. This evaluation helps you understand the gaps and areas of improvement and create a roadmap for migration... System inventory: Begin by taking inventory of your existing legacy infrastructure, including hardware, software, databases and any custom-built solutions. Understand the key functionalities that your current system provides and which of them are critical for your business operations.

Document all current EDI transactions flowing through your TMS. Before embarking on the integration process, businesses should evaluate their existing TMS and EDI systems. Understanding the current capabilities and limitations will help determine the best approach for integration.

Create a risk assessment for each trading partner connection. High-volume partners and those with strict SLA requirements should be prioritized for early migration.

Phase 2: Parallel Implementation (45 days)

Build your standalone EDI infrastructure while maintaining current operations. Thorough EDI testing is essential to ensure that the integration functions as expected. This step involves validating data accuracy and system performance... Test Transactions: Simulate various transaction scenarios to identify any potential issues.

Start with a small subset of trading partners for testing. This means that brokers can set up bitfreighter Managed EDI (which can usually be done in days with the help of our Concierge EDI team) and be instantly EDI compliant without the need for a TMS, or without integrating with their existing TMS. For those that need it, the bitfreighter Managed EDI interface can also export data into a spreadsheet or directly into their TMS so that there are no operational gaps or delays.

Validate that API connections to your TMS work correctly with real transaction data before expanding to your full partner network.

Phase 3: Full Migration and Optimization (15 days)

Once testing is complete and any issues have been resolved, businesses can proceed with the implementation of the EDI-TMS integration... Rollout Plan: Develop a detailed rollout plan that outlines the steps for going live with the integration. User Training: Provide comprehensive training to staff on how to use the integrated system effectively.

Complete the cutover during a planned maintenance window. Your standalone EDI platform maintains all partner connections while communicating with your TMS through stable API interfaces.

Monitor performance metrics closely during the first two weeks. Standalone EDI systems are critical business applications that most organizations treat as tier 1 applications, since more than half of their business revenue goes through this platform. Companies want 100% uptime, even when performing upgrades to their ERP or TMS systems.

Measuring Success: KPIs for Independent EDI Operations

Track these metrics to validate your investment in standalone EDI architecture:

Partner Onboarding Speed: The driving reason for moving to Epicor EDI was speed to market. Now, onboarding is complete in two to six weeks—a massive improvement. Compare this to approximately 40% requiring over 30 days to bring a new partner online with embedded systems.

Transaction Processing Reliability: Measure failed transaction rates before and after migration. Companies report 50-80% reduction in EDI errors after moving to standalone platforms.

System Migration Readiness: Your ultimate test comes when you need to upgrade or replace your TMS. With standalone EDI, this process should maintain 100% partner connectivity throughout the transition.

Cost Per Transaction: Most of the companies give a range/tiered pricing in their quotes. For e.g. for 500-1000 transactions per month, you will be charged $0.50 or 0.30 per transaction so that comes out to $250 or $150 and so on. Compare total cost of ownership including reduced migration risks.

The ROI becomes clear when you avoid your next TMS vendor lock-in scenario. SME's can set up EDI without large upfront investments, thus lowering critical setup costs and ongoing maintenance costs. Businesses that switch from SPS Commerce save up to 40% in costs, demonstrating real savings potential when choosing the right provider.

Modern TMS solutions like Cargoson are building their platforms with API-first architecture specifically to work with independent EDI systems, recognizing that embedded EDI creates more problems than it solves.

Your standalone EDI architecture investment pays dividends every time technology changes around it. While competitors scramble to rebuild EDI connections after system upgrades, your operations continue without interruption, maintaining the partner relationships that drive your business forward.