The TMS Vendor Lock-In Crisis: How to Build Future-Proof EDI Integration Architecture That Works Across Multiple Transportation Management Systems in 2026

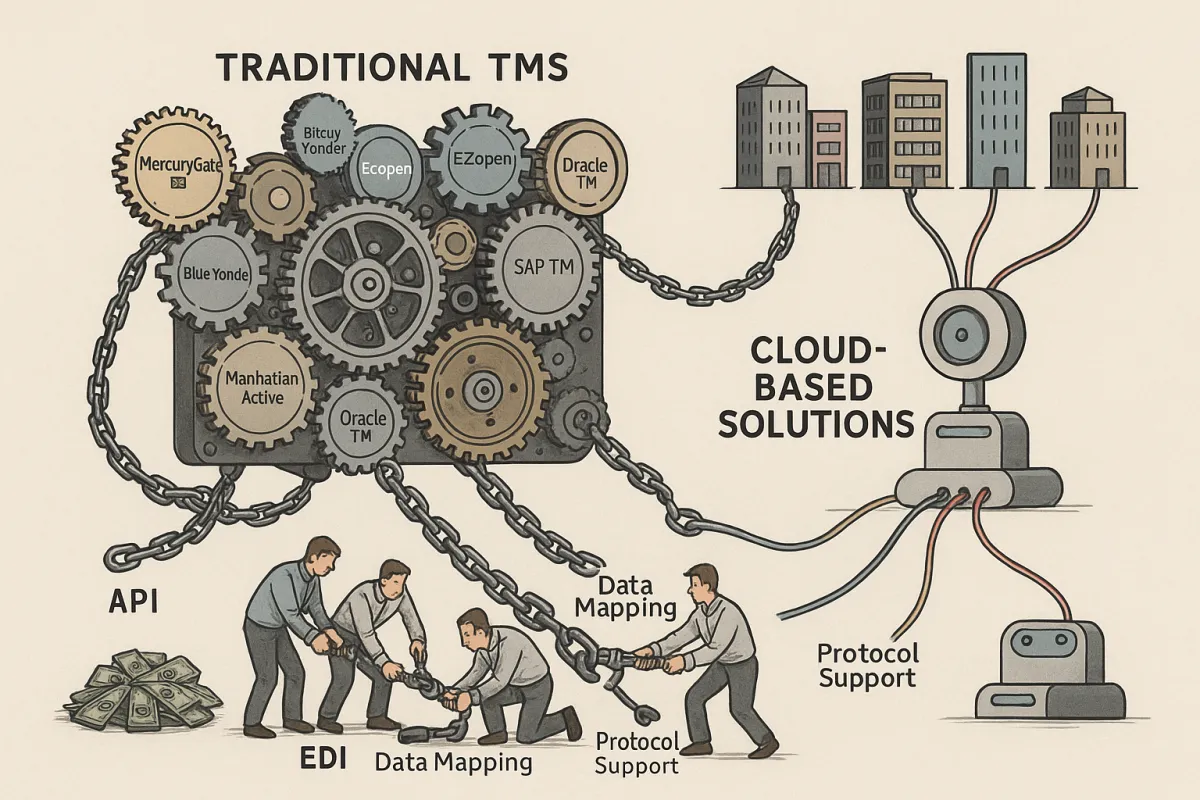

Multiple TMS platforms are forcing companies into costly vendor lock-in scenarios through tightly tied EDI systems that create dangerous dependencies when businesses need to change or upgrade their transportation management systems.

The Hidden Multi-Vendor TMS Integration Crisis Breaking EDI Networks

TMS vendors are creating a perfect storm of interoperability failures across major platforms. Because TMS and EDI systems are deeply connected, even minor mismatches between the two systems can lead to costly disruptions. Every TMS platform structures its data differently. Without precise mapping between new and existing fields, critical information can be dropped or misrouted.

The scale of this crisis becomes clear when you consider the major platforms: MercuryGate, Blue Yonder, E2open, Manhattan Active, Oracle TM, and SAP TM all handle EDI connections differently. Each requires specific data mapping, protocol support, and integration approaches. Some organizations are forced to re-onboard all trading partners when switching systems. Limited testing environments: Migration teams often lack a staging environment that accurately mirrors production, making it more challenging to identify issues before going live.

2026 marks a definitive pivot: modern transportation software increasingly integrates via APIs, yet most legacy TMS platforms still rely heavily on traditional EDI standards. This hybrid environment creates additional complexity for companies trying to maintain consistency across their trading partner networks.

Companies using cloud-based solutions like Cargoson are taking a different approach. Modern cloud-based shipping software connects directly with hundreds of carriers through pre-built API and EDI integrations. Instead of setting up separate technical connections with each transport provider, you get access to your whole carrier network through one platform.

Why Traditional TMS-Embedded EDI Creates Dangerous Dependencies

The root problem lies in how most TMS platforms handle EDI integration. If EDI and ERP are "loosely coupled," you'll end up with manual rekeying and reconciliation, which defeats the purpose of automation. But the opposite approach - tight coupling - creates even worse problems.

When enterprises grow and have to switch to a new ERP. This is because until the migration is complete, a standalone EDI solution can flow data based on the partner product migration to either the new or old ERP, until the migration is complete. The same principle applies to TMS migrations, but most companies don't realize this until they're facing a system change.

Protocol compatibility issues add another layer of complexity. Older EDI connections often rely on protocols like FTP or AS2. If the new TMS doesn't support those methods or supports them differently, message delivery can fail entirely. Different TMS platforms support varying combinations of AS2, SFTP, FTP, and modern API protocols, creating compatibility matrices that can break existing trading partner relationships.

Solutions like Cargoson address this by building carrier-agnostic architecture, meaning that it's capable of integrating with a wide range of carriers, not just specific ones. As long as the carrier has an API we can work with (or EDI, or even just email), you can incorporate their services into your system through our platform.

The $2.3 Million True Cost of TMS Vendor Lock-In

Hidden migration costs stack up quickly when companies face TMS vendor lock-in. 60 days written notice for any TMS EDI migration. This allows proper planning, resource allocation, and coordination with trading partners is standard practice for EDI specialists, but most companies don't plan this far ahead.

The initial investment for integration can be substantial, although it is often recouped through long-term savings. But that's just the beginning. Re-onboarding trading partners, system downtime during cutover periods, and compliance disruption costs can easily exceed $2.3 million for mid-sized companies with complex partner networks.

If the new TMS does not perform as expected and requires additional troubleshooting, consulting is billed at $250/hour. These consulting fees compound when multiple integration specialists are needed to maintain trading partner relationships during transitions.

Traditional TMS systems cost €100,000+ annually and take months to install, while modern cloud platforms offer faster deployment and transparent pricing. Some traditional systems require €100,000+ annual commitments, while others offer usage-based models.

Building TMS-Agnostic EDI Architecture: The Complete Framework

Creating standalone EDI infrastructure prevents vendor lock-in by separating data integration logic from TMS-specific functions. Separation of ERP is key as companies can avoid customizing their ERPs to handle EDI, which is costly and complex. Standalone EDI engines are also helpful when enterprises grow and have to switch to a new ERP. The same separation principle applies to TMS platforms.

Start with API-first integration layers that can connect to multiple TMS platforms simultaneously. This approach requires:

Define universal data models that work across different TMS platforms. Look for an EDI integration platform that can mix EDI with non-EDI formats (XML, JSON, CSV) and convert seamlessly between them, so you can automate invoices or order flows regardless of whether partners use classic interchange standards or modern APIs.

Implement middleware solutions that translate between TMS-specific data structures and standardized EDI formats. Integrating EDI with TMS can be technically challenging, especially for organizations with outdated systems or limited IT resources. Businesses may need to invest in middleware solutions to bridge the gap between legacy systems and modern EDI requirements.

Modern platforms like Cargoson take this approach by design. Cargoson's cloud-based TMS platform integrates with carriers by setting up direct API connections that automatically sync rates, transit times, and tracking information. Lots of these API connections are already pre-built and ready for use, but any customer can request a new carrier integration, for free, and this will be done within a few weeks.

The Hybrid EDI-API Strategy That Eliminates Platform Dependencies

The most effective approach combines traditional EDI standards with modern API connectivity through intelligent routing systems. While EDI is leading in terms of connecting technologies used in TMS deployment, API connectivity is increasing, especially among parcel and LTL freight carriers. It's, therefore, unlikely that APIs will fully replace EDI as the standard means for connection in the next several years.

Create routing rules that automatically determine whether to use EDI or API based on trading partner capabilities and message types. Purchase orders might flow through EDI 850 transactions for retail partners, while shipment status updates use real-time APIs for 3PL providers. This hybrid approach ensures no trading partner relationships break during TMS transitions.

Companies using MercuryGate, Transporeon, nShift, and other established platforms can implement middleware solutions that work independently of their core TMS. Cleo Integration Cloud combines EDI with API capabilities in a cloud-based environment. Businesses often choose this tool when moving from older systems to more modern infrastructure.

Cargoson's approach demonstrates how this works in practice: direct API/EDI integrations with carriers across all transport modes (FTL, LTL, parcel, air, and sea freight), allowing you to compare rates, book shipments, and track imports and deliveries from a single platform.

TMS Vendor Comparison: EDI Flexibility Analysis for 2026

Evaluating TMS platforms for EDI portability reveals significant differences in migration ease and vendor lock-in risks:

MercuryGate and Blue Yonder offer extensive EDI support but with proprietary mapping tools that create dependencies. Manhattan Active provides strong warehouse-transport integration but requires third-party partners for carrier connections. No proprietary network; relies on EDI/API connections and partners like MetaPack for parcel carriers. Adding new carriers can be complex and costly, often requiring third-party integration partners.

Oracle TM and SAP TM excel at enterprise-scale implementations but lock companies into complex customization cycles. E2open focuses on network effects but creates dependencies on their trading partner ecosystem. 3Gtms, Shiptify, and Uber Freight offer more flexible approaches but with limited enterprise features.

Cargoson scores highest for portability by design. Cargoson connects to European API/EDI connections. Cargoson builds true API/EDI connections with carriers, not just accounts in software or standardized EDI messages that carriers must implement themselves.

While carriers can easily join the platform through their portal, requesting completely new carrier API/EDI integrations is more complex and costly. Alpega typically doesn't build custom carrier integrations themselves but acquires companies with existing connections or provides standard EDI interfaces that carriers must implement. This reveals a key differentiation factor among TMS providers.

The Rise of Open Integration Standards

Emerging protocols are promoting better interoperability across TMS platforms. Multiple transports: AS2, SFTP/FTP, VAN, APIs, and portal automation. Common documents: POs, invoices, ship notices, inventory, remittance, and returns. Look for an EDI integration platform that can mix EDI with non-EDI formats (XML, JSON, CSV) and convert seamlessly between them.

Newer platforms like Cargoson are built with portability as a core requirement. Cargoson's architecture is built to be carrier-agnostic, meaning that it's capable of integrating with a wide range of carriers. As long as the carrier has an API we can work with (or EDI, or even just email), you can incorporate their services into your system through our platform.

The trend toward API-first design doesn't mean abandoning EDI standards. Instead, modern platforms support both approaches through unified integration layers that abstract away platform-specific implementation details.

Implementation Roadmap: Migrating from Vendor-Locked EDI

Execute TMS-agnostic EDI migration in 90 days with this structured approach:

Days 1-30: Assessment and Planning

Evaluate their existing TMS and EDI systems. Understanding the current capabilities and limitations will help determine the best approach for integration. Document all trading partner EDI connections, message types, and protocol requirements. Identify dependencies between current TMS platform and EDI processing.

Days 31-60: Architecture Design

Define data mapping early. Know how your new TMS structures data and how that maps to your existing EDI formats. This reduces the chance of mismatched fields or data loss midstream. Build middleware connections that work with multiple TMS platforms.

Days 61-90: Testing and Cutover

Set up a testing environment. Use a staging environment that mirrors production to validate message flows, run simulations, and catch issues before they go live. Coordinate with trading partners. Clearly communicate your migration timeline and requirements to partners, allowing them to align their systems or expectations as needed.

Modern cloud platforms significantly compress these timelines. Cloud-based TMS implementation typically takes 1-4 weeks compared to 6-18 months for traditional on-premise systems. Solutions like Cargoson can have shippers managing freight within days of signing up.

Risk mitigation requires fallback plans. Build a rollback plan. Even with the most careful preparation, surprises can happen. A documented fallback strategy gives you room to revert or reprocess messages without disrupting the supply chain.

Position solutions like Cargoson as migration targets because they eliminate future vendor lock-in risks. Some TMS providers like Cargoson will integrate any carrier for you, for free (while others charge you for that and make you wait months or years).